Recently, I’ve covered two high quality office REITs – Boston Properties (BXP) and Highwoods Property (HIW) and issued HOLD ratings for both, because valuations have become more expensive over the past three months and I identified additional risks for each. Today, I want to have a look at one more office REIT, which I consider high quality – Kilroy Realty Corporation (NYSE:KRC).

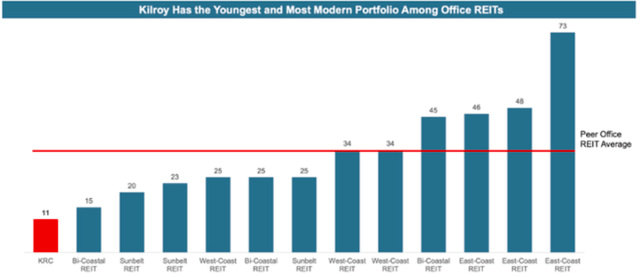

The reason I consider KRC high quality is that it owns predominantly A-Class space in very good locations. Notably, Kilroy also has the youngest office portfolio of all REITs with an average age of properties of just 11 years. This is significantly below the average property age of the entire peer group of 34 years and quite a bit below KRC’s nearest competitor BXP whose buildings are 15 years old on average. I’ve covered the reasons why this matters in my last article on Kilroy – in short, it reduces maintenance CAPEX need significantly and makes for significantly more resilient occupancy.

KRC

In terms of geographical presence, KRC owns a portfolio of offices located exclusively on the West Coast in the cities of Los Angeles, San Francisco, San Diego and Seattle. A pure West Coast exposure might scare some investors away, but it’s important to recognize that these fears may be overblown. While some business has indeed moved out of California and to tax-friendlier states such as Texas, California remains the #1 spot for tech investment and continues to see positive job growth (although lower than the Sunbelt). In the long-term, I think the market will be just fine and those who invest now will be rewarded.

In the meantime, KRC maintains occupancy of 88.6% with Los Angeles and Seattle lagging the average at 83.6% and San Francisco where 50% of total NOI generated leading the average at nearly 94% occupancy.

What’s important is that the REIT has been able to achieve solid leasing volumes over the first half of the year, leasing almost 300 ths. sft of space in Q1 and in Q2. Moreover, these leases have been executed at a 9.4% rent spread, though on a cash basis, the increase has been minimal. This shows that tenants are interested in KRC’s buildings

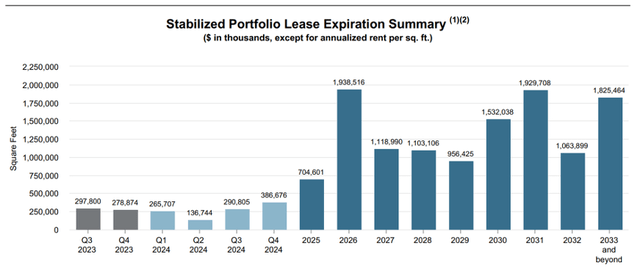

Looking at the ladder of lease maturities, it’s easy to see that the REIT is on track to close the year with flat occupancy. Expirations also seem manageable until 2025, after which they become quite high, but that should give the REIT plenty of time to figure out their next move and perhaps improve their portfolio by selling some of their worst assets or investing extra CAPEX to make them more attractive to tenants.

KRC

In terms of guidance, management has improved the outlook for the year slightly, following the Q2 result, and now targets occupancy of 86.8% to 87.8% by year-end. The target range for FFO per share now stands at $4.43-4.53 per share, which would represent about a 4% YoY drop, primarily as a result of increased interest expense.

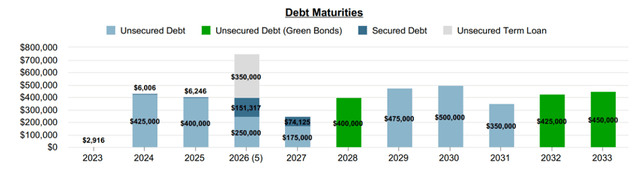

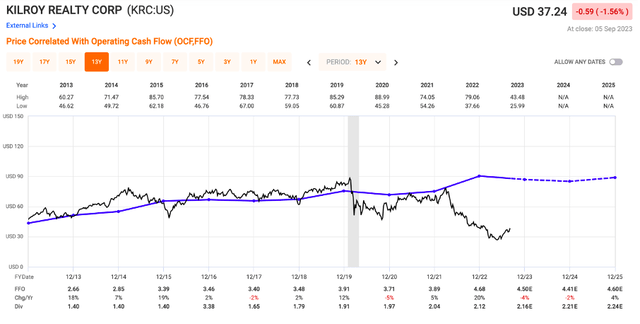

Future growth beyond this year is unlikely to be exciting. In fact, the consensus is for flat FFO until 2025, despite a solid BBB rated balance sheet with about 95% of the debt fixed and no maturities this year, which shields the REIT somewhat from interest rate risk.

In 2024 and 2025, though, the REIT will have to refinance about $400 million of debt each year, which presents some risk given full year FFO is expected around $500 million this year.

KRC

With little growth to be expected, and occupancy likely to be somewhat stable, KRC is definitely not a growth play, but given the fact that the valuation is now low at 8x FFO, compared to the historical average of 19x FFO, the stock can be a nice turn-around play for patient investors that can stomach some volatility.

To be fair, the same thing could have been told about BXP, but the one thing that Kilroy has over the Boston-based REIT is a one-of-a-kind young portfolio located in the biggest tech hub of the world, which makes it slightly superior, in my opinion. If you’re going to invest in just one office REIT and want one that’s arguably the highest quality, then Kilroy could be it.

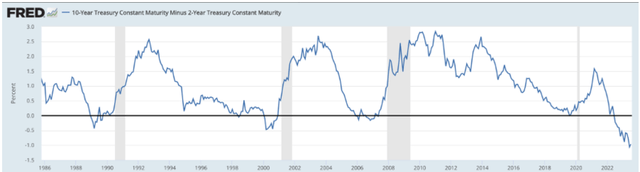

Currently trading at an implied cap rate of about 8.5%, I do see significant upside when interest rates start to decrease – which is my base case over the next 18 months or so as the US falls into a recession. This view is largely confirmed by a yield curve which is the most inverted it has been since the 1980s and while the inversion itself tells us nothing about timing, it has been correct to predict a recession every time in the past 50 years. That’s why I’m willing to bet that this time will not be different and if the US falls into a recession, the Fed will cut interest rates.

FRED

In fact, I think the REIT could easily re-rate to 10-12x FFO in that scenario, which could provide up to 50% upside on top of a solid 5.8% dividend yield which is largely safe with a payout ratio of 50%. That’s solid alpha potential, which is why I reiterate my BUY rating for Kilroy here at $37 per share.

FastGraphs

Read the full article here

Leave a Reply