Ladder Capital (NYSE:LADR) has suffered stock price weakness, with short periods of interruptions, ever since the trust reported results for its second quarter. Third quarter earnings, which were just reported, were better than the consensus, and the trust performed well in all core metrics.

The stock price weakness might be a good opportunity, in my view, to add a premier commercial real estate trust at a lower distributable earnings multiple for passive income.

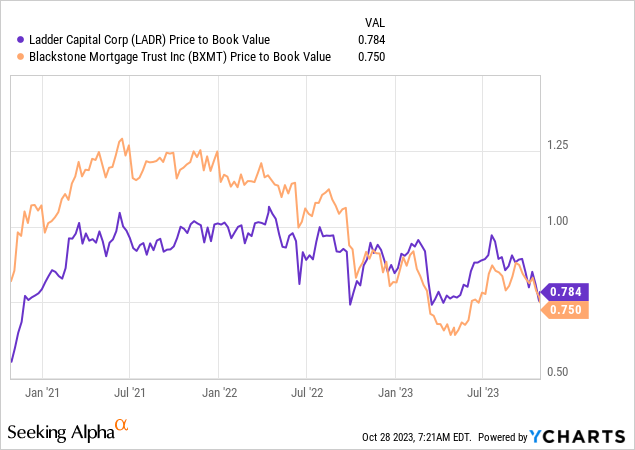

The discount to book value also expanded recently which I would expect to narrow over time.

Ladder Capital covered its $0.23 per share per quarter dividend comfortably in the third quarter with distributable earnings. The 10% yield is of high quality, in my view, and is worthy buying.

LADR Stock Price (Finviz)

Previous Rating

In “Ladder Capital Corp: 8.1% CRE Yield, But It’s A Hold Now (Downgrade)“, I scaled back my recommendation for passive income investors last quarter because the discount to book value narrowed to just 5%. The risk/reward relationship has improved, however, on the dip since Ladder Capital’s dividend remained well-covered in the third quarter.

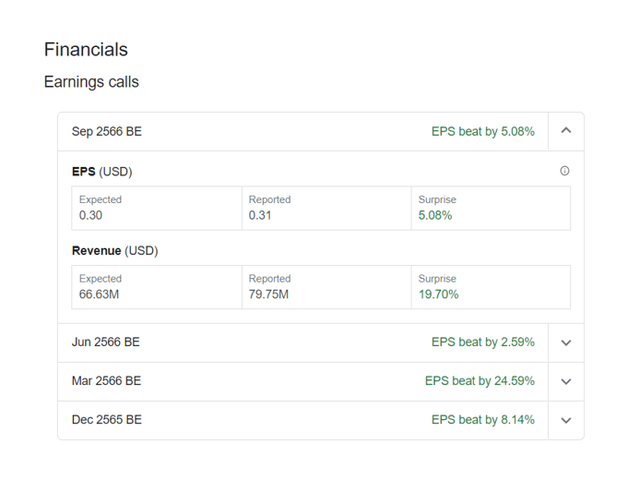

Earnings Beat For 3Q-23

Ladder Capital’s quarterly profit (as measured by its distributable earnings) surpassed the estimate by $0.01 per share which was the fourth profit beat in a row.

Earnings Calls (Ladder Capital)

Small Rebound In Originations In The Third Quarter

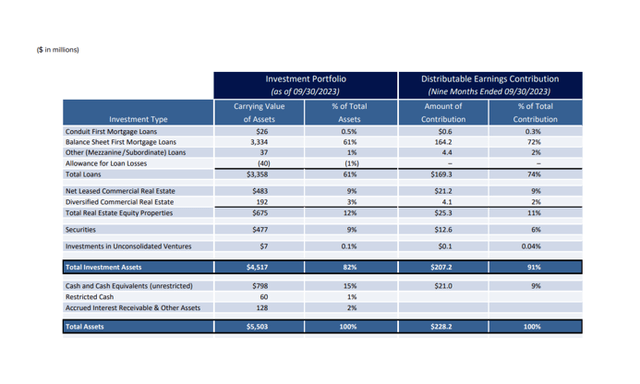

Ladder Capital owned a well-performing, broadly-diversified commercial real estate-focused loan portfolio in the third quarter that had a total value of $5.5 billion.

The trust’s investments included primarily commercial balance sheet first mortgage loans (61% of total assets and valued at a combined $3.3 billion) while other assets included conduit loans, commercial real estate securities and real estate equity (mostly net lease commercial real estate).

Ladder Capital’s allowance for loan losses increased 25% QoQ from $32 million in the second quarter to $40 million in the third which equated to about 1% of the total asset value.

I will start to be concerned about rising allowances when they account for 1.5-2.0%, right now I think Ladder Capital’s portfolio quality still looks good.

Loan Losses (Ladder Capital)

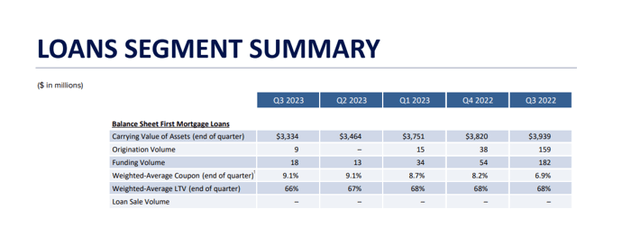

Ladder Capital did see its first loan origination, in the rather small amount of $9 million, since the first quarter of 2023 and the trust funded a total of $18 million in investments.

Like other commercial real estate companies that originate mortgage loans, Ladder Capital has seen a rather steep decline in originations in its loan segment in the last year amid an equally steep increase in interest rates. Higher interest rates makes loans more expensive (obviously) which has made new debt unattractive from a financing point of view.

Loans Segment Summary (Ladder Capital)

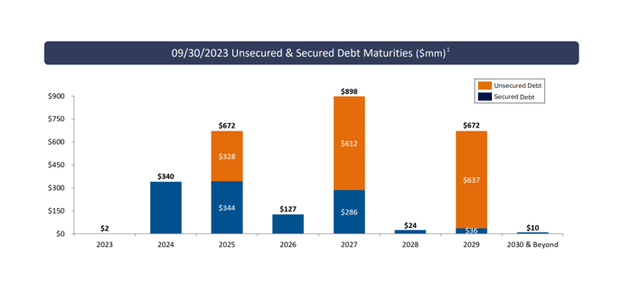

Strong Liquidity, No Near-Term Debt

Ladder Capital has no near-term debt maturities and a well-laddered debt structure that has pushed maturities out far into the future.

In 2024, Ladder Capital had a relatively modest $340 million in debt coming due. In light of liquidity in excess of $1.1 billion, the refinancing should not be a concern for passive income investors.

Unsecured And Secured Debt Maturities (Ladder Capital)

Dividend Comfortably Covered

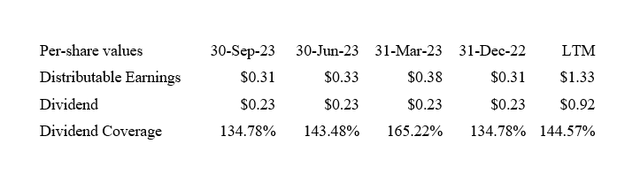

Ladder Capital earned $0.31 per share in distributable earnings in the last quarter and had an unchanged dividend pay-out of $0.23 per share, resulting in dividend coverage of 135%.

The dividend coverage ratio was 10 percentage points lower than in the last twelve months basis, but it was still sufficient to ensure that passive income investors should enjoy the payment of a stable dividend. Ladder Capital has consistently covered its dividend with distributable earnings in the last twelve months.

Dividend (Author Created Table Using Trust Information)

Low Distributable Earnings Multiple, High Discount To Book Value

Based on run-rate 3Q-23 distributable earnings, Ladder Capital might earn $1.24 per share in the next twelve months which equates to a 7.7x distributable earnings multiple.

Blackstone Mortgage Trust (BXMT), which already released earnings for 3Q-23, has distributable run-rate earnings (on a twelve months leading basis) of $3.12 per share and a corresponding distributable earnings multiple of 6.4x.

In both cases, I view the commercial real estate investment trusts as undervalued based on distributable earnings, but I arrive at the same conclusion when looking at the presently available discounts to book value.

Ladder Capital is selling at a book value discount of 22% compared to a 25% discount for Blackstone Mortgage Trust. BXMT had a well-performing loan portfolio and 126% dividend coverage in 3Q-23. The dividends for both CRE trusts are equally safe, in my view.

Why Ladder Capital Could See A Higher Valuation Multiple

Approximately 16% of Ladder Capital’s assets related to the office market which is facing a challenging period in the present high-interest environment. A rise in office loan defaults may lead to deteriorating dividend coverage for Ladder Capital.

Right now, I think the dividend is reasonably covered by distributable earnings. Ongoing quantitative tightening on the part of the central bank would obviously make the problem in the struggling office real estate market worse.

My Conclusion

Ladder Capital managed to cover its dividend of $0.23 per share per quarter comfortably with distributable earnings and the business remained as diversified as ever.

The stock price weakness that has reappeared after second quarter earnings is not justified. Since Ladder Capital’s third quarter earnings release was robust, I doubled down on the commercial real estate investment trust on Thursday as well as on Friday.

The 10% yield, that is presently available is a solid bargain that passive income investors might not want to miss.

Read the full article here

Leave a Reply