Bottom Line Upfront

Lockheed Martin (NYSE:LMT) is well valued and currently well postured for the future. However, for giants of this size, profiteering, budget overshoot and military equipment mishaps have led the Department of Defense (DoD) to prioritize small business initiatives. Recommendation for this article is hold for current shareholders and pass for potential future shareholders, with sights on large cap foreign Aerospace/Defense (A/D) companies, domestic mid cap A/D companies, and new A/D entering companies with technology crossover from commercial industry.

Series Of Mishaps

In the wake of the recent Lockheed Martin F-35 crash in South Carolina, it is yet another reminder of the implications facing the current American Defense industry.

$71 pins that cost less than a nickel, $80 for a drain pipe segment, with retail value of $1.41, profiteering by primes have been steadfast. The problem is so prevalent that a bi-partisan bill called Stop Price Gouging the Military Act has been circulating Congress since 2021.

In respect to the F-35 Program, an excellent Paper called Qualitative Case Study on the F-35 expands on the problems facing the program. The article mentions how cost overshoots forced re-baselining of the program in 2004, 2007, 2010, and 2012. While not all costs overruns are directly the fault of Lockheed Martin, what re-baselining illustrates is the focus on extremely exquisite, highly expensive platforms are not fruitful for the DoD. Such programs produce headaches and animosity towards the program in both Congress and the Pentagon. Forcing a paradigm shift away from primes towards new opportunities.

Outlook

Today, we are in peacetime, and with a ballooning Defense budget, the primes inability to convert dollar expensed to capability throughput has provided a massive opportunity for new players to enter the space. Currently, the U.S. is estimated to have dollar expensed for capability throughput at a ratio of 20:1, our near pier competitors, specifically China are at 4:1. This inefficiency is a side effect of the current military industrial complex, symptomatic of a post-Cold War era of consolidation in the A/D industry, leaving only a few main defense primes in the wake. Consequently, this consolidation has led to general malaise, and in turn has driven the Research and Development (R&D) Departments of the military services to expand and reprioritize newer, smaller and crossover companies. While it may take a decade, my expectation is that the current primes will become outpaced by these new competitors and put a cap on the long term potential growth of these mainstay primes.

Let me expand, the DoD identified this prime problem during the draw down of Afghanistan war in the mid 2010s. The Department of the Air Force (DoAF) responded by creating AFWERX a technology innovation accelerator for the service. There have been revitalized incentives in historical programs such as the Marine Corps Weapons Lab (MCWL) and the Navy Air Program Management Activity (PMA) programs to accelerate the onboarding of new contractors through the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs found here. While the SBIR and STTR only represent about $1.5 billion of the DoD R&D, I believe the real change will occur when the mothership of DoD R&D- the Defense Advanced Research Project Agency (DARPA) renews its focal points and topline budget expansion to support SBIR, STTR and similar initiatives to look outside the primes. See the Congressional Research Service Report on DARPA for more detail.

There is of course a legitimate counter argument. New entries into A/D are going to be met with resistance both by General Staff service members looking for a revolving door and the Prime’s deep pocketed lobbyist wings. Acquisitions of new entries by Primes have and will continue to occur, increasing the breadth and scope of Primes in the evolving technology space of A/D. There is also the chance that the initiatives taken by the DoD and Congress in terms of SBIR, STTR and DARPA don’t lead to tangible value, as the barrier to entry in the industry even with initiatives is steep.

While these effects certainly weigh on disruptors in the space, the overwhelming momentum towards new initiatives is challenging the primes. Not to the extent that I believe the primes will go away, or even become unprofitable in the future, only that the DoD out of necessity is going to shift focus away from these giants to new and smaller players, who will provide higher quality goods and services at lower costs for new and exquisite capabilities the DoD will need to fight America’s future wars.

Now, onto the company.

Background

The Lockheed Martin Corporation is a prime global aerospace, defense, and technology giant, that for many in the industry view as synonymous with innovation and excellence for the Department of Defense (DoD) and the military industrial complex. Since the consolidation of the Defense industry following the Cold War, Lockheed Martin has emerged as a kings amongst kings, with a diverse portfolio including advanced aircraft, missile systems, space exploration hardware, and secure communication technologies, all of which play a pivotal role in safeguarding national security and advancing scientific discovery.

In addition to these tangible goods, Lockheed Martin provides a wide array of services, ranging from cybersecurity and data analytics to logistics support and engineering expertise. Through these offerings, Lockheed Martin remains at the forefront of addressing the complex challenges facing our world, ultimately contributing to a safer, more secure, and technologically advanced future.

Margins And Returns

The financials don’t lie, and they truly are superb. Despite sub mean industry gross Margins at 12.9%, the efficiency of Lockheed Martin in other top line efficiencies with Operating and Net Margins are in the top quartile of all A/D companies at 12.86% and 10.82% respectfully. Performance like this makes this A/D conglomerate a top performer in the industry. Seen here in past 10k filings.

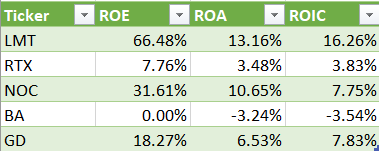

Bottomline performance is as expected- remarkable. Return on Equity (ROE), Return on Asset (ROA) and Return on Capital (ROC) are all in the top 10% of all A/D companies. When compared to its large cap pier group of Boeing (BA), RTX (RTX) and Northrup Grumman (NOC), Lockheed Martin is knocking it out of the park.

Chart of ROE, ROA and ROIC of competitors (Author’s representation)

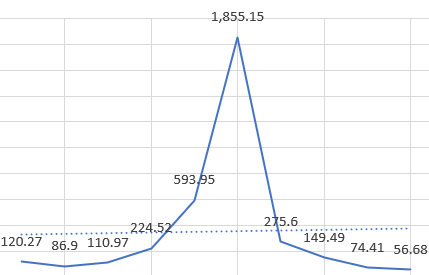

What’s most surprising is Lockheed Martin’s superb ROE margins. See below for annual reported ROE margins since 2013. Note: 56.68% is end of Q4 2022, 66.48% is Q3 2023

Author’s representation

Backlog

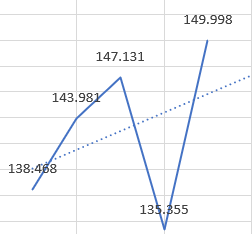

The runway in terms of committed backlog for Lockheed Martin has remained robust. Please see below for backlog since 2018.

Author’s representation

With a backlog to market cap aka book-to-bill ratio of 1.43x, Lockheed Martin is committed through the decade, and runs in tandem with RTX at 1.68x, NOC at 1.22x, and GD at 1.52x. All of these aforementioned primes are well postured for future growth. Not only in current backlog, historical execution, but in there deep penetration in the procurement cycles across the DoD, the primes are here to stay. The real question investors should be asking, is to what extent and would their A/D exposure be better suited elsewhere.

Price

For those who read my first article on BAE Systems found here. I like to use a Buffett/Graham valuation model to determine intrinsic value. Based on this, I believe Lockheed Martin is currently well valued at $412 price per share, as my projection has its current intrinsic from $410-$460. Let me explain.

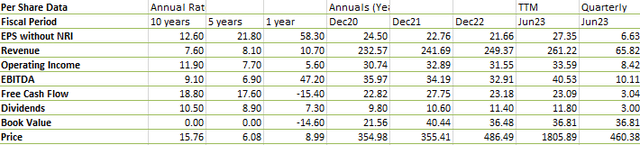

Looking at historical multiples of Price to Earning (P/E), Price to Share (P/S) and Price to Book (P/B) ratios. Measuring these ratios against the five year medians; I use historical Discounted Free Cash Flow (FCF) to measure current valuation and project future valuation. See here for Seeking Alpha’s valuation metric.

I see a reasonable valuation when comparing current valuations to the historical five year medians- 5 year median given enough data for a Discounted FCF model- I will get into this more later.

The current P/E ratio is 15.1- compared to the company’s five year median of 16.4, this is a 7.9% discount. P/S ratio is currently 1.58 compared to a median of 1.73- a 8.7% discount. P/B ratio is 11.2 versus median of 6.5- a 72.3% premium. Averaged out, we see a median premium value mark of 18.56% premium.

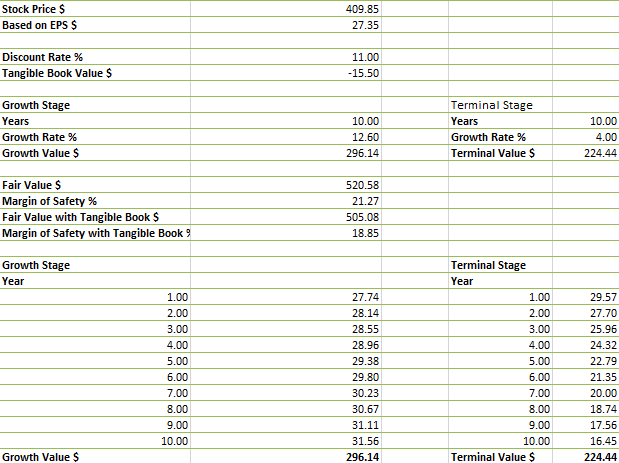

Discounted FCF calculation is below:

Valuation = (Growth Multiple) x FCF (5-yr average) + 0.8 x Total Equity

Based on this formula, current intrinsic Discounted FCF is $520 a share, indicating a margin of safety at its current share price of ~20%.

Generally anything below 10x Price to FCF ratio is considered tasty, and considering the current ratio for Lockheed Martin is 17.1x, the future valuation looks stretched even though the current Discounted FCF value is higher than the current share price.

In respect to Weighted Average Cost of Capital (WACC), FCF Growth and Terminal Value. See below.

Weights:

Weight of equity = E / (E + D) = 103213.125 / (103213.125 + 13552.5) = 0.8839

Weight of debt = D / (E + D) = 13552.5 / (103213.125 + 13552.5) = 0.1161

Cost of Equity: 6.692%

General practice is to use the 10-Year Treasury Constant Maturity Rate as the risk-free rate. The current risk-free rate is 4.652%.

Beta- The sensitivity of the expected excess asset returns to the expected excess market returns. Lockheed Martin’s beta is 0.34.

Market Premium- Expected Return of the Market measured against the Risk-Free Rate of Return. Analyst standard is 6-7%.

Cost of Equity = 4.65200000% + 0.34 * 6% = 6.692%

See below for DCF Model:

Author’s representation

Author’s representation

All measurements taken into a count, I see discounts in P/E and P/S, with a high premium in P/B, averaging a slight premium to its 5 year medians. Countering this, we see a solid technical moat of DCF and a cautionary note in Price to Free Cash Flow ratio. For this reason, I believe Lockheed Martin, as it stands today is well on the low side of well valued at $409, with a price range of $410-$460.

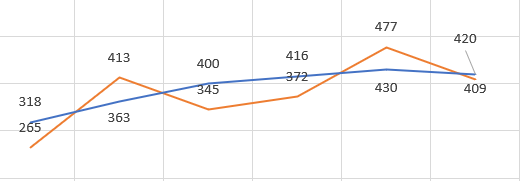

See below for modeled intrinsic value (blue) versus share price annually since 2019 (orange).

Author’s representation

Whether it’s the chicken (Margin of Safety), or the egg (Price to FCF ratio), an investment in Lockheed Martin at its current share price is compelling from a face value look. It is for this exact reason that I believe many analysts are keen to recommend investment. I argue, they are too busy looking at the trees and not at the forest, the tectonic plates of new DoD initiatives and the future players in the A/D space may very well shift the future outlooks of these giants.

Conclusion

“Si Vis Pacem, Para Bellum”- if you want peace, prepare for war; and the DoD is aggressively shifting to do just that via initiatives to bring more players to the table. The defense prime war machine that fueled the wars of Iraq and Afghanistan will not be the only players, let alone the main players in the next fight. Sure, if called upon today, they would be the main drivers of the early to mid-stages of a near peer war.

Lest we forget the likes of the Lionel toy train company, producing compasses for warships, the Ford Motor company producing B-24 Liberator bombers, and Mattatuck Manufacturing making upholstery nails, switching to make cartridge clips for rifles. In a conflict manufacturing crossover, will occur. Lockheed Martin will not Service as a Software products (SaaS), Google, Microsoft and the like will.

My proposition to the potential Lockheed Martin investor is to expand their horizons and look beyond to large cap foreign A/D, domestic mid cap A/D companies, and new A/D entering companies with technology crossover from commercial industry.

Read the full article here

Leave a Reply