Following the announcement of its all-stock acquisition of shopping center peer RPT Realty (RPT), I’ve decided to take a closer look at Kimco Realty (NYSE:KIM). Having owned shares of RPT (which I profiled in May), I immediately recognized that Kimco was getting a very good deal. Conversely while I was pleased to see my RPT shares shoot up on the deal announcement, I was less than thrilled with the price received.

That said, I’ve long viewed Kimco as a well-run collection of attractive shopping center assets and believe that management’s opportunistic purchase of high quality assets at discounted prices is a recipe for shareholder value creation.

While Kimco isn’t cheap enough for me to buy today (discussed below), it is a REIT I would like to own should Mr. Market give me an opportunity.

Current Results

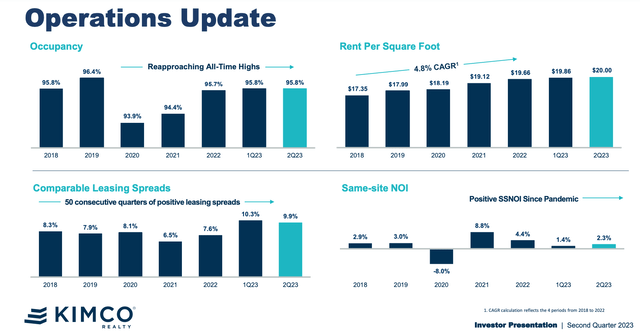

Kimco Recent Results (Kimco Investor Presentation)

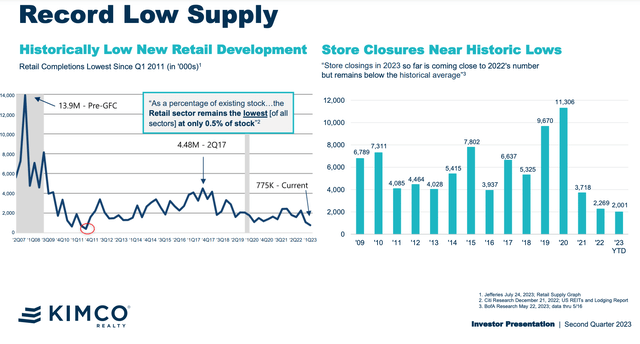

Kimco has been a beneficiary of the retail real estate renaissance whereby a combination of increased tenant demand coupled with very limited new supply (as shown below) has boosted both occupancy and rent. While rents have steadily increased (as shown above), current rent levels do not yet justify development of new space – particularly given high financing costs and elevated construction cost. As such we are unlikely to see any meaningful additions to supply in the foreseeable future.

New Retail Development (Kimco Investor Presentation)

The whole shopping center space has been deluged by an overwhelming demand for space since 2021. Looking back, the pandemic seems to have served as a wash-out for the weakest retailers (shown above)- the closure of retailers with unsustainable business models/over-leveraged balance sheets was dramatically accelerated (shopping center occupancy dipped into the high 80s for a couple of quarters). However, since 2021 we have witnessed a marked turn in the retail leasing environment as:

- Most retailers have now right-sized their store footprint, and the era of mass store closures is over. This has led to an increased tenant renewal rate, which supports occupancy and rents.

- Newer retailers, many of which are digitally native, have started opening stores. This recent podcast highlights the journey of one digitally native brand, which in a short period has grown to nearly 100 stores.

- This was aided by a favorable backdrop as consumer spending surged following the pandemic era stimulus (as well as the spending of pent-up savings).

- Perhaps most importantly, with most workers now spending only 2-4 days per week in the office, the demand for suburban consumer products and services has significantly increased (recently chronicled in the Wall St Journal). Retailers, restaurants, gyms and other service providers are opening locations at a faster pace to meet this additional demand.

In 2021, retailers opened more stores than they closed (for the first time in years) and this trend has continued through 2022 and into 2023. While the economic environment deteriorated throughout 2022, leasing activity has remained robust.

It is worth noting that retailer results have continued to weaken throughout 2023 and there is a risk that this could dampen demand for new space.

Acquisition of RPT makes Strategic & Financial Sense

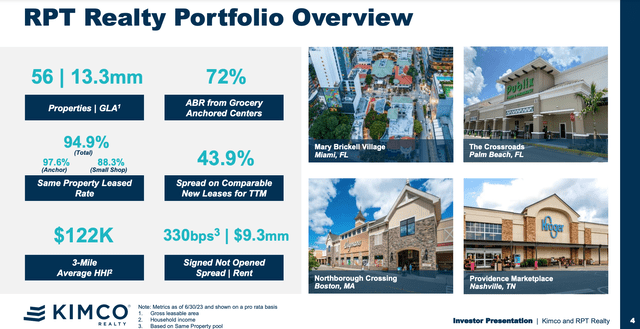

RPT Overview (Kimco Investor Presentation )

Like Kimco, as shown above, nearly 3/4 of RPT’s rent comes from grocery anchored shopping centers. This is similar to standalone Kimco’s 82% grocery anchored weighting. Grocers are desirable tenants and the relatively high frequency of grocery purchases drives increased visitation to shopping centers, boosting traffic and driving higher sales for all tenants. This in turn boosts occupancy and gives the landlord more leverage in negotiating higher rents.

In addition, since 2018, RPT divested many of its shopping centers lower growth midwestern markets like Illinois and Michigan while increasing exposure to faster growing markets like Florida which benefits from outsize population growth. As we sit today, Florida represents 20% of NOI and should continue to increase going forward. The strategy of divesting lower growth assets to focus on shopping centers with more favorable demographic and economic prospects is very similar to the strategy Kimco (and really all of the shopping center REITs) has followed since 2014.

RPT Acquisition is Modestly Accretive to NAV per share

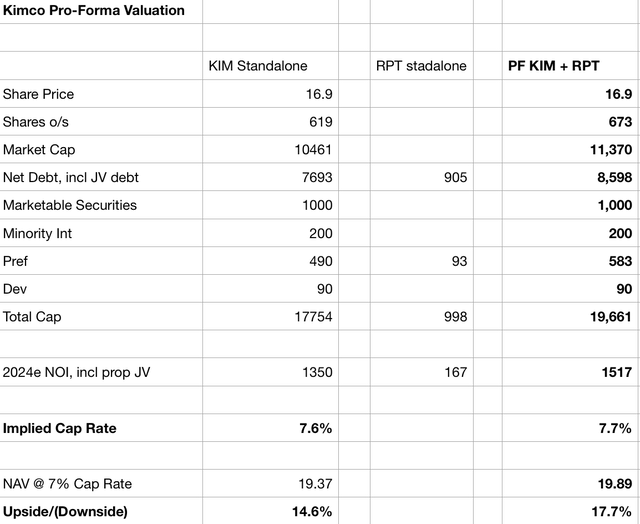

Below I show my pro-forma calculation of both the implied cap rate and NAV for Kimco plus RPT. As you can see, the deal is modestly accretive to both the implied cap rate and NAV per share.

Kimco Pro-Forma NAV (Company Filings; Author Estimates)

At a 7.7% implied cap rate, Kimco trades at a slight valuation premium to shopping center peers like Kite Realty (KRG), Brixmor (BRX), and Site Centers (SITC) which have implied cap rates of 8-8.8%. I consider the group as a whole to be modestly undervalued – I think 7-7.25% is a more appropriate cap rate given the prospects for 2-3% same-store NOI growth, bolstered by the aforementioned favorable supply outlook. Assuming a 7% cap rate, Kimco trade at about an 15% discount to NAV.

Conclusion

I see Kimco as owning a collection of quality shopping center assets which are well positioned for the medium and long term. I like management’s strategy of purchasing quality assets at a discount. As a value investor I like to buy in at a 25-30% discount to my estimate of fair value and would be interested in owning Kimco shares below $14.50. Given the volatility in REITs over the past year, I wouldn’t be surprised if I get an opportunity to own Kimco shares in the not too distant future.

Read the full article here

Leave a Reply