Investment updates

Investors continue to sell shares of LivaNova PLC (NASDAQ:LIVN) with the equity stock down some 17–18% since my August publication. Critically, LIVN was reiterated as a hold in that publication for the following reasons:

- The Q2 FY’23 results were a mixed bag, with some positive growth reflected in the P&L statement and balance sheet.

- Top-line growth was observed, with corresponding margin decompression.

- Although these results indicate some progress, it is still uncertain if the economic characteristics of the business will sustain this growth + the firm’s competitive position over the long-term.

Switching to the current market, little has changed in the way of LIVN’s investment prospects in my opinion. As a reminder, the company put up $294mm in quarterly sales in Q2, up ~16% YoY, with strong growth in its cardiopulmonary and neuromodulation segments (up ~20% and 13.7%, respectively). Around 6% of this was pricing, the rest built from volumes of its core products.

Management projects 8–10% sales growth in FY’23, calling for $1.13Bn at the top line this year, and I estimate it could throw off $150–$180mm in FCF at the end of the period.

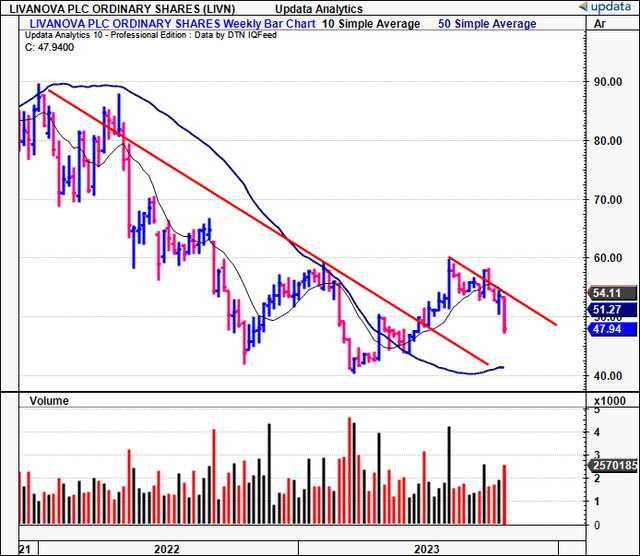

That’s all well and good, but what matters equally are the market’s expectations, i.e., what is guiding the company’s current market values, and what opportunity there is for LIVN to beat these. With shares trading below the 50DMA, LIVN’s FY’23 rally was short-lived (Figure 1), and the entire sector has been hit hard rolling into the back end of the year, spilling over into many selective names. The stock still trades at 18x forward earnings and EBIT, without the long-term economic characteristics to support these multiples in my opinion.

This report will discuss the changes in LIVN’s investment outlook since the last publication and offer insights into:

(i). The price-implied expectations of the company set by the market,

(ii). What prospects LIVN has to outpace these expectations,

(iii). What, if anything, might result in these changes.

Net-net, I continue to rate LIVN a hold based on the factors presented here today.

Figure 1. LIVN 2-year weekly price evolution, now trading below 50DMA, continued downside with increasing sell volume.

Data: Updata

Critical facts pattern to reiterated hold thesis—what’s changed, what hasn’t

1. Essenz clearance in U.S. and EU

LIVN announced in August it had received 510(k) clearance by the FDA and CE Mark in Europe for its Essenz In-Line Blood Monitor (“ILBM”). The monitor is said to continuously measure blood parameters during cardiac and pulmonary bypass surgeries. It consists of a heart-lung machine, a monitoring unit for the patient, along with sensory technology, which envelopes the ILBM.

It will integrate into LIVN’s broader CBP platform known as Essenz Perfusion System, which also provides blood monitoring and management capacity to perfusionists during surgery.

The company says it was designed in collaboration with >300 customers throughout the globe, and has already been used with >1,000 patients:

Existing blood gas analyzers only reflect a patient’s clinical condition at the exact moment a sample is drawn, which can quickly change and become irrelevant. With the Essenz ILBM, perfusionists receive in-line continuous monitoring of the patient’s parameters for the duration of a procedure. This allows for the delivery of a patient-tailored approach to perfusion rooted in data-driven decisions.

LIVN announced the update on August 30th, and since then, the market’s appraisal has remained unchanged. Does it foresee a major change to its economics, valuation, or fundamentals? Likely not in my estimation.

2. Price implied expectations

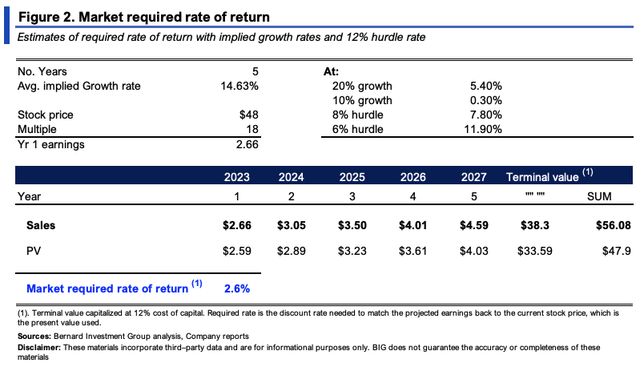

LIVN sells at 18x forward earnings and 18x forward EBIT. At the current stock price of $47.94 as I write, the market expects $2.66 in forward earnings (47.94/18 = $2.66), and $165mm in EBIT (2,980/18.05 = 165). Using consensus forward estimates from FY’23–’25, the average expected growth rate at this multiple is 14.6% (Figure 2).

The required rate of return investors need to buy LIVN at these multiples is also seen below. I estimate 14-15% bottom-line growth is fair out to FY’28, after which I’ve capitalized the company’s earnings at a 12% hurdle rate to reflect our internal threshold and long-term market rates. The market’s required rate of return is the discount rate needed to bring these forward estimates back to the current market value, which is 2.6% at the time of writing. These expectations range from 0.3%–11.9% based on various stipulations, as seen below.

Critical insights are gleaned from this, namely:

- The market requires a reasonably low rate of return, indicating there is relatively low-risk levels priced into LIVN,

- LIVN’s forward cash flows (size, timing, magnitude) aren’t expected to be lumpy,

- Growth expectations are likely flat and captured in LIVN’s current market values,

- That forward investment returns (at least expected returns) based on these low accepted levels of risk are suspicious.

Further insights are obtained by comparing the expected returns on the company’s investments:

- LIVN produced 12.4% return on existing capital last period (adj. for R&D) and FY’23 adj. EBIT is expected to reach ~$260mm from $232mm in FY’22, 12% YoY growth (note: adjustments are made for R&D, which is capitalized on the balance sheet as an intangible asset, then amortized over a 7-year useful life).

- It also trades at 1.37x EV/invested capital, indicating flat expected business returns, and the expected ROIC (1/(EV/IC)xROIC)) equals 9% (1/(1.37×0.124) = 9%). As such, the expected reinvestment rate (RI = g/ROIC), obtained via the function of growth and ROIC, comes to 75%, suggesting the market expects LIVN to retain and reinvest $195mm of its FY’23 pre-tax income to grow the business.

BIG Insights

3. Prospects to outpace market expectations

Based on the company’s economic characteristics, my estimation is the market has accurately reflected the company’s forward outlook within a statistically significant range.

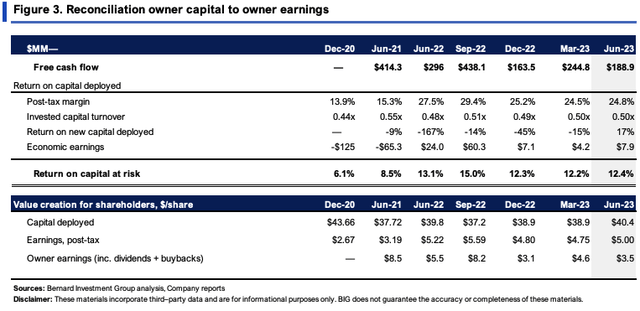

For one, LIVN is a relatively high-margin, low capital turnover business. Profits are obtained on the sale + placement of its products, but turnover of said products is low. Hence, the ratio of sales to capital is low at 0.5x, on trailing after-tax margins of ~24%, as seen in Figure 3.

BIG Insights

Secondly, the point on LIVN’s margin/capital turnover axis is critical, given the following:

- Over the last 3 years, its sales have grown at 1.5% each period, on average operating margins of ~21% (again adj. for R&D as before).

- The FCF it can throw off to shareholders is therefore most sensitive to changes in operating margin.

- For example, at this steady state, a 2% change in sales could see LINV throw off $194–$222mm in FCF over the coming 2 years, whereas a 200bps margin loosening (to 23%) could see it produce $232—$246mm.

Can it decompress operating margins by this amount? On est. sales of $1.13Bn this year, and consensus estimates of $1.19Bn in FY’24, this calls for ~$260mm pre-tax, and there is scope for it to hit that number, as discussed earlier.

With a $195mm reinvestment (discussed earlier), LIVN would have employed $2.37Bn of capital into the business, and at $260mm, would recognize 10.9% return on capital—in line with the market’s expectations of ~9% from before.

Consequently, in my estimation, it boils down to (i) LIVN’s propensity to realize higher operating margins, (ii) its ability to keep up post-tax returns on capital required in the business, and (iii) grow pre and post-tax earnings without a heavy reinvestment of capital to do so. Based on the calculus presented here, my estimation is the market may have already captured this potential in LIVN’s current market value.

Valuation and conclusion

The stock sells at 18x forward earnings and EBIT, as mentioned earlier. These are both respective premiums to the sector, ~2% and ~16%, respectively. You’re also buying a 3.6% forward cash flow yield in LIVN as I write, and the company has created ~$2 in book value for every $1 in market value.

On the topic of potential mispricing/change in expectations, consider the following:

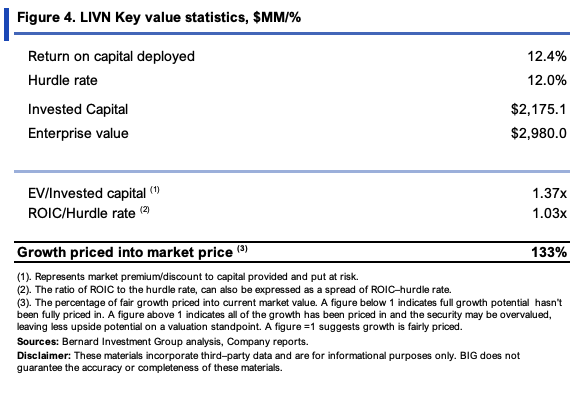

(1). LIVN trades at ~1.4x EV/invested capital, and 1.03x the ratio of ROIC to our hurdle rate of 12%.

(2). This implies its forward earnings power is also well captured at its current marks, as seen in Figure 4.

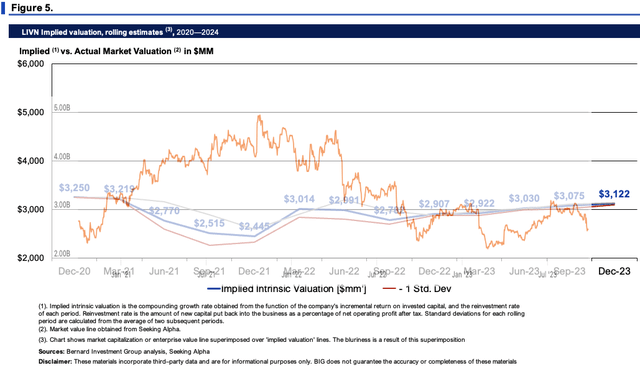

(3). Further, compounding LIVN’s intrinsic value at the function of its ROIC and reinvestment rates (inc. forward estimates at its steady state) indicates the market has been a fairly accurate judge of intrinsic value in 2023. You can see the dislocations in 2021 in Figure 5, but that wasn’t a fundamentals–based market, I’m sure many will agree. The recent selloff provides some scope for reversion to the upside, but not on a long-term basis. In that vein, a fair value of $3–$3.1Bn in market value appears fair for LIVN in my opinion, and hence no margin of safety to comment on.

All of the factors raised therefore corroborate that (a) the market’s revised expectations are somewhat accurate, and (b) the potential for a change in expectations is yet to be seen, at least in my opinion.

BIG Insights

BIG Insights

In short, the broad market has turned south in H2 FY’23 on a number of broad pressures. This has spilled over into many selective names, LIVN included. Moreover, the market’s individual expectations for LIVN have revised lower across FY’23 in total. This is telling. It implies investors foresee tighter growth/value prospects for the company going forward. It also suggests LIVN’s propensity to unlock shareholder value may be hindered. Do we believe the market’s appraisal? Based on the culmination of factors raised here today, my estimation is there is no statistical mispricing on offer, and that the selloff may be more-or-less justified. I believe LIVN is valued fairly at ~$3–$3.1Bn at the time of writing. Net-net, I continue to rate LIVN a hold.

Read the full article here

Leave a Reply