Introduction

“Investors looking to shelter from inflationary pressures, while still enjoying the benefits of safe long-term compounding, should consider Linde plc (LIN). This industrial-gases multinational enjoys an undisputedly rich corporate history and a market-leading core return on capital that will take its growth investments to the next level.

The merger between Linde AG and Praxair has left the new Linde with pretty much all of the latter’s assets, a move which the management team hasn’t so far regretted. We are pleasantly surprised by the much improved business performance, as Linde’s operating metrics continue to be miles ahead of peers L’Air Liquide S.A. (AIQUF) (AIQUY) and Air Products and Chemicals, Inc. (APD).“

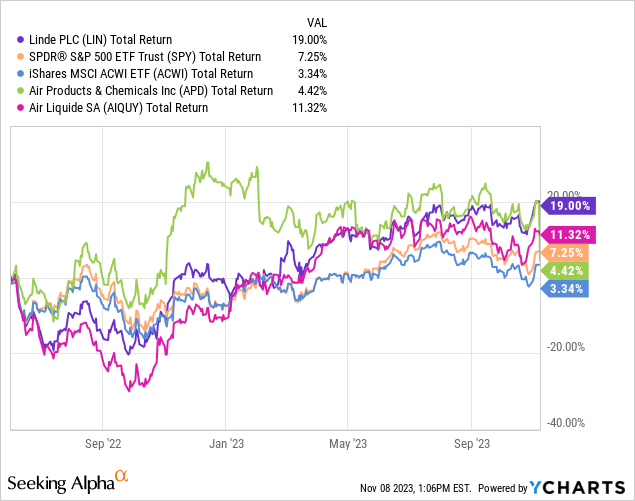

That’s what we wrote back in June 2022. Although LIN made a rather false start, shares have since handsomely outperformed its peers and worldwide benchmarks.

We attribute its outperformance to the following aspects:

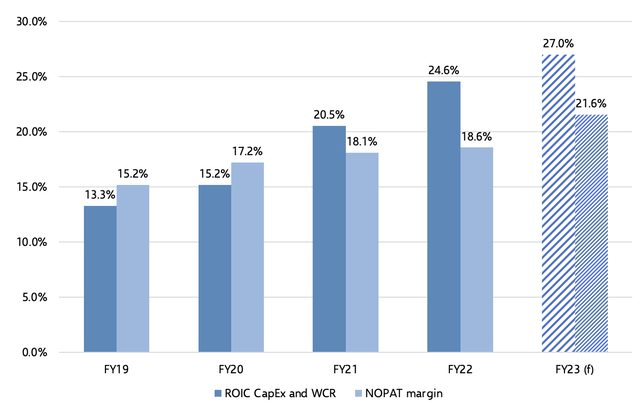

- industry-leading ROC, even against the current macroeconomic backdrop. Today Linde boasts 27% ROC (adjusted NOPAT excluding non-cash PPA charges related to the Praxair and Linde AG merger). Its direct peers remain stuck at 9% to 11%.

- lower leverage than its peers (1.9 times NOPAT versus 3 times for Air Liquide and Air Products);

- solid cash conversion to pursue growth initiatives;

- and lastly, effectively enlarging its network density for new and existing customers in the form of a growing base and project CapEx.

Based on the recent financial trends, and with Chinese end markets recovering, albeit slowly, there’s an upside to LIN’s near-term volume growth. Coupled with a growing sale of gas backlog, further ROC improvements, and the stated goal of delivering EPS growth ex. FX in excess of 10%, we remain bullish on LIN’s long-term prospects.

Since no one can predict the next stock market correction and subsequent rallies, we refrain from selling this steady compounder that has already proven it will win over time, regardless of how the future unfolds.

We argue that LIN’s long-term prudent capital allocation should weather the next inevitable downturn. This view is supported by an estimated FY24 NOPAT yield on an enterprise value of 4.3%, which isn’t excessively expensive considering the business quality.

The Two Ingredients for Value Creation: ROC and Cash Flow

While we won’t repeat ourselves with the elements already mentioned in our introductory article of last year, the success of compounding stocks boils down to a repeating value-creating process.

Being explicit about ROC and cash flow efficiency is what sets Linde’s management team apart from the rest. Just a few quotes to underpin our motivation from the latest conference call:

“During uncertain times like today, shareholders want to sleep well at night knowing their investment is safe in management’s hands, which is further supported on Slide 5. Proper capital management and quality cash generation have always been at the core of our operating rhythm. We’ve been following the same capital allocation policy for decades. It starts with generating true operating cash flow, because contrary to what some might think working capital does matter.

While our mandate is to maintain an A credit rating and grow the dividend, the priority for our capital is to invest into the business. This follows our time-tested investment criteria, which has enabled Linde to consistently achieve industry-leading ROC year-after-year. After investing into the business, surplus cash is used for share repurchases. Having a strong balance sheet, stable cash generation and an active stock repurchase program enables value-creating opportunities during turbulent markets. In fact, our best stock repurchases happened when equity markets overreact.

This is why we recently announced a new $15 billion stock repurchase program, allowing us to optimize our excess free cash flow and robust balance sheet. We’ll continue to take advantage of stock market dislocations and return capital to our owners in a tax-efficient manner.” – CFO Matt White during Q3 2023 conference call

As you can see from the below graph, LIN’s profitability has grown over the past couple of years. Combined with a relatively stable capital base, this led to a more than proportional increase for its return on fixed tangible assets and working capital (please note that our calculation of ROC may differ from LIN’s versions as it takes 4- and 5-quarter trailing NOPAT and adjusted invested capital).

Option Generator

Now, it’s important to note that in FY22, LIN passed through a significant amount of energy costs, which did not affect absolute profit dollars but did reduce relative operating margin. As such, investors should not take the revenue and reported profitability numbers at face value. The only “true” profit drivers are volume growth (base and project backlog), pricing, and productivity optimizations.

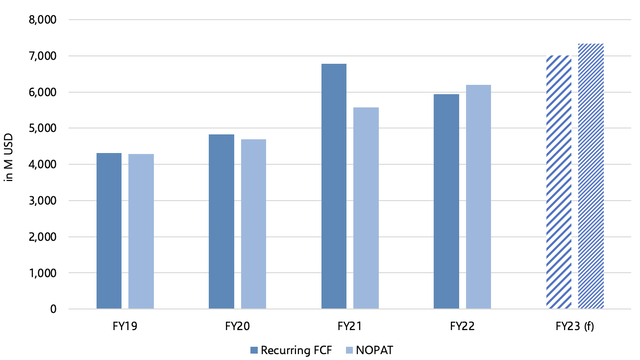

In terms of NOPAT versus recurring free cash flow, we can conclude that LIN has been able to convert most of its recurring net operating income after taxes into real cash. Our definition of LIN’s recurring free cash flow is based on NOPAT, after which we deduct the net base investments (base CAPEX minus D&A), lease repayments, financial result after tax, working capital changes, and dividends and/or transactions with NCI.

Option Generator Research

In FY21, LIN benefited from a strong return of the capital cycle as evidenced by the positive contribution from contract liabilities, i.e. engineering working capital. In other years, working capital trends remained quite stable. Thanks to a relatively un-levered balance sheet with 1.15 times net debt to EBITDA and the issued debt instruments at a low-interest cost in the early part of 2022, interest costs won’t have much of an impact on FCF conversion going forward.

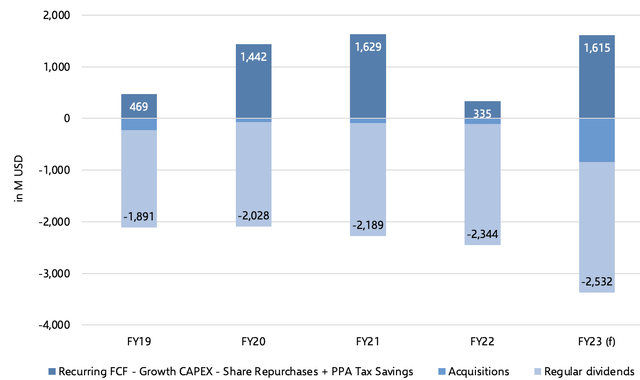

The real question for investors figuring out the compounding capabilities of a company is whether it can deploy all of its remaining recurring free cash flow. As for LIN, the only reason why the absolute debt level has increased over the last few years is the growing dividend. In itself, paying out dividends is not a driver of the NOPAT per share.

After taking into account LIN’s growth CAPEX, acquisitions, share buybacks, and PPA tax savings (as a result of the merger), the total remaining free cash flow has so far been positive in each of the past 5 years. Because of this situation, LIN’s board of directors approved a new 15 billion USD share repurchase program on Oct 23, 2023.

Option Generator Research

Q3 Results Underscore the Business Model for All Seasons

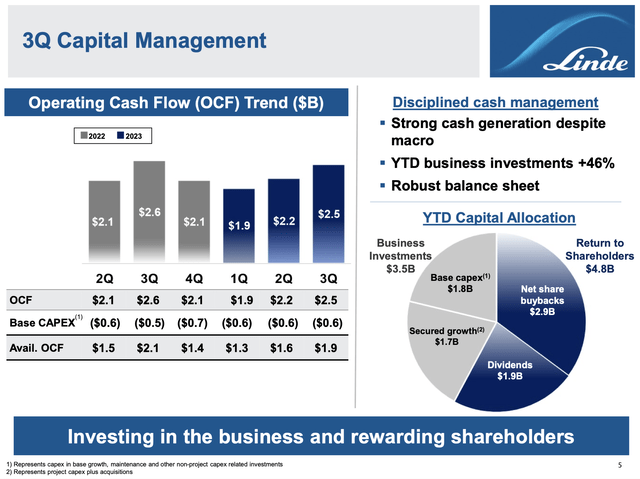

Moving to the recent third-quarter results, White Star Research did a great job in unraveling LIN’s Q3 profit drivers. So, let’s take a closer look at LIN’s capital management trends instead. After 9 months into 2023, it generated 6.6 billion USD of operating cash flow and reinvested 3.5 billion USD back into the business.

Linde Plc

Option Generator Research

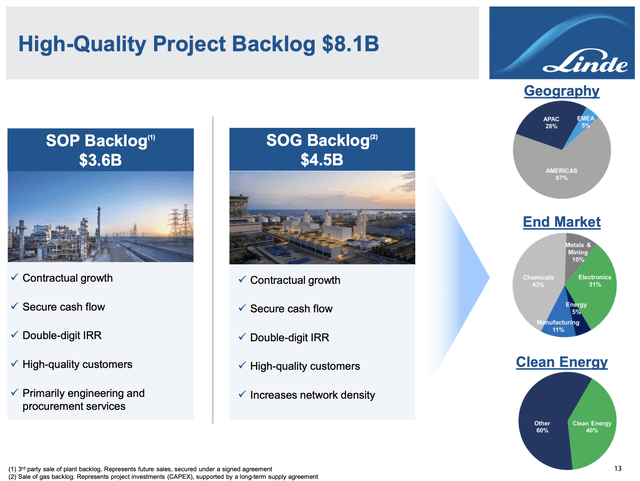

The sale of gas backlog grew 300M quarter-on-quarter and so we expect total FY23 CAPEX to increase by over 23% versus FY22. As LIN’s explicit ROC and profitability focus should help it overcome general macroeconomic weakness, steady reinvestments are likely to support FY24 and FY25 volume trends with incrementally growing returns on top.

Although the economic outlook remains tepid, CEO Lamb mentioned slightly improving trends in China and electronic end markets. Also, the “Americas” segment experienced larger than normal power cost increases, pulling the operating margin down, albeit temporarily. This primarily affected LIN’s merchant and packaged business and the negative effect will be absorbed over the next 1 to 2 quarters.

Linde Plc

Option Generator Research

Future NOPAT/Share Drivers

After LIN’s third-quarter earnings release, we’ve confirmed our expected NOPAT/share drivers:

- 1% to 2% annual base volume revenue growth

- 3% annual pricing attribution

- 2% to 3% annual project backlog accretion to EPS

- 3% to 4% annual share repurchases to deploy all of its recurring cash flows

Summing up all of the above, one gets 8% to 11% annual EPS growth.

However, it doesn’t end there as LIN is laser-focused on improving productivity and extracting cash flow out of growth avenues that don’t require much CAPEX. That’s why its fixed-fee contracts enable greater leverage during uncertain macroeconomic times. We believe LIN should be able to drive NOPAT by another 3%, through productivity efforts and a larger scale.

Fair Value

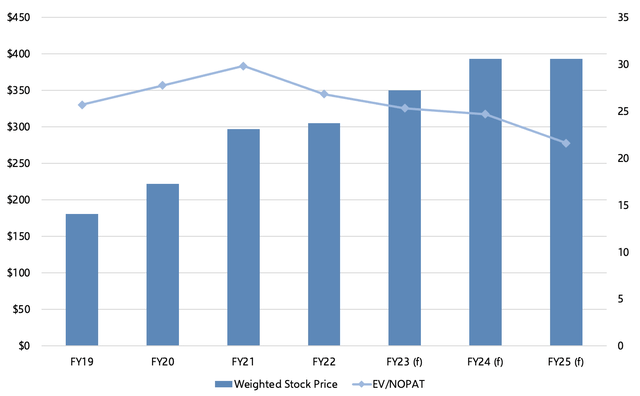

The above financial metrics make us believe LIN should trade at a premium to the market and to its peers. It’s always difficult to conduct a discounted cash flow model, as there are several moving parts. Therefore, we’d like to gauge whether or not the market has already applauded the progress made over the past years.

LIN’s ROC has been trending upward as have the cash flows and EPS, yet the EV/NOPAT multiple has fallen slightly. While interest rates have gone up, the strengthened business model is likely to play a much bigger role in renewed multiple expansion (as it did from FY19 till FY21).

Option Generator Research

Based on a 28 times EV/NOPAT multiple (3.6% yield), we get to a $446 price target for 2024, resulting in a 13.5% upside potential from today’s level.

Picking a fixed multiple or discount rate is always arbitrary. If a stock is trading at a fair multiple, your annualized return will be determined by its annual NOPAT per share growth and return on capital, both of which are above average for LIN.

Risks

Compared to our 2022 thesis, risks have not materially changed over the past year and a half. One might suggest the terminal interest rate risk is now higher for longer, but given LIN’s solid balance sheet, it’s not that material.

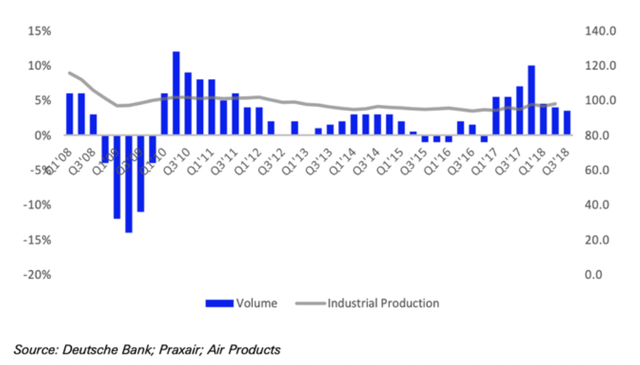

A worldwide slowdown in manufacturing activity would undoubtedly impact its revenues and cash flow, especially its Americas segment which is exposed to petrochemical end markets.

This is true when considering Praxair’s weakness in 2015-2016, during which it posted 8 consecutive quarters of flat-to-down volumes. Declining output in U.S. steel, oil & gas, and manufacturing, and recessionary conditions in Brazil were partly offset by modest growth in Europe (back then, Praxair had less exposure to this region). The same logic applies to the Great Recession of 2007-2009.

Deutsche Bank

Given the size of Linde, acquiring market share to offset broad-based declining volumes as a result of shrinking global industrial output will not be a key differentiator. Apart from some small rollups, its market-leading position does not allow for substantial acquisitions. This, in turn, also means that M&A execution risk is virtually absent.

Linde’s management team has enough levers in place to grow cash flows organically well into the future, leading to a stable financial position.

Conclusion

LIN continues to drive long-term shareholder value creation. We view its stated goal of achieving annual double-digit EPS growth as feasible. Our guesstimate of NOPAT/share drivers implies 11% to 14% annual growth. Furthermore, while the macroeconomic situation remains far from optimal, LIN has fine-tuned its business model for all seasons.

Regarding the current stock valuation, we view the 4.3% NOPAT/EV return for FY24 as attractive. Through several economic shocks, LIN has proven itself capable of maximizing shareholder value.

Compared to its peers, Air Products is now trading at 4.4% NOPAT/EV, which is remarkable given its noticeably lower Return on Capital. The same logic applies to Air Liquide currently trading at 4.0% NOPAT/EV.

As such, LIN should continue to produce industry-leading stock market returns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply