In May 2023, it was announced that Oneok would attempt to acquire Magellan Midstream Partners. At the time of the announcement, the acquisition valued Magellan Midstream Partners at $67.50 per share. This represented a significant premium to where shares were trading near $55 per share. On the day of the announcement, Oneok took a 10 percent dive on the news but has since recovered.

The vote on whether the merger will be approved by unitholders is set for September 21 at 10 am CST and there has been some organized opposition to the merger. It is important that unitholders who plan to vote have the information necessary to make an informed decision. Both companies have laid out the reasons why the merger makes sense for unitholders.

With the voting just days away, it will be exciting and interesting to watch the outcome as there are two adamantly opposed sides of the deal.

History of Magellan Midstream Partners

Before I cover the details of the acquisition, I always like to cover the brief history of the company in question. Magellan Midstream Partners originally began trading publicly as Williams Energy Partners in February 2001. A couple of years later, the company changed its name to Magellan Midstream Partners in September 2003.

Prior to February 2001, the company was part of a portfolio of companies under the broader umbrella of the Williams Companies, headquartered in Tulsa, Oklahoma.

The Williams Companies may sound familiar as it is currently a publicly traded Fortune 500 company that focuses on electricity generation and natural gas transportation and processing. In 2011, the Williams Companies also spun off their energy exploration and production assets into WPX Energy.

WPX Energy recently merged with Devon Energy in 2021, as I wrote about here, and held an impressive portfolio of assets.

The history of the Williams Companies goes back to 1908 when the two Williams Brothers, began a construction business that transformed into a pipeline construction company that originated in Fort Smith, Arkansas.

The pipeline industry was a small but growing industry and had previously been confined to the northeastern states where oil was first discovered. At the turn of the century, oil began to be discovered in southern states such as Texas and Oklahoma.

During World War II, The Williams Company played an important role in connecting pipelines to the Eastern United States to ensure a continuous supply of energy in the event that the United States was attacked. In this unlikely event, it would be able to access energy from different regions of the United States.

What is Oneok Getting?

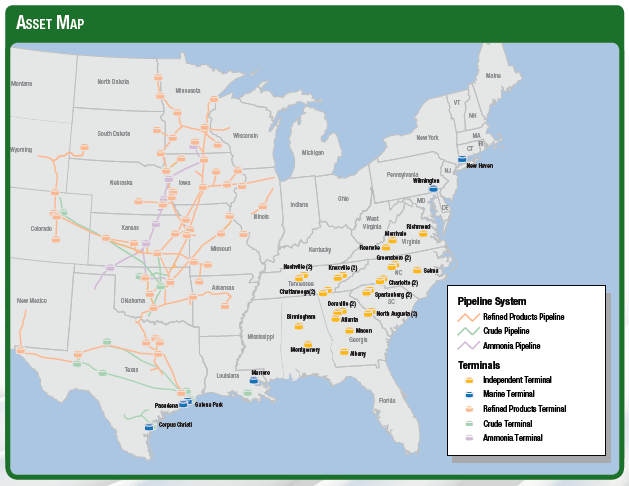

Since being separated from The Williams Companies, Magellan Midstream Partners has had a solid track record and today owns an impressive portfolio of midstream assets. According to their website, this includes:

- 80 different product terminals.

- 100 million barrels of petroleum product storage.

- 2,200 miles of crude oil pipelines.

- 9,700 miles of refined product pipelines.

- 1,100 miles of ammonia pipelines.

Magellan owns many key assets, but one asset that is very strategic in my mind is the Long Horn Pipeline that runs from El Paso to Houston. At present, this pipeline transports roughly 275,000 barrels of crude oil per day to the Houston area. In 2019, it was reported that Magellan was exploring a sale of a 35 percent stake in the pipeline but based on my research, it did not follow through with the sale. I don’t know the exact geographical location of this pipeline in relation to Permian Oil Production, but I suspect this pipeline will receive plenty of demand in the coming years as most E&P companies are heavily focused on the Permian Basin.

This map below highlights the company’s assets in the eastern United States, but one can see their other assets in the south and Midwest as well.

MMP Asset Map (Magellan Presentation)

Benefits of the Merger

As laid out by the Oneok presentation slide below, like many acquisitions, they see the benefits of the acquisition as being:

- Diversity of their sources of free cash flow.

- Greater returns on invested capital based on their industry leadership.

- An attractive dividend which ultimately, is expected from.

- Greater growth opportunities which they were not specific where they see those coming from.

- Strong(er) balance sheet.

Merger/Acquisition Benefits (Oneok presentation)

New Asset Profile

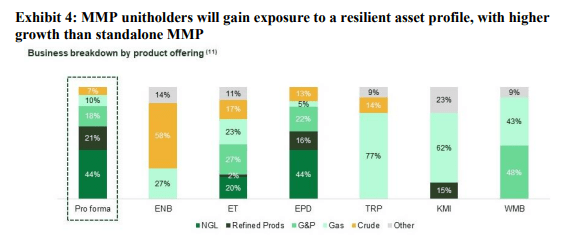

This slide demonstrates the asset profile of the new company. Enterprise Product Partners and Oneok will have a very similar product profile with Natural Gas Liquids making up the largest portion of the company’s products.

Combined Company Asset Profile (MMP Presentation)

Synergies

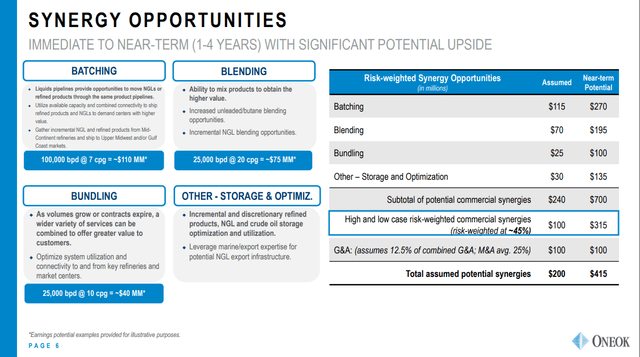

The company believes that over time they can save up to $700 million through batching, blending, bundling, and storage optimization. The company has placed a 45% adjusted risk weighting which brings it to what they believe is a conservative amount of $415 million in synergy savings between the companies.

- Batching means they can combine a product into the same pipeline instead of using two pipelines for the same product such as NGLs.

- Blending means they can mix more products in order to create more higher-value products.

- Bundling means the same as what it would mean when you buy insurance products. The company will be able to offer a higher variety of products to customers, thereby increasing value to the customer.

- Storage Optimization means the company can combine storage facilities and potentially use them more efficiently to maximize revenue.

Synergy Opportunities (Oneok Slide)

The Purchase Premium

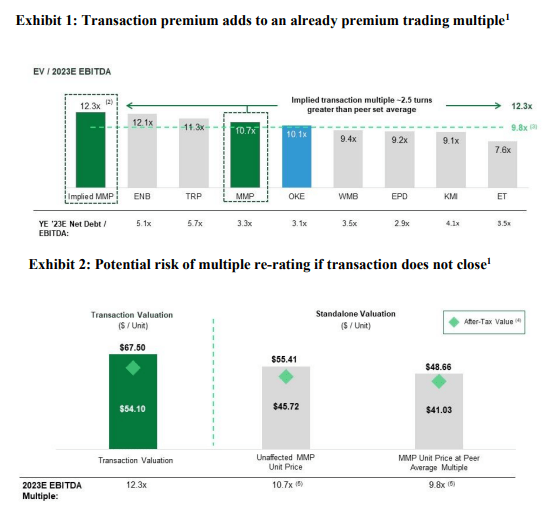

Magellan would like its shareholders to understand that they believe Oneok is paying a premium above what a) the market would value Magellan at and b) above what another interested buyer would pay. The slides below show that the acquisition price places the EV/2023E EBITDA ratio at 12.3 times which is significantly above what most similar companies trade for on the market. (see slide below).

Furthermore, the Magellan leadership believes that if the transaction doesn’t succeed, there will be a significant decline in the share price. And if it trades in line with peers, it would decline to roughly $48.66. Although this may be true, this is both a short-term and fear-based method to try to create their desired result. That said, the argument also has validity when considering the time value of money. Is the premium that could be received today worth waiting in the long term to receive a premium that is higher. Without knowing when that day would one day come, it is impossible to be sure.

Even if you believed Magellan deserved a higher price, it would likely make more sense to take the premium that Oneok is offering and then take that money and invest in a similar midstream company you believe presents a better value… or hold Oneok for the long-term.

Oneok Purchase Premium (MMP Presentation)

Proxy Firm’s Confirmation

There have been several large proxy firms on both sides of the issue. Here are a couple of quotes from two firms that came out in favor of the acquisition recently.

Here’s a quote from the firm Glass Lewis:

To be sure, each unitholder will have to decide, based on their individual circumstances and perhaps other broader assumptions, whether the proposed merger is acceptable and sensible to them, particularly in terms of the resulting acceleration of deferred taxes… After review, we believe the Company has largely presented a convincing case that the proposed merger should generally yield greater after-tax value to unitholders compared to the standalone alternative. Based on these factors, and absent a superior available alternative, we believe the proposed merger warrants unitholder support at this time.

The firm ISS was quoted as saying this:

…given that tax consequences vary among holders, the terms imply an immediate realization of value, and the strategic rationale appears reasonable, unitholders are recommended to support the transaction with caution.

These were just a couple of quotes from some firms in favor of the deal. In this next section, I will present the side’s position that opposes the deal.

The Opposition’s Argument

There are some large unitholders of MMP that have voiced strong opposition to the acquisition. The company Energy Income Partners, LLC owns roughly 3 percent of Magellan Midstream Partners and is one unitholder that strongly opposes the acquisition. They have a dedicated website to share their viewpoint found here. I have copied a few of the most important slides from their presentation below but if you want to hear their full argument, I recommend visiting their site.

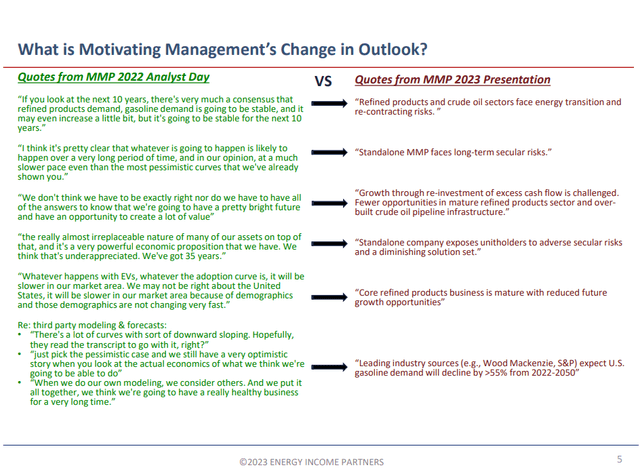

Changes in MMP’s Outlook

Energy Income Partners believes that Magellan’s management has done a complete 180-degree turn in their outlook for their industry. The slide below demonstrates quotes from their 2022 analyst day compared to the 2023 presentation that tried to sell the idea of acquisition to unitholders.

MMP’s Change in Outlook (EIP Presentation)

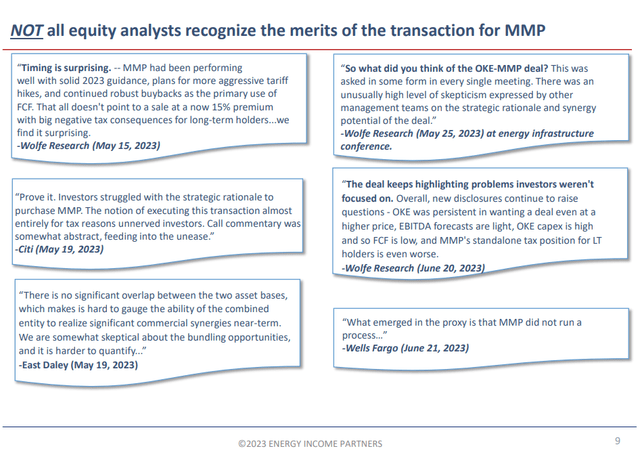

What Synergies?

EIP provides in this slide, various quotes from industry analysts that claim that the synergies the two companies tout are not really there. Here we see multiple analysts saying similar things about the supposed synergies the combined company hopes to benefit from.

Analyst Quotes on the Merger (EIP Presentation)

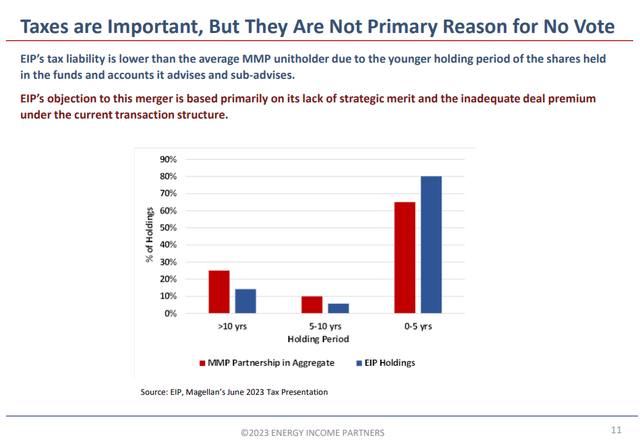

Taxes Matter, But Not Primary Problem

EIP has been represented as saying the tax implications of the deal take a chunk out of the deal premium. In other words, the premium being paid by Oneok is not sufficient enough to make up for the tax consequences. However, EIP states that this is important, but not the primary reason the deal is bad. They claim that since they are a “younger” holder of MMP units, that their tax implications are not as bad compared to someone who has been holding the units for much longer.

Rather, the company opposes the deal primarily on its lack of “strategic merit.”

Taxes Important But Not Primary (EIP Presentation)

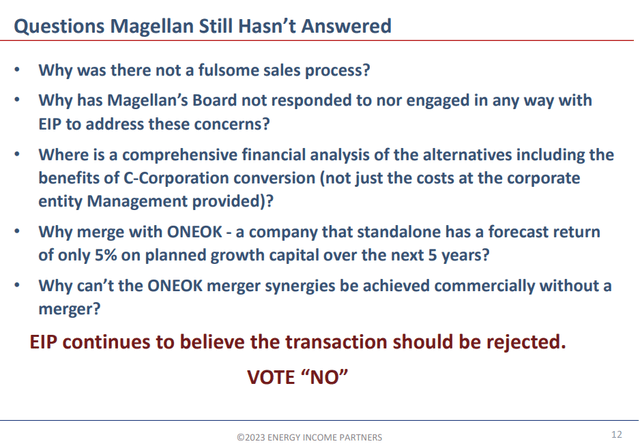

Questions Unanswered

Energy Income Partners believes these are the questions that the Magellan Management team has yet to answer.

- EIP claims that the sales process was not conducted in a fulsome manner, meaning it was not thorough enough.

- EIP also claims that Magellan’s Board has not engaged with their arguments or concerns.

- EIP would like to see an alternative analysis showing the benefits of converting to a C-Corp, which is what Oneok currently is structured as.

- EIP claims that Oneok has a track record of delivering inferior returns.

- EIP would like to know why Oneok can’t achieve these synergies that it is seeking without swallowing up Magellan’s assets.

EIP Questions for Magellan Management (EIP Presentation)

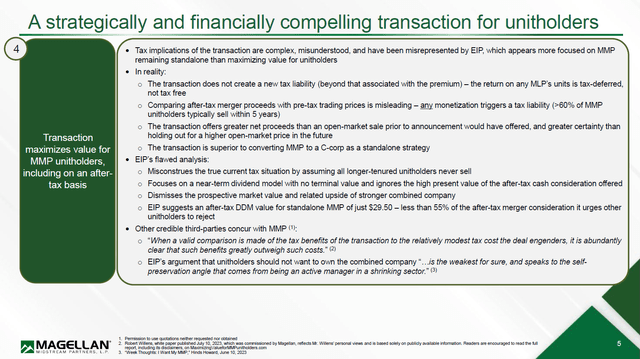

Tax Implications and MMP Response

Magellan is considered an MLP or Master Limited Partnership and its unitholders have unique tax advantages. Oneok, Inc. on the other hand, is not a Master Limited Partnership. Master Limited Partnerships have tax advantages in that any investment in an MLP is considered a contribution of capital. Therefore, any “dividend” payment is considered a return of capital to the unitholder and is therefore, not taxed until the dividends exceed the amount of capital contributed, or the unitholder sells and removes their capital from the MLP.

One of the biggest pushbacks against the merger is that it will create a taxable event for Magellan unitholders. This is because Oneok is paying each unitholder $25 cash for each unit. This distribution in the form of cash will create tax implications.

However, Magellan unitholders are also receiving .667 shares of Oneok in exchange for each share of Magellan. This transition from Magellan shares into Oneok shares will create a taxable event as I understand it, as your units will be swapped into Oneok shares.

For those that are concerned with tax consequences, Magellan Midstream Partners makes the claim that 60 percent of unitholders sell within 5 years anyway and so any tax consequences will ultimately be realized on a 5-year horizon eventually.

It is also important to know that Oneok Inc. is structured as a C-Corp and not an MLP, and so the tax benefits from the MLP structure will also no longer exist.

Magellan Management lays out its response to some of the tax concerns in this slide below.

Tax Implication of the Deal (MMP Presentation)

Aaron Milford, the CEO of Magellan recently said this about the potential taxes.

Do you want $45 after the tax-free deal, or would you prefer $55 now with the upside of the pro forma because what I think is misunderstood is that this transaction is not creating these taxes; these taxes exist in either scenario, and anytime a unit holder wants to sell a unit, they’re going to pay taxes.

Conclusion

So, if you are a Magellan unitholder, hopefully, you found this compilation of data useful. The Oneok and Magellan management is definitely in favor of this acquisition. Many of the arguments from both sides are difficult to quantify exactly and will be unique to each unitholder, especially when it comes to tax consequences.

If the acquisition goes through, will it truly bring greater synergies? If you believe it will, then Oneok shares will be worth holding. If you don’t think it will, then hopefully you can pocket the premium that Oneok paid and go deploy your capital somewhere else. (should the acquisition be accepted).

Read the full article here

Leave a Reply