Back in April, I detailed how communication services company Lumen Technologies (NYSE:LUMN) was facing a major decision. After eliminating the dividend due to reduced cash flow, the board of directors had authorized a share repurchase plan. With an asset sale expected to close late this year, a decision would need to be made on what to do with the proceeds. Nearly five months later, the continued fall in the company’s share price makes the situation here even more interesting.

Over the past year, Lumen shares have lost roughly 85% of their value. At this time in 2022, the stock was over $9 a share, but recently the stock hit a multi-year low of just $1.35. Investors have been worried about the deterioration in the company’s revenue base along with the potential for significant liabilities due to lead cable replacement. Due to previous divestitures as well as the surge in interest rates, free cash flow generation has all but evaporated.

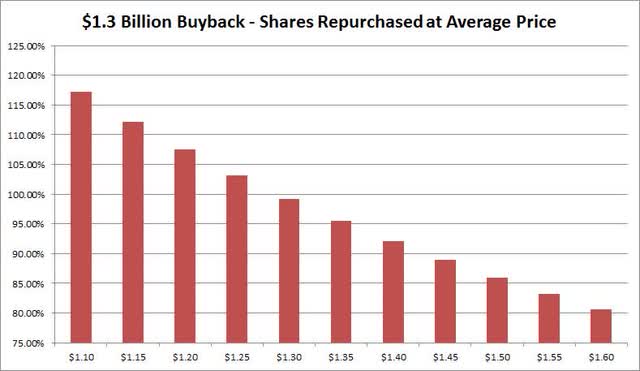

As of July 28th, there were just over 1 billion shares outstanding, according to the latest 10-Q filing. At the recent low in shares, the company’s total market cap was about $1.36 billion. As a reminder, the board authorized a buyback of $1.5 billion through late 2024, of which $200 million had been utilized as of that latest quarterly filing. With $1.3 billion remaining on the buyback, Lumen shares at their low were just six cents away from a key point. At roughly $1.29 a share, the company could in theory buy back every outstanding share it has. As the chart below shows, even at prices a little higher than that, almost all of the shares that are outstanding could be repurchased.

$1.3 Billion Buyback Power (Author’s Example)

Lumen doesn’t have the best balance sheet currently, part of the reason why the stock has declined so much. At the end of Q2, the company had just over $400 million in cash, but more than $20 billion in debt. That net debt position, however, has been reduced nearly in half from the end of 2017, at which point it totaled almost $38 billion. Management since then has used a combination of free cash flow and asset sales to help the financial situation.

As we approach the end of Q3, we are just a quarter or so away from the company’s expected close of its latest asset sale. When the company had an Investor Event back in June, future guidance assumed that $1.5 billion of cash from this sale would be used for further debt paybacks. With interest rates continuing to rise, and the Fed potentially looking to hike perhaps one more time, lowering the debt pile certainly is the best strategy for the income and cash flow statements moving forward. As a reminder, guidance was for $500 million to $1.3 billion of free cash flow to be generated between 2024 and 2027, assuming debt is refinanced at 11% and $1.5 billion from the asset sale was used to pay down debt.

However, the math has certainly changed over the past five months with the stock falling to where it is currently. With the ability now to retire basically almost every outstanding share, I think management has to at least discuss the possibility of using some of these coming asset sale proceeds for share repurchases. Don’t forget, about 15% of shares outstanding were short at the end of August, so chasing away some of those naysayers could also be very good for the share price.

Some investors may laugh at the idea of buying back the stock with so much debt currently. However, a material increase in the share price could also help in the future. A rise to even $2 or perhaps $3 would show more confidence in the company, and that could help with lenders down the line as Lumen works to refinance some debts down the road. Also, if the stock were to skyrocket after a buyback, management could always sell some shares back into the market and use those proceeds for paying down debt, while still lowering the overall share count in the process.

Wall Street itself remains fairly positive on the stock. While the average target price has come down with shares over the last year, the current valuation figure still represents a doubling from today’s levels. I continue to rate the stock a hold, because the business has not seen results turn just yet, implying the potential for the stock to go lower. However, that negativity is partially offset by the possibility of the buyback, as well as the potential for results to improve in the coming years.

As the stock has moved lower, there also is an increased chance of the company being bought out, whether by a larger player in the space or even a private equity firm. That’s why I’m hesitant to recommend shorting the name here. In fact, as the stock moves closer to $1, I may even raise my rating to a buy, just because of the increased chances for a buyback or buyout. Getting those sale proceeds in later this year or even early in 2024 gives the company some needed financial flexibility.

With Lumen shares hitting more new lows recently, the idea of using upcoming asset sale proceeds for a buyback has to be on the table now. We are now approaching the point where the company could retire all of its shares outstanding. While debt repayments are good for profitability and cash flow in the long term, even a few hundred million used for the buyback could be a strong signal to investors that could greatly improve sentiment in the short term. With results expected to turn around in the coming years, now would be a good time for management to signal it believes in Lumen’s future.

Read the full article here

Leave a Reply