JPMorgan Chase is scheduled to report third-quarter earnings before the opening bell Friday.

Here’s what Wall Street expects, according to analyst estimates compiled by LSEG, formerly known as Refinitiv

- Earnings per share: $3.96

- Revenue: $39.65 billion

JPMorgan will be watched closely for clues on how the industry fared amid surging interest rates and rising loan losses.

While the biggest U.S. bank by assets has navigated volatile rates adeptly so far this year, the situation has caught several peers off guard, including a trio of midsized lenders that collapsed after deposit runs.

Bank stocks plunged last month after the Federal Reserve signaled it would keep interest rates higher for longer than expected to fight inflation amid unexpectedly robust economic growth. The 10-year Treasury yield, a key figure for long-term rates, jumped 74 basis points in the third quarter. One basis point equals one-hundredth of a percentage point.

Higher rates hit banks in several ways. The industry has been forced to pay up for deposits as customers shift holdings into higher-yielding instruments like money market funds. Rising yields mean the bonds owned by banks fall in value, creating unrealized losses that pressure capital levels. And higher borrowing costs tamp down demand for mortgages and corporate loans.

Banks including JPMorgan have also been setting aside more funds for anticipated loan losses.

Wall Street may provide little help this quarter, with investment banking fees likely to remain subdued and trading revenue expected to be flat or down slightly.

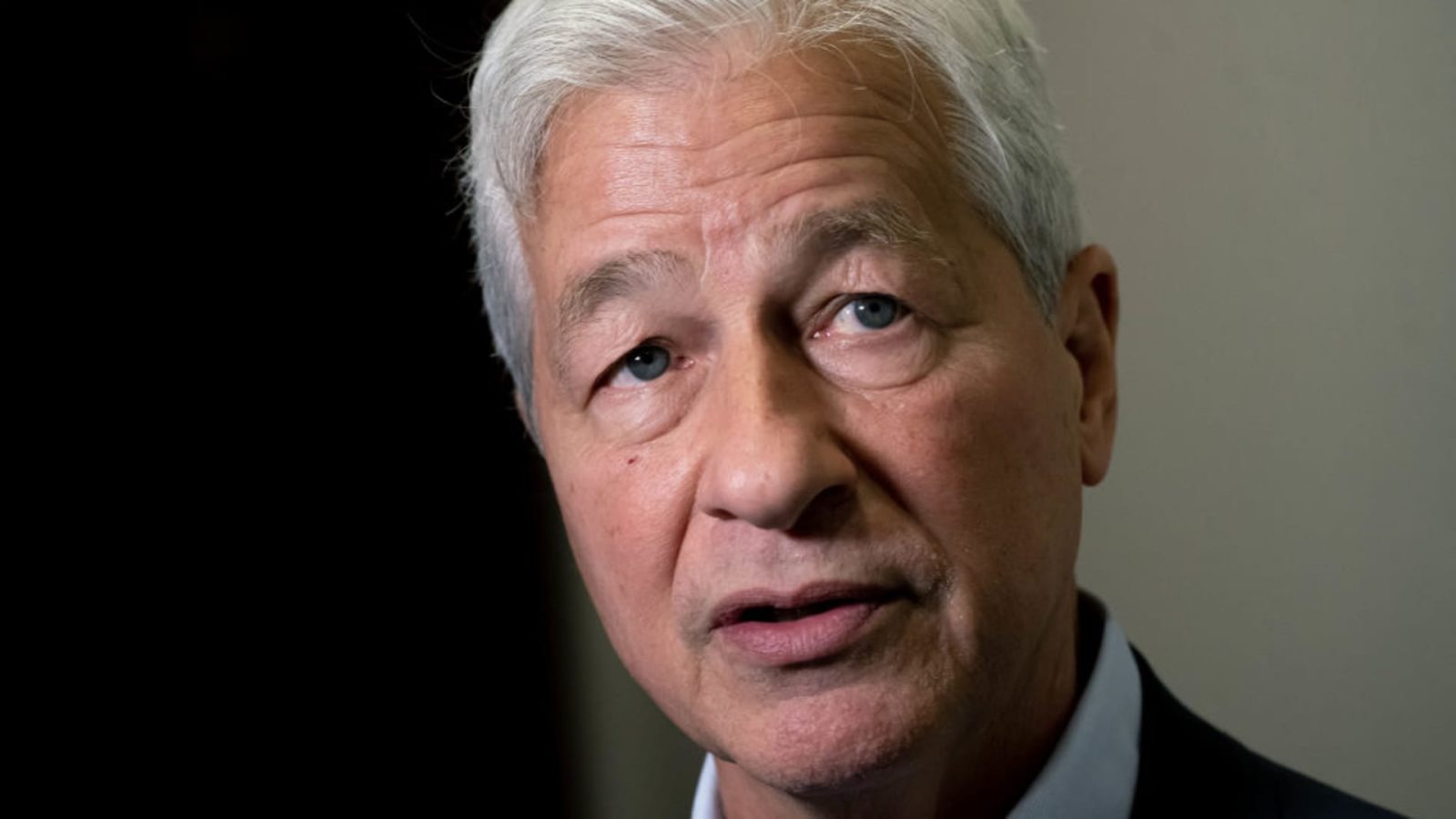

Finally, analysts will want to hear what CEO Jamie Dimon has to say about the economy and his expectations for the banking industry. Dimon has been vocal in his opposition against proposed increases in capital requirements.

Shares of JPMorgan have climbed 8.7% year to date, far outperforming the 19% decline of the KBW Bank Index.

Wells Fargo and Citigroup are scheduled to release results later Friday morning. Bank of America and Goldman Sachs report Tuesday, and Morgan Stanley discloses results on Wednesday.

This story is developing. Please check back for updates.

Read the full article here

Leave a Reply