The global lithium market has seen immense volatility over the past decade as the demand and supply of electric vehicles have soared. Top lithium mining stocks, such as Livent (NYSE:LTHM), have faced immense stock volatility as rising lithium demand and supply causes the market to oscillate between glut and shortage dynamics. Many investors are attracted to lithium miners such as Livent as a more attractive means of gaining positive exposure to the electric and hybrid vehicle demand boom.

I covered Livent in February in “Livent: Headed Lower As Lithium Prices Collapse Amid Impending Glut,” with a bearish outlook due to falling lithium prices. The stock has lost slightly over a fifth of its value since then as its valuation adjusted to a lower lithium price outlook. In the future, while LTHM and lithium may face some downside risks due to their negative trend, I believe it is nearing a more robust support level that could bring renewed stability to the market. While LTHM is risky, particularly on a short-term basis, I believe that its fundamental valuation and the outlook for lithium are starting to appear more attractive.

Lithium’s price has fallen dramatically over the past year as the market has returned to a glut. The slowdown in China’s economy has added to concerns, considering it is one of the largest global importers of lithium and has a burgeoning EV market. Still, US electric vehicle sales are booming and may continue to rise despite generally falling vehicle sales due to higher gasoline prices. Thus, while Livent could see its EPS compress over the coming quarters, it may still have solid long-term value for investors today.

A Problem of “High Demand, High Supply”

Indeed, LTHM trades at a much lower forward “P/E” of 9.5X compared to Tesla (TSLA) at ~75X, making the stock a potentially more suitable means of betting on the EV market. Of course, Tesla’s sales growth is far higher than Livent’s at ~600% over the past five years. That said, Livent’s sales growth is also quite strong at 125%, a solid figure compared to its valuation. On a TTM per-share basis, its sales growth has been 47% over the past five years, with 180% in EPS growth; however, its EPS is highly volatile due to changes in lithium prices. Thus, Livent has some growth potential, which may accelerate as its merger with Allkem is completed.

Livent’s managers believe the merger will be highly accretive for LTHM because they’ll consolidate supply networks and other business facets. Indeed, the merger appears to be a tremendous strategic option, considering the global lithium industry needs consolidation. It is still a relatively young industry, given lithium demand has risen by a magnitude over the recent decade and should continue to grow dramatically – making it “young” given its size. As it matures, we’re starting to see consolidation efforts expand as the largest lithium giants look to expand their profit margin and growth capacity.

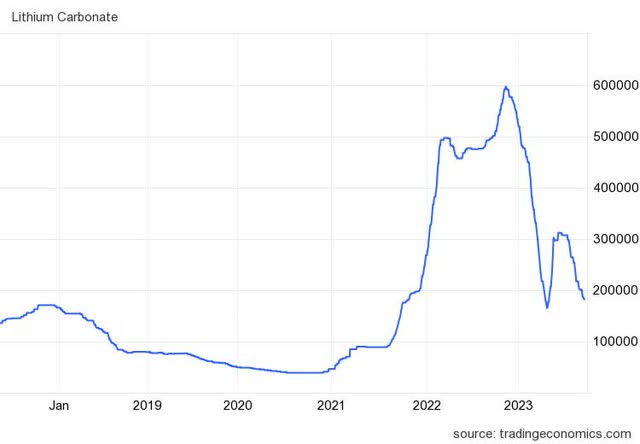

While lithium is a very high-growth mining segment, its price is relatively depressed today. In CNY, the price of lithium has fallen from over 600K/ton to 182K/ton from its 2022 peak to today. The Chinese market is crucial for lithium because many global electric vehicles are being produced in that country. While prices are down significantly from last year, they remain above most pre-COVID levels. See below:

Lithium Price in Chinese Yuan (TradingEconomics.com)

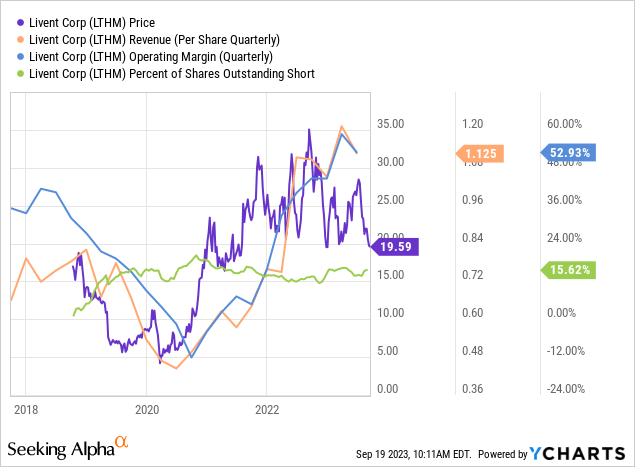

The crash in lithium prices has led to declines in Livent’s value. The stock is currently down around 44% over the past year and is back near the low end of its recent historical range. Short-sellers have piled into the company, causing its short interest to rise to ~15.5%. The company still benefits from elevated fixed-price contracts, so its revenue and operating margins are near peak levels despite the decline in the key commodity. Short volumes are elevated but are not considerably higher than they’ve been over recent years. See below:

There could be numerous reasons for the higher short interest on Livent. One may be that many speculators simply believe that the stock is either overvalued or that lithium will not benefit from electric vehicles as much as investors suggest. In my view, Livent’s high short interest is not necessarily an overvalued sign; it may be a hedging tactic from more advanced market speculators. For example, one can buy TSLA or another EV car company shares while short-selling LTHM.

This could be a good pair trade because TSLA or others have theoretically more significant upside due to higher EV demand. This is because both lithium demand and supply are rising together. However, should EV demand decline, TSLA and LTHM should decline simultaneously. Fundamentally, this pair trade exists because Livent’s output will increase with higher demand but not necessarily fall should EV demand decline. At any rate, Livent’s high short interest is notable but not necessarily a direct indication that the “smart money” believes LTM to be overvalued.

The core issue with lithium mining is that lithium is not a rare commodity. Lithium is not mined in the traditional way of most metals. It is produced from lithium-rich salt brines, primarily based in Bolivia, Chile, and Argentina. Currently, annual global lithium demand is around 600-700 thousand tons of lithium carbonate compared to nearly 26 million tons of proven reserves. Of course, proven reserves and actual potential reserves are very different, as proven reserves tend to rise with exploration. Weeks ago, Lithium Americas (LAC) published that it discovered a lithium supply around the Nevada-Oregon border with 20-40M tons of lithium reserves. LAC surged by nearly 10% on the news, while LTHM fell by around 10% over the past week. If LAC can secure rights to this discovery, it will have access to a potentially larger supply pool than the entire “lithium triangle” in South America, where most operations are currently concentrated.

Fundamentally, the world has a ton of lithium to go around, and compared to most metals, it is easy for miners to expand supply because it is produced via water rapidly brines, not requiring so much heavy machine digging and drilling. As such, global lithium production has quadrupled since 2015, perhaps the only commodity to see output rise during the COVID period. Global lithium demand is growing at about the same pace, and both are expected to triple or quadruple again by 2030.

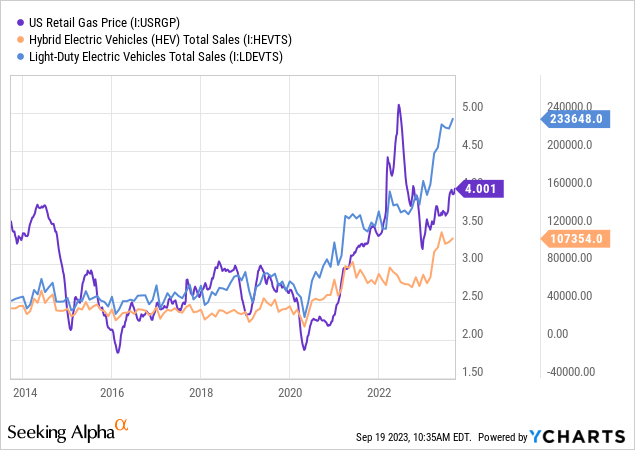

Strong EV and HEV vehicle sales trends, support demand for lithium. Total US light vehicle sales are slowing, likely due to household economic trends, but that has not stopped demand for EVs and HEVs. One key factor lifting EV and HEV sales is the ongoing rebound in gasoline prices. As gasoline becomes more expensive, more people are interested in EVs because operating cost savings offset their higher costs. See below:

There is a general correlation between gasoline prices and HEV sales. The relationship is particularly clear if we look over a longer time horizon, as the data provider for those metrics has. Earlier this year, many concerns arose regarding a slowdown in EV sales; however, by these measures, EV and HEV demand is growing faster today, likely caused by the rebound in gasoline prices.

Globally, it is still possible, if not likely, that EV sales will slip over the coming year due to the more recent economic declines in Asia and the delayed impact of higher interest rates in Western markets – which we’re starting to see play out more broadly in durable goods demand trends. On a short-term basis, I expect lithium to remain in a glut dynamic for the coming two to four quarters, mainly if a recession occurs, given rising lithium output. Livent’s EPS may compress as its contracts roll off at lower prices. In the long run, the market should rebalance more positively, but I do not expect 2022’s high lithium prices ever to return as knock-on impacts from lockdowns and stimulus primarily caused that. Lithium is not a particularly economical commodity due to the vast global reserves and lower cost of supply growth; however, Livent may still obtain stable profits as the market matures to become less volatile.

Does Livent Offer Discount Potential?

LTHM’s lower TTM “P/E” of 11X may appear attractive, but its EPS will likely decline going forward due to lower prices as its fixed price contracts expire. According to its last 10-K (pg. 43), its production costs are around $4.7K per ton of Lithium Carbonate Equivalent. Of course, production costs do not usually account for other factors relevant to EPS (its ‘AISC’ is not published). Today’s global lithium price in USD is around $25K per ton, but still far below prices seen at last year’s peak. Regardless, Livent would still be profitable even if it were selling lithium at today’s prices. That said, lithium briefly fell enough in 2019-2020 for Livent to temporarily become unprofitable, so the same may occur if the glut continues to grow.

Livent does not fully publish its fixed-price contracts on its SEC reports. During its last investor call, its managers stated that 70% of its 2023 lithium volumes were contracted at 2022 prices, allowing the company to earn immense profits despite declining lithium prices. However, its managers also mentioned that its 2024 pricing contracts were still “up for discussion,” implying that it will not sell in 2022 in 2024, although they expect its fixed-price contracts to be above 2023 prices.

Without the detailed data, we cannot know precisely what Livent’s realized price is vs. the market price and how its realized prices will change going forward. The company last became unprofitable (using operating margins) during the 2020-2iod, the year after lithium slipped into the 35-75K CNY per ton range in 2019-2020. In the future, I generally expect Livent’s breakeven cost to be around 75K CNY/Ton, accounting for a 30%+ cost increase since then due to inflation. Again, this is a very general estimate, given the lack of available data.

Lithium has floated around 200-300K CNY per ton this year, slightly below that range. Thus, I’ll assume its contract pricing is around 230K CNY per ton. Of course, not all of its lithium is sold to China, and it has currency hedges, but I am looking to make a generalized EPS outlook range, not a specific EPS target. Based on that pricing outlook and its total operating cost estimate, I estimate that its operating margin will be around 155K CNY per ton in 2024. The company estimates its production will be about 40K by next year. Based on that margin and production estimate, in USD terms, this gives us an operating income outlook of ~$870M. Assuming a 30% tax rate and no changes in shares outstanding, this equates to a 2024 EPS estimate of $3.4, about 30% above the current consensus estimate.

The Bottom Line

Problematically, this is only a rough target, given the lack of clear data available. Unlike most miners, Livent’s output is expanding extremely fast, so it cannot give as clear guidance as most miners. My outlook assumes it achieves relatively high growth without compromising mining costs. It also assumes stable exchange and tax rates, which is not necessarily likely given its operation in a complex global environment. Further, my estimate assumes it sells lithium at higher prices than the current prices based on the company’s statements regarding its 2024 contract goals. In reality, its 2024 prices could be well below that target.

Still, despite the uncertainty, I am slightly bullish on LTHM today and believe it is a much better long-term value investment than most. Lithium is in a small glut today, which may expand if demand for EVs falters; however, high gas prices also aid EV and HEV sales. Lithium demand could slip, but it will almost certainly rise in the long run. Lithium supplies may also grow too quickly, the most significant risk to Livent given vast global reserves. That said, it should be many years before LAC’s discovery in the US impacts the market due to regulatory issues. Livent’s production costs are so low that it will remain profitable at much lower prices. Further, its valuation is also low given its high production growth rate, with higher supplies likely offsetting lower prices.

Without a doubt, LTHM is a volatile stock, and investors who do not want too much risk should avoid investing too heavily in it, particularly given its recent string of declines. That said, it’s relatively idiosyncratic compared to stocks in general, with unique risk and reward factors. Combined with its low valuation, high growth rate, and potentially accretive merger, I believe its long-term upside is more extensive than its potential downside.

Read the full article here

Leave a Reply