Back in May, I wrote that Lyft’s (NASDAQ:LYFT) new CEO had his work cut out for him, as being the #2 player in ridesharing was not an easy position to be in given the scale needed for the business. With the stock up about 5% since then, let’s catch on to the name.

Company Profile

As a reminder, LYFT is the #2 rideshare company in the U.S., connecting passengers with drivers. The company operates throughout the U.S., as well as in a few cities in Canada.

The company generates the bulk of its revenue by collecting service fees and commissions from drivers whom it pares with passengers. LYFT also has a few other burgeoning businesses, including a car rental program for drivers and users, a network of bikes and scooters, and an app for public transport options.

New CEO Makes An Impact

In my original write-up ahead of LYFT’s Q1 results, I noted that the stock would likely make a big move, which was the case, with the stock falling over -20% the following session. While the company beat on the top and bottom lines, investors were unhappy with the company’s reported number of active riders of 19.6 million, which was below the 19.8 million consensus, as well as Q2 EBITDA guidance of $20-30 million, which was way below the $51 million consensus at the time.

When Q2 came around, the company saw a nice rebound in active riders to 21.5 million, which was up 8% year over year and up nearly 10% sequentially. Revenue per active rider, however, slipped to $47.51, down nearly -5% from $49.89 a year ago.

Overall revenue rose 3% to $1.02 billion. The number of rides was up strong, rising 18%. The company said the results were powered by more people getting out for work and travel. However, prime time pricing dropped by -35% compared to Q1.

The company said that its new Wait and Save option for riders not in a hurry has been a big hit. This option lets riders price shop in its app. Wait and Save trips grew 40% in the quarter, and the company said the option averaged more than 150,000 rises per week in New York City.

Gross margins improved nicely year over year, coming in at 40.6% versus 34.4% a year ago. However, they were down sequentially from 45.1% in Q1.

LYFT was also able to solidly reduce costs during the quarter. Sales and marketing expenses were down -22% to $109.2 million, while G&A expenses were -24% lower to $201.4 million.

Adjusted EBITDA came in at $41.0 million, above the guidance the company provided during its Q1 call. Stock-based comp expenses notably were $113.9 million, which would wipe out those gains. However, it was a big reduction from $176.6 million a year ago.

Turning to the balance sheet, LYFT had $1.7 billion in cash and short-term investments and $808 million in debt.

Through the first six months of the year, operating cash flow was -$144 million. Free cash flow was -$184.2 million.

Looking ahead, LYFT expects Q3 revenue of between $1.13-1.15 billion, representing 7-9% growth year over year. It expects ride growth of about 20%, with lower revenue per ride versus a year ago. It is looking for a contribution margin of approximately 45% in the quarter. Finally, it forecast adjusted EBITDA of between $75-85 million.

Discussing its Q4 outlook on its Q2 call, CFO Erin Brewer said:

“I’d like to turn now and make some directional comments on the fourth quarter in anticipation of our third-party insurance contract renewals on October 1. We’d like to give you our current best thinking on the range of expected outcomes. Our preliminary view of the fourth quarter suggests revenue will grow low to mid-single digits quarter-over-quarter. Additionally, fourth quarter adjusted EBITDA margin as a percentage of revenue will be in line to slightly lower than the level in Q2 2023. This reflects expectations of continued strong rideshare ride growth year-over-year in the fourth quarter, the impact of our insurance renewals and continued improvement in our cost structure. Of course, we’ll look to refine this view in our Q3 earnings call in the fall. Let me address how we’re managing our third-party insurance renewals and what we are doing differently this year. With the Q4 renewal of our third-party insurance contracts, we expect to have substantial visibility into our insurance costs for the next 12 months.”

Prior to its earnings, the company said that it was exploring options for its bike and scooter business, including a possible sale or partnership. The company also noted that it has had strong inbound interest in the business. Given a lack of disclosure around the revenue and profitability of the unit, is hard to pinpoint a price that the company might be able to fetch for the business. However, the company did buy bikeshare company PBSC in 2022 for $163.5 million and at the end of last year, its bike fleet was valued at $179.3 million on its balance sheet, before depreciation. A price of around $150-200 million might make sense.

Overall, LYFT saw a marked improvement in its Q2 results, with a nice jump in rideshare growth and active riders. Pricing has come down a bit, but margins have remained solid, and the company has also done a nice job of reducing costs.

The Q3 guidance looks pretty solid, although its initial comments on Q4 seem to suggest that the quarter won’t be quite as strong. While new CEO David Risher has a tough road ahead, so far it looks like he is doing a good job, attracting both drivers and riders to the platform through innovation and new offerings.

Valuation

LYFT trades at 18.8x adjusted EBITDA based on 2023 analyst estimates of $195.5 million. Based on the 2024 consensus of $307.9 million, the stock trades at a 12x multiple. Its EBITDA projections are much lower than the last time I looked at the stock.

On a PE basis, it trades at 30x the 2023 consensus of 38 cents and 22.6x the 2024 consensus of 50 cents.

It is projected to grow revenue by 6.4% this year and 11.8% next.

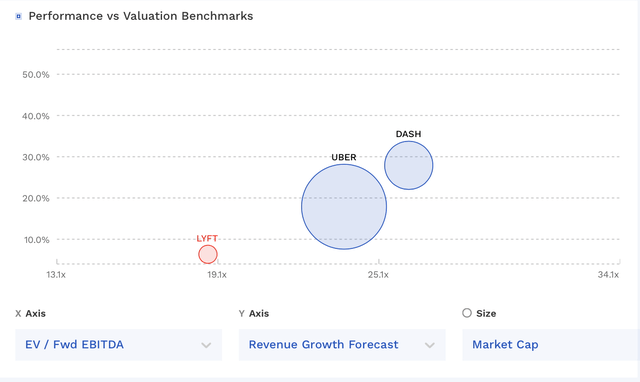

The company trades at a significant discount to Uber (UBER), as well as DoorDash (DASH). However, it is notable that LYFT has over $750 million in stock-based compensation expenses in 2022, or over 18% of its 2022 revenue. That’s starting to come down, put is still high at $294.3 million through the first 6 months of the year. On a run-rate basis, that wipes out all of its EBITDA and then some.

LYFT Valuation Vs Peers (FinBox)

Conclusion

LYFT has been making some nice steps early under new CEO David Risher, but it still has a long way to go. I’ve liked the moves he’s made with technology and incentives to attract drivers, while the Wait and Save option appears to be a hit with riders.

While the company trades at a discount to its peers, its stock comp is still pretty egregious in my book, and when taking that into account, the stock isn’t really anywhere close to being profitable. I believe stock comp is a real expense and that investors should take it into account when looking at valuation metrics such as EBITDA where it is taken out. LYFT even takes it out for adjusted net income as well.

As such, I remain “neutral” on LYFT, and think the company also needs to address its stock comp and how it reports metrics like adjusted net income.

Read the full article here

Leave a Reply