Introduction

With so much uncertainty right now and investors unsure if the market will continue dropping, I think it’s a great time to get blue-chip stocks like Kroger (NYSE:KR) on the pullback. For the record, I’ve been holding the stock for a while now and have watched it come down recently from a high of roughly $50 to the current price. One reason I believe for the pullback is because the stock has a low-yield of around just 2%. This coupled with higher percentages offered on fixed-rate investments has made lower-yielding (investments) in the market unattractive at the moment. There’s also the controversy surrounding the pending Albertsons (ACI) acquisition that doesn’t help either. Like the saying goes, “there’s always an opportunity somewhere,” but investors have to be willing to walk through the fire to take advantage. Right now I think KR is a bargain and I give five reasons why I think you should consider adding them to your portfolio.

#1 Boring & Conservative

Like Warren Buffett, the biggest reason for me owning the stock is it’s boring and conservative. I don’t know if that’s his reasoning for owning KR, but he seems to like businesses that are simple, and predictable, translation boring and conservative. And in the current environment, boring isn’t so bad right now. In my opinion, owning these stocks and higher-yielding ones in your portfolio is another way of diversifying. Or that’s how I view it in my portfolio. On December 1st of 2022, the stock hit a share price of $50.41 and has since retracted to its current. For the last year KR has traded in this range while other stocks like Walmart (WMT) went from $129 a year ago to a high above $165 where it traded in September of this year. On October 13th of last year, KR closed at $46.57, a difference of -5%.

Ycharts

So investors might be saying “Why would I want to own a stock like Kroger where I would be down, when I can own WMT and be in the green?” That’s a valid question but as most of us know stocks never move in a straight line. Up or down. They fluctuate constantly. But if you had held KR for the past decade, you would be up by 111%, more than doubling your money. My point? Have a long-term outlook when investing. I get it, everyone is different and have different investment goals.

Ycharts

No one wants to lose money but the more I listen to greats like Peter Lynch and Warren Buffett, the more I come to understand. Something Warren Buffett said and I remind myself of it from time to time, especially during downturns in the market. If I buy XYZ company, I am not concerned about what they’re gonna earn in the next year. The next year is gonna be over and then people are gonna be looking at the year after that. If I’m right about where they’re gonna be in 5 or 10 years, we’ll make a lot of money. I can’t time stocks based on what they’re gonna do this quarter or next quarter, and I don’t know anybody else that can either, but maybe they can.

#2 Growing Dividend

Since then another thing that has grown is the dividend, from $0.1650 to $0.29. The company raised the dividend for the 16th consecutive year by 11.5% from $0.26 back in June of this year. One thing the company has also done is grow its earnings and free cash flow. With the exception of 2017 & 2018, Kroger has covered its dividend with free cash flow pretty handily in the last 10 years. KR’s FCF average since 2014 is roughly $2 billion, and has paid out less than half of that with an average of $464 million in dividends paid over the same time frame.

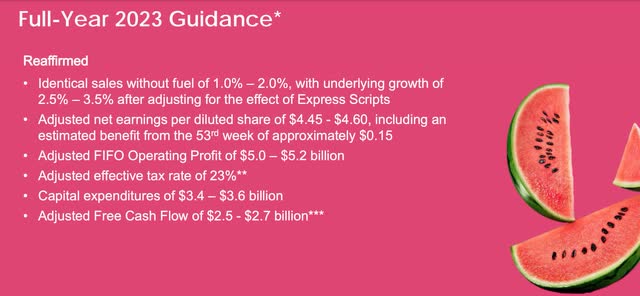

KR investor presentation

During Q2 earnings management stated they expect FCF of $2.5 billion to $2.7 billion for 2023. This is up from $2.3 billion to $2.5 billion they guided for in the 4th quarter of 2022. One way the company has been able to achieve this is by cost-savings initiatives. KR is currently on track to achieve $1 billion in cost-savings for the sixth consecutive year. And while revenue fell 2.3% and same store sales were also behind the consensus mark by 1.3%, the company did manage to grow EPS by 6.6% year-over-year. Additionally, management has been able to grow the bottom-line despite YoY headwinds from fuel profitability and underlying operating results.

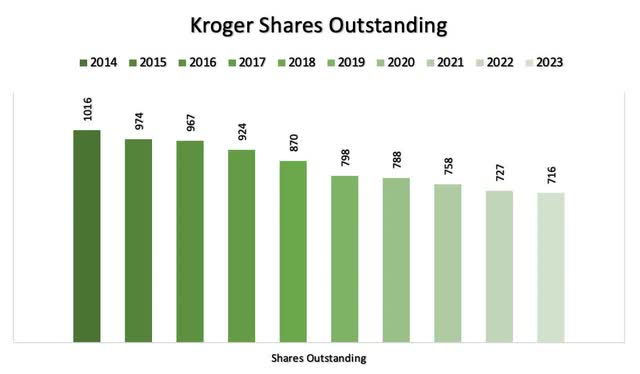

#3 Share Buybacks

In the past decade, KR has also returned cash to its shareholders via buybacks. The company has significantly decreased its shares in the past 10 years through multiple buyback programs. In 2021, Kroger repurchased $1.4 billion worth of shares and approximately $821 million in 2022. On September 9th of last year, management approved another program to acquire $1 billion worth of shares but paused it during the third quarter of 2022 to prioritize de-leveraging for the proposed merger with Albertsons, which is scheduled for early 2024.

Author creation

Another reason why I think the board of directors decided to pause the program was due to the recent opioid settlement against the company for $1.4 billion. This resulted in a loss of $1.54 per share during the 2nd quarter. Initial payments are scheduled to start soon in December 2023. KR is scheduled to pay approximately $140 million per year for the first six years and approximately $110 million for the following five years after that. This is not expected to affect the pending merger with ACI. If the deal doesn’t go through, I expect KR to restart the program sometime in the next year. If it does go through, I expect the retailer to resume buybacks in the next 18-24 months.

#4 Low Debt & Pending Merger

Kroger has made several acquisitions in the last decade but has managed to keep their debt at manageable levels throughout. The company currently has a Net Debt to EBITDA of 1.31x, down from 1.63x a year ago, and is below their targeted range of 2.3x to 2.5x. Since 2018, KR has managed to decrease its debt from $14.78 billion to $10.77 billion. Although they have a larger amount of debt compared to their smaller food retail peers like Ahold Delhaize (OTCQX:ADRNY) ($8.1 billion) & Albertsons ($7.9 billion), their debt is well covered by its operating cash flow of nearly 60%. The company currently has $2.4 billion in cash on hand. But if the merger does get approved, KR is expected to take on approximately $4.7 billion of ACI’s net debt.

Management is very focused on the health of its balance sheet has stated they expect to achieve a Net Total Debt to adjusted EBIDTA of 2.5x within the first 18 months following the merger. Furthermore, the deal is expected to be accretive to earnings in the first year following close, and approximately 30% accretive by the fourth year. It is also expected to deliver $1 billion of annual run-rate synergies. KR is already one of the largest grocery stores in the U.S. and the deal with ACI would put them on par, and able to compete with behemoths like Costco (COST) & Walmart.

SimplyWallSt

#5 Undervalued

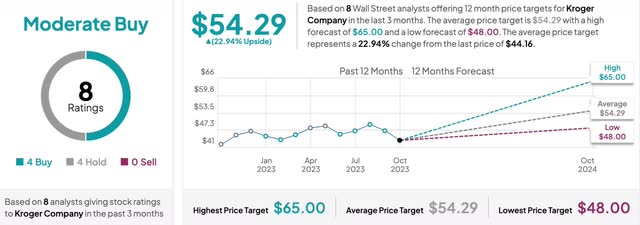

Similar to the Asian Investor, I too think KR is trading at an attractive valuation right now and offers some nice upside to its average price target. They also are trading at a lower P/E than its 5-year average. Analysts currently have the stock rated a moderate buy with a high price target of $65. I personally like KR below $45 so now is a good time to buy, especially if you have a long-term outlook.

As I mentioned earlier, I expect the retailer to continue buybacks in the medium-term, increasing earnings in the process. When the Fed decides to cut rates in the near future, I expect KR to trade closer to their price target of $54-$56. If the deal fails to get approved, I expect KR’s price to drop a bit, although not by a lot as I think the share price is already reflecting the deal not going through.

Tipranks

Risks

As a brick-and-mortar retailer, the biggest risk the company faces is competition from larger retailers such as WMT, COST, and Amazon (AMZN).If the economy does go into a recession, consumers may prefer to spend their money at the larger, more well-known retailers. Then there’s the recent emergence of weight loss drugs which are expected to lead to lesser food consumption.

Large retailers such as WMT have already reported seeing a slight pullback in items purchased. Analysts are estimating that 7% of the population could be on these drugs by 2035. If so, this could lead to a 30% decrease in daily calorie intake due to the lesser consumption of food. Although this is a risk, I don’t suspect any major loss of sales for grocers such as KR, WMT, & COST and expect them to adjust accordingly if these do become a major problem in the foreseeable future.

Another thing investors should be on the lookout for is the ACI deal not getting approved. It seems like every day there’s a new roadblock. Last week the state of California mentioned they were preparing a lawsuit to block the proposed merger. The two companies has also faced pushback from the FTC and have divested 413 stores to make sure the deal goes through as planned. Management stated during Q2 earnings that they are prepared to divest up to 650 stores if needed. If the deal gets blocked, this could cause some temporary share price weakness.

Conclusion

Kroger is an excellent stock that has returned enormous amounts of cash to its shareholders via buybacks and increased dividends. The company recently put the program on hold to prioritize de-leveraging for the proposed merger with ACI. I think the deal not going through is already reflected in the share price as the stock has recently seen its price fall from roughly $50 to current. Due to this I think KR offers a great valuation for investors with a long-term outlook. During economic uncertainty, KR is a perfect stock to hold as it is boring & conservative. The grocer also has a stellar track record of almost two decades of dividend growth, and offers a much cheaper valuation to other larger grocers such as Walmart and Costco.

Read the full article here

Leave a Reply