After a treacherous ride through 2022, Mark Zuckerberg has learned his lesson to not go against the tide with his “Metaverse at all costs” strategy, and instead directly address some of market’s hottest demands – namely, profitable growth and AI. And the stock (NASDAQ:META) has continued to build on the successful delivery of the company’s commitment to a year of efficiency since. Specifically, Meta’s Q3 outperformance drove an incremental post-earnings late trading rally of about 3%, pushing gains higher despite rocky market sentiment due to surging bond yields in recent weeks. In addition to continued margin expansion enabled by the increasingly prominent impact of cost savings initiatives implemented this year, Meta’s growing focus on AI developments also underscores tremendous monetization opportunities ahead.

We believe Meta’s potential as one of the greatest AI companies in the market remains overlooked. By leveraging its market-leading reach in social media and advertising, Meta is well-positioned to monetize on opportunities across the AI value chain. This ranges from the provision of relevant infrastructure and foundation models needed to facilitate the development and deployment of AI technologies, to the incorporation of AI across its existing business components. Specifically, within Meta’s existing business portfolio itself presents many verticals of AI monetization, such as advertising, business messaging, and content creation. And all of which remains early stages of implementing and monetizing their respective AI-enabled capabilities, reinforcing Meta’s sustained trajectory of growth. Meta’s increased efforts in AI developments are also complementary to its capital-intensive Metaverse ambitions set out in recent years by potentially turning the speculative development into something more practical for mainstream adoption over the longer term.

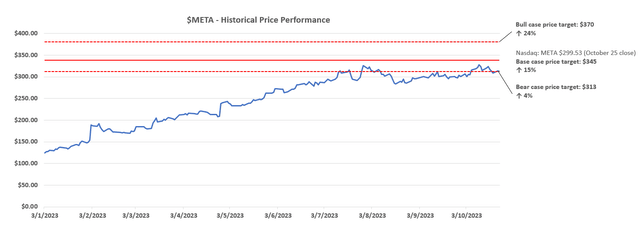

Despite the stock’s 150%-plus rally this year, it still trades at valuation multiples that trail Meta’s comparable mega-cap Internet peers. Coupled with multiple avenues across the business for AI monetization, the stock presents further room to run from current levels.

Taking Off On a New Page in Advertising Sales

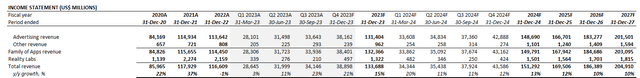

Meta’s Q3 Family of Apps revenue grew 24% y/y to $$33.9 billion, led by continued acceleration in advertising revenue sales. Specifically, advertising revenue grew 24% y/y to $$33.6 billion during the third quarter despite continued ad pricing pressures (-6% in Q3 vs. -16% in Q2).

The impressive results continue to highlight improved engagement measurement and performance for advertisers in recent quarters following the integration of AI features across Meta’s advertising formats, such as Advantage+. Ad impressions grew 31% year-over-year in the third quarter, marking continued improvements from 34% in the prior quarter.

This is in line with recent industry checks, which continue to indicate rising ad dollar share gains at Meta thanks to its improving return on ad spend (“ROAS”) and declining cost per action (“CPA”) offered to advertisers. The company also has continued to tweak its various tools aimed at overcoming targeting and performance measurement challenges since Apple’s (AAPL) implementation of “App Tracking Transparency,” which helps to drive further ad dollar share gains.

This includes continued enhancements made to “Conversion Lift,” a proprietary tool at Meta that measures the direct “causal impact that Facebook, Instagram and Audience Network ads have on business performance.” The tool offers a differentiated value proposition to advertisers by enabling “cross-device conversion measurement,” which tracks conversions directly linked to ads deployed through Meta’s Family of Apps, removing the inefficiencies of siloed measurement systems. This has been especially applicable with the increasing adoption of multi-channel commerce (i.e. physical store, online store through web browsers, mobile app store, in-app storefronts, etc.). Specifically, smartphones now drive about three quarters of global retail site traffic, and account for more than 60% of online purchases, underscoring the value proposition of Meta’s Conversion Lift measurement tool to advertisers.

In addition to improved effectiveness of Meta’s AI-infused ad platforms and measurement tools, the company’s various ad distribution channels/surfaces have also been well received – particularly Meta Shop and Reels ads in recent quarters. Specifically, Reels has more than 200 billion plays per day across Facebook and Instagram, with monetization steadily ramping up beyond the annual revenue run-rate of $10 billion across Meta’s Family of Apps. This is in line with advertisers’ observations of higher conversion rates on these distribution channels in recent quarters, which are favorable to Meta’s continued aims at increasing monetization of Reels. Increasing adoption of click-to-message ads also highlights the feature’s appeal as an “incremental surface opportunity” for advertisers, underscoring favorable prospects for the emerging ad revenue growth driver going forward. This emerging growth tailwind is further corroborated by the consistent high double-digit percentage expansion of WhatsApp Business and click-to-message ad revenue in recent quarters.

Taken together, the improvements continue to showcase Meta’s advantageous positioning in capturing the return of ad dollars allocated to social media ad formats in recent quarters, as the company continues to best its comparable peers in the post-AT&T era. Specifically, social media ad demand expectations have been on the rise in recent months, with full-year 2023 growth now estimated at 13.4%, up from 8.4% last projected in June and 6.4% projected in March. And Meta’s continued commitment to improving its advertising market share gains through innovation, which is corroborated by its consistent outperformance relative to the broader social media peer group this year, makes it well-positioned to capitalize on the segment’s tailwinds. The company’s consistent streak of strong ad sales reacceleration observed through 2023 so far also helps to cushion the persistent cyclical impact on broader ad industry demand under currently uncertain macroeconomic conditions.

Meta Steps Up on AI Monetization

As discussed in our previous coverage on the stock, Meta’s proprietary Llama foundation model has been fundamental to its AI developments this year. In the latest development, the company has introduced Llama 2, the next-generation open-source large language model now in general availability for free research and commercial use.

Llama 2 is essentially the redesigned version of its predecessor, which was previously offered under limited availability for research-related use cases. The newly formed generative AI group at Meta had performed incremental enhancements and tests on the model in recent months before introducing the latest version fit for general availability and internal integration across the company’s Family of Apps and internal operations. Meta also partnered with Microsoft to open-source Llama 2, with the model leveraging real-time information from the Bing search engine as well.

In addition to Azure, Meta has made Llama 2 available on key cloud-computing service and foundation model providers such as Amazon Web Services (AMZN) and Hugging Face. By open-sourcing Llama 2, Meta not only democratizes generative AI developments for all business types – especially the small- and medium-sized businesses it caters to – but also enables efficiency in driving future model enhancements by leveraging “a wider community of developers.” And over the longer term, Llama 2 shows potential for further monetization. One of the readily available ways is by taking a share of what cloud service providers like Azure, AWS and Google Cloud (GOOG / GOOGL) charge for reselling foundation model services such as Azure OpenAI Service, AWS Bedrock and SageMaker, and Google Cloud Vertex AI.

Llama 2 also is fundamental to the broader roll-out of AI features across Meta’s existing business. The foundation model already underpins some of Meta’s latest AI tools launched last month at its 2023 Connect conference:

- Emu: Emu, or “Expressive Media Universe,” is a generative AI tool that converts text to image, simulating OpenAI’s GPT-enabled DALL-E. Specifically, Emu will be integrated across WhatsApp, Messenger, Instagram and Facebook Stories over the next month, allowing the conversion of text into “multiple unique, high-quality stickers in seconds.” And leveraging Emu’s technology, Meta also will be introducing “restyle” and “backdrop” to Instagram in the coming months, which will allow users to alter images and/or change backgrounds through simple text prompts that describe the visual style desired. This is expected to bolster engagement across Meta’s Family of Apps, as the developments aim at improving user experience and simplifying the content creation process.

- Meta AI: Meta AI is the company’s proprietary chatbot that rivals OpenAI’s ChatGPT. The conversational generative AI assistant will be deployed through WhatsApp, Messenger, Instagram, as well as its Quest 3 and Ray-Ban Meta AR/VR devices in the coming months. Meta AI underscores several monetization opportunities through the company’s existing offerings – particularly business messaging. As the emerging revenue stream ramps up momentum, Meta AI is likely to further complement adoption by providing seamless integration between automated and real-person online customer service for its enterprise users. And for Family of Apps, Meta AI integration also is expected to be a key engagement driver. Meta has introduced 28 persona-driven AIs influenced by “cultural icons and influencers” ranging from Snoop Dogg to Tom Brady, which are aimed at improving social media interactions across WhatsApp, Messenger and Instagram.

- AI Studio: Metal also introduced AI Studio during the latest Connect conference, which underscores its emerging foray in servicing DevOps. With AI Studio, Meta will help developers “build third-party AIs” for integration with the company’s existing portfolio of messaging services through APIs. Businesses can also leverage AI Studio to “create AIs that reflect their brand’s values and improve customer service experiences” through Meta’s Family of Apps. Meanwhile, creators can use AI Studio to enhance their content creation process and “extend their virtual presence” across Meta’s social media offerings. The development likely paves the way for broader AI applications in the Metaverse, highlighting the company’s aspirations to foster adoption by bolstering the nascent technology’s use cases. This is corroborated by the upcoming introduction of a sandbox next year specifically built to “enable anyone to experiment with creating their own AI,” which Meta aims at eventually extending to the Metaverse.

Fundamental Considerations

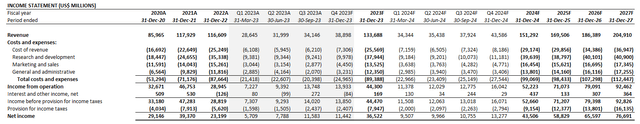

Adjusting our previous forecast for Meta’s actual Q3 performance and forward prospects as discussed in the foregoing analysis, we expect the company’s 2023 revenue to expand 15% y/y to $133.7 billion. Specifically, Family of Apps revenue is expected to expand 16%year-over-year to $$132.4 billion, driven primarily by advertising growth of 16% to $131.4 billion. Meanwhile, other revenue is also expected to gradually increase its mix contribution in Family of Apps revenue over the longer term, driven primarily by continued momentum in the adoption of Meta’s business messaging offerings. Reality Labs revenue is expected to decline 39% y/y to $1.3 billion this year, with longer-term growth likely to remain modest given limited visibility on the adoption and monetization roadmap for Meta’s AR/VR devices, and other Metaverse ambitions such as Horizon Worlds.

Author

On the cost front, we expect full-year operating margin to expand toward 33% for 2023. This is in line with expectations for the full quarter impact of headcount reductions implemented through the third quarter, which is evident in the substantial operating leverage observed during the period, offset by increasing losses in Reality Labs driven by ongoing development costs and investments pertaining to Meta’s AR/VR ambitions. We expect Meta’s longer-term margin expansion trajectory to be more aggressive, driven primarily by scaling AI-related products alongside the broader Metaverse ecosystem.

Author

Meta_Platforms_-_Forecasted_Financial_Information.pdf

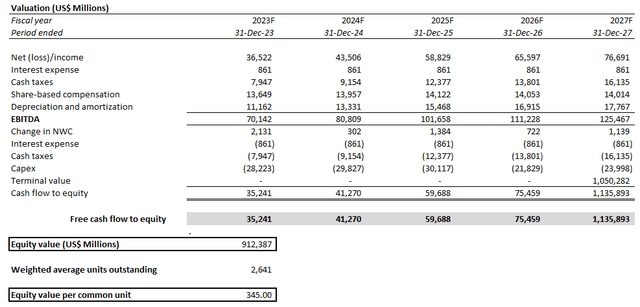

Valuation Considerations

Author

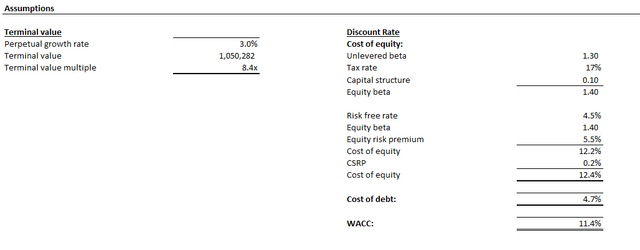

Our base case $345 price target for Meta is based on the discounted cash flow (“DCF”) methodology, which values projected cash flows taken in conjunction with the fundamental forecast discussed in the earlier section. An 11.4% WACC in line with Meta’s capital structure and risk profile is applied, alongside a perpetual growth rate of 3% reflective of the company’s anticipated growth trajectory.

Author

Author

Final Thoughts

Currently trading at 6x forward sales and 23x forward earnings, Meta’s market valuation continues to trail its comparable mega-cap Internet peers’ average. Not only does this reflect further upside from the company’s consistent delivery of value accretive fundamental drivers enabled by ad sales recovery and earnings expansion, but also incremental gains from AI-enabled monetization opportunities over the longer term. Taken together, Meta’s Q3 outperformance has not only reinforced investors’ confidence in the stock, but also harbingers potential for lucrative valuation multiple expansion from current levels driven by resilient market interest in AI.

Read the full article here

Leave a Reply