Two experts see major challenges facing the adoption of new obesity drugs.

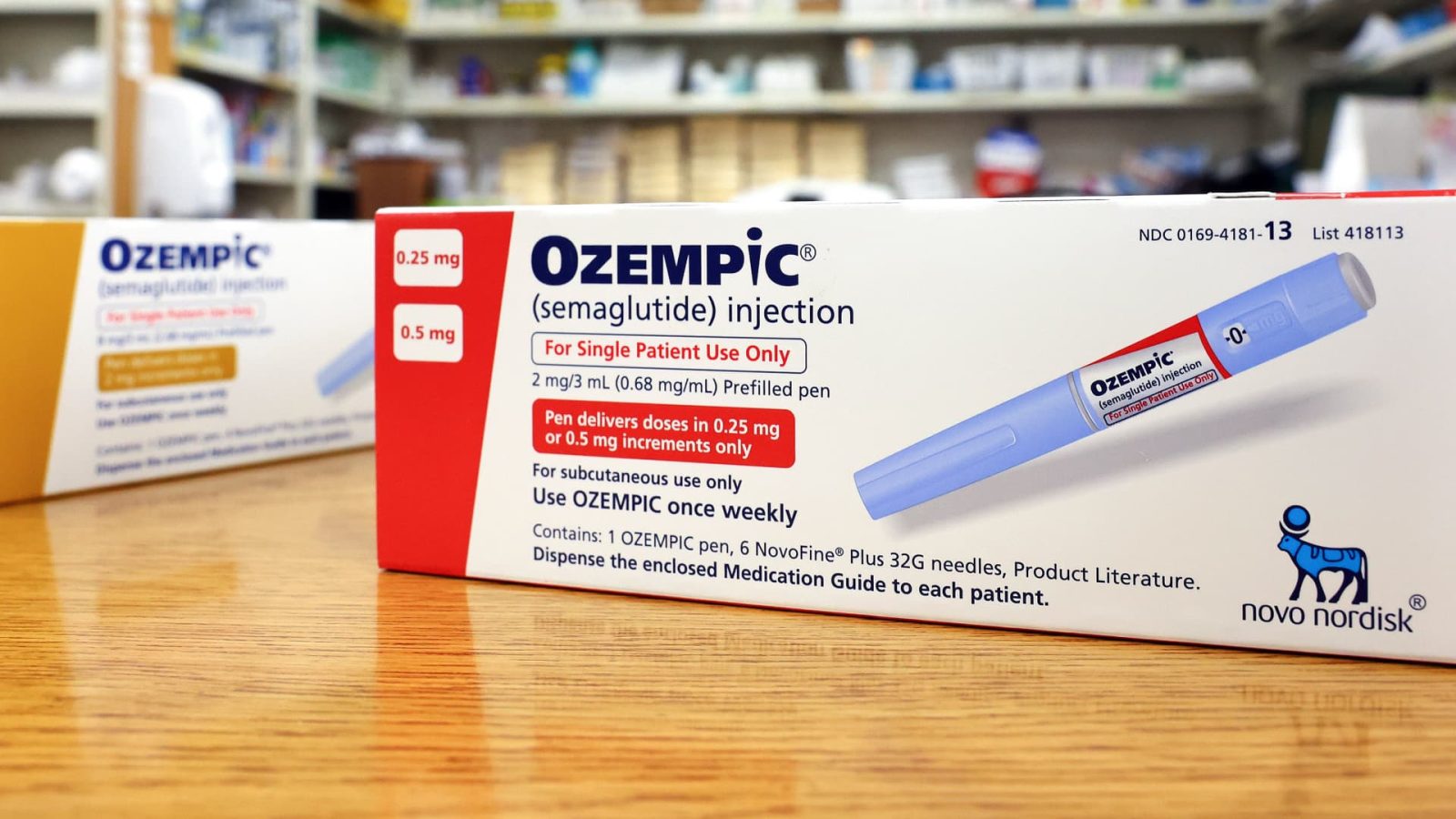

Dr. Kavita Patel, a physician and NBC News medical contributor, believes fresh data from Novo Nordisk on Ozempic’s ability to delay the progression of chronic kidney disease is among the strongest supporting evidence for secondary uses of the drug.

However, she considers data supporting the use of obesity drugs for other conditions including Alzheimer’s and alcohol addiction as underdeveloped.

“Those trials … are nowhere near as robust as the data we have on [Novo Nordisk trial] FLOW, on sleep apnea, cardiovascular risks, on diabetes control — double-blind placebo, randomized controlled trials that are incredible,” she told CNBC’s “Fast Money” on Wednesday. “We have a long way to go for that. I’ve seen a lot of miracle drugs before.”

Novo Nordisk halted FLOW on Tuesday. According to the company’s press release, it happened more than a year after an interim analysis showed that Ozempic could treat chronic kidney disease in Type 2 diabetic patients.

As of Friday’s close, Novo Nordisk is up 9.82% since its announcement. Its obesity drug maker competitor Eli Lilly is up 5.16% in the same period.

Patel believes efficacy is just one of the major hurdles the medication needs to clear before it can be approved for uses outside of diabetes management.

“We know this drug works really well in diabetics. But there are so many barriers to getting there —including cost, adherence, prescriber rate,” said Patel, who also served as a White House Health Policy Director under President Obama.

Patients opting to use GLP-1 drugs — a group of medications initially designed to control diabetes — for weight management often must pay out-of-pocket.

“Right now, we are seeing active employers, entire states that are declining to cover on the weight loss indication,” Patel said.

If the U.S. Food and Drug Administration approves Ozempic for use in Type 2 diabetics with chronic kidney disease, which Patel believes will happen, it could force the hand of insurance companies to expand their coverage of the drug.

“We’ll see a final package of data that will just be so compelling, that it would be wrong not to cover this, because it should be superior to what we have available to us,” she noted. “That is something that I think the insurance companies will have a difficult time [with].”

Mizuho Health Care Sector Strategist Jared Holz also expects challenges related to insurance coverage as more patients begin taking GLP-1 drugs, which could limit overall adoption.

“The payers, at some point, are going to be saying, ‘We get it, but we cannot pay for these at this volume without seeing the benefit, which may be 10 years from now, 20 years from now, 30.’ We have no idea when the offset is going to be,” he also told CNBC’s “Fast Money.”

Holz also pointed out the divide emerging in the health care sector between Novo Nordisk, Eli Lilly and their pharmaceutical peers.

“We haven’t seen this kind of valuation disconnect between the peer group, maybe in the history of the sector,” he said.

The growth trend may not be sustainable for Novo Nordisk and Eli Lilly, based on current supply constraints that have left patients unable to secure dosages.

“The companies can’t make enough, I don’t think, to actually put out revenue that’s going to appease investors, given where the stocks are trading,” said Holz.

A Novo Nordisk spokesperson did not offer a comment due to the company’s quiet period ahead of earnings. Eli Lilly did not immediately respond to a request for comment.

Read the full article here

Leave a Reply