U.K. retailer Marks and Spencer (OTCQX:MAKSY) has been doing good work in improving its business performance, which has helped boost its share price.

I last covered the name in May 2022 with my “sell” piece “Marks And Spencer: Why I Remain Bearish”, since when the shares have moved up by 44%. My thesis then (which broadly speaking remains unchanged) is that the former U.K. high street stalwart was increasingly losing relevance due to a quality gap versus rivals than it used to have and a growing shift to omnichannel retail by customers that poses an ongoing threat to footfall in stores, which might not be made up for by the company’s digital efforts including a tie-up with Ocado (OTCPK:OCDGF).

Given that rise and business developments since my last piece was published I think it is worth revisiting the investment case.

Business has Been Brisk

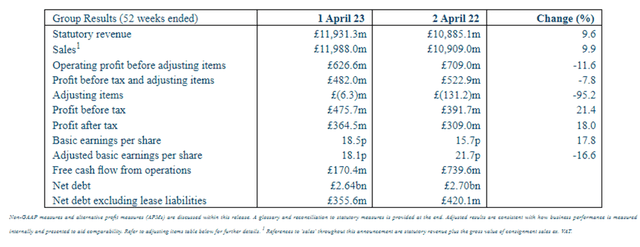

Last year saw solid performance in the business at the financial level. Revenues grew in high single digits, while post-tax profits were up by almost a fifth. However, basic earnings per share fell and free cash flow from operations was significantly lower, falling 77% to £170m.

Company final results 2022

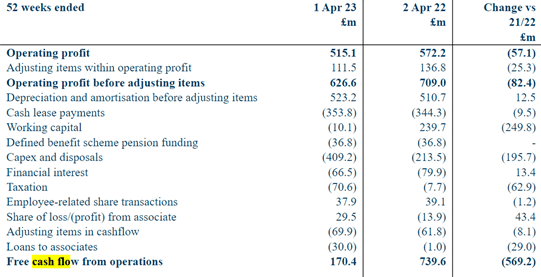

Last year’s cash flows don’t look great at surface level but a lot of the reason for the dramatic fall in working capital was variance in capex and working capital, which is part of the necessary price to keep the store estate relevant and have the right product in stores to meet demand.

company final results 2022

Last month, the company updated the market on current trading and its outlook for the year.

Like for like food sales grew 11% year-on-year while clothing sales were up 6% on the same basis.

So, what is going on here? Has Marks found a way to grow its business by focusing on the potential in food and digital channels while reversing long-term challenges in the clothing part of the business?

The company has taken a hit in terms of profit margins rather than passing on the full impact of inflation to customers both in its food and clothing businesses. It may have had little choice as rivals have been doing the same (unlisted supermarket operator Lidl recently announced a sizeable loss in its U.K. operation last year despite a roaring trade).

More strategically, the company has also been working to improve the appeal of its offering, for example through product innovation in food and new ranges in the rag business. This is what has had to happen for a very long time, so though not exactly timely it is at least welcome. I think that can help to improve short-term perceptions of what the brand stands for and drive sales, as we saw last year.

The larger question, however, remains open. The clothing market has become even more competitive than before, notably online. Grocery retailing – long a brutally competitive market in the U.K. – may be more defensible for the company as it has strong brand trust and a large store network, which continue to be important for selling food at scale, while also using a tie-up with Ocado to drive its online brand sales. What exactly does Marks bring to the market that rivals cannot?

On the plus side, as the revenues show, the business remains substantial and clearly there is still a fairly large regular customer base. When it comes to food, at least, Marks like Waitrose is seen as a touchpoint for quality and if it works hard to keep that reputation I think that is a competitive advantage, although the ever more price-driven nature of the U.K. mass market for grocery could mitigate against that. Indeed, for a salutary lesson we could look at Waitrose parent the John Lewis Partnership, which like Marks has both food and clothing/interiors retail operations although under different brands. The past several years have seen John Lewis wrestle with ongoing challenges to its relevance, leading to it reshaping its portfolio and closing some shops, while announcing in March that it had fallen to a loss the prior year and was cancelling its staff bonus (it is an employee co-operative).

Long-Term Return Prospects

The dividend remains cancelled but the company signalled in its interim results that it expects to bring it back next year at the time of its interim results. Back in 2019, it stood at 13.9p per share, which at the current share price would equate to a prospective yield of 5.9%.

However, I doubt the dividend will come back at anything like that level. The company said that its planned reintroduction would be at a “modest” level.

For the coming years, then, I think the dividend potential here may be alright but no more than that, especially given the sorts of yields currently offered by other FTSE 100 companies in the London market.

What about further share price gain? After all, the shares have stormed ahead despite my previously pessimistic diagnosis. In fact, they are up 151% in little under a year.

I think some of that reflects the fact that there is now real momentum in the shares, likely due to the solid business performance I outlined above.

Still, that puts the shares on a price-to-earnings ratio of 13. That may sound cheap and indeed is half the level of U.K. grocery giant Tesco (OTCPK:TSCDF). However, it is the same as NEXT (OTCPK:NXGPF), a company with a much more compelling track record than Marks over the past decade and one I think has a clearer handle on long-term strategy.

I continue to see executional risks for Marks, as we have seen so many times in the past, and do not think the current price offers good value. I maintain my “sell” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply