Global memory and AI chipmakers like Micron (MU) and Nvidia (NVDA) are seeing an end to a supply surplus for semiconductors.

In 2022 and 2023, the chip market for smartphones, PCs, and data centers contracted, as corporate clients and consumers reduced their expenditures due to economic challenges stemming from inflation and increasing interest rates.

But the undercurrent of these inventory problems stemmed from excessive capex spending, particularly in memory chips, which I first warned about in my June 25, 2021, Seeking Alpha article entitled Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023, where I presented my thesis for a sharp downturn in 2023 that will extend into 2024.

The dour economy arising from inflationary fiscal spending and Fed policy to reduce this inflation by raising interest rates pulled in the oversupply to mid-2022. At that time, consumers with limited discretionary spending chose to spend their money on food and gasoline rather than electronic gadgets using semiconductors.

The surplus led to a collective historic first-half operating loss of 15.2 trillion won ($12 billion) for the top two global memory chip manufacturers, namely Samsung (OTCPK:SSNLF) (9.1 trillion) and SK Hynix (6.1 trillion).

Demand for consumer electronics, particularly PCs and Smartphones, is recovering very gradually, but recently China, the largest purchaser of chips globally, is currently scaling back its overall demand. Both Samsung and SK Hynix have indicated that China’s reopening has not sparked a resurgence in the smartphone market. Consequently, they are extending production cutbacks for NAND memory chips, crucial components used in smartphones for digital data storage.

In this article, I present details from two perspectives – inventory and chip production. These are in opposition – inventory is a lagging indicator and chip production a leading indicator. I show Quarterly Days of Inventory for various sectors, all of which use DRAMs and NAND.

Days of Inventory

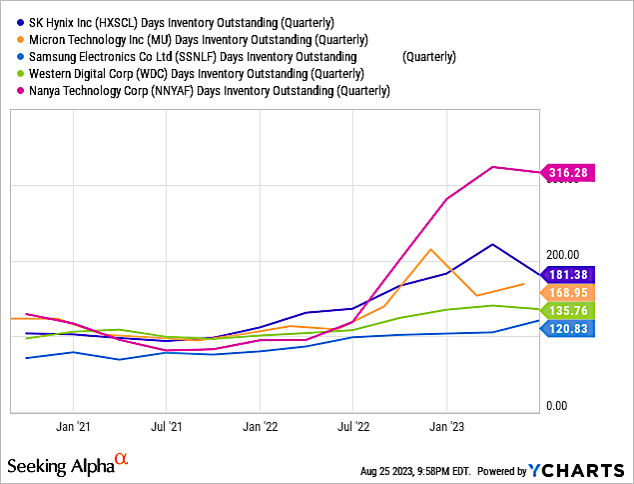

Memory

Memory companies were the first to report revenue drops from the lack of demand from PCs and Smartphones in 2Q 2022. Since the second half of 2022, the worldwide NAND Flash market has been encountering a challenging demand situation. In reaction to this, the supply chain has been working fervently to reduce existing inventory, resulting in a decline of NAND Flash contract prices by approximately 20-25%.

A significant drop in DRAM prices was mostly attributed to high inventory levels of DDR4 and LPDDR5 as PC DRAM, server DRAM, and mobile DRAM collectively account for over 85% of DRAM consumption.

Chart 1 shows that inventory is dropping in the past quarter, but is well ahead of the average 100 days a year ago. Micron, in its recent earnings call, noted:

“We continue to expect stronger industry bit shipments for DRAM and NAND in the second half of the calendar year, driven by secular content growth and continued improvement in customer inventory.

Due to increases in process steps and product complexity, we now target inventory levels of around 120 days.”

YCharts

Chart 1

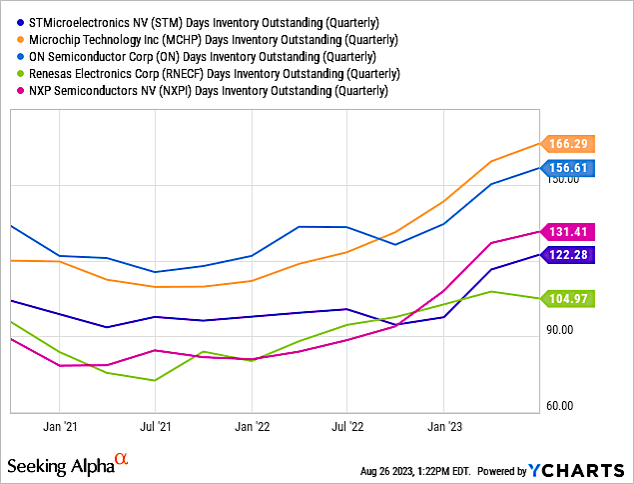

Automotive

In 2020, because of Covid, automobile shipments During the first peak of Covid-19 in the spring, sales of new vehicles collapsed as auto plants shuttered and showrooms were closed.

Auto sales quickly recovered, but chipmakers were slow to recover, resulting in a shortage of automotive MCUs. As a result of the U.S. administration’s war of fossil fuels, EVs were given priority for MCUs, resulting in ICE (internal combustion engines) sitting at plants waiting for MCUs and other chips, while the market expanded.

I discussed my analysis and thesis in a September 22, 2022, Seeking Alpha article “Ford: One Excuse After Another As Changing Business Strategy Stymies Supply Chain.”

- According to NXP’s (NXPI) Q2 2023 report, revenue of the automobile business reached 1.866 billion US dollars, a year-on-year increase of 9% and a month-on-month increase of 2%, accounting for about 56.5% of the total revenue.

- Infineon (OTCQX:IFNNY) in its Q2 2023 call reported that, Automotive reached a record high of €2,129 million and a QoQ increase of 2%.

- STMicroelectronics (STM) reported in its Q2 2023 call that due to sales driven by demand in the automotive industry, ST’s revenue in the second quarter increased to $4.33 billion, an increase of 12.7% year-on-year.

Chart 2 shows Days of Outstanding Inventory for companies where more than 30% of their revenues come from automotive chip sales. Recent quarterly change has been comparable while Renesas (OTCPK:RNECF) dropped.

YCharts

Chart 2

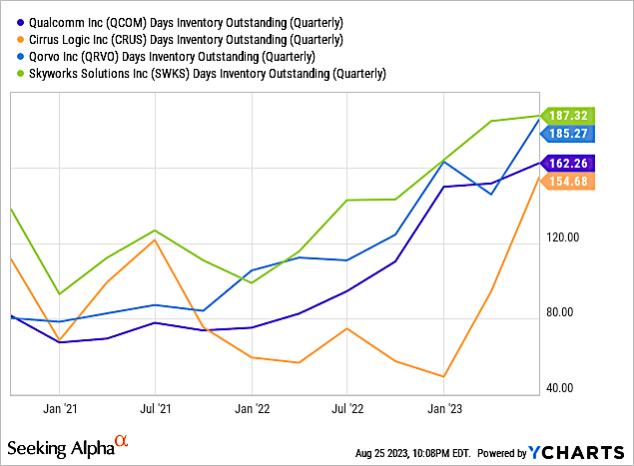

Smartphone

In the second quarter of 2023 (2Q23), global smartphone shipments experienced a year-over-year decline of 6.8%, totaling 268.0 million units, according to IDC. Although this represents the eighth consecutive quarter of contraction for the market due to challenges like subdued demand, inflation, macroeconomic uncertainties, and surplus inventory, the pace of decline is moderating in comparison to preceding quarters.

Days of inventory for leading smartphone semiconductor suppliers are shown in Chart 3. Cirrus Logic (CRUS), whose smartphone revenues account for 85% of total revenues, saw inventory increase significantly in the past quarter. Cirrus Logic is a leader in low-power, high-precision mixed-signal processing solutions.

According to Cirrus CFO Venk Nathamuni:

“we’ve been building inventory to support seasonal product launches in the second half of the calendar year, and fulfill our wafer purchase commitments for our long-term capacity agreement with GlobalFoundries.”

YCharts

Chart 3

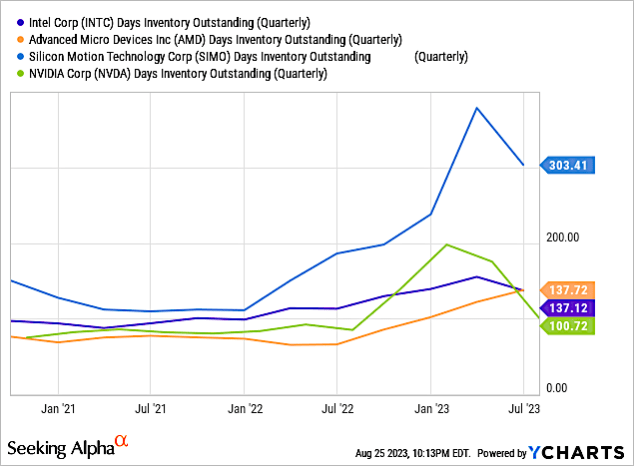

PCs

Total shipments of desktops and notebooks were down by 11.5% with a total of 62.1 million units in Q2 2023, according to Canalys. This follows two consecutive quarters of PC shipments decline by over 30%.

Chart 4 shows that days of inventory are dropping for nearly all PC chip companies. This choice of companies is arbitrary, because Nvidia and AMD (AMD) are both achieving press for their AI chips. Nevertheless, PCs accounted for nearly 60% of Silicon Motion’s (OTC:SIMC) total revenues, 55% of Intel’s (INTC) revenues, 45% of AMD’s total revenues, and 40% of Nvidia’s total revenues, primarily gaming.

YCharts

Chart 4

Industrial

According to The National Association of Manufacturers (NAM), economic activity in the U.S., manufacturing industry declined for the ninth month in a row in July 2023. While the Manufacturing Purchasing Managers’ Index was 46.4 in July, up from 46.0 in June, any number under 50 indicates contraction.

S&P Global’s gauge of worldwide manufacturing activity held steady at 48.7 in July, matching the lowest level since June 2020, with sub-indices of factory output and new orders both slipping to six-month lows. A reading below 50 marks a contraction in activity. Global factory activity remained in a slump in July, a sign slowing growth and weakness in China were taking a toll on the world economy,

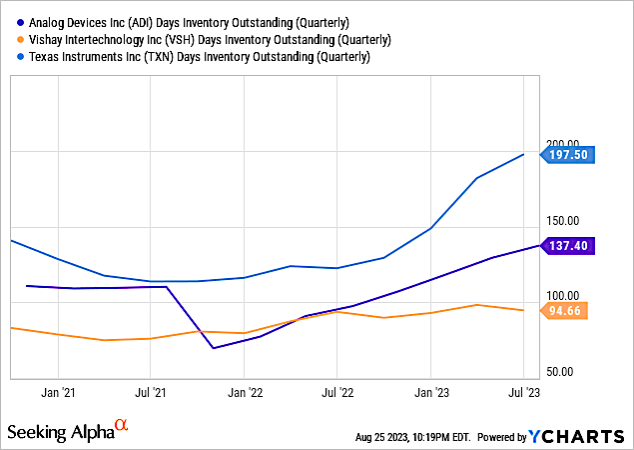

Chart 5 shows inventory of semiconductor companies whose products are used for industrial applications. Vishay Intertechnology (VSH) showed an improvement but Texas Instruments (TXN) and Analog Devices (ADI), which make analog chips, have exhibited increasing days of inventory.

YCharts

Chart 5

Semiconductor Output

Memory Revenues

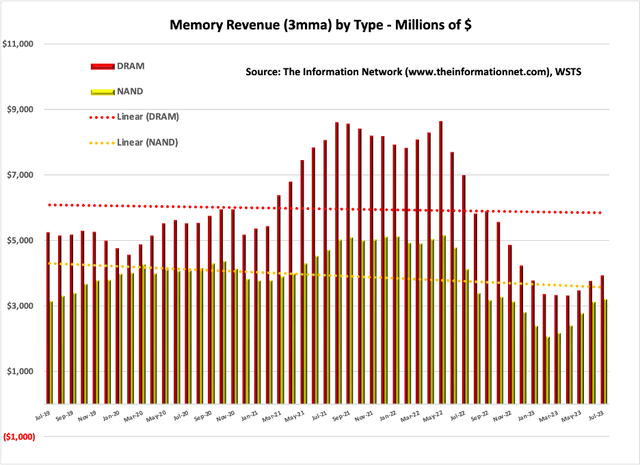

Chart 6 shows DRAM and NAND memory revenues. DRAMs started a recovery in revenue in May 2023 and NAND in March 2023.

Significantly, DRAM revenues dropped from a peak of $8,648 in May 2022 to $3,327 million in March 2023, a drop of 61.5%

NAND revenues dropped from a peak of $5,148 in May 2022 to $2,072 in February 2023, a drop of 59.8%.

The Information Network

Chart 6

Investor Takeaway

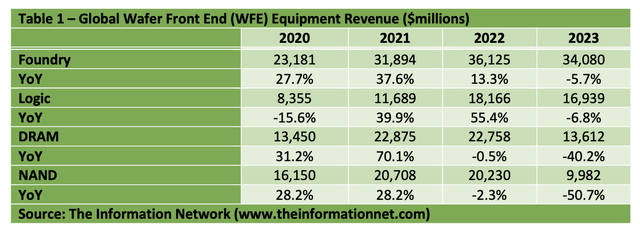

Days of inventory, which have been above historic levels for the past year, are attributed to excessive WFE spend that created excess capacity and increased chip supply. I had warned investors in mid-2021 of this, based on WFE spend shown in Table 1.

Memory companies spent huge amounts of money in 2020 and 2021 on WFE, ignoring my thesis several years earlier that a memory crash was coming in 2019 due to large capex/WFE spend, which it did. As soon as the bloodshed stopped, they started buying again. Now memory companies are suffering again.

In addition, poor fiscal policy leading to high inflation that resulted in Fed tightening exacerbated the oversupply by decreasing demand. I had warned this would start in 2023, but the problem was pulled in by six months because of the dour economy.

The Information Network

Semiconductor inventories remain high, especially in end markets with declining demand (automotive and smartphones). Thus, memory growth through 2H 2023 will be uneven with PCs and Industrial recovering first.

But a total reduction in inventory will occur when demand for chips is greater than supply, and that will be dependent on macroeconomic factors. As these macro headwinds dissipate, chip oversupply will drop as demand for gadgets containing chips is satisfied.

Despite an improving inventory and chip output, Micron has made little headway in the AI/HBM business, commanding just a 10% share of the HBM market and is scheduled to begin mass-producing HBM3 in early 2024.

For DDR5, while SK Hynix is the only company in full production of the 128GB chip, and Samsung is just starting production, MU has only just introduced a 96GB chip.

Read the full article here

Leave a Reply