Dear readers/followers,

My last article on Millicom International Cellular (NASDAQ:TIGO) at this point is over 10 months old. And while we haven’t seen outperformance to the market, we have seen impressive overall trends given how much most telcos are actually down. My position in the company is too small to really take any sort of victory lap here, even if that was what I wanted to do (it’s not).

Instead, I mean to update my long-term thesis on this company, and see if it at some point might become a candidate for something where I go in “deeply”, as opposed to very slowly, as I am handling the company today.

Now, a good point is that we’re actually up for the past 10 months since I last wrote about the company.

The negative part?

It’s not actually higher than the S&P500.

So, in this update, I’m going to focus on what’s actually changed since I last updated on this company.

Let’s see what we have here.

Millicom – Not unattractive, not for the long term at least

So, Millicom is a bit of a problematic business to invest in. Why, you may ask?

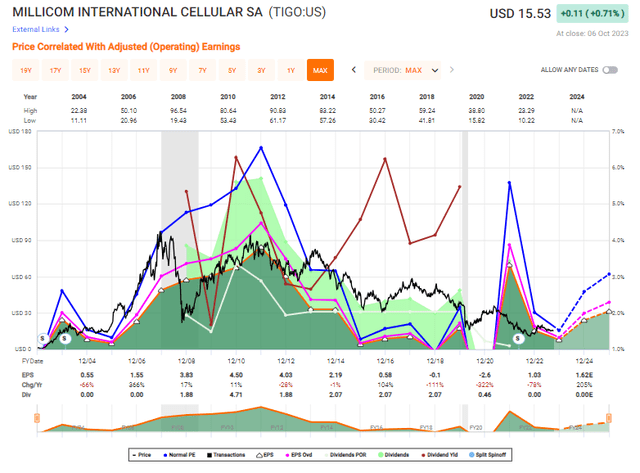

I find that sometimes illustrations paint better pictures than words ever can, so here is the company’s ~20-year valuation, yield and earnings.

TIGO EPS/Valuation (F.A.S.T Graphs)

This is not a pretty picture. We have yield all over the place, we have earnings all over the place, we have extreme yields one year, then nothing or much lower a few years later. At one time it was a dividend-investor darling, but if you invested back in 2020, you’re currently significantly in the negative to the tune of 60% negative RoR.

What gives?

Well, contrary to what many people say, this is actually not a “bad” company, even if it looks like it. The company was actually one of the three first cellular developments (by license) to be granted a license by the FCC, in Raleigh-Durham, NC. After planning for two years, the company began operations here in 1982. When this company was developing, only 8% of the world’s population had phone service, and Millicom’s business idea was to change that, promoting global mobile tech through the use of local strategic JVs.

In that sense, it was well ahead of its time, with a rich history. Millicom was among the first companies to set up networks in the UK (the Racal-Millicom JV became Vodafone (VOD), China (through China Telecom Systems), and others. It oversaw Microtel Communications, teaming up with British Aerospace and Pacific Telesis, and later became Orange (ORAN), which in turn was M&A’d by the new parent company Mannesmann, which later was incorporated into Vodafone.

But a rich history like this is only of limited help if your current results don’t meet demands. And Millicom has left Africa and other growth markets to essentially focus on one area – LATAM.

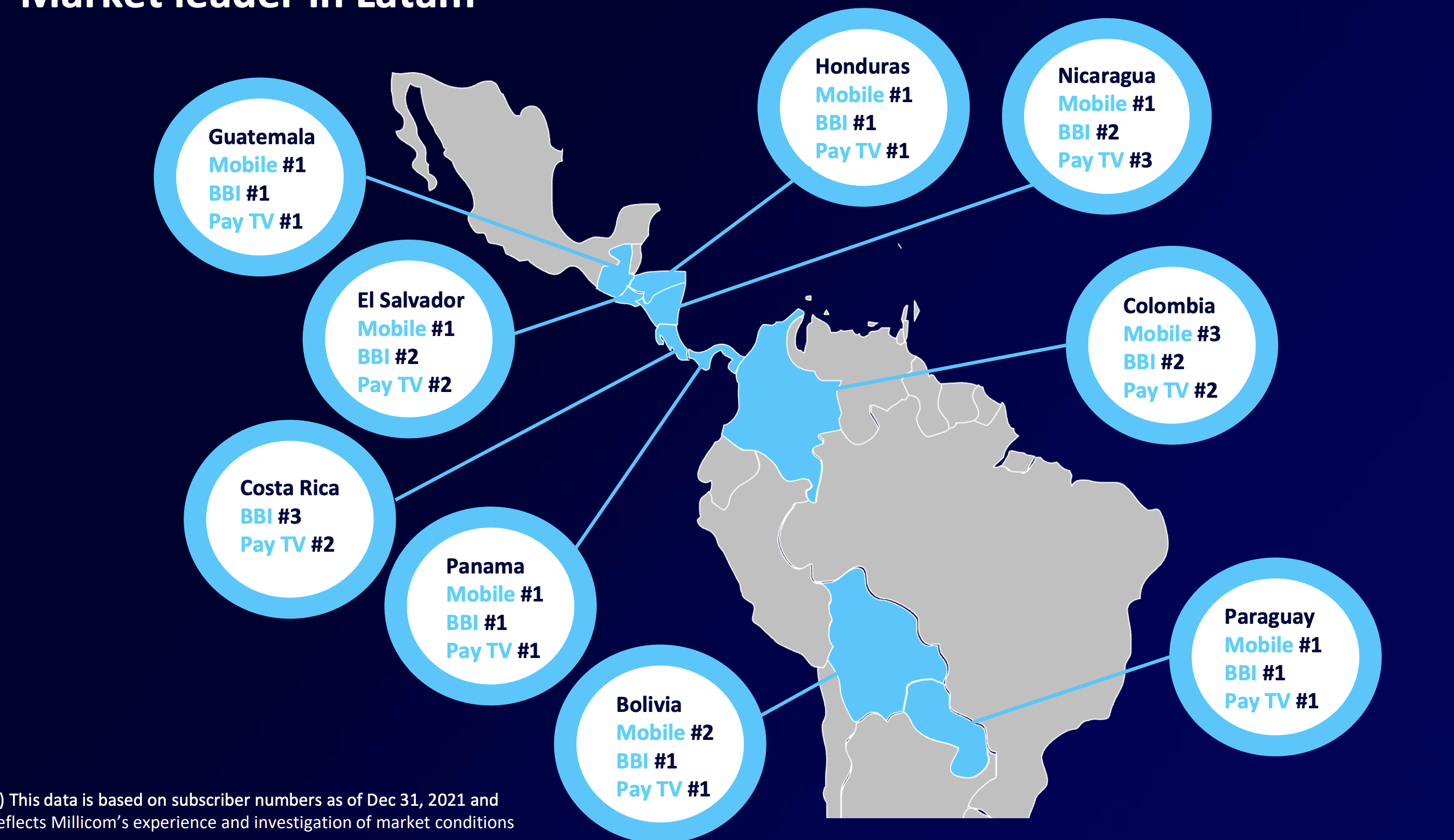

The company’s LATAM operations are focused on areas like Panama, Nicaragua, Guatemala, and similar areas. If you think that these aren’t all that stable geographies to operate in, that’s because they aren’t.

But TIGO is now one of LATAM/SA’s largest Telco, but in areas where other operators aren’t.

There’s something to be said for that. Here are the company’s operating areas.

TIGO IR (TIGO IR)

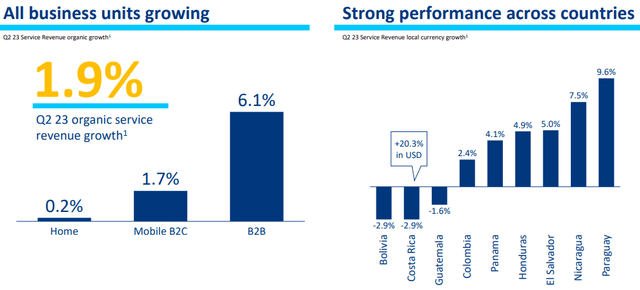

Results for the latest quarter aren’t bad at all. We’re seeing 1.9% service revenue growth, and the company’s postpaid and B2B momentum continuing upward. Pricing discipline is in effect, and its operations in Colombia and Guatemala are advancing.

In fact, all of the company’s business units are growing. Some country areas are down, but most are up, and several are up over or close to 5-7%.

TIGO IR (TIGO IR)

B2B especially, as you can see, is continuing its upward trajectory at 29% organic service revenue growth. The company’s migration to postpaid instead of prepaid accounts is also continuing, currently seeing 16.4% organic CAGR.

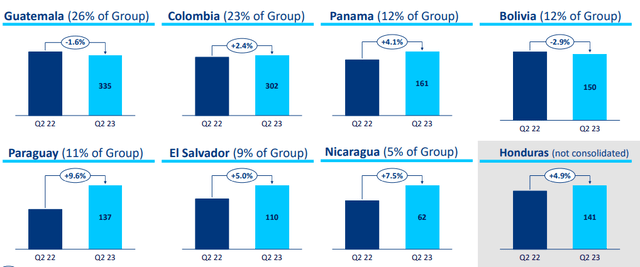

As a whole, you can say that the company is growing quicker in smaller countries than in bigger countries – though it’s important to understand that Bolivia and Colombia alone account for 43% of home service revenue.

EBITDA margins, which is a good comparison because it’s what most Telcos on a global basis use. A good EBITDA margin for a telco I look at is 40%+ in home markets and 35-37% EBITDA in secondary margins. The current margins for TIGO are closer to 32.4% in home markets like Colombia. This is not great, but it’s also up in terms of margin expansion for around 2 years at this point, and it’s continuing to reverse to a 34-35% level which we saw back in very early 2021.

However, some of the issues locally have to do with inflation. Colombia has one of the most significant inflation rates out of all the country averages. US is currently at 3%. TIGO country average is at 4.6%.

Colombia is 12.1% – so you can obviously see what sort of issue this brings.

Here is the current revenue split in terms of service revenue as to how things look for every country.

TIGO IR (TIGO IR)

Colombia is really the only “margin issue” out there, and it’s here that we start to see the advantages of investing in TIGO. Guatemala, for instance, has over 50% EBITDA margin, which is higher than any European telco for any area. Margins are over 38% in Bolivia, Panama, Paraguay, Honduras and Nicaragua – with several of these significantly over 40%.

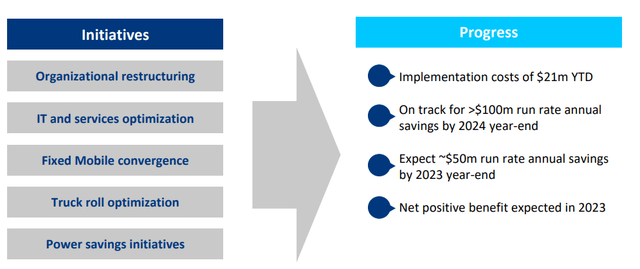

And the company is moving forward on its project Everest, which is part of making things even more profitable, delivering significant savings for 2023-2025.

TIGO IR (TIGO IR)

TIGO has been on this so-called transformative journey for several years at this point. The next set of goals includes upsizing its Cable and winning more capacities and users in Colombia and other areas, as well as trying to use its leadership to work the infrastructure and fintech sector, specifically addressing the under penetration in these areas, working OCF growth.

Again, to say things aren’t going well for TIGO would be wrong. The problem is the lack of real credit rating, the lack of any sort of yield, and the extremely uncertain position this company’s forecasts put us in.

The problem with TIGO is primarily two things.

First off, the current CapEx increase expectation, which is likely to put the company above 17% of sales eventually, is going to be fairly rough in this sort of interest rate environment. The company is already fairly debt-heavy towards the 2025-2027E period, and if this continues on a forward basis with more CapEx, this is going to be loaded even more, with many of the bonds already at over 6.2% for the company.

So the reason for the company’s underperformance and why it “won’t rise”, I put on this fact and really the fundamentals. The fact that the company for 20 years hasn’t managed to provide stability for investors is only an addition here.

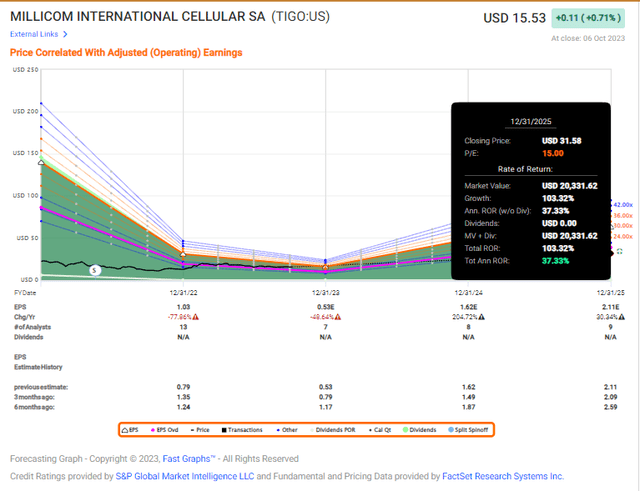

The company is not unattractive – and some forecasts call this year, with inflation at peak in some areas, the worst year for the company. In fact, the current FactSet forecasts call for the company to rise triple digits in terms of EPS in 2024E, and another 30% in 2025E.

This could act as a catalyst for a significant reversal – and let’s see what this would mean in terms of valuation.

Millicom – The valuation is compelling, but the forecast inaccuracy still makes it doubtful

I in act specified this in my last article, because the forecasts are still showing the same trends. In my last article, I pointed to a 50% annualized potential RoR.

Today, this is what this looks like based only on a 15x forward P/E.

F.A.S.T graphs TIGO upside (F.A.S.T graphs)

To clear up my thesis early on – I do believe that TIGO is a “BUY” here.

But I also want to clarify that only the most risk-tolerant investors should play this stock – because it does not have a dividend, and I don’t see the company reintroducing a dividend even if the earnings go this way. The company is likely to focus on downpayment of debt – and it probably should do exactly that.

So, dividend investors should stay away. The sort of investors that should look at this company are those that are looking for high, longer-term capital appreciation investors, that are willing to wait perhaps 2-3 years for that 100-200% upside.

TIGO may deliver just that.

In order to invest in Millicom, you need to be able to stomach the risk that the investment brings with it. As it stands, and for the time being, that’s not something that even I am willing to do – the opportunities on the market today as it stands are far more appealing on a total basis than what TIGO offers today.

Still, it’s “BUY” for the risk-tolerant investor. I’m talking triple-digit upside. I’m talking the company, even trading at $15.5, has an over 28% upside to the conservative targets here. 6 S&P Global analysts follow the company, and target between $16 on the low side to $30/share on the high side, with an average of $20/share, 3 analysts out of those 6 are currently at a “BUY”.

My position in the company is very limited. I also don’t have any clear intention of expanding it here – the market is offering too good alternatives.

But I can see some investors being comfortable with that risk, and wanting that exposure and potential 100-200% RoR. One of my close acquaintances makes his money that way – finding undervalued emerging market companies with very good fundamentals, and holding them until they reverse. He’s made fortunes this way, and he’s very deeply invested in TIGO.

Others may be of a similar mindset.

This company is for those of you.

Thesis

- Millicom Cellular is a company in the telecommunications business that is the equivalent of a growth stock in this sector. The company has emerging market exposure in LATAM, and with the right set of circumstances, could triple within 5 years, or ten-fold in 10-15 if things go the way the company expects.

- However, the risk/reward ratio is massive here compared to what’s otherwise available on the market and what qualities telcos are known for. So while based on valuation, I view this company as buyable, I would be extremely cautious unless you’re anything but very risk-tolerant.

- Nonetheless, I give TIGO a conservative PT of $18/share and consider it a “BUY” at this time.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I view the company as qualitative and cheap – the only problem is the dividend and risk – and those are big ones. It’s also a stretch to call it conservative, but I do believe the underlying assets are “safe”.

Read the full article here

Leave a Reply