Thesis

Meta Platforms, Inc. (NASDAQ:META), formerly Facebook, Inc., is an American multinational technology conglomerate based in Menlo Park, California. The company owns and operates Facebook, Instagram, Threads, and WhatsApp, among other products and services.

The company had a rough year in 2022, plagued by slow growth in ad spend, Apple’s regulations, and the bursting of the Metaverse bubble. The earnings, and consequentially, the stock have made a strong comeback in 2023 due to strong growth in ad revenue powered by Reels. I believe the company stands to benefit from the increasing popularity of Instagram among the youth or what I call the “demographic dividend.” The company’s incredible ability to adapt to changing consumer trends and monetize its features will also be a tailwind.

Catalysts

Demographic Dividend

Meta’s family of apps is built for the new generation. CEO Mark Zuckerberg has curated almost an ecosystem for the new generation that has them hooked to their mobile phones. Anecdotally, I have seen the average age of new Instagram users decreasing. My friends and I created Instagram accounts when we were 15-16 years of age, and now I see my younger sibling and his friends create Instagram accounts as soon as they can, which is at age 13. It has become almost necessary for the younger generation to connect with peers at school or interact with the digitally evolving modern world. It’s also because of the increasing smartphone adoption/usage as kids get smartphones at a much younger age.

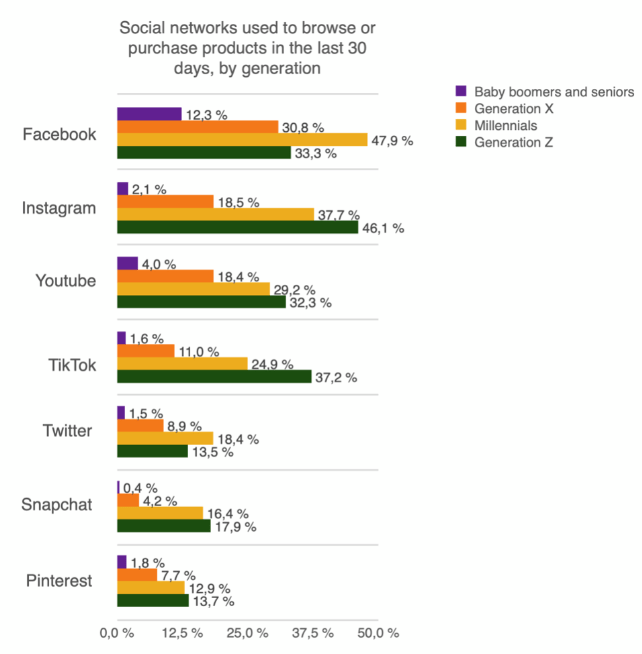

The younger generations tend to spend more time on their phones, especially social media to stay connected with their friends, entertainment, etc. Younger generations also shop more through social media with Facebook and Instagram at the forefront of that. Research shows that nearly 50% of Gen Z and Millennials shop on social media. This is also reflected in the growth in the number of ad impressions on Meta’s Family of Apps, which grew 31% YoY in Q3 2023 compared to the same quarter last year.

Gen-Z is shown to have spent the most time of all generations on social media with the intention of shopping and spending. The below graph shows that 3 out of 4 Gen Z consumers plan to make purchases on social media. Instagram and Facebook were used the most by Gen-Z and Millennials.

PYMNTS Intelligence Research

As the above graph shows, Instagram is the most popular social media application among Gen-Z for shopping, coming in ahead of TikTok, and Facebook followed by YouTube in fourth. As for the Millennials, Facebook and Instagram rank first and second respectively, followed by YouTube, TikTok, and other social media apps.

I expect this trend to continue as the younger generation will continue spending more time and money on shopping through social media. META is capitalizing on this trend by partnering to create a new in-app shopping feature just last month.

Users on Facebook and Instagram will now be able to shop at Amazon using select ads while using those apps. For Meta, the deal could accelerate on-platform shopping and help with measurement, aiding artificial intelligence (“AI”) targeting efforts for other ads. I think this increases monetization opportunities for Meta due to increased ad volumes from Amazon and the acceleration of Meta’s on-platform shopping capabilities. Meta is shifting its Shop sellers to its own checkout experience, with processing fees remaining unchanged.

I do not think this significantly adds to the cost of revenue or software development costs and so this new revenue stream could increase revenue growth from Instagram and Facebook, whilst also enabling margin expansion.

Adaptability and Monetization

While some may criticize Meta for lack of innovation and for copying features from rivals, I want to take a contrarian stance to commend Meta for their adaptability. One can criticize Meta for copying the Stories feature from Snapchat or the Reels feature after the TikTok ban in India, but it’s what people are watching on their feeds and they’re sharing memes about this topic through the very same features that other apps have inspired.

Instagram has a competitive advantage over other social platforms when it comes to engagement. This allows it to charge a premium, especially when it comes to advertising. The average Cost-per-Click for Instagram ads is a whopping $3.56 while platforms like Facebook, Twitter, and Pinterest (PINS) are under $2.

As social media studies have highlighted performance statistics and benefits of integrating Reels into an Instagram content strategy, an increased number of businesses have started to do so.

This was confirmed by data from Social Insider, with Instagram Reels having a usage increase of 57.4% over 2023. Their research also shows that Reels have twice as much reach compared to other content types in 2023, and double the average impression rate. Internal Instagram data reveals that 70% of shoppers look to the platform for their next purchase. As per the Q3 2023 earnings call, Reels is now a net neutral to the company’s ad revenue much earlier than expected and has enabled a 40% increase in time spent on Instagram since its introduction.

With a decline in attention spans, I think Ads between reels and stories will become the most effective way for businesses to advertise and I expect Meta to benefit from a more structural shift away from print advertising to digital advertising.

Metaverse/ AR-VR/ Reality Labs

In late 2021, the metaverse was set into hype off a chain reaction that saw NFTs become mainstream during the cryptocurrency bull market of 2020-21. In October 2021, Facebook announced that it would change its name to Meta. Meta’s Reality Labs division has an operating loss of $15.75 billion on a TTM basis and a cumulative loss of $31.125 billion since Q3 2021.

While Metaverse applications are largely limited to the gaming industry currently, it has a lot of applications in advertising and e-commerce. S&P Global surveyed 4,000 people across 42 countries, of which 80% said they were “somewhat” or “very interested” in the metaverse. More than half expect the Metaverse to have a “very large” or “revolutionary” impact. Accenture surveyed 9,000 people, of whom 5,000 said they wanted to become active users of the Metaverse. About 40% of the surveyed people also wanted to engage with retail and commerce activities and the metaverse.

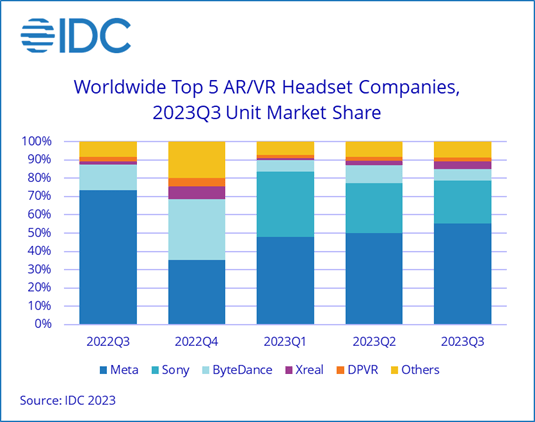

The Augmented Reality market is expected to grow from $25.1 billion in 2023 to $71.2 billion in 2028, growing at an astonishing pace of 23.2% CAGR, whereas the Virtual Reality market is expected to grow from $12.9 billion in 2023 to $29.6 billion in 2028, growing at 18% CAGR. As for headsets, IDC forecasts 96.5% CAGR growth from 2023-2027 for VR headsets, and 30% CAGR for AR headsets till 2027. Meta continues to dominate the market, with a 50.2% share during Q2 2023, while Sony (27.1%) and ByteDance (9.6%), which owns the Pico brand, both gained share every year.

IDC 2023

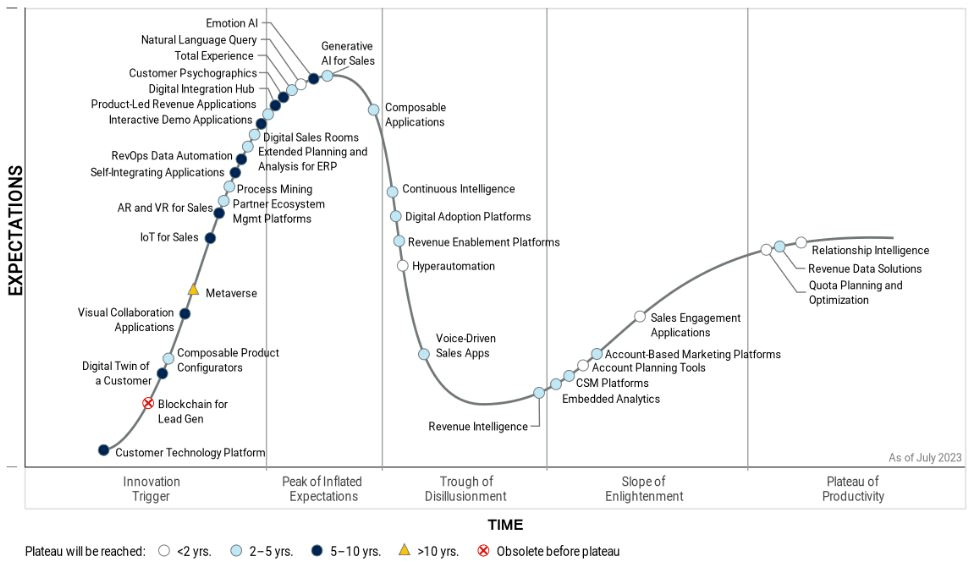

As per Gartner’s Hype Cycle update in July 2023, AR/VR for Sales and the Metaverse are still only in the Innovation Trigger phase, indicating there is a lot of scope for innovation and we are nowhere near peak or past euphoria for these technologies. Gartner expects “Early adopters of AR and VR will complement on-site selling and physical product demonstrations currently performed.” Gartner predicts that by 2025 “50% of all enterprise B2B sales technology implementations will include digital sales rooms, so sales leaders must prepare now.”

Gartner Hype Cycle July 2023 Update

AR/VR has a lot of scope for social media and e-commerce. For social media, it may help increase the time spent on social media by increasing user retention and engagement, through more realistic and immersive experiences. Podcaster Lex Fridman also hosted Mark Zuckerberg on his podcast, where they interacted through AR/VR technology showcasing to the audience how it can create immersive interactions with humans and the surrounding environment. It also has an application in E-Commerce as it can enable users to experience the outfit through augmented reality, allowing them to visualize how it would look on them. This is why the deal with Amazon (AMZN), allowing customers to shop in-app, makes a lot of sense for both Meta and Amazon and is highly futuristic.

This is exactly what Meta is doing–preparing for the future (2025 and beyond) by investing in its Reality Labs segment today. Keeping in mind the huge potential there is for the Metaverse and AR/VR Technologies, Meta is completely justified in betting on it and I also expect it to pay off very well for the company. Meta has also partnered with Logitech in developing the Quest 2 VR Headset.

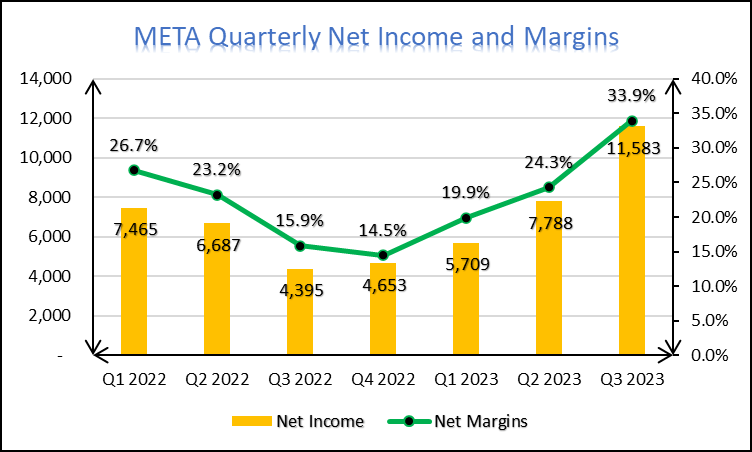

Expansion in Profit Margins

Meta suffered a big blow in 2022 due to a slowdown in global advertising expenditure growth as a consequence of the rate hikes and high inflation in the year. It was also stung by Apple’s (AAPL) new feature on “app tracking transparency” that allowed users to stop apps such as Facebook from tracking them across other apps. This caused a blow to its revenues, but costs remained high, and as a result operating profit margins declined sharply from 43% in Q2 2021 to 20% in Q3 2022.

It was at this point (Q1 2023) that Meta started to announce restructuring and layoffs that had helped improve its profit margins. The company also started to deploy AI-driven recommendations for users on Facebook and Instagram. The company’s feature of “WhatsApp for Business,” a paid messaging feature for Businesses, also started to pick up steam, with users growing 40% in Q1 2023 compared to Q4 2022. As per Q3 2023, the Advantage+ Shopping Campaigns have reached a $10 billion run rate, and the company’s ability to employ AI instead of having to increase the workforce is also driving margins higher.

META Quarterly Income Statement

Valuation

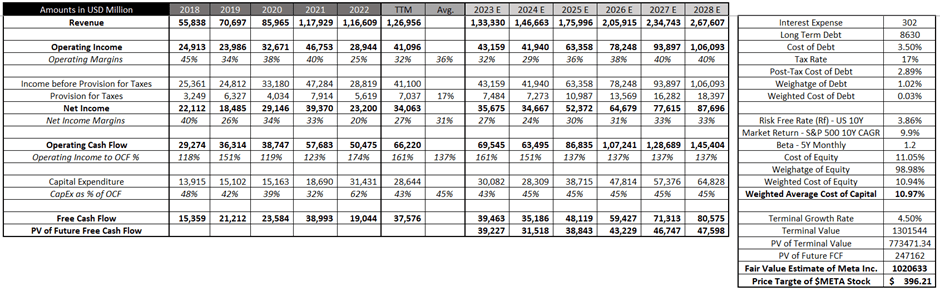

After having looked at the catalysts, let us look at valuing Meta using the Discounted Cash Flow (“DCF”) Method.

Long Term Revenue Growth has been assumed to be 14% CAGR, higher than estimates of 11.5% CAGR to account for all the catalysts mentioned – the demographic dividend, the adaptability of Meta, and especially the long-term growth expectations I have of the Reality Labs segment of the business.

Operating Margins are lower this year, and I expect them to be lower next year on account of decreased advertising revenue. This is because revenue growth for next year has been assumed to be lower than other years since I expect the economy to slow down mildly as the lag effects of the Fed’s rate hikes kick in. But after 2024, I expect Meta’s margins to keep improving as the growth benefits from Metaverse start to kick in 2025.

The effective tax rate was taken as an average of the last five years. Operating Cash Flow was estimated using the Operating Income to Operating Cash Flow conversion ratio, taken at the TTM level for 2023. Then, it was assumed to be slowly decreasing towards the five-year average. Capital Expenditure was then taken as an average of the Operating Cash Flow and deducted from the Operating Cash Flow to estimate the Free Cash Flow.

The Free Cash Flow was then discounted at the Weighted Average Cost of Capital calculated using the CAPM method. As per my estimates, the fair value of Meta is $1.02 Trillion which means my stock price target for $META is $396.21. This indicates a roughly 12% potential upside from the closing price of $354.09 on 21st December 2023.

My Financial Projections

Risks

Risk of Failure – Reality Labs and Threads

As discussed in the Catalysts section, Meta is a company that is great at taking inspiration from features offered by its rivals. However, that doesn’t seem to be the case with its micro-blogging platform Threads. It was the fastest app to reach 150 million sign-ups. However, it was all hype and no game. As of mid-August, it only had 576,000 daily active users. The app does have 100 million monthly active users, and Mark Zuckerberg has announced several additional features. In my opinion, these features aren’t novel to social media apps and I do not expect that Threads will be able to significantly add to DAUs because of these features. As of a week into its launch, Meta announced it had no immediate plans of monetizing Threads.

Another weak point at Meta has been the entire Metaverse and AR/VR division, i.e., Reality Labs. The division has an operating loss of $15.75 billion on a TTM basis and a cumulative loss of $31.125 billion since Q3 2021. These losses are also hurting the Free Cash Flow generated by the company, which is a drag on valuations. Sales of augmented and virtual reality (AR and VR) headsets continue to decline sharply due to weak economic conditions and ageing product lines, according to IDC. Global shipments for AR/VR devices fell 46% year on year in the second quarter of 2023, according to IDC’s latest Worldwide Quarterly Augmented and Virtual Reality Headset Tracker, with commercial shipments falling in line with the overall market (44.4%). This amounts to the fourth successive quarterly decline in shipments and follows another steep drop-off in the first quarter (54.4% year on year, according to IDC figures from June).

The company has recently introduced the Quest 3 which it claims is priced very competitively, especially considering the new features introduced over the Quest 2. The company also claims that early reviews for the Quest 3 have been great. The company has guided losses to widen in 2024 in this segment. While the magnitude of these losses is not known, the reason behind the increasing losses is expected to be due to increased headcount costs and the development of next-generation AR/VR products.

All in all, there are short-term challenges for the AR/VR ecosystem and hence Reality Labs but it is one industry that can really take off rapidly as has been highlighted in the Catalysts section.

Decreasing Advertising Expenditure and Advertising CPMs

While there is no denying that Reels and Stories are highly effective tools for advertising and can be drivers of advertising revenue for Meta, there is one downside to this. Since reels and stories and shorter forms of content, they also attract lower CPM rates, and this has been acknowledged by the company in its Q3 2023 earnings call. However, a bigger concern lies if there is a decrease in advertising expenditure on a larger scale. As per Insider Intelligence, there has been a continuous decline in advertising expenditure in the United States. As for 2024, it is expected that growth in global ad spending will slow down to 5.3% compared to 5.8% this year.

This is not as big a risk, since Meta’s ad revenue has grown rapidly (24% growth in Q3 2023), somewhat on account of a low base effect but largely due to the monetization of reels. Additionally, since 2024 is an election year in the U.S. and India, political advertising spending is expected to increase. U.S. election ad spending is expected to increase to a record $16 billion in 2024, and Facebook is the biggest player in this category.

Conclusion

I would like to conclude this report with a Buy Recommendation for Meta stock, with a target price of $396. I believe that the tailwinds arising from Meta Platforms, Inc.’s Family of Apps becoming increasingly popular among the younger generation and the company’s ability to adapt and monetize its new features will continue to power its growth.

Read the full article here

Leave a Reply