Investment Thesis

MasterBrand (NYSE:MBC) has significantly outperformed the broader markets, gaining ~24% since my previous buy rating in late September. While the company faces near-term challenges due to the tough macroeconomic environment, there is light at the end of the tunnel and the company’s revenue should bottom next year helped by the retail inventory destocking ending, revenue comparisons becoming easier year-over-year, and a potential reversal in the interest rate cycle. The medium to long-term market fundamentals for both repair and remodel (R&R) and new construction end market remain solid with higher home equity levels, the rising average age of existing U.S. housing inventory, and over a decade of underbuilding of new homes post the great housing recession of 2008.

In terms of margins, the company is executing really well and the margin should continue to improve with the help of cost savings, complexity reduction, and productivity initiatives. Further, as MBC returns to revenue growth in the medium term, the company should also see a good operating leverage. The stock is trading at a discount to its peer American Woodmark (AMWD) and considering good medium to long-term growth prospects and a reasonable valuation, I have a buy rating on the MBC stock.

Revenue Analysis and Outlook

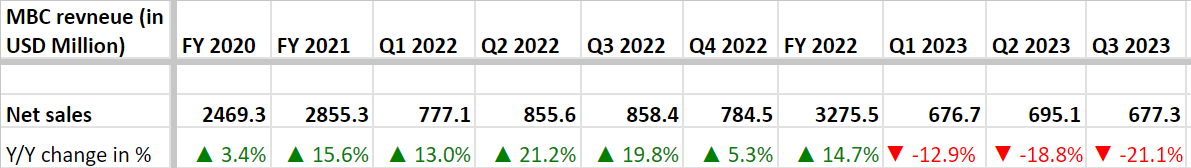

After strong growth in the past few years due to housing and home improvement boost post Covid, MasterBrand has to face headwinds from tough macroeconomic environment in FY23. This trend continued in the third quarter of 2023 where MBC reported a 21.1% Y/Y decline in net sales to $677.3 million due to lower volumes brought on by weaker end-market demand, trade downs from higher-priced products to lower-priced products, and a $0.7 million unfavorable impact of FX translation. These negatives more than offset the favorable impact of the carry forward impact of price increases implemented in late 2022.

MBC’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, while the company’s near-term outlook remains challenging with high-interest rates and an inflationary environment impacting end-market demand, there are few positives as well. On its last earnings call, management noted that the retail inventory destocking in the U.S. which has been impacting the company’s sales for the last several quarters is now over. So, this should be one less headwind going forward. Also, if we look at Y/Y comparisons, they are becoming meaningfully easier in the coming quarters as the company laps double-digits Y/Y decline starting Q1 next year. Further, with some of the signs of inflationary headwind receding, there are talks of interest rate cuts next year which should help demand, especially in the new construction market.

Management has guided for mid-teen percentage declines Y/Y in Q4, which is better than the 21.1% decline that the company witnessed in Q3. As the company began comping double-digit percentage declines starting Q1 FY24, I expect sales to turn flattish next year.

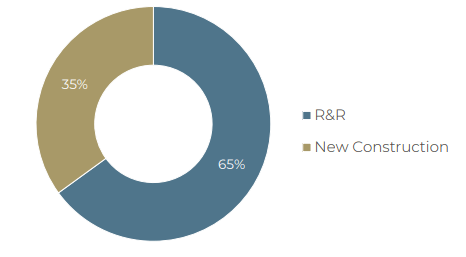

The long-term outlook for the company is good. The company’s repair and remodel (R&R) business should benefit from rising home equity levels (due to real estate price appreciation post-COVID) as home equity levels and home improvement spendings are usually positively correlated. In addition, the rising average age of homes in the U.S. should also help R&R demand. The fundamentals of the new housing construction market are also good with over a decade of underbuilding post the great housing recession of 2008 resulting in a favorable supply-demand situation. Further, the company is investing in Tech-Enabled initiatives to improve buyer experience and connection with channel partners and customers. The benefits of these initiatives should become apparent once the end market starts improving

MBC End-market Exposure (Company Presentation)

Margin Analysis and Outlook

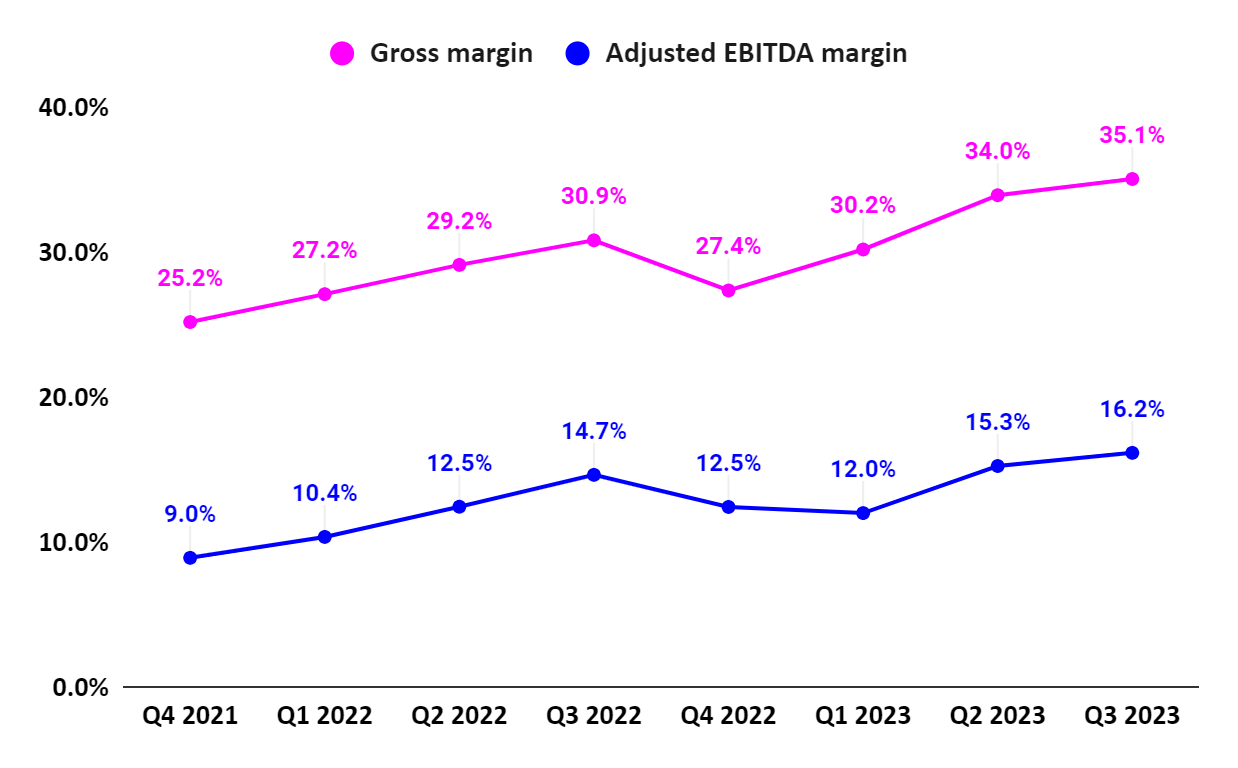

In Q3 2023, the continued supply chain improvements, and productivity, restructuring and restructuring-related savings resulted in margin expansion despite the decline in sales. The gross margin improved by 420 bps Y/Y to 35.1% attributed to lower material and freight costs and realized savings from cost reduction actions which effectively offset the negative impacts of lower volumes, trade downs, and labor inflation. The Y/Y improvement in gross margin led to a 150 bps Y/Y increase in adjusted EBITDA margin to 16.2%.

MBC’s Gross margin and Adjusted EBITDA margin (Company Data, GS Analytics Research)

The company has done a really good job in terms of cost reduction and productivity initiatives. In addition to Y/Y margin expansion, it is interesting to note that the company was able to sequentially improve margins from Q2 to Q3 despite a decrease in sales and more than doubling its investment in technology.

The company is doing a really good job in terms of reducing complexity and implementing productivity initiatives. Some of these initiatives include the common box initiative to standardize work across the plants and improve efficiency, automation including rolling out of RFID technology across its manufacturing network to improve inventory control and reduce labor costs, and cloud migration to leverage centralized master data and real-time analytics. I believe once the end markets improve and revenue growth resumes, the company should see a good operating leverage thanks to these cost-control efforts. So, the medium to long term margin outlook is positive.

Valuation and Conclusion

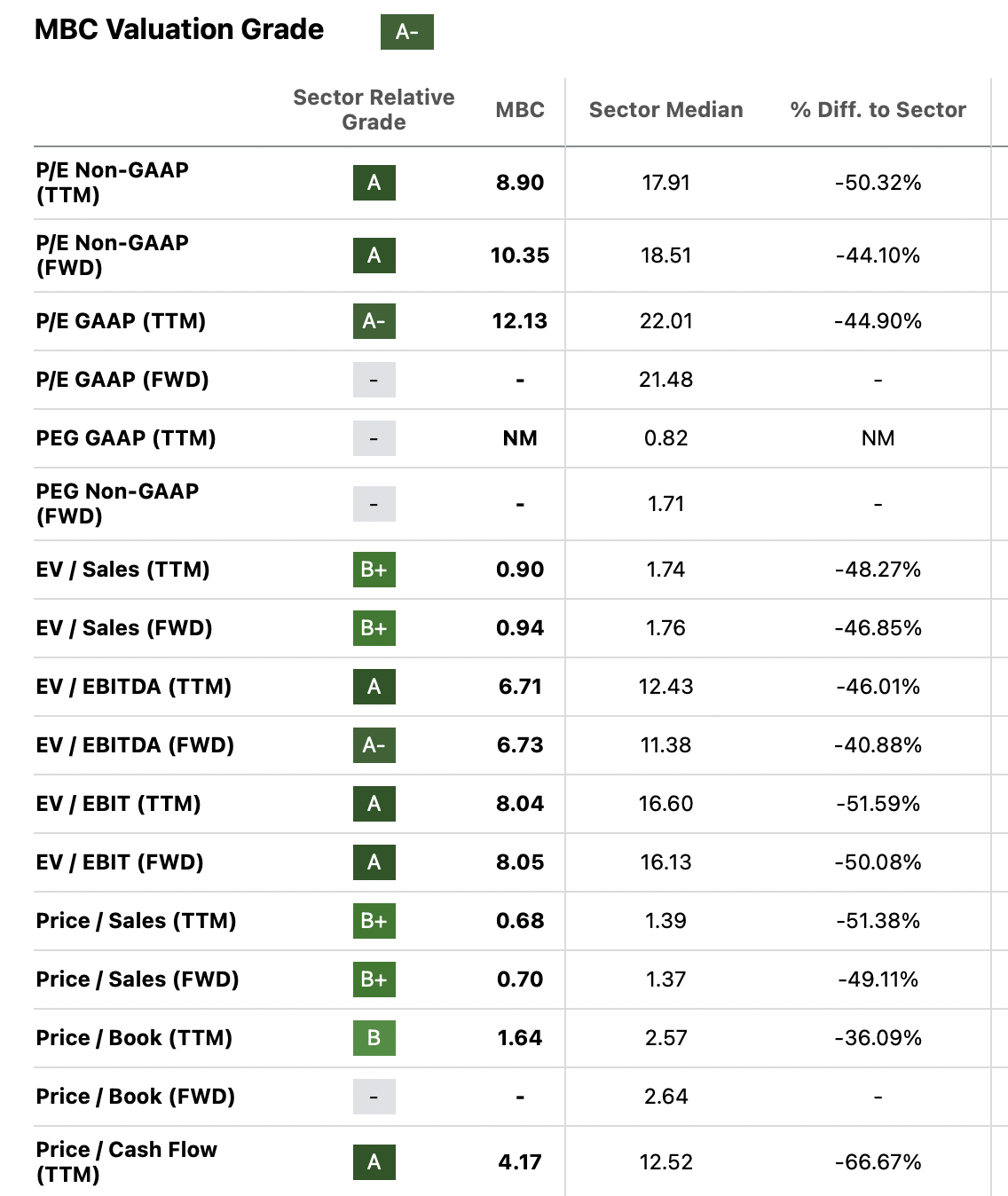

MBC stock is trading at an EV/EBITDA (TTM) of 6.71x and EV/EBITDA (FWD) of 6.73x. This is a discount versus American Woodmark (AMWD), it immediately listed peer, which is trading at a EV/EBITDA (TTM) of 7.38x and an EV/EBITDA (FWD) of 7.34x.

The company’s valuation is also at a meaningful discount to sector median.

MBC valuation grade (Seeking Alpha Quant Rating)

The company’s revenue is near the bottom and should benefit from easier Y/Y comps, U.S. retail inventory destocking ending, and potential for interest rate cuts next year. The longer-term outlook is also positive, with high home equity levels and an aging U.S. housing inventory helping the R&R end market, and a decade-plus of underconstruction of new homes post great recession helping the new construction end market. The margin growth should continue to see benefits from cost savings, complexity reductions, and productivity initiatives. As the revenue returns to growth in the medium term, the margins should also benefit from operating leverage. Given the good medium to long-term growth prospects and a reasonable valuation, I continue to have a buy rating on the MBC stock.

Read the full article here

Leave a Reply