MidCap Financial Investment Corporation (NASDAQ:MFIC) is a publicly traded business development company or BDC with a market cap of just over $880 million.

While it is relatively small in size, there is a strong knowledge embedded in the organization since it operates as part of Apollo’s Direct Origination Platform, which in turn has more than $30 billion of AUM.

The investment strategy of MFIC differs a bit from its peer universe as the focus is primarily put on investing in senior secured middle market loans.

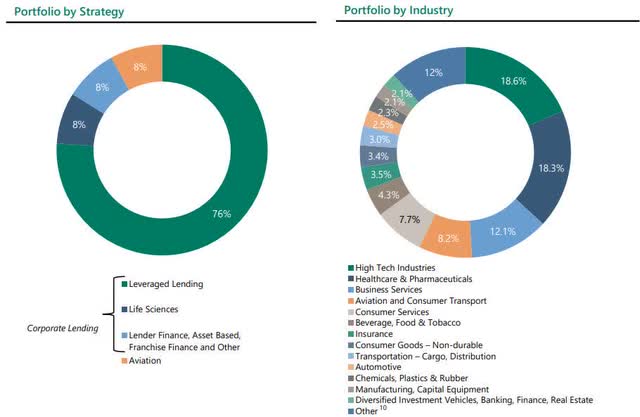

MidCap Financial Investment Corporation September 2023 Investor Presentation

The chart above depicts the focus nicely. There is heavy skew towards leveraged finance loans accounting for ~75% of the portfolio with the remaining share equally split among life sciences, aviation and other segments. In terms of the exposure by industry, high tech, healthcare & pharma, and aviation constitute around half of the total allocations.

For a BDC with a market cap below $1 billion, I would say that the diversification is solid. Some concentration risks remain especially from life sciences and high tech industries, but again, this is not that different compared to the rest of BDC players.

Another crucially important aspect is the terms on which MFIC originates its loans. All of the existing loans are based on floating rate and an average credit risk premium of 614 basis points. And majority of the loans are channeled as secured first lien loans providing an extra layer of safety.

The immediate conclusion is that MFIC is relatively diversified and protected from the interest rate risk as all of the loans embody SOFR component. The floating mechanics work very well in times of high interest rate environment, which is one of the key drivers behind MFIC’s ability to distribute ~11% dividend yield.

The thesis

In my opinion, this is a right environment when to invest in private credit BDC vehicles. There are several reasons for this, but the main two are the following:

- Higher for longer scenario allowing for an increased spread capture between cost of financing and the rate at which loans are given as the credit risk premiums are clearly up.

- Recent distress in the banking sector and mounting problems in the commercial real estate space coupled with inflationary pressures on the small businesses have made the access to financing less available.

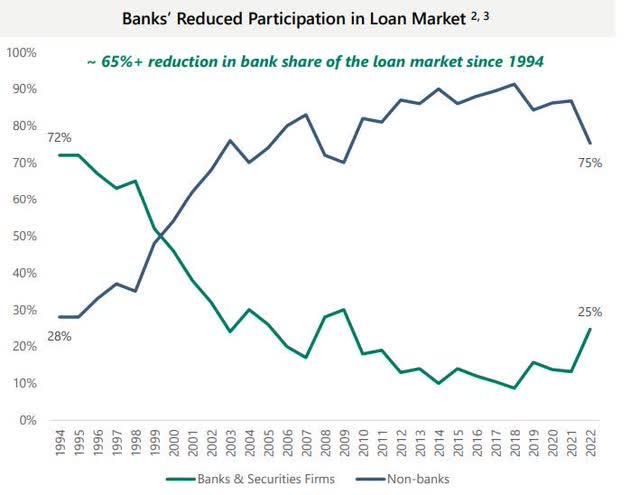

MidCap Financial Investment Corporation September 2023 Investor Presentation

We can see this situation playing out via statistics as well.

MidCap Financial Investment Corporation September 2023 Investor Presentation

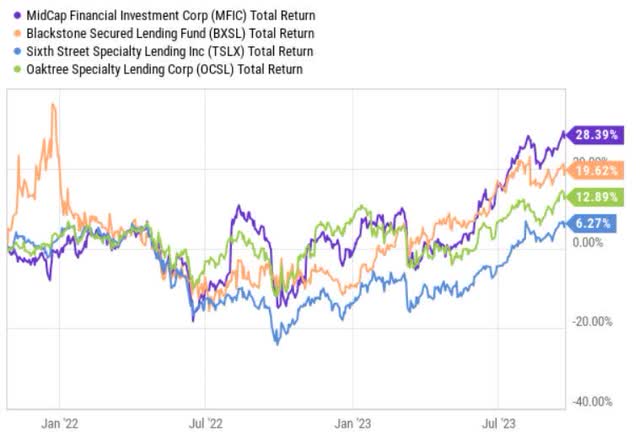

The total return chart of MFIC and three of the closest peers having similar exposures, focus on secured first lien and skew towards floating loans, have all performed well since the FED switched to a more aggressive monetary policy.

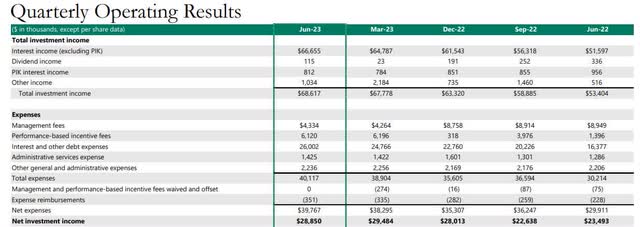

Financial Results for the Quarter Ended June 30, 2023

Looking at the financial data, we can see how MFIC has managed to register an improving net investment income performance by transitioning from ~$23 million territory last year to closer to $29 million per quarter this year. Here it is important to note that during the same period (from June, 2022 to June, 2023), the share count decreased a bit by about 2%. This means that the recent growth has been attributable to internal drivers rather than external and dilutive financing.

The key reason for the aforementioned growth has been the combination of increased spread from SOFR and portfolio growth due to continued reinvestments and an assumption of incremental leverage.

However, with all of this being said, there are two issues, which render MFIC’s investment case subpar relative to other names. It is that MFIC’s has clearly chosen a more risk oriented strategy, which has to a large extent paid off considering the reflected chart above.

In other words, during well-performing markets and economy, MFIC’s has got compensated for the assumed risk, which has resulted in a very solid performance beating many of the sector peers.

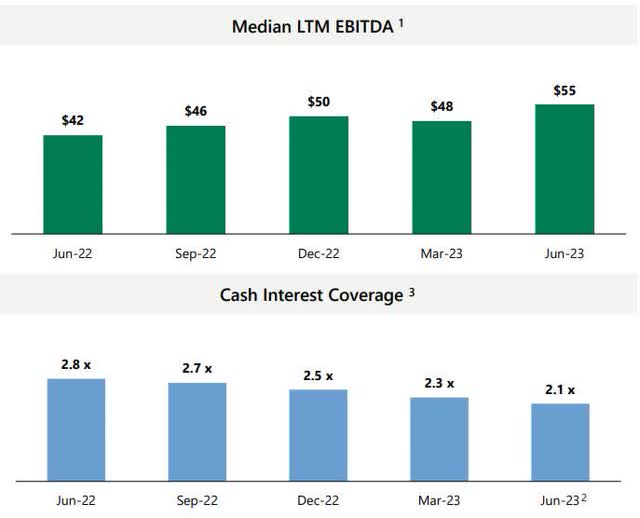

The first concern is that the median size of EBITDA of companies to which MFIC has channeled debt financing is relatively small around $55 million. As we can see by looking at various small to medium-cap indices, smaller size companies have been struggling with their earnings since the interest rates have gone up.

The small (medium) size factor per definition introduces a more pronounced financial risk within the portfolio. Against the backdrop of looming recessionary risks, declining economic activity and general tightness in the financing markets, companies with smaller balance sheets are set to struggle.

We have to keep in mind that the companies, which rely on financing from BDCs are not the best quality per definition. Usually, these are private companies with already exhausted financial capacity to accommodate growth.

MidCap Financial Investment Corporation September 2023 Investor Presentation

The worst thing in this context is the declining cash interest coverage, which has gone down quarter by quarter starting from early 2022 (June, 2022 per the picture above). This means that the underlying financial profile of MFIC’s companies is deteriorating with cash interest coverage ratio revolving around a risky territory (i.e., below 2x).

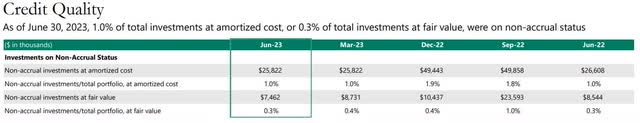

Second concern is the conservative or almost non-existent accruals. It is very hard to believe that the portfolio quality has remained more or less unchanged, while the cash interest coverage metric has gone down by ~25%.

MidCap Financial Investment Corporation Earnings Supplemental Information for Quarter Ended June 30, 2023

Considering that almost all of MFIC’s loans are generated via private market transactions (i.e., without any directly measurable pricing mechanism) and inherently carry more flexible covenants, MFIC has ample room to make internal judgment as to what the level of potential impairment risk is.

So, we do not have a clear visibility on the actual situation or performance of these loans, but given the increasing financial risk and extremely high interest rates, it does not seem totally fair to make so conservative assumptions.

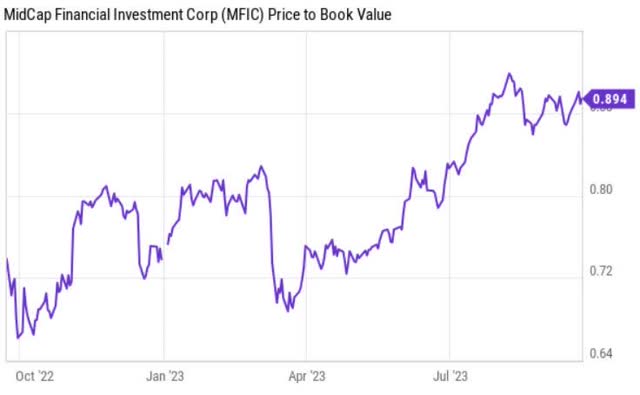

Finally, one of the key reasons why MFIC is not a direct sell is because of the valuations. On the one hand, it is more expensive relative to the 5-year historical average, but on the other hand it trades below most of its peers.

Ycharts

The price to book value (or P/B) multiple has increased dramatically in the TTM period, which is in line with the aforementioned outperformance. Based on the current level, the MFIC’s P/B is ~ 14% above the 5-year historical average.

So, from this we could imply that MFIC has indeed got a bit cheaper despite the inherent risk profile, which has become more of a concern given the prevailing macroeconomic backdrop.

However, when we compare MFIC to comparable names such as Blackstone Secured Lending (NYSE:BXSL), Sixth Street Specialty Lending, Inc. (NYSE:TSLX), and Oaktree Specialty Lending (NASDAQ:OCSL), the picture starts to become not that straight forward.

Ycharts

As of now, MFIC trades ~15% below its BDC peers (albeit, the gap has narrowed recently). It seems that the market has also recognized the weakening of the underlying credit profile and is concerned about the exposure towards small/mid-cap companies with clearly decreasing coverage factors. So, the delta between valuations is to a large extent attributable to the implied risk of elevated credit losses (i.e., write-offs).

Yet, in case the market and the overall economy start to assume a positive sentiment again and the data come out indicating solid growth potential ahead (either fundamentally or driven by lower interest rates), there is a strong likelihood that MFIC performs well closing the valuation gap (as the risk associated with small / mid cap companies decreases).

The bottom line

All in all, MFIC operates in a segment, which currently enjoys some significant tailwinds mainly because of the relatively high interest rates.

The structure of MFIC is sound and solid since the BDC puts a major focus on secured first lien and floating rate loans in a diversified manner.

However, as the recent outperformance indicates, MFIC’s returns have exceeded those of the peers due to a more solid cash generation and stable NAV. This has been partly explained by the higher risk that MFIC has assumed by focusing on the smaller / mid cap companies, and partly by very minimal NAV write-offs.

On a go forward basis, I expect MFIC to still perform relatively well given the structural macro support for alternative loan markets. Nevertheless, I think that the probability is rather high that MFIC underperforms its peers due to a clearly deteriorating credit profile of its portfolio companies and historically conservative loan write-offs.

Read the full article here

Leave a Reply