Lumen Technologies, Inc. (NYSE:LUMN) has been operating in the telecommunications market for just under 100 years. It has therefore gone through various market phases and has primarily experienced the technological growth of fiber for connectivity. Analyzing the revenue and profitability data we find ourselves faced with a profitable company but with data that convey the worst situation of the last decade. The most worrying aspect concerns the growth of the business which seems to be heading towards a negative trend that is difficult to interrupt. In the last year, Lumen has faced a major cultural change by replacing much of the management and has identified what may be the most profitable niche market sectors to dive in. The company’s capabilities and assets show how the company can cope with the delicate moment and have a chance of getting out of it. The objectives for 2027 are also clear and describe a possible recovery of the business. The risks are high and represented by the competitiveness of the sector but also by the company debt as well as the need to raise new funds for future investments. The share price evaluation turns out to be particularly advantageous and with a very high risk level, my rate is Buy.

General Overview

Lumen Technologies is an American company that specializes in providing telecommunications services and communications infrastructure. Founded in 1930 as CenturyLink and later renamed Lumen Technologies in 2020, the company focuses on a broad range of services, including high-speed Internet connectivity, network services, and business communications.

Lumen is known for its global fiber optic network, which spans thousands of kilometers and covers many areas of North America, Europe, Asia.

Its network infrastructure is critical to supporting the connectivity, cloud, and security services offered to enterprise customers. The company serves both corporate and residential clients, offering communications solutions tailored to each client’s specific needs. These services include high-speed Internet connections, private networking solutions, cloud services, and cybersecurity solutions.

Its vast experience and global network make it an important player in the telecommunications and IT services industry.

Financial and Highlights

Revenue and Margins

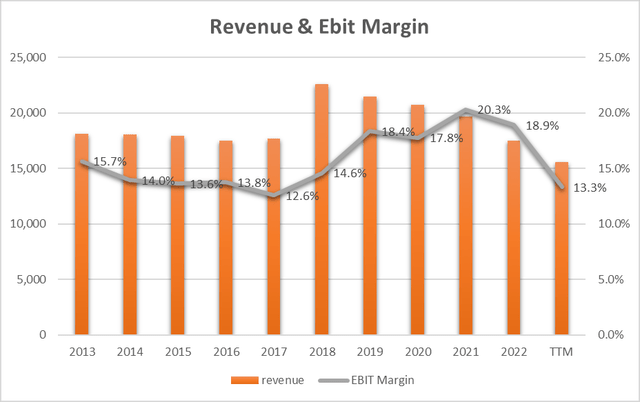

Seeking Alpha + Author Graph

The graph shows a trend in revenue over the last 10 years and we can see how 2023 sees the lowest figure ever reached with a constantly decreasing trend starting from 2018. Margins (EBIT) also have a decreasing trend starting from 2021 and only 5 percentage points were left on the ground in the last year. It is therefore undeniable that the company is going through a particularly critical period that has lasted for several years in terms of revenue and for a couple of years also in terms of margins. The last year has also seen a negative FCF generation (mainly due to the taxes on disinvestments in previous years) which accentuates the negative situation on the financial side.

The share price has followed this trend and is underlining a very serious corporate crisis.

The above is if we have ‘growth’ as a point of reference. We are faced with a company that is continuing to lose customers, margins, and value for shareholders.

Possible Turnaround in progress

Management turnaround

In the last year, almost all the business directors have changed and there is a new atmosphere in the company as we can hear from Chris Stansbury (EVP and CFO):

But if I think about the past, not quite a year, 10 months since Kate arrived, there’s been an enormous change that I can’t state that strongly enough. I mean, what we’re doing today in so many ways is completely the opposite of what we were doing in the past. And that started with the elimination of the dividend.

which underlines the major change taking place at the corporate culture level.

Particularly at an operational level, it is interesting to note how management has intervened in the sales sector where the measurement parameters have transformed from the achievement of quotas and from the same compensation model for all products/services (without any weight in terms of marginal contribution) to a model closer to the reference product/market which takes into consideration factors such as the life cycle and above all margins.

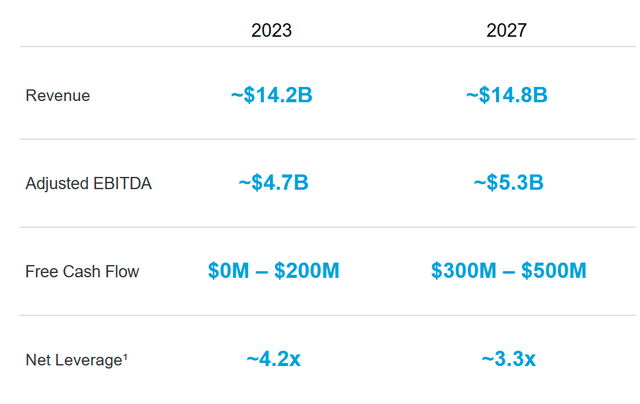

We can therefore speak of a great cultural transformation underway which has as its strategic objectives the reporting of the growth of financial parameters in the coming years (2027 is the first target)

Lumen Investor Day 2023 Presentation

Focus on the growing opportunities

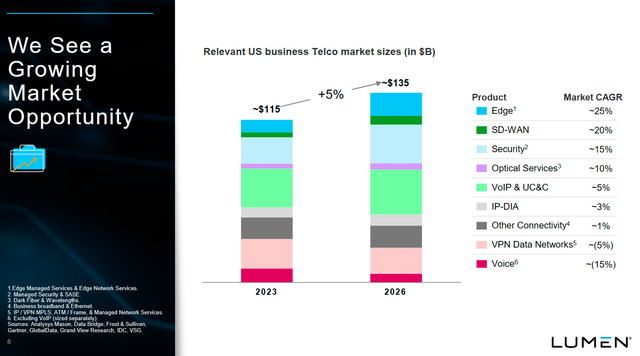

Lumen Investor Day 2023 Presentation

If we analyze the best opportunities in double-digit growth markets we see that Edge Compute represents the best opportunity with a potential of 25% [CAGR].

Edge computing could be defined as a distributed computing paradigm that moves data processing and analysis closer to the source of data generation. Instead of transmitting all data to remote servers or centralized data centers for processing, Edge Computing performs processing directly on the device or servers local or “at the edge” of the network.

This approach offers several advantages, including Low Latency. By reducing the physical distance between the data and the processing point, you reduce latency (the delay) in data transmission. This is crucial for real-time applications such as autonomous vehicles, industrial automation, and online gaming.

In this area of intervention, Lumen has the competitive advantage of being able to operate edge computing directly on top of its infrastructure. This favorably affects the latency which stands at 5 milliseconds as we can hear in TD Cowen’s 9th Annual Communications Infrastructure Summit Conference:

It’s been around for a couple of years. And it’s really starting to ramp, where we see Edge starting to get some traction is used cases. Yes, so it’s really the used cases that take advantage of our advantage there, which is the latency advantage that Edge gives and the fact that our Edge sits on top of one of the largest networks in the world, so where you need significant network capacity, where you need low latency.

The second best opportunity (20% CAGR) is SD-WAN.

SD-WAN stands for “Software-Defined Wide Area Network”. It is a networking technology and approach that offers greater agility, flexibility, and control in enterprise networks, particularly in Wide Area Networks (WANs). The main goal of SD-WAN is to simplify the management and control of WAN networks, making corporate communications more efficient and reliable. This technology is widely used by companies with many remote locations or branch offices, as well as organizations looking to make the most of WAN networks in an increasingly digitalized world.

Also in this market segment, Lumen has some competitive advantages linked to underlay services. Underlay services are critical to the operation of complex networks and play a key role in ensuring that data is transported reliably and consistently across the underlying network infrastructure. These services provide the foundation for the additional functionality and applications that operate above them in the overlay network, including SD-WAN services, cloud computing, and enterprise applications.

From this point of view, Lumen is well positioned, as it integrates all underlays and overlays onto its network in a symbiotic and integrated manner.

The NaaS wave

The term “Network as a Service” (NaaS) refers to a network service delivery model in which a network service provider offers network infrastructure, including connectivity and related services, as a cloud-based service. In essence, NaaS transforms traditional network infrastructure into an on-demand service, allowing businesses to enjoy a scalable and flexible network without having to directly manage the underlying hardware or complexities of network configuration. NaaS could be particularly attractive to companies looking to reduce operating costs, simplify network management, and adapt more flexibly to changing business needs.

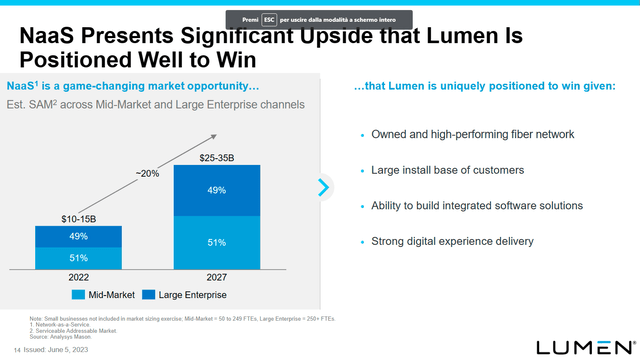

Lumen Investor Day 2023 Presentation

All services such as Edge Compute or SD-WAN integrate into a larger context that can be called NaaS. Network as a Service is a large-scale phenomenon that is attracting the attention of all the big players. The competitive arena is therefore decidedly crowded and the challenges are particularly complicated. In this context, Lumen has a truly great competitive advantage in that of being able to operate and offer its services on its physical assets.

The ownership of the physical asset (the fiber optic network) also allows the company to have much higher economic margins than competitors.

Debt

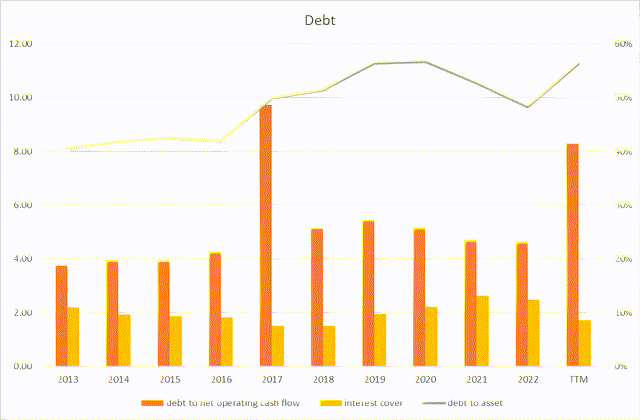

Seeking Alpha + Author Graph

Corporate debt represents a large element of risk. As we can see from the graph above, the debt on assets (grey line) stands well above 50% and the fact that the trend has been growing for around 10 years also underlines the high corporate risk. In 2023 we also note that the net operating cash flow ratio has exceeded the value of 8 and that at the same time, the ability to repay interest has fallen below 2. These data show us a fairly risky situation from a corporate debt point of view and put Lumen itself in dangerous conditions when compared to the need to find new investment capital.

As we can hear from Chris Stansbury [CFO]:

We have to have the money that we need to transform the company. If we delay, then I think the likelihood of success goes down dramatically, because customers see the innovation that we have available to us in the Enterprise side. And if we miss that window, we miss that window. And I think there’s a big first mover advantage if we get that done. So it’s critical that we have access to the capital to do what we need to do in both Enterprise and Mass Markets.

Another important aspect concerns the restructuring of existing debt expiring in 2027 as we can hear (Chris Stansbury):

The second thing is, is that we have to deal with maturities between now and 2027. And ideally, start to attack that ‘27 tower in some way so that, that wall is dealt with now. And while that will certainly come at a higher cost, I think there is a solution that deals with those things, and it gives us the liquidity to compensate for that higher cost…. So really, what we’re talking about is higher coupon in the near-term, which I think is manageable.

The challenge is therefore imposing and places Lumen in a situation of high business continuity risk. The management is confident that the situation will turn positive but the investor must take this element into account before making decisions.

Lumen and Earnings Power Value

Assuming that the cash profit remains constant over the long term (risky assumption), I use the EPV (earnings power value) method to calculate the intrinsic share price value.

The method starts with EBIT. The second step is to add depreciation and amortization and then subtract stay-in-business CAPEX.

The result is the Cash Trading Profit

I then subtract the taxes by calculating the amount using the actual tax rate that the company pays.

The result is the After-Tax Cash Trading Profit

At least to calculate the total company enterprise value I divide the After-Tax Cash Profit by the interest Rate I define as fine for this kind of Company (LUMN is a High-risk company so I decided to use 15%)

The result is the Total Company Earnings Power Value. Dividing the result by the total number of shares we find the value per single share.

The table below shows the calculation for LUMN

|

EBIT |

2,079.00 |

|

Dep & amort |

3,083.00 |

|

CAPEX |

-3,114.00 |

|

Cash Trading Profit |

2,048.00 |

|

TAX |

24.70% |

|

TAX |

-505.856 |

|

After TAX cash profit |

1,542.14 |

|

Interest Rate |

15% |

|

EPV |

10280.96 |

|

Share in issue |

1,008.10 |

|

EPV per share |

10.2 |

$10.2 represents the share price valuation using the EPV method. If we compare the data with the current market price ($1.3) we see that the current price could be seen as cheap.

Peers, competition, and risks

Lumen Technologies operates in several industries, including telecommunications, network infrastructure, and cloud services. Its main competitors vary depending on the market segment in which it operates.

Here are some of the top competitors in each industry:

- Verizon Communications Inc. (VZ)

- AT&T Inc. (T)

- Crown Castle Inc. (CCI)

- International Business Machines Corporation (IBM)

- Cisco Systems, Inc. (CSCO)

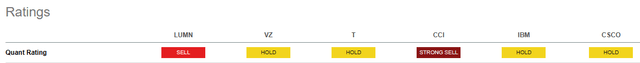

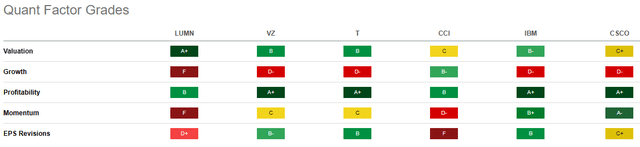

Using Seeking Alpha’s Quant Ratings we have a ‘Sell’ rate related to the ‘Hold’ rating in VZ, T, IBM, and CSCO and a lower rating for CCI. These ratings highlight a difficult and hard time for the Communication Services industry especially if we talk about infrastructure and real estate (CCI).

Seeking Alpha

From the Quant Factor Grades point of view, we can see how LUMN is outstanding in Valuation (which underlines the favorable moment for the company in terms of share price) and has also green labels in Profitability (which underlines that the company is still making money).

Growth and Momentum represent the lowest factor grades ever, especially when compared to peers.

In general, the comparison highlights a market moment that is unfavorable to the industry and generally suggests a moment of waiting before taking any position.

Seeking Alpha

It is important to note that the telecommunications and IT services market is highly competitive and constantly evolving, with new competitors and company mergers that may change the competitive dynamic over time.

Lumen Technologies must therefore constantly adapt to maintain its position in the market and compete effectively with these competing companies.

Lumen also has a greater degree of difficulty in business execution as it competes simultaneously on multiple fronts (infrastructure, cloud, service, software…) while competitors are more focused and could be more punctual in solving customer problems. The other fundamental element relates to the ability to make new investments for future growth. The telecommunications giants identified in the comparative analysis may have greater resources than LUMN and therefore have a competitive advantage vital for business continuity.

Bottom line

Lumen is going through a particularly difficult period with business growth and mounting debt. A major company turnaround has been underway for about 1 year and the basic elements analyzed in this article underline a positive outlook in terms of niche market growth and the solutions offered by the company. The risk of an investment in Lumen is particularly high due to the competitiveness of the industry and the need for new capital for the company’s growth. The share price evaluation is particularly attractive and makes me lean towards a small initial investment to then define a larger entry in the future. My rate is Buy.

Read the full article here

Leave a Reply