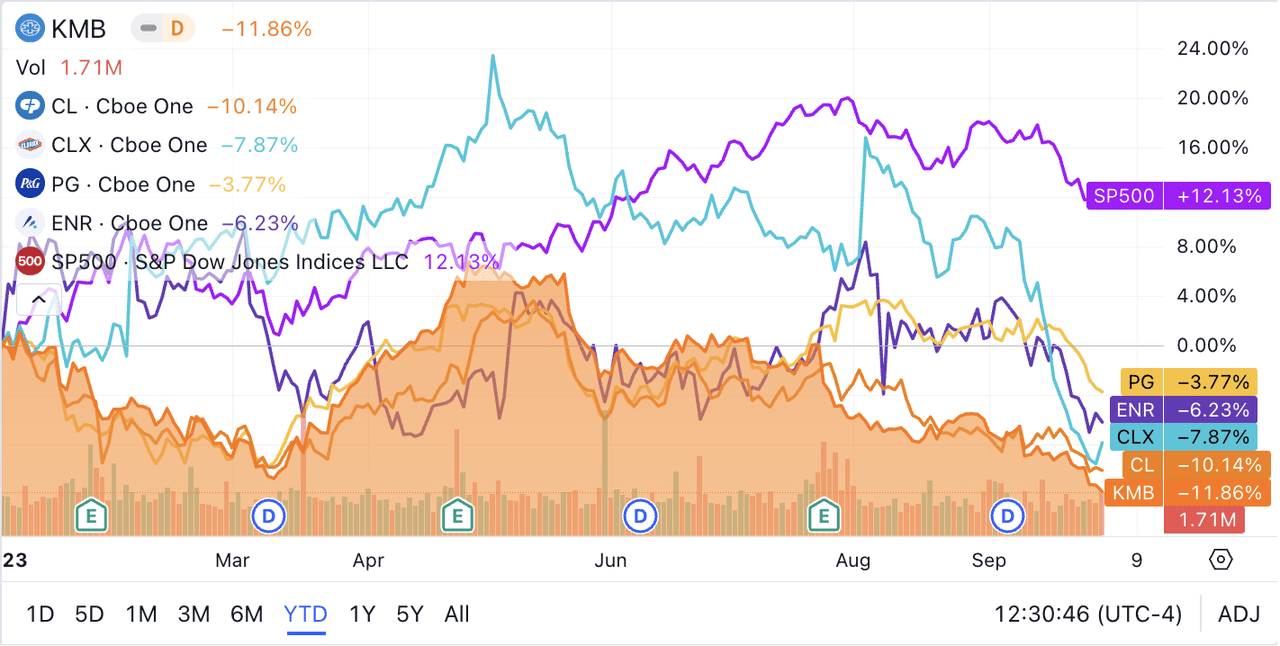

I rated Kimberly-Clark (NYSE:KMB) a hold in January 2023. Since then, the stock has dropped 11% compared to the S&P 500 (SP500) positive return of 11.2%. I have renewed interest in the Consumer Staples sector, looking for bargains, as the Vanguard Consumer Staples Index ETF (VDC) has dropped 4.3%, compared to the 12.2% gain for the Vanguard S&P 500 Index ETF (VOO) year-to-date. The consumer staples sector offers low volatility and good dividend income, and as a dividend income investor, I cherish both qualities. Regarding dividend income, Kimberly-Clark is closing in on a 4% yield; although I would continue to rate it a hold at its current valuation, I am looking to add to my holding below $118. The stock is trading at $120.85; a 2.3% drop would take it closer to my price target and dividend yield.

Margins, aided by solid brands and economy, may have crested.

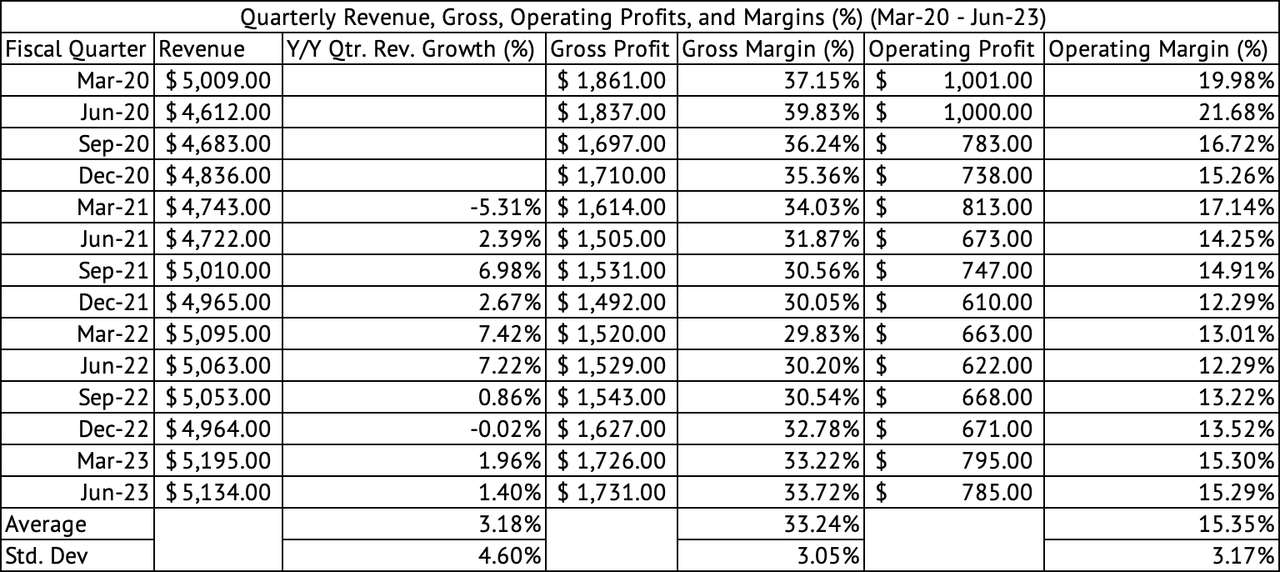

The company’s revenue growth has returned down to earth, but the company has managed to expand its margins, aided by receding inflation (Exhibit 1). However, revenue growth may be a challenge in the future. The CEO, Mike Hsu, mentioned that they have gained 400 basis points in market share in diapers since 2019. The global drop in birth rates is a challenge the company faces in its Huggies business, which is beyond its control. Gaining more market share may be more challenging for the company, and the margin gains may also recede if a recession sets in and the promotions increase. Nelson Urdaneta, the CFO, mentioned that they could “premiumize” the diapers and feminine care categories in China, which has helped with pricing and margins.

The company has forecasted 3% to 5% organic sales growth with a low-double-digit increase in operating profits. The company registered $2.62 billion in operating profit in 2022. Over the trailing twelve months, the company is on track to register a double-digit growth in operating profit with $2.90 billion. The company should easily achieve its profit targets this fiscal year. The company may have to turn to productivity gains and keep promotions under check, since most gains from fading inflation may have registered in its margins. With oil prices surging over 30% since June and Brent Crute approaching $100 a barrel, there are renewed fears of inflation as pressure mounts on consumer spending.

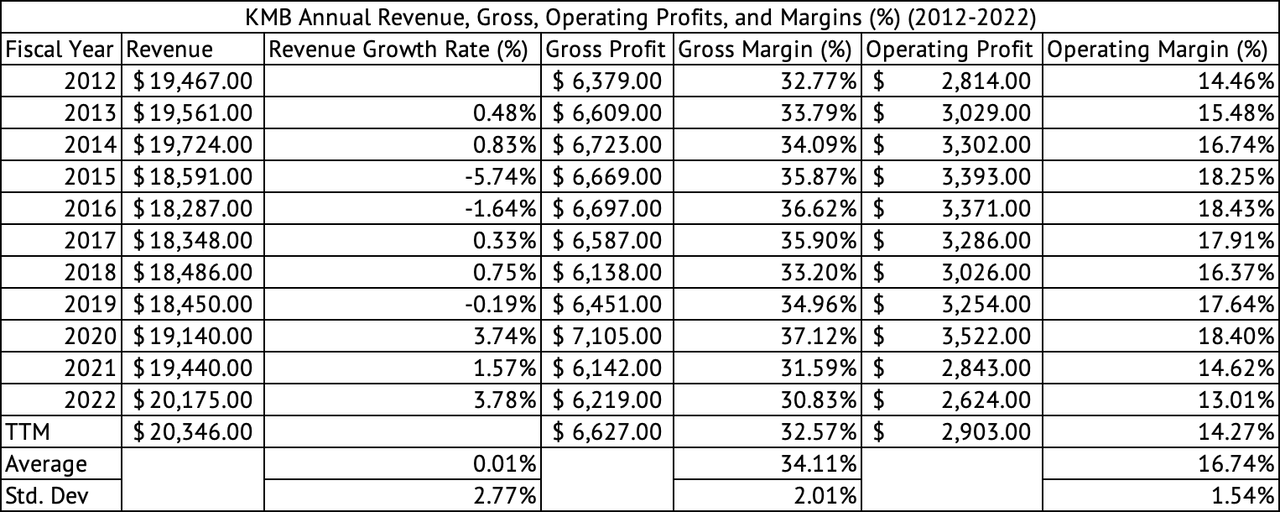

In 2019, the pre-pandemic era, the company achieved nearly a 35% gross margin and a 17.6% operating margin (Exhibit 2). We may never see the return of business and economic conditions of 2019. The 2010s were marked by low inflation and interest rates. The interest rates were artificially low during the past decade, which will not be the case this decade. Changing demographics, high inflation, and interest rates can put a lid on Kimberly-Clark’s margin expansion story. Not all demographic trends are unfavorable; the aging population across the globe may be a positive for the company’s adult care products, such as Depend and Poise.

Exhibit 1:

Kimberly-Clark Quarterly Revenue, Gross, Operating Profits, and Margins (%) (Seeking Alpha, Author Compilation)

Exhibit 2:

Kimberly-Clark Annual Revenue, Gross, and Operating Margins (Seeking Alpha, Author Compilation)

Good dividend yield but low growth.

The stock yields 3.9%, which has grown 3.4% annually over the past five years. The company pays about $1.5 billion in annual dividend payments, while it generated $3.1 billion in cash from its operations over the trailing twelve months. Besides a massive annual dividend payment, there are a lot of other demands on the company’s operating cash. For instance, the company spent nearly $800 million in capital expenditures over the past twelve months.

The company carries over $8 billion in debt, with a debt-to-EBITDA ratio 2.3x. This is a manageable debt load as long as the company can grow its revenues and maintain its margins. The company also does a lot of share repurchases, having spent $8.6 billion over the past decade. But the pace of repurchases has slowed considerably, with the company making $400 million and $100 million in repurchases in 2021 and 2022.

The dividend yield is good, but not great in this rate environment. The dividend growth is low, given that the sector median growth rate is over 5%. The dividend payout ratio is also on the high end, and the company has many demands on its cash, from capital expenditures to debt servicing. Investors may be better off waiting for a dividend yield above 4%. The stock must drop below $118 to yield above 4%. Given the high yield from money market funds, investors have the luxury of waiting while earning a decent income.

Richly valued.

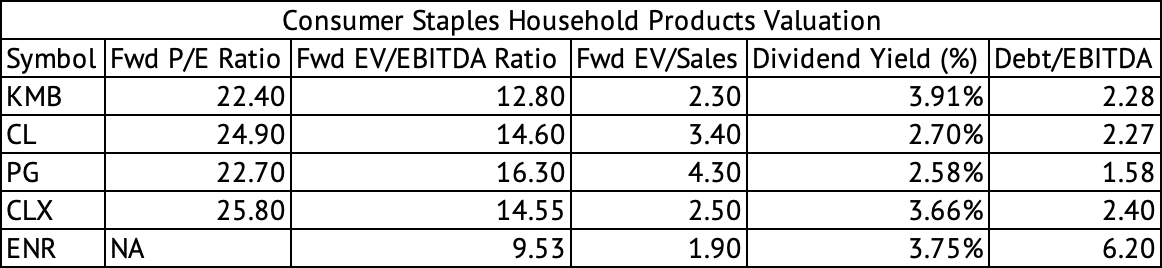

The stock, at 12.8x EV to EBITDA multiple and 22.4x PE, is trading in line with its peers, such as Procter & Gamble (PG), Clorox (CLX), and Colgate-Palmolive (CL) (Exhibit 3). As inflation recedes, the household products sector has seen its margins improve over the past few quarters, but the stocks have performed poorly. Clorox, Procter & Gamble, Kimberly-Clark, Energizer (ENR), and Colgate-Palmolive are all down year-to-date compared to the S&P 500 Index’s positive return of 12.1% (Exhibit 4).

Exhibit 3:

Valuation of Household Products Companies (Seeking Alpha, Author Calculations, and Compilation)

Exhibit 4:

YTD Performance of Household Products Companies (Seeking Alpha)

The Fed targets a 2% inflation rate and may have to increase rates further to achieve its targets. Since most investors own the consumer staples sector for its dividend yield and low volatility, they may prefer owning U.S. Treasuries, which yield 5% on the short end of the curve. A rise in interest rates may cause a further drop in share price in the consumer staples sector. Other high dividend-yielding sectors, such as utilities (VPU) and real estate (VNQ), are down 16% and 8% YTD, with yields of 3.6% and 4.7%, respectively.

Although Kimberly-Clark is valued in line with its peers, the consumer staples sector, including Kimberly-Clark, may be overvalued. With the prospect of higher for longer interest rates and with bonds yielding good income, dividend income seekers should patiently wait for the stock to yield above 4% before buying.

Kimberly-Clark Corporation has solid brands and improved its margins over the past few quarters. The margins may have crested, and further gains may be more complicated. The company’s dividend is still low in the current rate environment, and the dividend might grow at a low-single-digit pace in the future, which is another negative when considering the stock. The household products sector looks overvalued. Investors may have to wait for the sector to pull back before investing. I rate Kimberly-Clark a hold.

Read the full article here

Leave a Reply