For any investor, it is inherent that we all seek a compelling value proposition in every investment. The initial strategy that comes to mind for me is often “Buy low, Sell high.” While this principle may sound straightforward, its execution proves to be more challenging than it seems, particularly in determining what is the right price to pay for a stock.

Lowe’s Companies, Inc. (NYSE:LOW) stands out as one of these high-quality companies that today trades at a discount and could be considered as a “Buy low” proposition. Given the challenging landscape for existing home sales due to historically elevated mortgage rates and inflationary pressures, Lowe’s has been under pressure last 2 years with stock price virtually flat.

Although the decline in mortgage rates may take 1-3 years to play-out, exerting near-term pressure on the stock, Lowe’s is well positioned to weather this phase and thrive as DIY home improvement and PRO projects gain momentum in a more favorable economic landscape, especially considering the aging average home in the US, which is currently on average 46 years old.

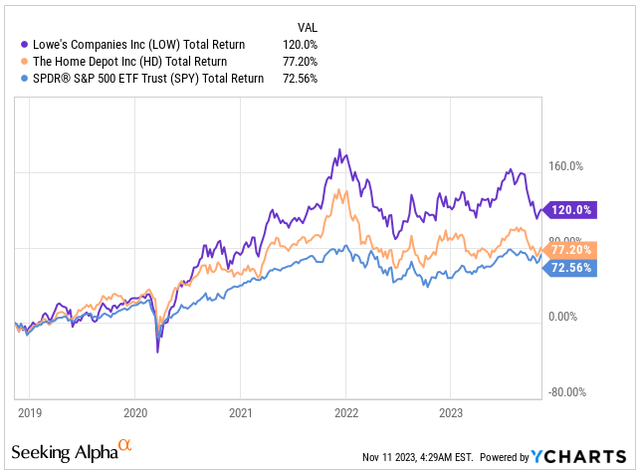

In comparison to my other favored dividend growth choice, Home Depot (HD), on which I recently wrote an article which you can find here, Lowe’s has fared significantly better in the last 5 years.

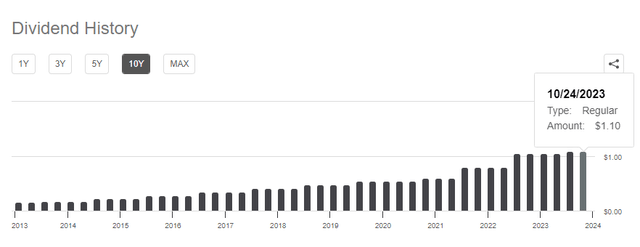

Lowe’s has consistently outperformed both Home Depot and the S&P 500 Index (SPY), showcasing stable price appreciation. Moreover, Lowe’s attractive 2.31% dividend yield, increased by 5% earlier this year despite the challenging environment, confirms the fundamental strength of the company. This factor adds to its appeal, especially when considering that the dividend has annually grown by around 20% over the past 5 years.

Total Return (Seeking Alpha)

Given the quality of Lowe’s business, marked by a strong leadership and trading at a reasonable valuation, coupled with its strategic positioning to capitalize on the aging of US homes amid a scarcity of available land for new construction, I recently doubled down on Lowe’s. It now stands as the largest holding in my dividend growth portfolio.

Let me show you while I like Lowe’s here.

Short-term headwinds do not overshadow long-term growth

Lowe’s, a key home improvement retailer in the US and Canada, specializing in building materials, appliances, décor, tools, outdoor living, and more, has shown minimal movement in its stock price over the past two years. This follows a substantial price appreciation during the low-interest-rate environment triggered by the pandemic between 2020 and 2021, where the company has borrowed from the future demand.

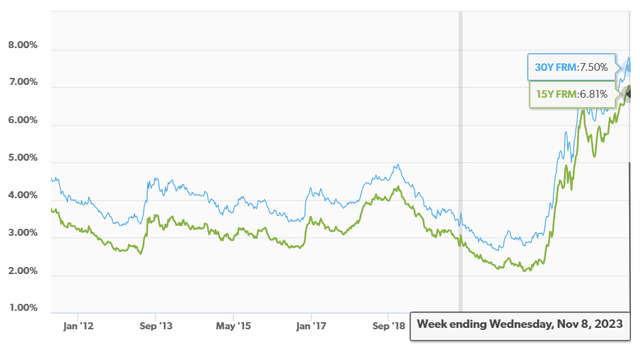

With inflation gaining momentum in 2022, the FED has intervened, applying brakes to the economy and implementing 11 consecutive rate hikes. The rates have risen from 5.25% to 5.50%, taking a toll on mortgage rates, which have surged from the pandemic low of 2.60% to the current 7.50%.

Mortgage Rates (Freddie Mac)

If you secured a mortgage rate below 3% in 2020, there’s little incentive to sell your home and purchase a new one at the significantly elevated rates, which would result in substantially higher monthly payments.

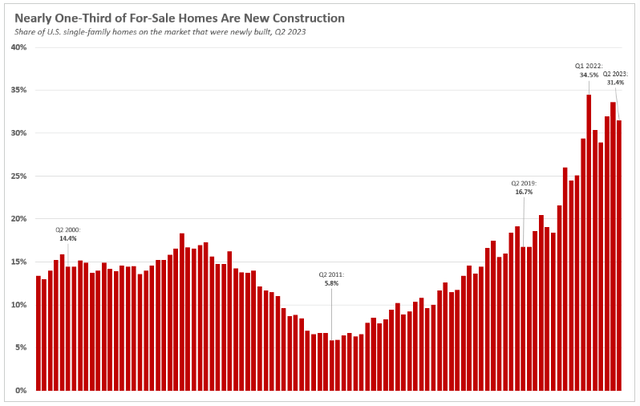

This trend has naturally translated into sluggish sales of existing homes, with nearly one-third of homes in the US now being sold as new constructions—a record compared to the approximately 17% of new construction sales in 2020. Consequently, home builders like D.R. Horton (DHI) have significantly benefited from this shift in the market.

New Construction vs. Existing Homes Sales (DSNews)

This poses a challenge for Lowe’s, as the company typically thrives during periods of increased existing home sales rather than new constructions. Existing homeowners tend to invest in renovations, home improvements, and upgrades—areas that form the core of Lowe’s business.

The FED is currently emphasizing the concept of “higher for longer.” While I am confident that they will make every effort to combat inflation and reach the 2% target, there is already a noticeable cooling off in inflation.

During the last Federal Open Market Committee “FOMC” meeting in November, Powell’s rhetoric prompted the market to start pricing in potential rate cuts by late Q2 or early Q3 of 2024. If this materializes, it could stimulate the economy by lowering mortgage rates and reigniting the real estate market, particularly in existing home sales.

Companies like Lowe’s and Home Depot could seize this opportunity and capitalize on the potential resurgence.

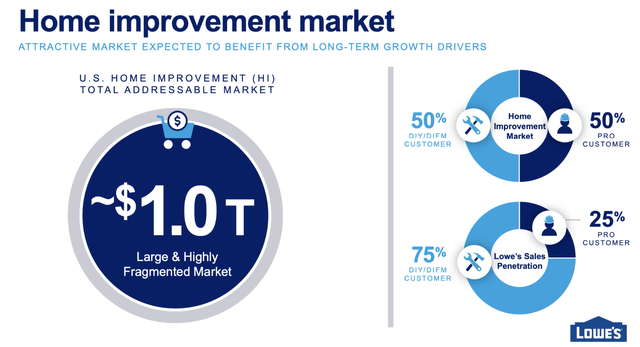

However, Lowe’s is not idly waiting for the economy to improve. The company estimates the addressable market for US Home Improvement to be approximately $1 trillion, evenly split between DIY customers and PRO customers.

Nevertheless, Lowe’s sales penetration is notably skewed, with approximately 75% directed towards DIY customers and only around 25% towards PRO customers.

In the current environment, I believe that having an increased exposure to PRO customers would be more advantageous, especially considering the substantial increase in new constructions being sold.

Home Improvement Market (Lowe’s IR)

Lowe’s management is actively steering towards a more substantial presence in the PRO Customer market, viewing it as a pivotal driver for further growth. The recent collaboration with Klein Tools and the expansion of brand portfolios tailored to professionals, such as electricians and HVAC specialists, underscore a persistent commitment to cultivating the PRO business and counteracting the decline in DIY sales.

Moreover, Lowe’s is making significant investments in enhancing its online sales presence. Over the past five years, online penetration has surged from 4.5% to 10.5%.

Simultaneously, the company is broadening its installation base, augmenting its product range to ensure that both DIY and PRO customers can access every necessary material, décor and appliances for home construction, eliminating the need to shop elsewhere.

In a bid to establish a comprehensive one-stop-shop experience for rural customers, Lowe’s is expanding its presence in more rural areas. This move aims to consolidate offerings related to home improvement, farming, and ranching, positioning Lowe’s to compete with companies like Tractor Supply Company (TSCO).

The positive aspect is that Lowe’s has a well-defined strategy for the unfolding expansion and anticipates fundamental improvements in its financials between 2025-27.

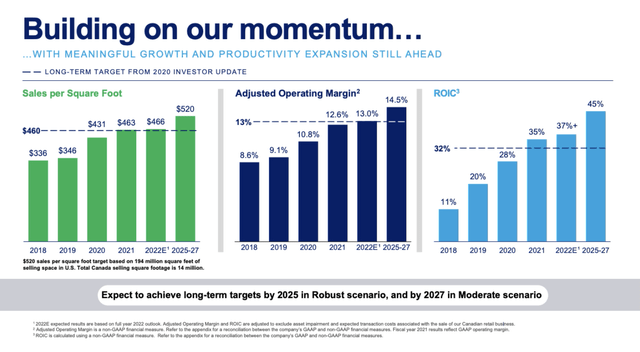

Lowe’s has successfully increased its Operating Margin from 8.6% in 2018 to approximately 12.7% based on the last 12 months’ data. Further expansion is anticipated, with a projected growth to around 14.5% over the next 1-3 years.

Additionally, by focusing on optimizing its locations and warehouse solutions, Lowe’s aims to elevate its sales per square foot to approximately $520, a notable increase from the $336 recorded in 2018, reflecting their commitment to efficiency.

Financial Metrics Outlook (Lowe’s IR)

This brings me to the point of Lowe’s FY23 Q3 earnings, set to be reported on November 21st.

I anticipate the company to deliver approximately $21 billion in revenue, accompanied by an EPS in the range of $3.05 to $3.12. This suggests a decrease of around 5.6% in the mid-point compared to the same period last year.

Simultaneously, I anticipate that Lowe’s will face another challenging quarter in Q4 FY23. Nevertheless, I am optimistic about a significant reversal in the trend, expecting growth in both revenue and EPS sometime in March and June next year, coinciding with the prime season of real estate sales.

This makes the current moment an opportune time to start accumulating shares, strategically positioning for the anticipated future growth.

Undervalued with a robust buyback program and dividend growth

While I anticipate a reasonable reversal in revenue and EPS growth, Lowe’s is currently trading at a very favorable valuation.

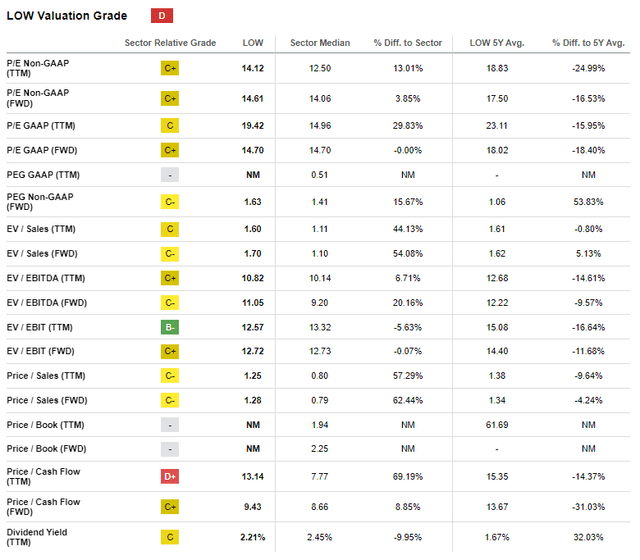

The stock is presently trading at a PE Ratio of 14.12x its FY23 earnings, indicating a 25% discount.

Naturally, we expect to see a lower current-year PE, considering the falling EPS during this year.

The situation improves when we look into FY24, with Lowe’s trading at 14.70x its FY24 earnings, representing an 18.4% decrease compared to its 5-year average.

This is also more favorable than Home Depot’s 19.23x, indicating a discount of around 23.5% compared to its main peer.

Valuation Grade (Seeking Alpha)

Admittedly, given the uncertainty in interest rates, my thesis may take a couple more quarters to materialize. However, investing in a high-quality business like Lowe’s at a discount of around 20% compared to its historical norms provides a substantial margin of safety.

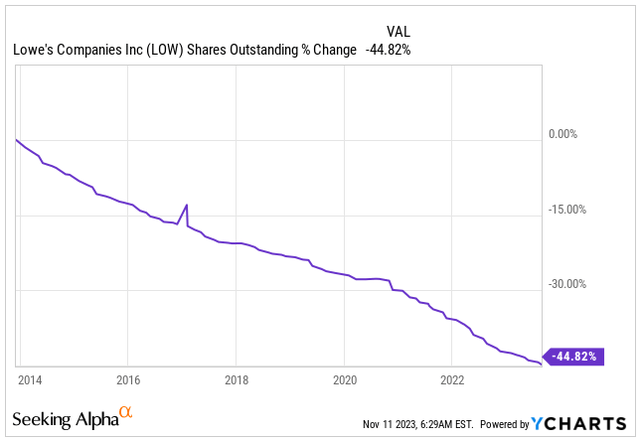

It’s crucial to note that Lowe’s operates as a free cash flow machine. While we shouldn’t anticipate more than low to mid-single-digit revenue growth over the next decade, significant EPS growth is expected. This aligns with the historical trajectory where the company has repurchased close to 45% of its total shares outstanding in the last decade.

Shares Outstanding (Seeking Alpha)

Driven by the expansion of the operating margin and share buyback initiatives, I anticipate the EPS to grow from $13.32 for FY23 to approximately $21.78 by the end of 2029, implying a 7.3% CAGR.

Revisiting the valuation to align with historical standards, if Lowe’s were to trade with a Forward PE of 16 by 2029, a reasonable expectation would be for the stock to be trading at around $348, representing a 7.5% CAGR return annually.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| EPS $ | 13.32 | 14.22 | 15.75 | 18.16 | 19.91 | 21.31 | 21.78 |

| EPS Growth | -3.0% | 6.8% | 10.8% | 15.3% | 9.6% | 7.0% | 2.2% |

| Forward PE | 16.0 | 17.0 | 18.5 | 17.0 | 17.0 | 16.0 | 16.0 |

| Stock Price $ | 213 | 242 | 291 | 309 | 338 | 341 | 348 |

Considering the 2.31% dividend, which has demonstrated a growth rate of approximately 21% CAGR over the past years, a reasonable expectation is that Lowe’s return will hover around 10% to 11% annually over the next seven years.

In my opinion, these returns are poised to outperform the market, all while offering substantial margin of safety at present, making it a compelling investment choice.

Dividend History (Seeking Alpha)

Conclusion

Lowe’s has faced challenges in the last two years, particularly due to the FED’s 11 rate hikes, which have driven mortgage rates to a two-decade high, resulting in a significant decrease in existing home sales. Consequently, this has put a brake on DIY home improvement projects and house remodeling, which constitute the core of Lowe’s business.

However, I anticipate a shift in the tide as I expect the FED to start cutting rates sometime in Q2-Q3 2024. This, in turn, should lead to a substantial spike in existing home sales, favorably impacting Lowe’s business. I am optimistic about a reversal in revenue and EPS growth around the same time next year, coinciding with the robust real estate sales season.

The current depressed valuation of Lowe’s presents investors with a compelling opportunity to invest in a high-quality business. Poised to grow in the next decade, Lowe’s leverages the average aging of US houses, providing a significant margin of safety and the potential for market-beating returns.

Read the full article here

Leave a Reply