Effective after the close yesterday, Lithium Americas (“OldCo”) split into Lithium Americas Corp. (“NewCo”) (LAC) and Lithium Americas (Argentina) Corp. (NYSE:LAAC). The company issued equal shares in LAC and LAAC and allowed the market to determine the value of each company. In early trading today, shares of LAC shot above $11, while shares of LAAC hovered around $6. Essentially, the market ruled that the North American business (Thacker Pass) was ~65% of the OldCo’s value. This article will look at how this split has left LAAC extraordinarily undervalued.

Cauchari-Olaroz

Initial lithium production at Cauchari-Olaroz began in June, beginning a year-long production ramp to reach nameplate capacity with battery-grade lithium. The project, which is expected to produce 40,000 tpa of lithium carbonate, is the largest brine operation to come online in over 20 years (since SQM’s operation at the Salar de Atacama).

Initial harvesting of lithium at Cauchari-Olaroz (Lithium Argentina)

Lithium Argentina is entitled to 49% of production, while Ganfeng (OTCPK:GNENF) is entitled to the remaining 51%. However, the local Jujuy government has an 8.5% stake in the project, which essentially acts as a bottom-line royalty given it doesn’t have much involvement in day-to-day operations.

Regardless, according to the company’s 2019 DFS for the Cauchari-Olaroz project, production costs are expected to be $3,576 per tonne of lithium carbonate. While this is likely outdated, following the significant inflation seen since then, it does demonstrate that the project operates at the bottom of the lithium cost curve. I would estimate a more representative production cost of $4,500 per tonne lithium carbonate.

Assuming market pricing of $25,000 per tonne, LAAC’s 44.8% stake in the Cauchari-Olaroz project would net them a gross profit of ~$367.36 million. As a reminder, the company currently expects to reach this rate of production in mid-2024. Ganfeng and LAAC are also currently undergoing work to expand total production to 60,000 tpa.

Pastos Grandes and Pozuelos

In 2021, Lithium Americas announced that it had entered into a definitive agreement to acquire Millennial Lithium for $390 million. A year later, the company announced that it had entered into a definitive agreement to acquire Arena Minerals (read this article for more information about the company and its properties) for $227 million.

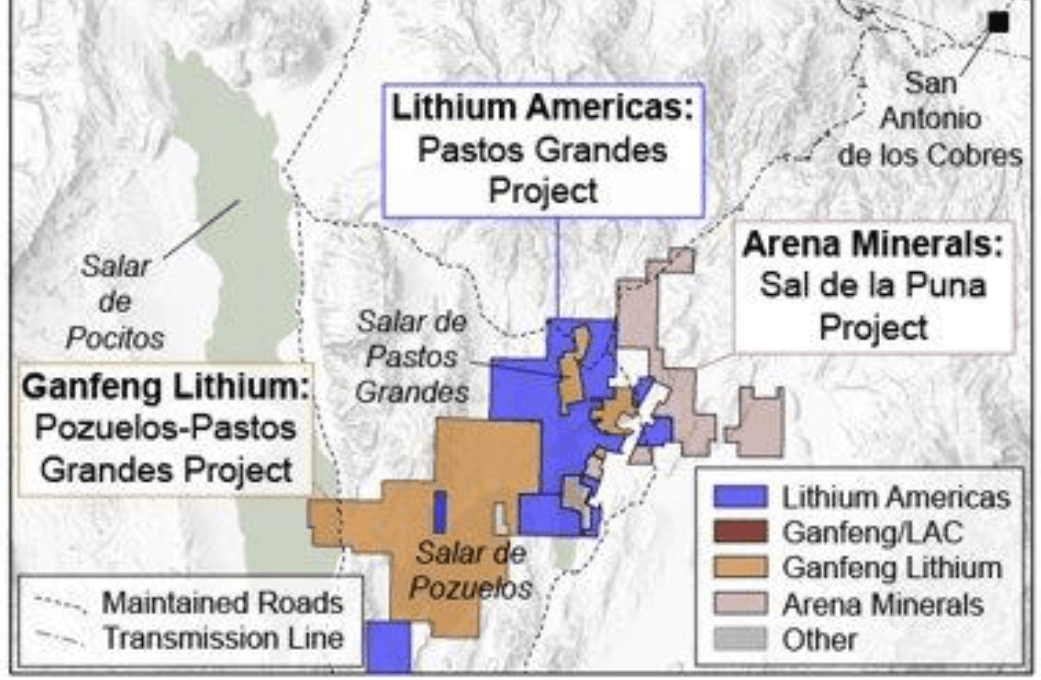

Land ownership in the Pastos Grandes and Pozuelos salars (Lithium Argentina)

These acquisitions gave Lithium Americas a total of 27,796 hectares (14,091 hectares from Millennial and 13,705 hectares from Arena Minerals) in the Pastos Grandes and Pozuelos salars. For reference, the massive Cauchari-Olaroz project covers 60,712 hectares, of which 28,717 hectares are permitted for resource extraction. Note that Ganfeng holds a 35% stake in the former Arena Minerals project.

Millennial Lithium, prior to its acquisition, had completed a DFS that supported a 40-year mine life with a production rate of 24,000 tpa. The company estimated that production costs would be $3,388 per tonne of lithium carbonate.

The land from Arena Minerals wasn’t nearly as developed, without even a representative resource estimate. That being said, early exploration work indicated a similar resource to Millennial and, combined, I have little doubt that output would reach 40,000 tpa.

As the map above shows, Ganfeng also has a significant stake in the area outside of its 35% stake in the former Arena project. As such, it’s quite possible that the two companies will look to consolidate their projects under one roof, similar to Cauchari-Olaroz, forming another massive brine operation.

Valuation Discussion

Based on the outstanding share count of 160,047,671, LAAC is currently valued just a few million dollars below $1 billion. To put this in context, acquisitions in the Pastos Grandes basin cost a total of $617 million, thus implying a value of just $383 million for Cauchari-Olaroz.

It’s not like Lithium Americas overpaid for these assets either. Ganfeng’s $962 million acquisition of Lithea, which gave it access to a 13,470-hectare land package in the Pastos Grandes and Pozuelos salars, is solid evidence of that assertion. Keep in mind, LAAC also received an additional 11,000 hectares in the Cauchari salar (Cauchari East) with its acquisition of Millennial (not counted in the 60,712-hectare Cauchari-Olaroz project).

Regardless, as a producing lithium company, LAAC’s value should be much more closely aligned with the expected output at Cauchari-Olaroz. Upon reaching nameplate capacity, Cauchari-Olaroz should be valued at no less than $2.75 billion (based on a 7.5x gross profit multiple). Factoring in the planned 20,000 tpa expansion, this is a conservative estimate.

While, again, far too conservative in my opinion given LAAC’s continued development of the projects, the company’s other properties should be valued at no less than $617 million (the combined acquisition value). This implies a total value of $3.367 billion for Lithium Argentina upon reaching nameplate production capacity at Cauchari-Olaroz.

Investor Takeaway

3x upside in less than a year for a company that is largely de-risked, having started its production ramp already, truly makes no sense to me. For some reason, the market seems to value hard-rock assets above brine assets, despite brine assets occupying a lower spot on the cost curve. But this has been taken to an extreme with LAAC.

There’s no reason that a company like Patriot Battery Metals (OTCQX:PMETF), which hasn’t even completed a preliminary feasibility study, should be valued (current value of ~$900 million) similarly to a producing lithium company with world-class assets. Let’s look at LAC too, which holds the Thacker Pass project.

Expected to eventually reach 80,000 tpa of lithium carbonate production, there’s no question that this project is a behemoth. However, across LAAC’s various projects in Argentina, I feel rather confident that the company should surpass 70,000 tpa adjusted for Ganfeng’s ownership. Yet again, LAAC is much closer to mass commercialization but trades at a significantly lower value (LAC is currently valued at ~$1.8 billion).

I don’t feel that LAC is overvalued at all, it too has significant upside, but I use this comparison to highlight how absurd LAAC’s current value seems to be. At this point, it seems as though shares won’t trade near a fair value until Cauchari-Olaroz begins producing at scale, though they will likely move based on various catalysts leading up to that. These catalysts may include first revenue recognition, expected this year, and first battery-grade lithium carbonate production.

In fact, LAAC has already shipped its first lithium products and plans to produce a total of 5,000 tonnes of lithium carbonate by the end of the year. It’s unclear what purity this will be, but revenues from these sales should be at least $100 million (assuming sales price of $20,000 per tonne).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply