I just finished listening to the latest earnings call from MoneyLion (NYSE:ML) and immediately thought to bring an analysis of the stock here on Seeking Alpha. Indeed, I believe that the company has reached a very interesting point in its history, which offers a very appealing entry point for investors: over the next 12-24 months, I predict that the stock could perform exceptionally well and I will begin my coverage with a BUY rating.

My investment thesis is based on the fact that this is a macroeconomically challenging period for a company operating a business model like MoneyLion’s. However, instead of seeing customers flee and margins decrease, the company has managed to continue growing both in terms of revenue and margins. With the profitability of the business clearly improving, I believe that the market is undervaluing this company’s medium-term prospects.

MoneyLion’s Business Model

MoneyLion is a fintech company that provides customers with an app through which they can access all the most important services for managing their personal finances: debit cards, small loans, an investment account, expense tracking, and even a cryptocurrency exchange. Furthermore, the company has cultivated a large marketplace over time, within which customers can compare and subscribe to the best offers related to personal loans, insurance, credit cards, and investments.

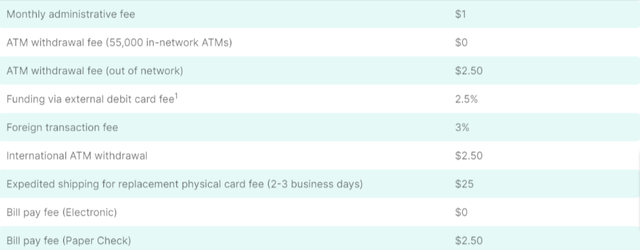

Since MoneyLion is not a bank, it relies on Pathward for the management of customer accounts. The accounts are non-interest bearing and feature a fixed administrative fee of just $1.

MoneyLion’s two distinctive services are InstaCash and Credit Builder Plus. InstaCash allows you to request, interest-free, up to $1,000 to cover expenses until the next paycheck. Credit Builder Plus is a subscription service designed to improve your credit rating through personalized installment loans: the service costs $19.99 per month and the APR on loans is currently 5.99-29.99%, offering very attractive margins for MoneyLion.

Main sources of revenue on the consumers side (MoneyLion | Corporate Website)

The company operates a business model with two branches:

- Consumer (60-70% of revenue) – service fees, interest income, subscriptions, crypto commission, and cardholder fees;

- Enterprise (30-40% of revenue) – mainly affiliate fees, advertising, and media management fees derived from MoneyLion’s marketplace.

A Look at the Financials

Below is a table with the balance sheet data that I consider most important for a correct analysis of the stock at this time (source Seeking Alpha, data in $ millions).

| Dec 2019 | Dec 2020 | Dec 2021 | Dec 2022 | TTM | |

| Revenue | 48.3 | 74.9 | 164.1 | 330.6 | 372.6 |

| Gross profit | 30.1 | 50.8 | 81.3 | 134.7 | 168.4 |

| Operating income | -51.5 | -0.5 | -76.6 | -98.7 | -46 |

| EBITDA | -51.1 | 0.6 | -74.2 | -77 | -21.5 |

| Cash & Equivalents | 0.2 | 19.4 | 201.8 | 115.9 | 96.7 |

| Total debt | 29.2 | 46.6 | 186.6 | 241.6 | 212.5 |

| Cash from operations | -46.4 | 3 | -8.6 | 3.4 | 50.9 |

From these data, it is very clear that:

- The company has been able to continue to grow significantly even during 2022/23, despite offering a non-interest bearing service in a time of extremely high-interest rates;

- The gross profit margin has increased, despite the company not collecting interest on customer deposits and despite the high rate of inflation;

- The operating margin has improved significantly over the past 12 months;

- In the recent quarters, MoneyLion has been able to generate a positive cash from operations;

- Gradually, the company is now finally able to repay a part of its debts. This is very important, since the company had an interest expense of $30.9 million over the last 12 months against a total debt of $212.5 million.

MoneyLion has been able to navigate through macroeconomic headwinds by building a business model that has not been negatively affected by the current situation. Moreover, I would like to draw attention to three operational metrics that I consider fundamental, presented in the latest earnings call:

- The customer acquisition cost has once again remained below $15;

- The ARPU (annual revenue per user) is $40 at this time;

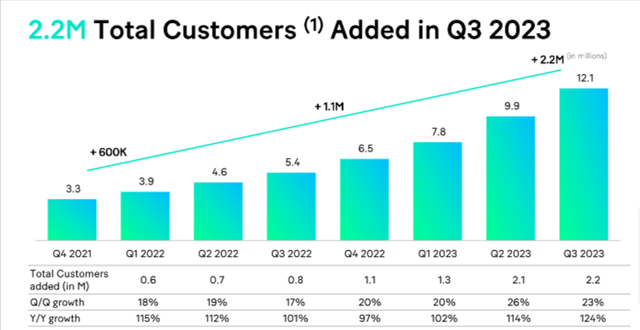

- In the third quarter of the year, the company reached 2.2 million new users. Further down, I will present a chart showing the evolution of the number of users over time.

MoneyLion | Q3 2023 Earnings Presentation

Valuation

Since MoneyLion is still an unprofitable company and in the midst of its expansion phase, it would not be possible to use a DCF model for valuation. Regarding the most relevant multiples, below is a table with data from Seeking Alpha.

|

Sector Relative Grade |

ML | Sector Median | % Diff. to Sector | |

| EV / Sales (TTM) | A- | 0.94 | 2.85 | -67.11% |

| EV / Sales (FWD) | A | 0.84 | 2.99 | -71.99% |

| Price / Sales (TTM) | A | 0.54 | 2.31 | -76.62% |

| Price / Sales (FWD) | A | 0.57 | 2.29 | -75.16% |

| Price / Book (TTM) | B- | 0.96 | 1.04 | -8.19% |

| Price / Cash Flow (TTM) | B+ | 4.79 | 6.74 | -29.04% |

These data show us two things: first, from the standpoint of the ratio between revenues and company valuation, MoneyLion has a lower valuation compared to the sector average in an industry dense with value stocks like the financial sector. Even the price/book ratio is competitive.

At the same time, we are talking about a bonafide growth stock. One would normally expect much higher multiples for price/sales or EV/sales, but it is clear that in 2023, unprofitable companies have been strongly penalized by the market. And it is precisely this excessive caution which, in my opinion, creates an ideal entry point to leverage MoneyLion’s growth in the coming years.

I would point out that in 2022 there were reported $136.8 million in asset writedown and restructuring costs, which rose to $163.5 million during the current year. This is the reason why cash from operations and free cash flow are significantly better than EBITDA. This is mainly attributable to the provision for credit losses on consumer receivables on loans granted to customers.

Why I am Bullish on MoneyLion

My investment thesis is based on three key points:

- We have reached the point where MoneyLion no longer needs to burn cash to support its growth;

- The growth rate has remained very high even though customers can now find alternatives that offer attractive interest on deposits;

- When interest rates decrease, the company will have the opportunity to grow even more.

1. The ability to generate liquidity is fundamental

Throughout 2023, we have seen how the markets are penalizing unprofitable companies and even more those that do not produce cash flow. Now that MoneyLion is able to meet its liquidity needs, the stock will become much more attractive to investors. Entering into 2024 with the ability to generate cash flow, the company will also be able to continue repaying its extremely burdensome debts and further improve its profitability.

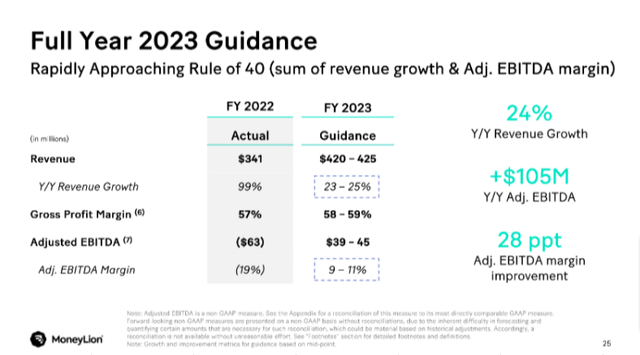

2. The growth rate is excellent

The management now expects to close the year with revenue of $420-425 million, which would imply a growth rate of 27% at the midpoint compared to last year. All this despite the fact that at this time, a non-interest bearing account is less attractive than it has been in the last 15 years. This demonstrates that there is strong demand for the app and for MoneyLion’s services, even in the face of headwinds blowing from the macroeconomic context.

MoneyLion | Q3 2023 Earnings Call

3. Excellent positioning in anticipation of falling rates

The increase in interest rates has not only led to an increase in the appeal of interest-bearing accounts but also a decrease in loan requests within MoneyLion’s marketplace. This is a point the management focused on in the last earnings call, since affiliate fees and advertisements related to loans represented 85% of the marketplace’s total revenue in 2022.

I expect that, when rates begin to fall, traditional bank customers will be less motivated to keep liquidity in classic checking accounts; at the same time, I expect that marketplace revenues will increase due to higher demand for loans and advertising connected to these services.

Conclusions and Final Thoughts

MoneyLion is a company that has managed to navigate a very difficult period for fintech businesses, marked at the same time by strong competition and an unfavorable macroeconomic context. While many of its competitors struggle to prevent a decline in user base, MoneyLion continues to grow both in terms of revenue and margins.

Now that the company is able to generate liquidity with its business, I expect the stock to start being rewarded by Wall Street. Consequently, I plan to start building my position in ML and will initiate my coverage with a BUY rating.

Risks Associated with the Analysis

As with any analysis, there are risks to consider:

- The company could suffer a setback in growth rate, especially in an “even higher for even longer” interest rate scenario;

- Margins could be tested if customer acquisition cost were to increase over the coming quarters, for example, due to weak market demand;

- In the event of a recession, a large number of users might start defaulting on debts related to InstaCash. At the end of Q1 2023, MoneyLion had $176 million in consumer receivables on its balance sheet.

However, I believe that it is worth taking these risks given the opportunities presented by this investment.

Read the full article here

Leave a Reply