HPF Investors Checking Out The Z-Score On Some Preferred CEFs

Generally, an income investor’s primary aim is to receive a regular and steady dividend from their holdings. Capital appreciation is appreciated, but it serves as a secondary goal to the dividends. Heck, at times on this platform, we have income investor commentators who have no regard for their principal, as long as their investment doles out the monthly dough. John Hancock Preferred Income Fund II (NYSE:HPF) serves these investors based on its investment objective.

The fund seeks to provide a high level of current income consistent with preservation of capital. The fund’s secondary investment objective is to provide growth of capital to the extent consistent with its primary objective.

Source: Semi Annual Report

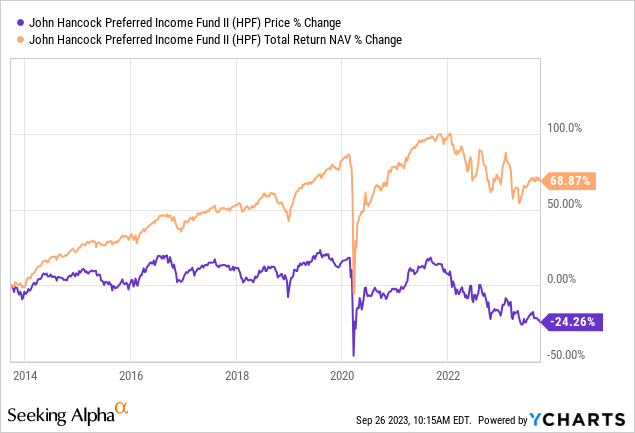

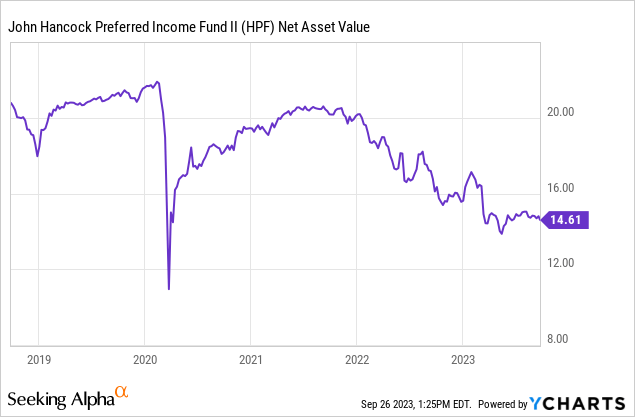

Over the last decade, HPF has delivered on its primary objective, with its investors having a net positive total return on NAV.

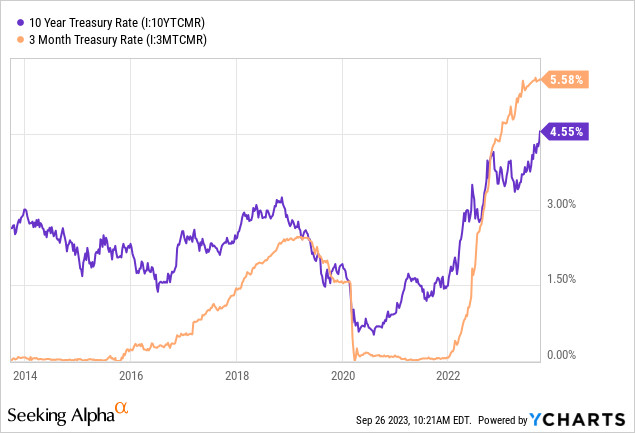

Investors, however, have not had to work very hard to beat the risk-free returns during most of this time frame.

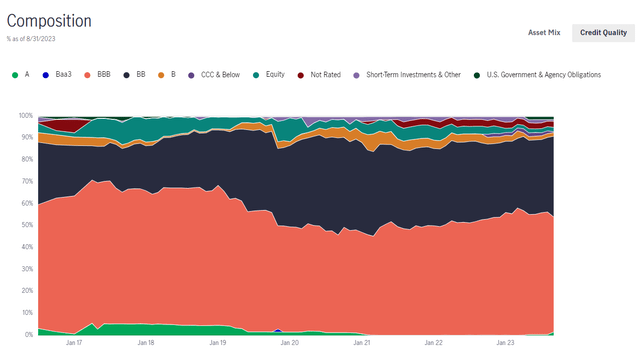

HPF generally invests at least 80% of its total assets in preferred securities, which include those of the convertible variety. The preferred securities portion of the portfolio comprises both fixed and floating rate issuances. At least 50% of the said securities are explicitly rated investment grade or deemed of comparable quality by the fund team. Even those that are rated below investment grade have to be at the minimum a “B” (S&P or Moody’s) at the time of purchase. It was hard, and our eyes protested, but we braved through looking at the following chart and confirmed that the fund held true to its credit quality guideline at the end of last month.

Fund Website

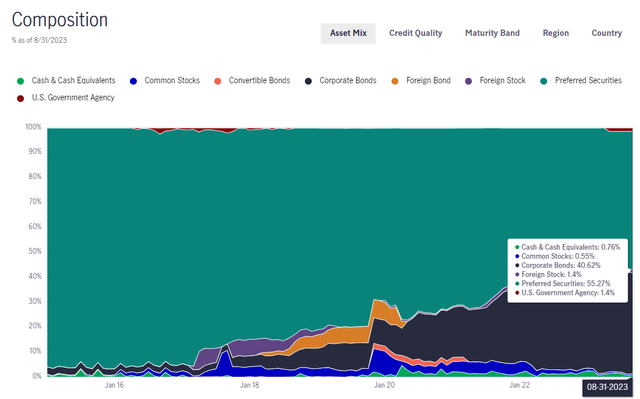

On the other hand, HPF had decreased its preferred holdings in favor of bonds as of the same date.

Fund Website

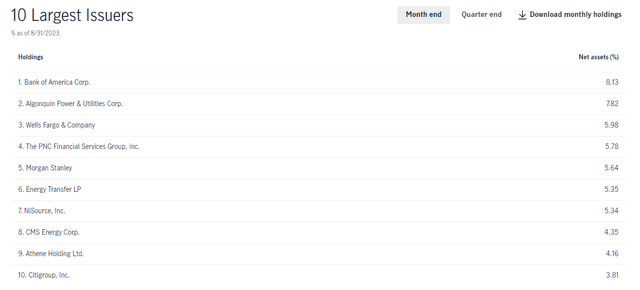

The last published data shows HPF holding 130 securities with more than half of the portfolio comprising securities from 10 issuers.

Fund Website

The above list includes well-known names, a few of which we have covered on this platform like Bank of America Corporation (BAC), Energy Transfer LP (ET), and Algonquin Power & Utilities Corp. (AQN).

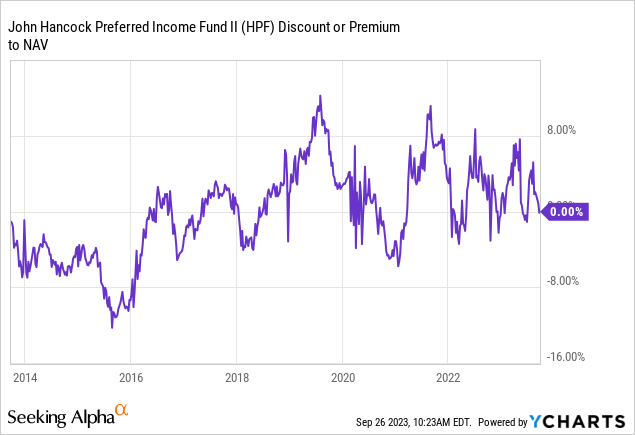

HPF reduced its monthly distribution from 14 cents to 12.35 cents back in October 2019 and has held it steady since then. At the current price of $14.61, it yields around 10.14%. This has no doubt played a hand in it enjoying a premium for most of the recent times, only now trading at an equilibrium to its NAV.

Outlook

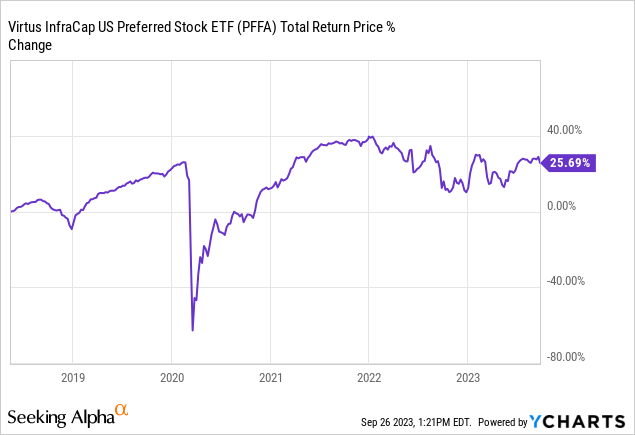

In the preferred share world, generating 10% yields on NAV is hard. Sure there are funds that claim to do it and you might believe them if you just saw their distributions, but reality does not agree. One example here would be Virtus InfraCap U.S. Preferred Stock ETF (PFFA), which although an ETF (and not a CEF like HPF) does bear out our thesis.

Total returns since inception have been about 5% annually.

Currently, you can find many quality preferred shares yielding 7%, but then you have to deduct the management fee which usually runs over 1% (1.13% for HPF). Leverage is not a good friend here as you have rapidly rising interest costs compressing spread versus the primarily fixed-rate preferred shares.

The fund pledges a portion of its assets as collateral to secure borrowings under the CFA. Such pledged assets are held in a special custody account with the fund’s custodian. The amount of assets required to be pledged by the fund is determined in accordance with the CFA. The fund retains the benefits of ownership of assets pledged to secure borrowings under the CFA. Effective January 1, 2023, interest charged is at the rate of OBFR (overnight bank funding rate) plus 0.75% and is payable monthly. Prior to January 1, 2023, interest was charged at a rate of one month LIBOR (London Interbank Offered Rate) plus 0.70%. As of January 31, 2023, the fund had borrowings of $206,700,000 at an interest rate of 5.07%, which are reflected in the Credit facility agreement payable on the Statement of assets and liabilities. During the six months ended January 31, 2023, the average borrowings under the CFA and the effective average interest rate were $206,700,000 and 4.33%, respectively

Source: Semi-Annual Report

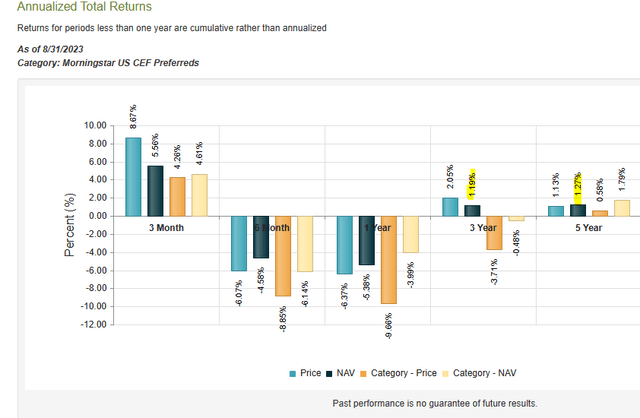

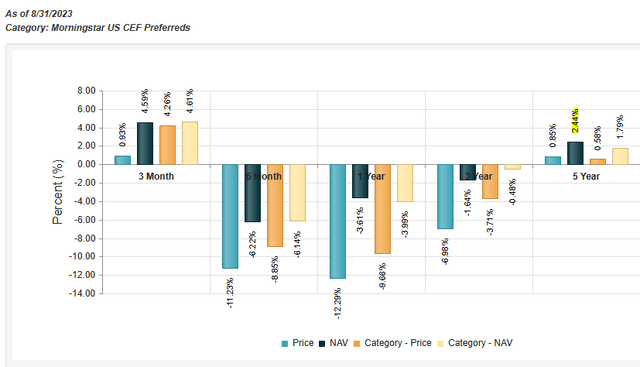

You can see this in HPF’s total return on NAV which lags its distribution yield by miles and miles in the last 3-5 years.

CEF Connect

This is despite having a good deal of exposure to floating rate preferred shares. When you do that over 5 years, you deplete your NAV.

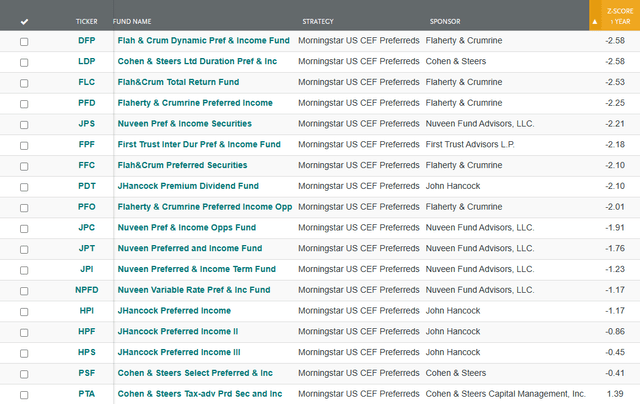

All of this should be generally well-known. What is interesting here is that this space (preferred share CEFs) has been bombed out, with a few select funds standing tall. What we mean by that is most funds are now trading at rather large discounts to NAV. HPF is the rare one without a discount and it is shadowed on either side with its sister fund, John Hancock Preferred Income Fund (HPI) and John Hancock Preferred Income Fund III (HPS).

CEF Connect

The belief system here has to be that the fund can continue sustaining this level of payouts indefinitely. As long as the day of reckoning is postponed, investors turn a blind eye to the risks. Heck, many even argue that it will not happen because it has not happened. Like the 60-year-old man who claims that because he has not spent a day in the hospital since birth, it is reasonable to assume the next 60 years will be the same. But HPF is really setting investors here for a big double whammy. After delivering really poor returns for the past 5 years, a distribution cut could take it immediately to a 15% discount to NAV. That is where the funds that have been recently cut, like Flaherty & Crumrine Total Return Fund (FLC) and Nuveen Preferred & Income Securities Fund (JPS) trade. Those funds also show what is likely to be a sustainable distribution yield for any preferred fund today.

CEF Connect

Investors might balk at looking at other funds that seem to have fared poorly as of late, but most of their total returns on NAV are comparable over 5 years. For example here is the data for FLC, which beats HPF.

CEF Connect

One final criteria would look at would be the Z-score and over there too, HPF is looking relatively expensive at negative 0.86.

CEF Connect

Verdict

HPF represents an abnormal risk here with exceptionally poor trailing 5-year returns and a distribution that is at risk of being cut. If this was already at a big discount to NAV, we would not bother warning about it. But, as things stand, this is not the extra risk you need in your portfolio. Consider a switch.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here

Leave a Reply