I have recently initiated coverage of Linde plc (NYSE:LIN) in which I described my general thesis behind the company (Linde: Best Of Breed Defensive Growth Plus Hydrogen Upside Make It A Buy) and outlined some key points of interest that I advise investors to monitor over the next quarters. On October 26, Linde released strong Q3 2023 results including the announcement of a new $15 billion share buyback program. Given management’s continued stellar execution in a difficult economic environment and further clarity on future margin expansion, I adjust my projections and increase my DCF-based price target by 6.5% to $442 per share, reflecting a current upside of c.18%.

Performance Highlights

For Q3, Linde reported revenues of $8.2 billion, flattish QoQ and down 7% YoY, notably missing street consensus by $360 million (4%). However, this YoY decline was largely driven by diminishing cost-pass-thru effects which came in 6% lower than Q3 22 with actual underlying sales up 3% YoY, benefitting from a 5% growth due to pricing and a favorable mix, partially offset by -2% from lower volumes. Despite the absolute decline, I view this print as very strong given that it again highlights the pricing power that Linde holds to maneuver the still shaky economic climate and downcycles in many of Linde’s markets with the sharpest declines in Electronics and Metals & Mining.

Operating Profit was up 15% YoY coming in at an adjusted margin of 28.3%, 40bps above Q2 23 and 550bps above Q3 22. Excluding the effects of cost-pass-thru, YoY growth stood at 400bps with EMEA recording the strongest performance of 600bps YoY and 50bps QoQ. This is a direct result of the operating leverage Linde is able to exert and was attained by a more favorable sales mix with stronger pricing as well as company wide productivity and efficiency increases. Driven by higher operating margins, after-tax Returns on Capital increased to 25.6%, 70bps above the previous Q and 380bps higher YoY.

Capital expenditures rose 24% YoY with much of this attributable to growth Capex in strategic long-term projects (56% YoY) while maintenance and network growth Capex increased by 11% respectively. Full-year outlook remained unchanged guiding for capital spending in the range of $3.5 billion to $4.0 billion, however given this quarter’s strong rise in Capex I do estimate FY23 Capex to come in towards the higher end of this range.

Additionally, the company announced the transfer of its shares to the NASDAQ which, according to management, would provide additional investor visibility and cost savings. This came as a surprise to me given Linde had just delisted its shares in Germany and relisted them on the NYSE earlier this year, however I do think this is a good choice by management as I estimate the additional visibility due to likely inclusion in the NASDAQ 100 index will positively benefit the share price going forward while the cost savings should quickly overtake the one-time cost of transferring its listing.

Key Takeaways

EMEA/APAC Margin Catch-Up Faster Than I Expected

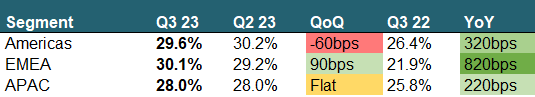

In my initiation I spoke about Linde’s opportunity to greatly expand operating margins by reaching a convergence between its “legacy assets” in EMEA and APAC and the Americas segment consisting of former Praxair assets. Despite me being confident in management’s ability to deliver on this given the trajectory we had already been seeing, I have been nothing short of impressed by Q3 results which saw this gap narrowing down to just 1.3%. EMEA in particular has delivered extremely impressive performance with margins at above 30.1% up 820bps YoY and 90bps QoQ (600bps YoY excluding cost pass-through). APAC grew operating margins to 28%, up 320bps YoY and flat QoQ (180bps YoY excluding cost pass-through) while Americas recorded a YoY expansion of 320bps and a decline of 60bps QoQ, mainly due to elevated power prices with management estimating a recovery over Q4 and Q1 24.

QoQ and YoY Segment Margins (Company Filings)

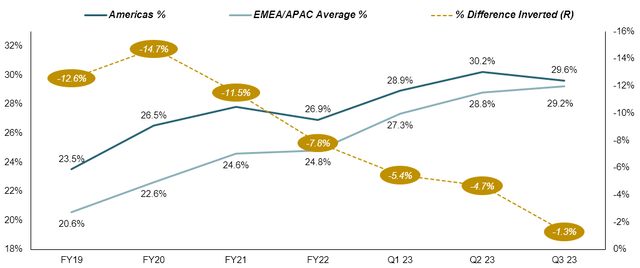

Size weighted average margin for the legacy EMEA and APAC segments comes in at 29.2%, up 40bps from last quarter, continuing the strong YTD trend in narrowing the gap to the Americas segment from 7.8% as of FY22 to 1.3% in Q3, aided by the quarterly dip in Americas margins due to mentioned power costs.

Margin Development Americas vs. EMEA/APAC (Company Filings)

Guidance of 20-50bps Annual Margin Expansion

One thing I like a lot about Linde’s management is their clarity when communicating with investors, often giving concrete figures, as it enables me to better understand where they try to steer the company. In the analyst conference following the Q3 release, management stated a projected annual margin expansion of 20-50bps going forward. Given the company’s strong track record at delivering on its targets I estimate actual figures to land in the higher part of the range for the coming years.

Massive $15 billion New Buyback Program Launched

Prior to the Q3 release, on October 23 alongside announcing a 9% YoY dividend raise, management also announced a new $15 billion share buyback program which, together with outstanding currently authorized $2 billion from February 2022, raises total capacity to $17 billion. Based on current share price this could retire up to 9.4% of total outstanding shares, following the 2%, Linde had bought back YTD. While this once again highlights management’s and board’s absolute commitment to rewarding shareholders as well as their strong confidence in Linde’s current trajectory, I continue to stand by the point made in my prior note and feel that the company could further increase the pace and amount of buybacks given its currently under-levered balance sheet.

Valuation Update

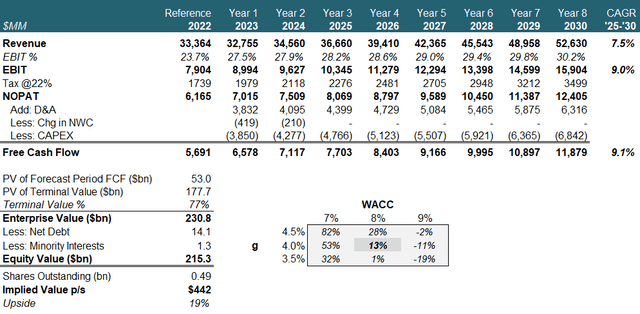

Following the Q3 results, I would like to take the opportunity and update my DCF-based valuation model to increase the length of my projection period to 7 years until 2030 allowing the model to account for both a “transition” period until FY25 based on broker consensus and a “steady” state from FY26.This steady state is driven by topline CAGR of 7.5%, the base case scenario laid out in my prior note and management long-term outlook of annual operating margin expansion of 20-50bps. Using this methodology I now project a FY30 EBIT margin of 29.4%, reflecting a 40bps annual expansion from FY25 on. I also adjust Linde’s tax rate to 22% from 20% and change my estimates for D&A and Capex to reach 12% and 13% of revenue for FY25 respectively and then staying constant. No changes are made to working capital changes where I continue to expect a revert back to the long-term average of 0 by FY25.

Using these inputs, I calculate a fair price per share of $442, 6.5% higher than in my previous model and giving a c.19% upside to current Linde stock trading level.

LIN Q3 Updated DCF Model (Company Filings and Author’s Projections)

Wrap-Up and Outlook

Despite the absolute YoY decline in sales I view this quarter as an incredibly strong one with Linde fully capitalizing on my investment thesis laid out earlier as this decline was mostly driven by diminishing cost-pass-thru with underlying sales actually growing 3% YoY. Through means of its strong pricing power and ongoing internal initiatives to increase efficiency, operating margins have increased significantly with especially strong performance in EMEA. Additionally, management provides further clarity on long-term margin trajectory (20-50bps expansion p.a.) and issues a vote of confidence in their current strategy by authorizing the buyback of up to 9.5% of outstanding stock.

For Q4, I expect a quarter relatively in line with the current one as volumes should remain subdued while I estimate the effects of cost-pass-thru to further wane. However, one key area of interest would be margins in the Americas segment which saw a decline in Q3 due to elevated power costs with management stating they expect a full recovery within the next two quarters. Some downside risks remain and mainly include a longer than anticipated slowdown in volumes which could hurt topline growth in the transition period with management guiding for a sequential recovery across core markets from H1 24 on.

Read the full article here

Leave a Reply