Leslie’s, Inc. (NASDAQ:LESL), the pool and spa care retailer, has continued posting weakening financials in past quarters below market’s prior expectations. With insiders now buying stock in the company in late August, investors seem to have picked up on a potential bottom for the continued financial slump.

In my previous article on the stock, “Leslie’s: Preparing For Post-Pandemic Financials”, I initiated the stock at a Hold rating anticipating a post-pandemic earnings slump as the company’s demand normalizes from the elevated level. As the market and I underestimated Leslie’s post-pandemic slump considerably, the stock has lost -40% of its value compared to S&P 500’s 36% return since the article was published on the 29th of October.

My Rating History on LESL (Seeking Alpha)

The Post-Pandemic Slump Has Deepened Beyond Prior Expectations

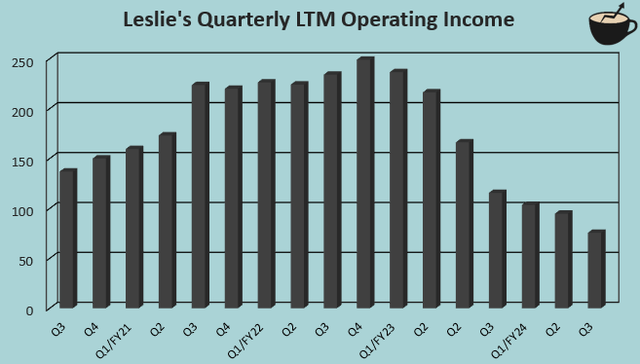

Leslie’s earnings slump has deepened after my previous article beyond previously expected levels with six consecutive quarters of notable year-on-year revenue declines as of Q3/FY2024 – coming away from the Covid pandemic, the revenue trend has turned from heightened demand into macro- and weather-pressured demand with a spending hangover from the pandemic in discretionary pool items.

As a result of poorer sales, as is typical for retailers, Leslie’s operating margin level has reacted incredibly negatively, also going below levels that I previously anticipated. The current trailing operating margin stands weak at just 5.5%, at less than half of Leslie’s FY2019 margin of 13.1% prior to the Covid pandemic.

Author’s Calculation Using TIKR Data

In the recently reported Q3 results, Leslie’s once again reported a revenue decline at a -6.8% level, with growth improving sequentially but still showing continued weakness. While a part of the decline was related to adverse weather in April and May, persistent macroeconomic issues also pushed revenues down amid the already weak post-pandemic industry trend. The reiterated FY2024 sales guidance of $1321-1347 million after Q3 represents mid-point Q4 sales of $401.7 million at a year-on-year decline of -7.1%, suggesting weaker trends to carry onto Q4 despite a stronger June for Leslie’s during Q3. As such, a recovery has been pushed to FY2025, the nearest.

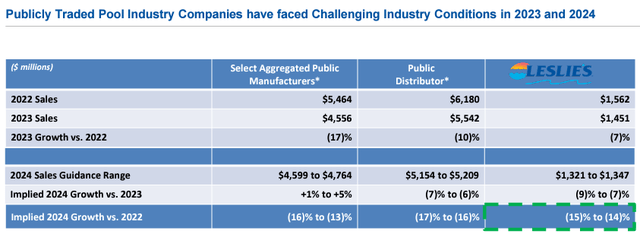

While the financials have been poor, Leslie’s still seems to be performing roughly in line with industry peers. The recent Q3 sales do trail peers, including Pool Corporation’s (POOL) slower -4.7% revenue decline in its latest quarter, Pentair’s (PNR) 1.6% growth, and Hayward Holdings’ (HAYW) 0.3% growth in the latest quarter, but the longer-term revenue trends from 2022 between Leslie’s and peers stand roughly similar. The companies also have different businesses and offerings in the same industry, making the quarterly fluctuation between peers understandable, unless Leslie’s underperformance carries onto the next few quarters as well. According to Leslie’s, the company still gained market share in Q3 according to third-party credit card data.

LESL Q3 Investor Presentation

With the outstanding trends, I believe that a midterm recovery is still very likely with already lower interest rates. The US consumer sentiment still stands weak, likely affecting Leslie’s sales poorly for the next few quarters in discretionary spending, but the macroeconomic weakness doesn’t look to pose a long-term threat with Leslie’s performing stably compared to the industry as a whole. The company’s remaining high long-term debt of $768.6 million still weighs on earnings through interest expenses, but I don’t believe that the debt is unbearably high.

In my opinion, the margin level stands as the most significant long-term risk – an industry recovery should aid Leslie’s in maintaining improved pricing, but the current trailing gross margin of just 36.2% trails quite significantly below the 40.9% level achieved in FY2019 making a rise back near the 13.1% operating margin in FY2019 hard.

Insiders Believe in a Recovery

Interestingly, insiders have recently bought stock. Leslie’s interim CEO John Strain bought 120000 shares on the 29th of August, and CFO Scott Bowman also joined in on the insider buys with 100000 shares. The purchases add up to around $562 thousand in total; it seems that insiders have confidence in a timely financial recovery.

The stock reacted with a very strong 21% rally on the 30th, as the insider buys have seemingly led the market to believe in a recovery as well. While I also believe that the insider buys are a great sign, potentially signaling a starting recovery in upcoming quarters, the macroeconomic outlook and Leslie’s guidance don’t yet suggest the recovery to start at least before FY2025 amid the weaker consumer sentiment.

Changes in Board & Management

Leslie’s has also changed its board structure and management significantly, with Steven Ortega and James Ray stepping down from the board of directors, and Maile Naylor and Lorna Nagler more recently joining to take the seats. I don’t believe that the changes to the board bring in very significant changes to Leslie’s strategy, but the new appointments do still bring fresher expertise into the company.

More critically, Leslie’s announced a CEO transition in late August. Michael Egeck has resigned his position as CEO in the company as Jason McDonell is joining Leslie’s from Advance Auto Parts (AAP), also spending time within PepsiCo (PEP). The appointment brings expertise from larger companies onto Leslie’s with consumer brand management expertise, and as such, I believe that the appointment is likely good for the company in addition to the refreshments in the board of directors.

John Strain is currently working as interim CEO until September 9th.

Updated Valuation

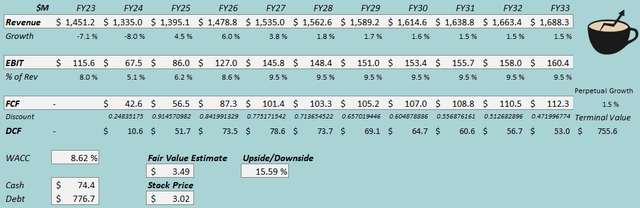

I updated my discounted cash flow [DCF] model. I now estimate demand to rebound from FY2025 to FY2027, with Leslie’s again returning to very slow 1.5% growth afterwards in my base scenario.

With the gross margin being pressured further and as sales could stand lower, I now estimate the EBIT margin more conservatively at a 9.5% stable level from FY2027 forward. Previously, I estimated the margin to reach 11.1% with an industry recovery, but I believe that a larger margin of safety is now fair. I again estimate quite a good cash flow conversion.

DCF Model (Author’s Calculation)

The estimates put Leslie’s fair value estimate at $3.49, 16% above the stock price at the time of writing – the stock has a healthy margin of safety in its current valuation, not yet bringing an attractive investment case in my base scenario. If margins are pushed higher than I now anticipate, the company’s leveraged financial position can easily bring great upside for the stock from the current level, still.

The fair value estimate is down from $5.46 previously due to the more conservative estimates.

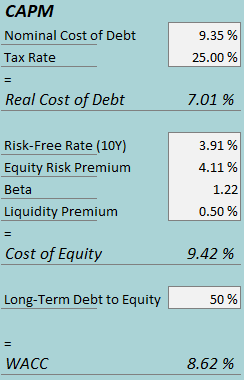

CAPM

A weighted average cost of capital of 8.62% is used in the DCF model, nearly the same as 8.56% used previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q3, Leslie’s had $18.2 million in interest expenses, making the company’s interest rate 9.35% with the current amount of interest-bearing debt. I now estimate a considerably higher 50% long-term debt-to-equity ratio compared to 35% previously.

To estimate the cost of equity, I use the 10-year bond yield of 3.91% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. Seeking Alpha now estimates Leslie’s beta at 1.22. With a liquidity premium of 0.5%, the cost of equity stands at 9.42% and the WACC at 8.62%.

Takeaway

Leslie’s financial slump has deepened after my previous article. A post-pandemic demand hangover, a low consumer sentiment, and weak weather have piled onto weak demand, pushing earnings into a very pressured level. With lower interest rates, management & board changes, and insider buys, I believe that a midterm recovery is likely. The recovery now comes with a fair margin of safety in the stock’s valuation as I believe that more cautious estimates are in place, and as such, I remain with a Hold rating for Leslie’s.

Read the full article here

Leave a Reply