Investment Summary

Looking at the movement of the share price in the last 12 months it seems that Mirion Technologies (NYSE:MIR) is making some lower lows, continuously as the valuation is contracting and nearing something more in line with the sector. This is despite the last quarter showcasing some strength as the company revised its guidance upwards slightly for the year and expects a top-line growth rate of 8 – 10%.

I find however that investors are not getting a very discounted price currently and this is of course lacking the inclusion of a decent margin of safety which a company like MIR which is driven much by somewhat cyclical demand might need. I think that the long-term outlook remains very solid for the business and demand should average out to be steady and this is why I am rating MIR a hold still.

A Market Overview

MIR is included in the information technology sector where it mostly focuses on providing radiation detection and monitoring services for an international customer base, some notable ones being the US, China, and Japan for example.

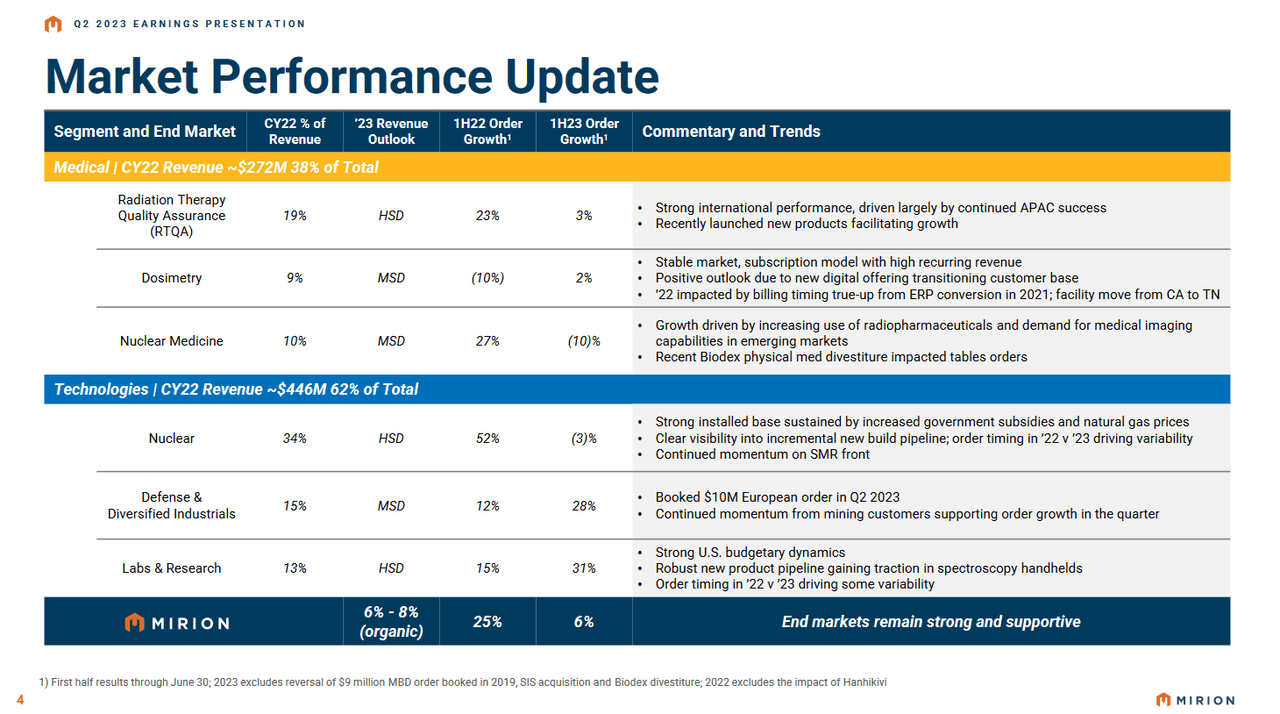

Market Overview (Investor Presentation)

The company divides its operations into two various segments which are Medical and Technologies. The medical segment is primarily generating revenues from radiation therapy quality assurances, which in comparison to the total revenues were 19% last quarter. The order growth has been impressive here quite frankly and is a highlight of the business. The company experienced a 3% 1H23 order growth which is driven by strong APAC success and new products being launched by the company. Going forward I think it will be crucial to watch the developments here as they will be indicative of the company’s growth potential.

Moving over to the second segment of the business the nuclear part in the technologies segment experienced strong order growth in 1H22 by 52% but has since declined to negative 3%. The timing of some orders is largely the reasoning behind this shift and it shouldn’t indicate that MIR is slacking in this part in my opinion. The SMR front continues to face momentum and I don’t think it will be showcasing a negative YoY order growth rate.

Quarterly Result

As I have made it clear in the beginning part of the article, I think that MIR right now is trading quite rich in comparison to the growth that it has.

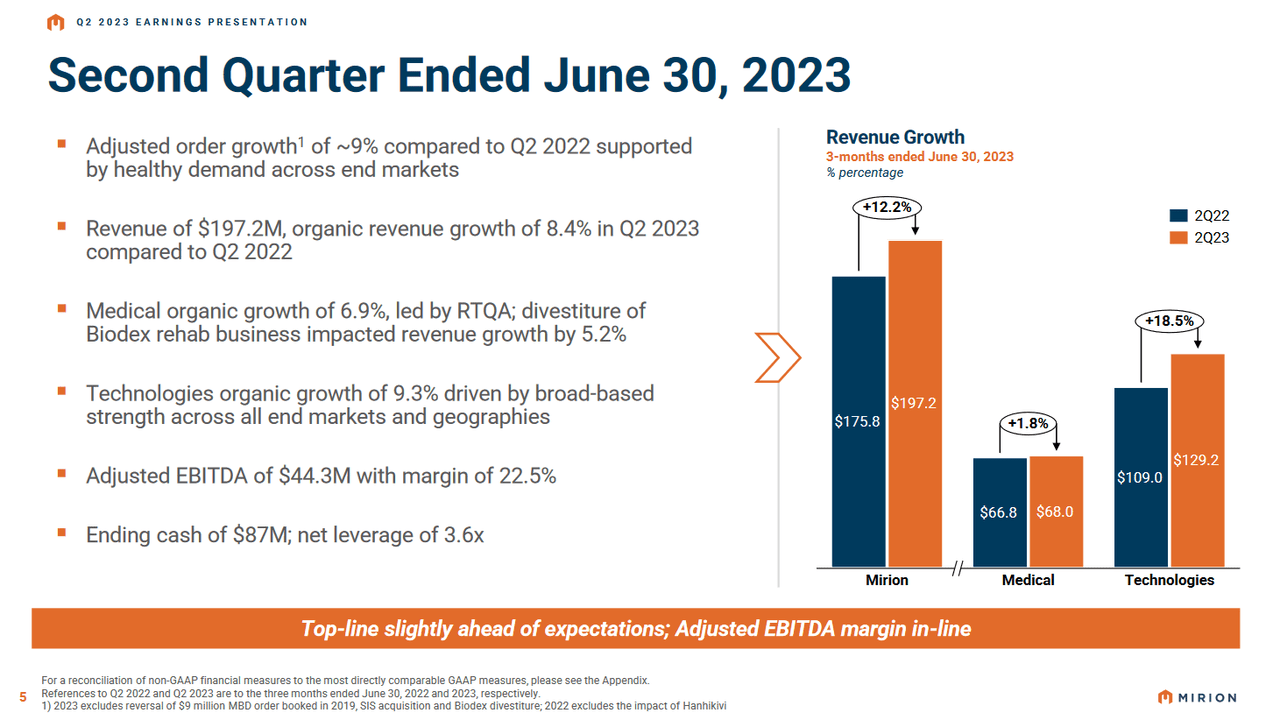

Q2 Results (Investor Presentation)

The last quarter showed the top line growing by 9% YoY which now makes MIR trade at a TTM p/s of over 2, which I find a little expensive and not indicative of being a very discounted price point. Furthermore, the bottom line saw a YoY decrease as higher tax rates and interest expenses started digging into the earnings. That leaves MIR with a FWD p/e of over 25 which gives it a premium of nearly 10% to the sector. As for where I would make MIR a buy would be if based on earnings alone it would trade at a discount of 10 – 15% to the sector. That leaves some downside from today’s prices and is the reason for the hold rating.

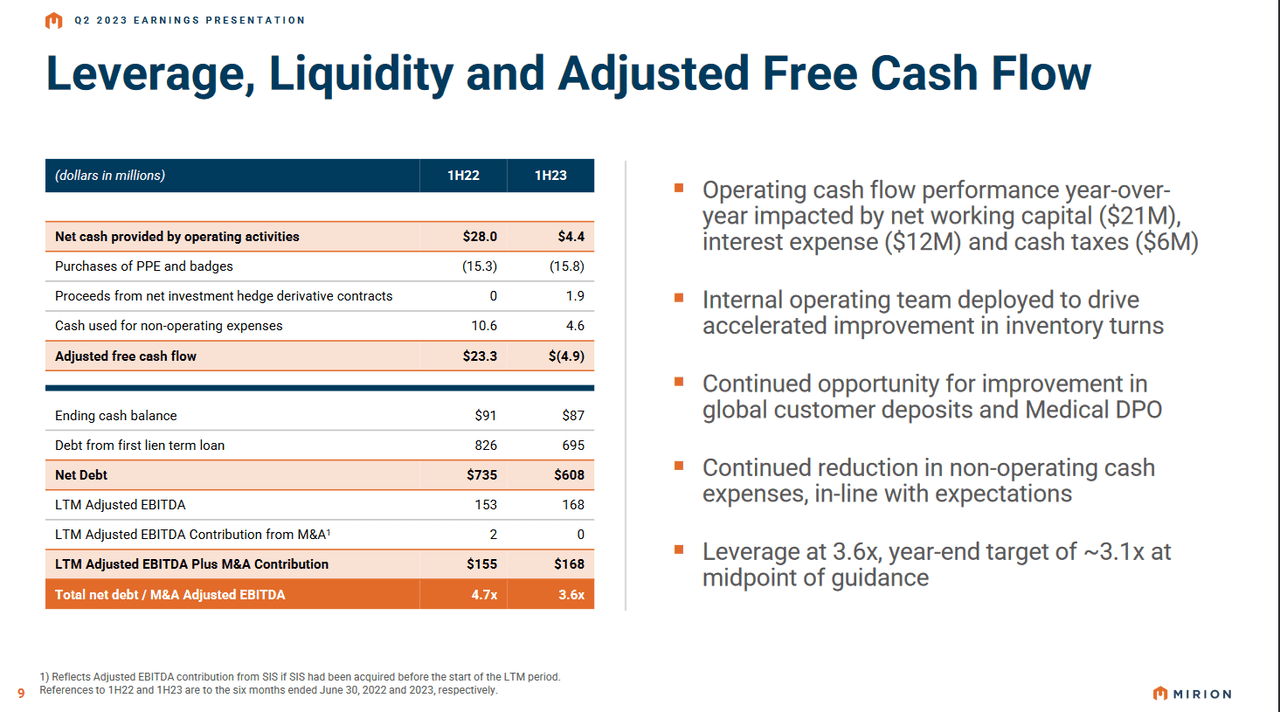

FCF Overview (Investor Presentation)

Looking at the cash position and liquidity level for the company I think it remains sound and perhaps could be a reason for the share price not going much lower than it has so far. The leverage ratio for the company has been decreased as the company has made strong progress in paying down debt. The net debts are at $608 million right now, down nearly $130 million in just 12 months. This leaves MIR with a total net debt/ M&A Adjusted EBITDA of 3.6, down from 4.7 a year prior.

Risks

MIR navigates a landscape where margin preservation and cash generation have emerged as key considerations. The company recently grappled with challenges stemming from its SIS business, experiencing an unforeseen contraction that translated into a margin reduction of 250 basis points. It’s noteworthy that this business division is relatively nascent within MIR’s operations, introducing an element of uncertainty and the potential for unanticipated costs moving forward.

Cash Flows (Seeking Alpha)

The intricacies of managing margins and sustaining healthy cash flows in a dynamic business environment underscore the need for strategic foresight and adaptability. The setback encountered within the SIS business, while impactful, offers a valuable learning opportunity for the company. As MIR continues to refine its operations and gain deeper insights into the nuances of this newer segment, it can harness these insights to mitigate similar challenges in the future.

Looking at inventory levels MIR recently disclosed a notable accumulation of inventory, marking a noteworthy aspect of the company’s cash generation complexities. As from the last report the inventories are at over $161 million which is a significant improvement from the $143 million it had on December 31, 2022. This elevated inventory position has played a role in the challenges faced by the company in effectively managing its cash flow. Adding to the intricacy of the situation, supply chain disruptions have also come into play, potentially exacerbating the existing predicament. Should these supply chain challenges persist into the second quarter, the repercussions could likely extend beyond operational logistics, leading to an escalation of margin pressures.

Last Pointers

I think that MIR showcased some resilience in the last report as the top line continued to improve, but the impacts of higher interest rates on the company have been visible as the adjusted EPS saw a decline YoY. Besides that, the valuation of the company is not letting on a discount which I would have liked to see.

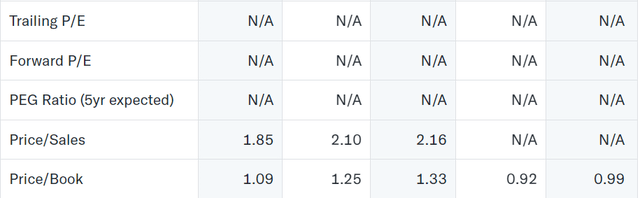

Company Valuation (Yahoo Finance)

Until I can have an earnings discount of about 10 – 15% I wouldn’t be rating the company a buy, unfortunately. However, I find the business model strong and the lower leverage the company now has further lends it to be a decent hold in my opinion.

Read the full article here

Leave a Reply