Investment Thesis

Mondelez International, Inc. (NASDAQ:MDLZ) has built itself a wide moat based on its competitive advantages: a wide range of category offerings, household brand reputation, and international footprint.

MDLZ is a snack and beverage company with a product portfolio that ranges from salty snacks, cookies, gum, crackers, snack bars, and biscuits to much more. Some of its biggest brand names include Oreos, Chip Ahoy, Ritz crackers, Tate’s Bake Shop, Toblerone chocolate, and Sour Patch Kids.

MDLZ Product Portfolio (Business Wire)

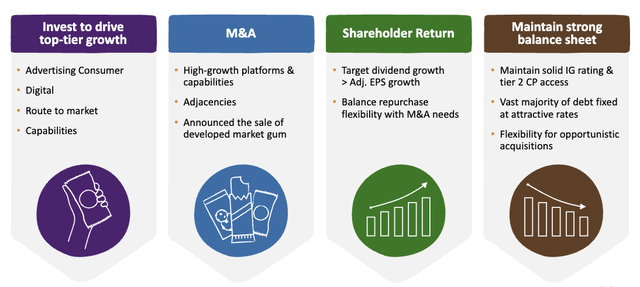

MDLZ has one of the best management teams I have seen under CEO Dirk Van De Put. Management is disciplined and committed to returning capital to shareholders through dividends, share buybacks, and price appreciation. They efficiently spend on marketing and advertising to build brand awareness and customer reach.

MDLZ constantly looks for new ways to innovate and expand operations. They build on their existing household brands and M&A to expand their portfolio. Since 2018, they have completed 9 acquisitions and constantly offered new treats, such as different Chip Ahoy flavors or double-stuffed Oreos, to continue growing revenues.

MDLZ Company Strategies (Mondelēz Investor Relations)

Over the last 5 years, MDLZ has grown revenue at a compounded annual growth rate (CAGR) of 5.3% and net income at a 6.3% CAGR. It has a strong dividend with a 2.4% yield, which it has increased for 11 years in a row at an 8.5% 10-year annualized growth rate. With a payout ratio of only 49%, there is still plenty of room for dividend appreciation.

MDLZ has $2.8 billion in free cash flow (“FCF”) and long-term debt with favorable fixed interest rates. It has above-average and industry-leading margins on both the top and bottom lines. Gross and operating margins have pulled back slightly from their 5-year averages due to increased operating costs from inflation pressure over the past few years. However, the stock has still had a total return of 82% over the last 5 years and looks to continue to improve.

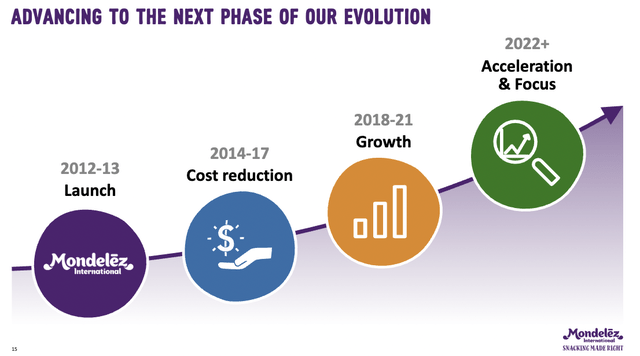

MDLZ Growth Evolution (Mondelēz Investor Relations)

With management’s focus on volume-driven profitable growth, I believe MDLZ can continue to be a good investment for long-term value holders. Increased profitability will help drive price appreciation, a rising dividend per share, and stock buybacks, which will ultimately make the hold worthwhile. The stock is down 10% from its 52-week high, and with a low beta of just 0.65, I suggest slowly creating or adding to a position here on any pullbacks for long-term value investors.

Company Overview & Fundamentals

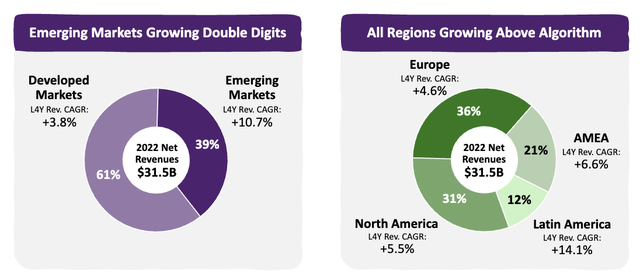

I mentioned that one of MDLZ’s competitive advantages is its global footprint. The company has a broad range of exposure across the world, which gives it endless opportunities for growth. The chart below shows MDLZ’s exposure in different regions (e.g., North America and Europe) and in developed and emerging markets.

MDLZ Revenue Geographical Segments (MDLZ Investor Relations)

This diversity in their product portfolio is rare, leading to a resilient business model with plenty of room for growth in both developed and emerging markets. Some current products, which they consider “local jewels,” only sell in certain regions but offer great potential for global growth.

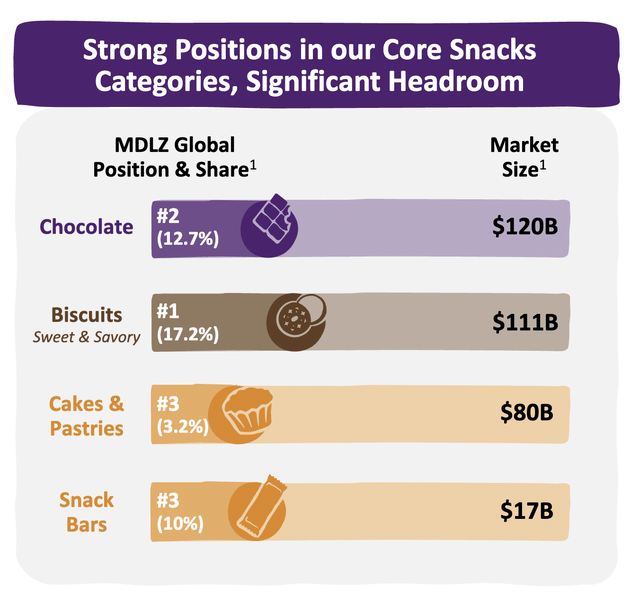

Mondelez operates in multiple food segments, with total revenue of $31.5 billion last fiscal year (FY) and guidance of $35.98 billion for this FY. The company is seeing accelerated growth through product innovation and domination in its respective categories. I have attached a visual graphic below that shows a few categories in which they compete.

MDLZ Core Snacks Market Share (Mondelēz Investor Relations)

MDLZ’s strong product portfolio helps it deliver steady cash flow. People love to snack, which allows MDLZ to be resilient in any market condition and remain a steady performer. It has $2.8 billion in free cash flow, which is a FCF yield of 3%. This is normal for a consumer staple stock, which tends to have lower margins and cash flows.

What worries me is that cash from operations (CFO) has been steady from 2018 to now. This means that cash flow is consistent and durable, but it has been struggling to grow. However, due to management’s discipline, MDLZ has still done a great job of efficiently returning capital to shareholders. In the last 5 years, it has shrunk its outstanding shares by 7.23%, grown its dividend per share (DPS) by 11.23% per year, and seen its price go up 63%. Investors should be happy with their total return, given the low risk and volatility (beta of 0.65).

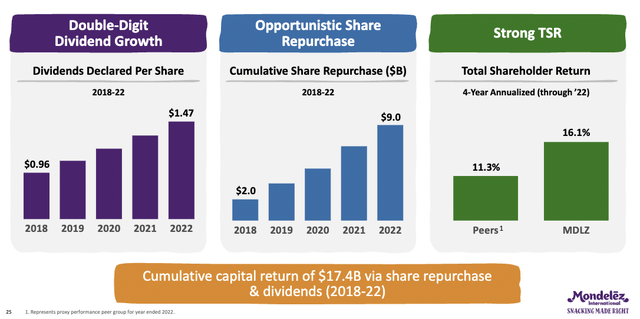

MDLZ Capital returned (Mondelēz Investor Relations)

The balance sheet is good, but not great, with current liabilities greater than current assets by about $7 billion. This shows that liquidity could be an issue if the company were to face a problem, but MDLZ is accustomed to this scenario and should be able to manage through it.

Overall, people own MDLZ because it is a safe and steady stock. Think about all the brands and households that keep Oreos, Ritz, Cliff bars, and more in their pantry. Mondelez has dominant shelf space in grocery stores and gas stations, which translates to a lot of its products in pantries in homes. With low risk and steady rewards, I suggest that risk-tolerant investors consider holding MDLZ long term.

Price Targets and Valuation

MDLZ currently trades at 21.6x 2023 price-to-earnings (P/E) and 19.9x 2024 P/E. Its 5-year average P/E is 21.1x, showing that the stock is currently trading around fair value. However, the market is forward-looking, and analyst expect 10% earnings per share (EPS) growth this year and 8.7% in 2024, which leads me to believe that there is room for price expansion.

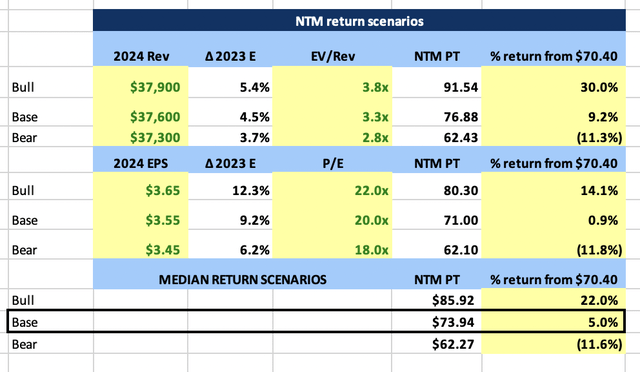

MDLZ’s enterprise value to sales (EV/S) ratio of 3.2x is below its 5-year average of 3.5x, indicating that sales have been growing faster than the stock price or value of the company. I used these valuations and the range in which MDLZ tends to trade, along with current analyst estimates, to generate a next 12 months (NTM) price target using a price target scenario table.

MDLZ NTM Price Target Scenarios (Author Calculations Based on Analyst Estimates From Data on Koyfin)

My analysis shows that MDLZ is trading at a slight discount to fair value. It has a risk-to-reward (R:R) ratio of 2.1x, which is below our 3x threshold, but 2.1x is still good. In fact, it should be comforting to investors that the numbers show the upside is 2x greater than the stock’s downside (3x would be even better, of course). Either way, this tells me that the stock is still a hold for value investors.

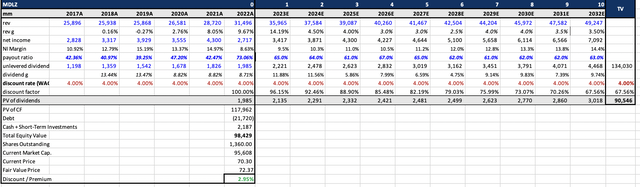

To double-check my numbers and analysis, I also conducted a dividend discount model (DDM) to get a current fair value for the stock based on the expected dividends and growth shareholders may see. I got very similar results: the stock is trading 3% lower than fair value, so very close. I have attached my results and work below.

MDLZ Dividend Discount Model (Author Calculations based on Data from Koyfin)

MDLZ has had and will continue to see steady top-line growth through new products and increased volume. Through economies of scale and management’s commitment to efficiency, earnings and profitability will grow over time. This will allow MDLZ to consistently raise the dividend at a respectable rate. All in all, shareholders will be happy and able to rest easy when holding MDLZ.

Risk

The main risk when considering MDLZ is inflation affecting input costs and profitability. The raw material costs of sugar, grains, cocoa, dairy, and more can fluctuate, which could impact margins from time to time. Inflation has been coming down, which is a good sign, but if it were to reaccelerate into 2024, EPS estimates could start to decline. This is where MDLZ’s broad portfolio of products could backfire, as it has many different input and raw material costs. Therefore, management must be careful not to increase marketing or advertising too quickly, so that operating income is not hit too hard if inflation starts to creep up.

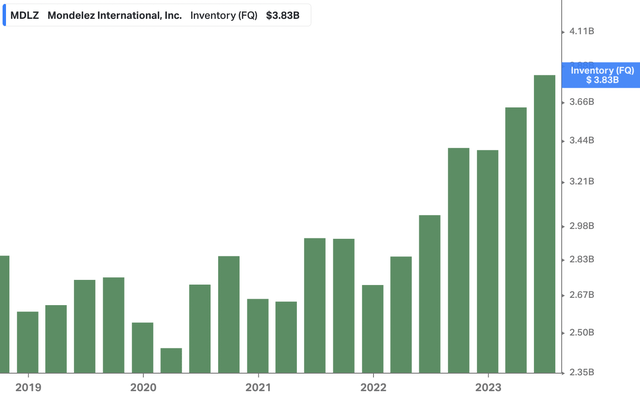

Higher inflation could also cause MDLZ to raise prices to its wholesalers and eventually to retail buyers, which could then inflate inventories if fewer people are willing to spend more money on snacks or switch to discount options that Walmart (WMT) and Kroger (KR) offer in stores. MDLZ’s inventory jumped 24.8% in 2022, and I will be watching closely where inventory levels come in at the end of 2023.

MDLZ Inventory Levels (Koyfin)

The last two risks to keep in mind are minor compared to the inflation/inventory risk. The first is the ever-changing nature of consumer trends and palates. Therefore, it is of utmost importance for MDLZ to continue to innovate through its brands and use M&A to offer new products. They have done a good job so far, but this is something that will need to continue for years to come.

The second risk, as I mentioned before, is closely paying attention to the company’s liquidity, given that current liabilities are greater than current assets. Their balance sheet tends to be like this, but if another pandemic, anomaly occurs, or rates continue to rise, the company could see itself in short-term trouble.

Conclusion

Mondelez International, Inc. is a great consumer staple stock for long-term investors. It is resilient in any economic condition, has low volatility, and offers consistent shareholder returns. The stock is currently trading around fair value, but has a 2:1 reward-to-risk ratio. MDLZ’s household brands and international footprint give it a competitive edge over competitors, allowing it to continuously be a solid hold for investors. Management’s discipline in strategic M&A, share buybacks, and dividend growth keeps shareholders happy. MDLZ dominates multiple snack and food categories and continues to innovate. I have high confidence in the management team to execute and expect them to continue firing on all cylinders. If Mondelez International, Inc. stock continues to pull back, I suggest looking to buy shares at $70 or under for long-term, risk-tolerant investors.

Read the full article here

Leave a Reply