Investment Summary

The share price right now sits far below the top Kornit Digital (NASDAQ:KRNT) had back in 2021 reaching above $160. The company has seen revenues fall but has maintained a decent balance sheet through the last couple of years and that seems to have cushioned them a little at least. However, without any significant margin improvement or being close to profitability, the company extrudes too much risk right now to make for a buy.

The company is included in the industrials sector where it mostly focuses on designing and marketing digital printing solutions for various end markets in the textile industry on an international scale. The fallout of demand seems to have pushed the valuation down and the hype around the company has in my opinion rightfully been lost. The company has a near negative 20% EBITDA margin and I don’t see enough of a market environment improvement over the short-medium term for KRNT to improve upon this to a positive level. This results in me right now rating KRNT stock a sell.

Market Overview

As we have discussed briefly, KRNT primarily focuses on offering various digital printing solutions all over the world to the textile industry. The products of KRNT induce direct-garment printing platforms for both smaller industrial operations and businesses but also larger mass producers in the industry. This means that a lot of the revenues for KRNT are reliant on them being able to competitively price their products and still make a profit, something they are yet to do based on net margins. Gross profits have exceeded 30% which is decent, but it needs to come all the way down to net margins too before KRNT could be a competitive buy in my opinion.

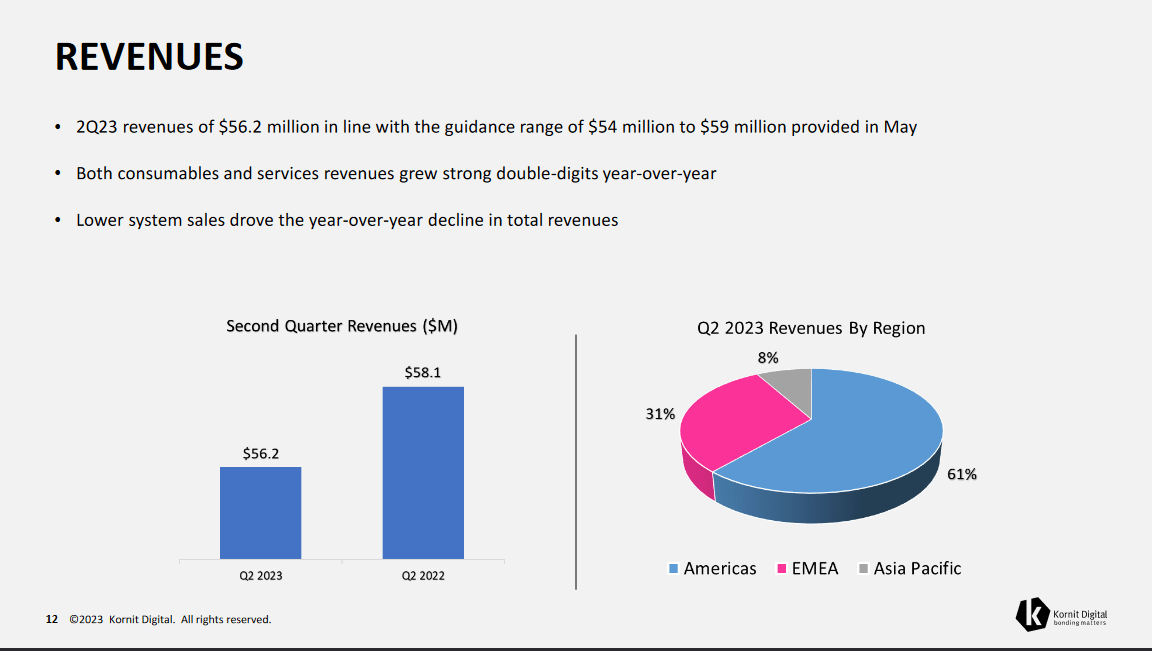

Revenue Split (Investor Presentation)

The vast majority of revenues come from the US and as of the last report that was 61% and the remaining from Europe and the Middle East. Revenues have been declining at an alarming rate as seen in the picture above here. Lower system sales drove the decline for the company but KRNT did note some strength in the consumables and services segments which grew at double digits year over year, but not at a sufficient amount to make the overall revenues increase.

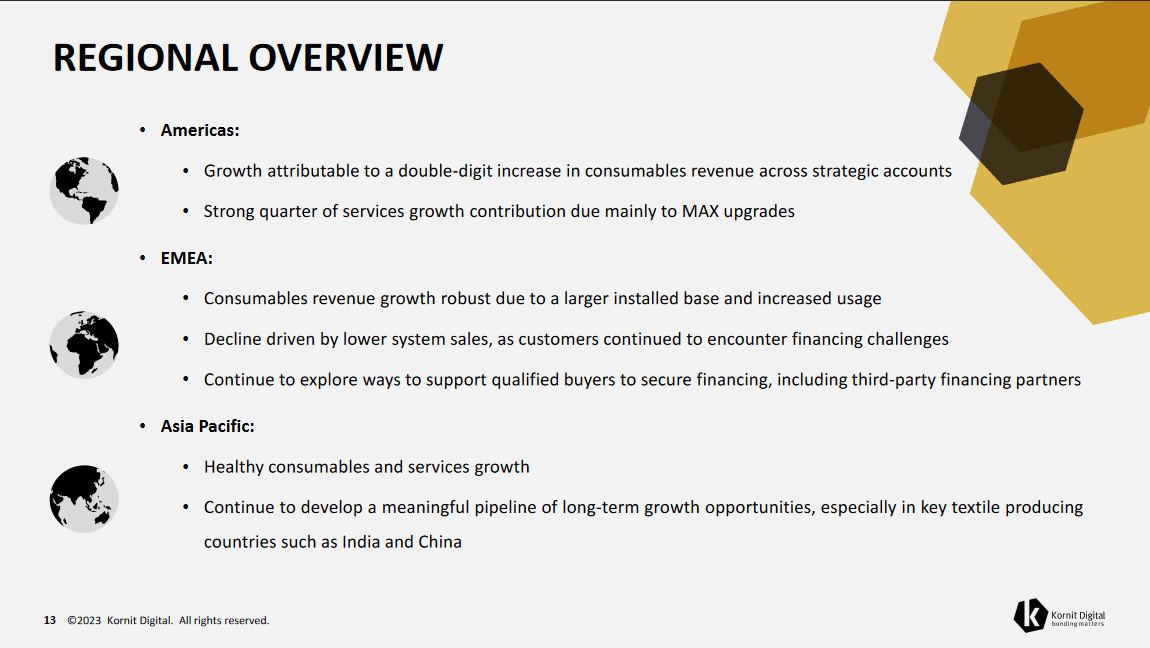

Regional Overview (Investor Presentation)

As we know, the largest market for the company is the Americas, which had a strong quarter of service growth, but lacked demand in system sales. If we look at emerging markets like the Asia Pacific then there was healthy growth in both consumables and services here which does create a long-term growth opportunity for the company. But expansion is of course expensive and I don’t think we will see the true impact of it on margins in the short term, unfortunately. Some of the perhaps obvious markets that KRNT can tap into here are India and China, two countries with massive populations and addressable markets for apparel and digital printing solutions, and hopefully system sales as well.

The company did provide some guidance for the remaining parts of 2023 where they anticipate consumables to make up a larger portion of the revenues and ultimately benefit the gross margins positively as the sales generated strong gross profits off the bat. The profitability of services improved at a solid rate as well for the last quarter and that in time should help benefit the bottom line if KRNT can properly lean into this and expand. That could eventually become a stable support for revenue generation for the business, possibly resulting in a higher p/s multiple than the 4.5 it has right now.

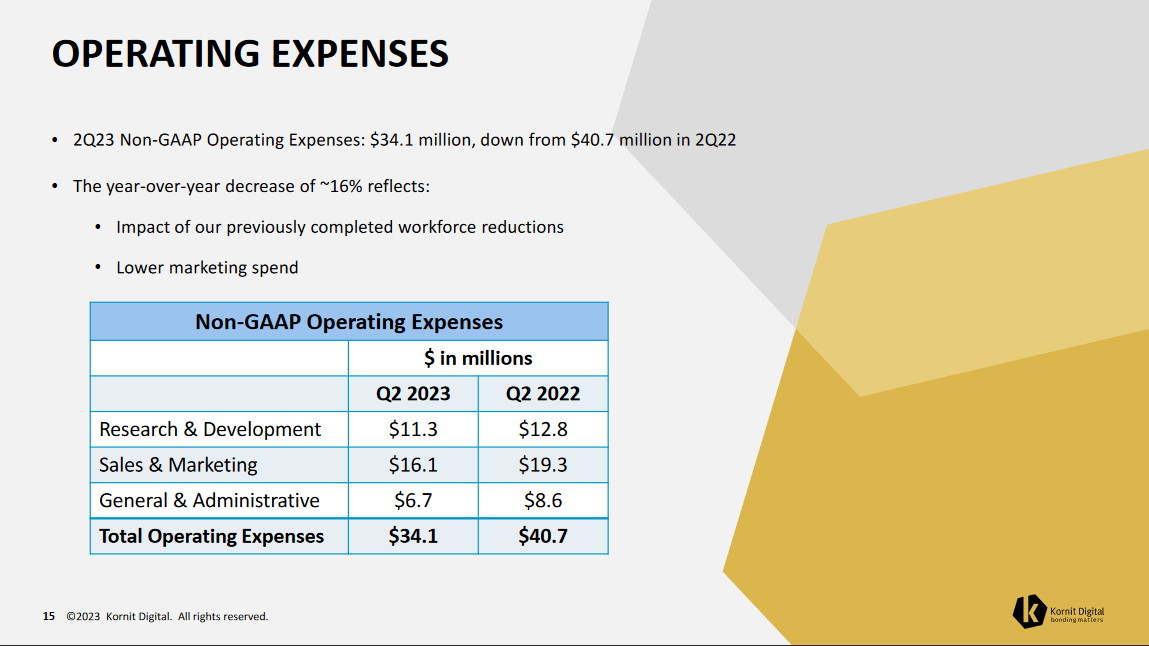

Operating Expense (Investor Presentation)

The softer market environment has forced KRNT to adapt though quite quickly, with some moves like workforce reductions being implemented. The company now has operating expenses of $34 million for the quarter, down from $40 million last year. marketing spending had decreased a fair bit which has helped the company save a lot, but that also possibly negates more revenues as fewer eyes are on the brand. I think that during a higher interest rate environment though this is the right move to make and should benefit KRNT in the medium term, or until rates go down and activity in the sector grows.

Risks

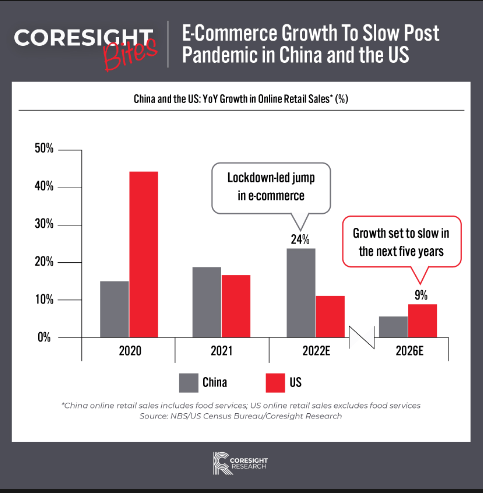

The deceleration in e-commerce expansion, coupled with prevailing macroeconomic challenges, has led to a situation where certain customers are grappling with surplus inventory. This trend is anticipated to persist in the short to medium term, posing a potential obstacle to the overall performance of the company.

Ecommerce (Coresight Research)

The current environment of subdued e-commerce growth is influencing consumer behavior and demand patterns. As the pace of online shopping slows down, businesses are faced with a scenario where the movement of goods may not align with their projections. This discrepancy between inventory levels and demand can lead to excess stock, creating challenges related to storage, cost management, and potential obsolescence.

When new customer production facilities face delays, it can impact a company’s ability to meet increasing demand or capitalize on new business opportunities. The extended wait time may result in missed market windows or the loss of competitive advantage, allowing competitors to gain a foothold or enter the market ahead.

Financials

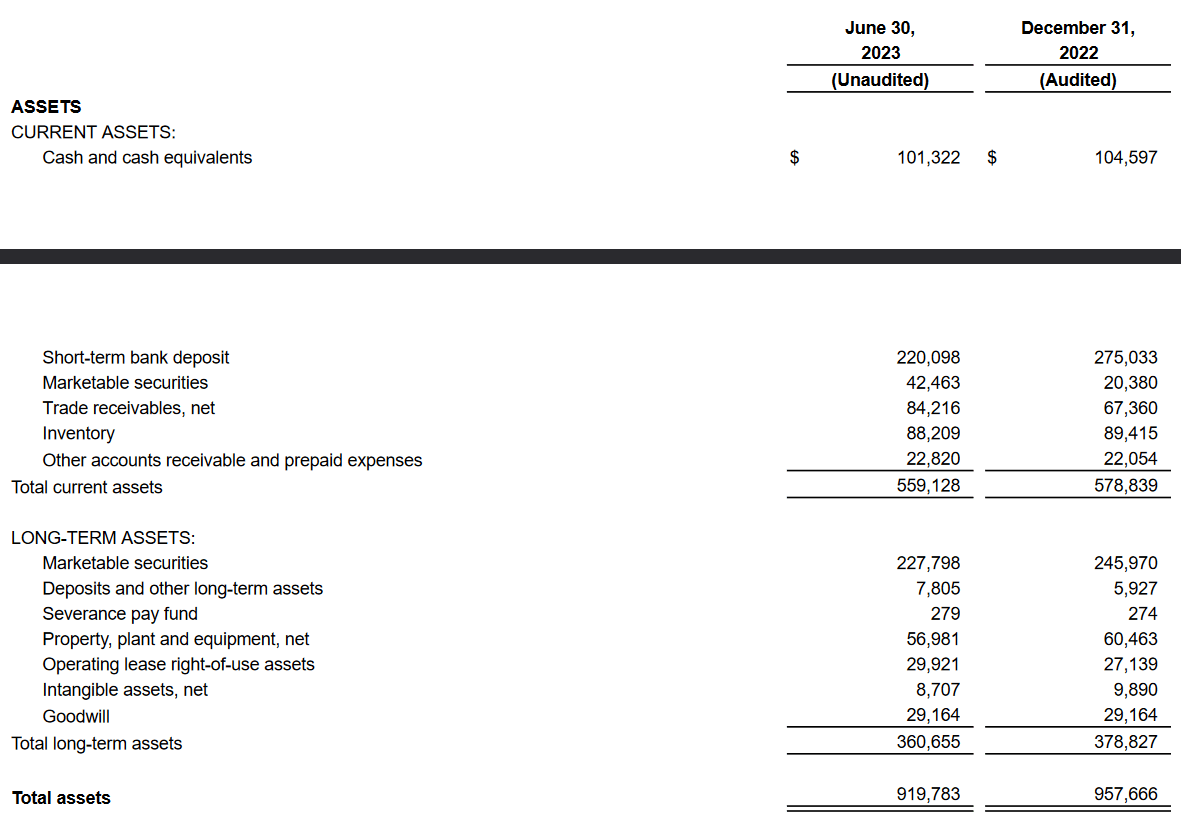

One of the benefits that KRNT does have is a very liquid financial position which is right now valued at over $300 million, nearly a third of its market cap. $100 million is found in cash and an additional $200 million in short-term deposits.

Asset Base (Earnings Report)

This has ensured that KRNT doesn’t have any issues paying down debt and in my opinion, this is perhaps one of the arguments for the company potentially being a hold rather than a sell. But the cash doesn’t do too much good if it’s just sitting there and not being used for expansion and growing capacities.

Diving deeper into the financials of the business we can see the inventory climbing steadily over the years to around $88 million right now. Just back in 2019, it was under $40 million, so a near double in that period seems to have come from stronger demand but the business has lacked the capability to transform this to profitability as that still sits negative of course. In 2019 the net incomes were actually at $10.2 million. So seeing how larger inventory levels for the company seem to have led to a struggling net margin tells me that they are having difficulties with actual turnover during some periods. A worry that warrants the sell rating I think.

Valuation & Wrap Up

KRNT has had some tough last few quarters where the margins have struggled and revenues have fallen drastically on a YoY basis. The company had a lot of hype around it in 2021 but the share price has fallen far from the high of $160. I don’t think a quick recovery will be visible and that makes me prone to have a sell rating for the company instead.

Stock Price (Seeking Alpha)

The positive around the company more or less just entails the liquid financial position, but if it’s not used for expansion and growing productions then it’s sort of neglected in the valuation. I will be waiting for KRNT to post consistent sequential revenue growth and for bottom-line margins to be positive before possibly upgrading my rating for the company.

Read the full article here

Leave a Reply