Short sellers have a bad rep these days. Well, they always have, but it seems to have reached a fever pitch in recent years.

Shorting is a hard way to make money: losses are infinite while profit is capped, and you’re fighting the general trend of the market. For me personally, shorting stocks is a time drain, where I focus too much attention on open short positions at the expense of my longs and searching for new opportunities. So I rarely short stocks, and when I do, it’s usually for an event driven trade.

But my view of short sellers is a positive one. Shorting is important for a well-functioning market, helpful in discovering fraud and serving as a check on overly promotional management teams. When there is significant short interest in a stock I own, rather than getting mad at the short sellers, it makes me to sharpen my pencil and do further diligence. If I’m ultimately proven right, shares could squeeze as a nice bonus, like just happened with H&R Block (HRB).

Sounds simple enough, but it takes a lot of intellectual flexibility to do this. You need to approach the situation with an open mind, and not just look for additional confirming evidence to support your existing position. This is hard and takes discipline.

When a very detailed short thesis for Medical Properties Trust (NYSE:MPW) was released by Rob Simone of Hedgeye in late July 2022, the majority of the investors and SA analysts dismissed it (and I’m putting that mildly) and clung to their existing positions. I saw precisely one person on SA consider it thoughtfully and change their mind. Most bulls doubled-down on existing talking points, with some criticizing Rob’s motives and credibility. They cost themselves money by doing so.

A Mediocre Opportunity

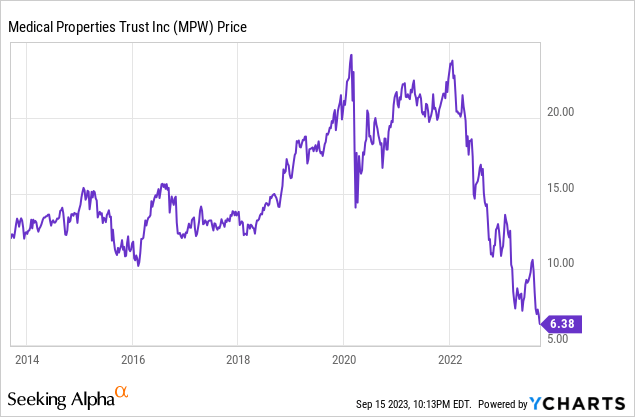

When the Hedgeye piece broke, Medical Properties Trust (MPW) traded around $17 and yielded in the mid 7% range. This was down from its all-time high, but still well above where it traded prior to mid-2018.

So shares were down, but hardly distressed, especially considering the S&P500 was also down over that timeframe.

Even if you dismissed the majority of the points in the Hedgeye analysis (and you shouldn’t have) there were several items that were both indisputable facts and giant red flags.

- MPW refusing the release Steward’s financials. The hand-waving by bulls around why this was acceptable was incredible to watch.

- MPW loaning money to Steward.

- MPW’s debt load and refinancing risk.

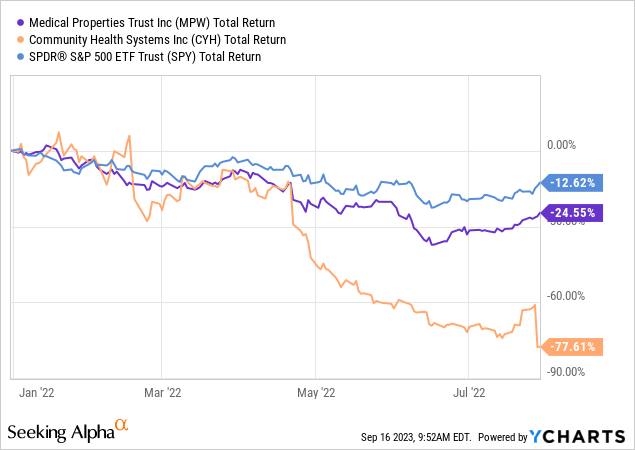

- Comparable Community Health Systems (CYH) falling in dramatic fashion over the prior 6 months.

MPW was unlikely to ever be a multi-bagger trading at $17. The upside case then was maybe ~10%/year if everything worked out perfectly?

This was a clear sell and where MPW investors should have thrown in the towel.

But it’s probably a buy now, right?

It’s certainly a better buy here at $6.36 than it was at $17. At least here, it could be a multi-bagger if everything works out. But there’s also a reasonable chance the equity is worthless.

I think the likely outcome is that MPW is a mediocre performer going forward. Further dividend reductions, or an elimination altogether, is still on the table, as the bonds are showing signs of severe distress. If I owned this, I’d want them to eliminate the dividend entirely and repurchase debt.

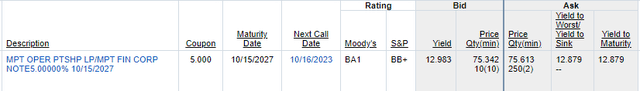

The 2027 5% bonds have a yield to maturity of nearly 13%, significantly higher than the equity at 9%.

MPT 2027 Bonds (Fidelity’s quote system)

In May of this year, these same bonds yielded 10%. So even after cutting the dividend by nearly 50%, which would normally be a major positive for the bonds, they’ve actually sold off even further.

With good reason.

If all of the historical disclosure and related party transactions weren’t bad enough, it’s 2nd largest tenant Prospect is now paying them in equity.

Author

As desperately as MPW needs cash, it was forced to accept equity as payment. Whether this equity would result in any cash flow, MPW stated:

“No, not at this time. We expect to realize that value upon the ultimate monetization of the PHP business. But, no, we’re not expecting any cash income related to that instrument.”

When backing this out, normalized FFO for 2Q was down 19.5% compared to the same period in 2022, and this comes before the negatives impact of asset sales and higher debt costs.

Oh, and the Debt

Warren Buffett famously quipped that “You never know who’s swimming naked until the tide goes out.” We can probably rewrite that as “You never know what businesses were just glorified carry trades until interest rates rise.”

MPW has a major problem. It’s about to hit a major wall of maturities in the next 24–36 months. With the 2027’s trading at a YTM of 13% (75 cents on the dollar) the market is telling MPW that its appetite for refinancing their debt is non-existent.

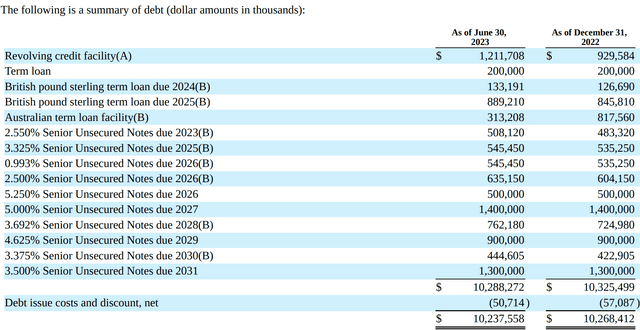

MPW Debt (MPW Q2 10-Q)

Even if you assume that all of the issues with Prospect and Steward are resolved, the coming wall of debt maturities is going to be a major challenge.

MPW’s ~$800m sale to Healthscope shows this well. Yes, it addresses next year’s refinancing risk, but results in losing ~$54 million in rental income while only saving ~$20 million in interest. They’re being forced to sell off the better performing assets while increasing concentration in Steward and Prospect. This is not what you want to see as an investor.

Know when the fold ’em

With Hedgeye’s bear case playing out with shocking accuracy, including the dividend cut, only recently did some of the SA MPW bulls finally give up. The time to sell was a year ago. This could still be a zero, but the risk-reward is almost certainly better at $6.36 than it was at $17.

That said, I still can’t find a compelling bull case to change my mind, so maybe giving up here is still the right move. Most of the bullish arguments I’ve read are combinations of the following

- The bottom is in (how many times have we heard this?)

- It’s dirt cheap (heard that 50% ago, too.)

- The dividend cut and asset sales are bullish (necessary, yes. bullish, no.)

- Steward and Prospect are just fine now (uh-huh.)

Very few bull cases even discuss the debt load and who is going to refinance their upcoming maturities when the 2027 debt is yielding 13%. Everyone is hanging on to the optically cheap P/FFO and ignoring that

- It includes non-cash items as described above

- They’ll likely need further asset sales, which will pressure FFO

- They will be running into higher financing costs, which will also pressure FFO

When you own a stock that’s down significantly, you’re at a big psychological disadvantage. Every time you login into your account and see the loss, in red font, you’re reminded of your mistake. Most want to sell, take the tax loss, and get it off their screen. Ironically, this is often the time to buy.

But it’s even better to try to avoid the loss in the first place.

Conclusion

The backlash against short sellers has been counterproductive for most investors. Instead of evaluating the business they own, some investors instead think they’re in a battle against nefarious short sellers. Why focus on the fact that you’re hopelessly underwater on a highly leveraged movie theatre operator (in a era where less people are going to the movies) when we can obsess over “burning the shorts”?

MPW is a landlord. They have no special technology or moat. That’s not bad, per se. But like many landlords, they were a clear beneficiary of a decade of zero percent rates. They’re also a landlord that has to keep propping up its top two tenants, and a landlord that has to sell performing assets to pay down debt they can’t refinance.

At $17, this was never a value investor’s dream, and it didn’t scream BUY-BUY-BUY. The cracks in the investment case were becoming pretty obvious to anyone looking at them objectively. At $6.36, this is a speculative purchase with both significant upside potential and downside risk, which is not usually what REIT investors are attracted to.

Rather than accusing shorts sellers of stoking fear, I’d encourage investors to say “thank you” and take the time to read their analysis. Many short sellers are pretty sharp (you need to be to swim against the general rising tide of the market) and are pretty good at identifying mediocre businesses trading above their intrinsic value. They’re not always right, but they’re usually worth listening to.

Read the full article here

Leave a Reply