U.S. Global Jets ETF (NYSEARCA:JETS) is an industry based ETF that specifically focuses on the airline industry. It offers exposure to close to 60 companies that are in industries related to the airline industry. There are reasons to be both bullish and bearish on the airline industry as a whole and this fund mostly offers a mixed bag to investors without a lot of compelling value as I’ll discuss in the remainder of this article.

The fund’s name might confuse some people since it includes “U.S.” and “Global” in its name at the same time, making many people wonder whether it is focused on American or global companies. Adding to more confusion is the list of fund’s holdings (which we will review below) where a great majority of the holdings are American companies with a few foreign companies thrown in just to make it more global. As a matter of fact, the fund is named after the company that manages it which is U.S. Global Investors Inc.

The fund’s description says it invests in companies including airlines, aircraft manufacturers, transportation infrastructure, airport services and aerospace and defense companies but in reality it mostly invests in airlines companies while everything else gets a negligible amount of its total weight. The fund’s top 10 holdings include 9 American and Canadian passenger airline companies accounting for almost 60% of its total weight. Furthermore, the top 4 holdings of the fund account for almost 40% of its total weight and all are American passenger airline companies.

JETS top 10 holdings (U.S. Global Investors, Inc. )

The fund also has small weight in companies in related industries such as Allegiant Travel (ALGT) which is a travel agency (2.93% of total weight), Expedia (EXPE) with 2% weight, Boeing (BA) with 2% weight and Textron (TXT) with 2% weight but this is more or less a passenger airline fund with other sub-sectors getting very little exposure. The fund also holds a number of non-American airline companies such as Singapore Airlines (OTCPK:SINGY), Turkish Airlines and Japan Airlines (OTCPK:JAPSY) but these account for 1% or less of the fund’s total weight. It’s almost as if these were added to the fund so that they can call it a global fund.

JETS Foreign Holdings (U.S. Global Investors, Inc. )

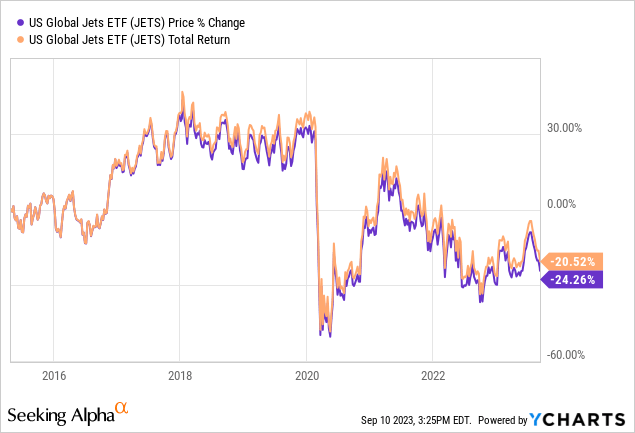

The fund’s share price is down -24% and total returns are down -21% since its inception 8 years ago. To be fair, it was doing well until the COVID crash in March 2020 but it never fully recovered since then. Those who bought it in the spring of 2020 and held until the end of the year made a lot of money (especially after announcement of vaccinations in November) but most other investors (including long-term buy and holders) didn’t make much money from it.

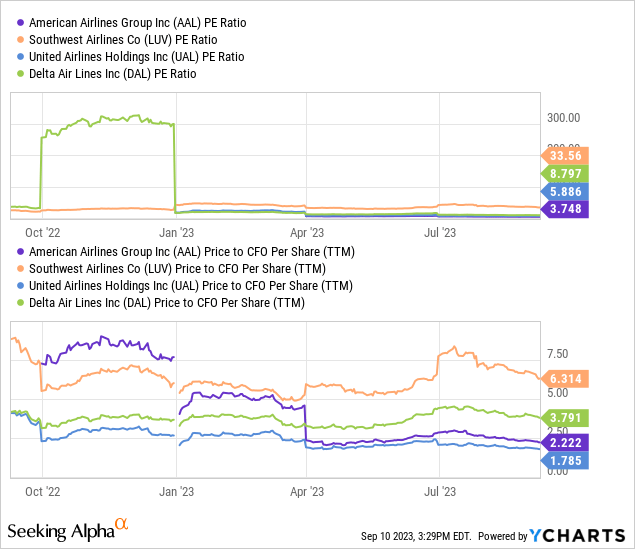

Currently airline stocks appear to be cheap with most major airline stocks trading in single digit P/Es and single digit Price to CFO (cash from operations). For example United Airlines (UAL) currently trades for a P/E of 5.88 and P/CFO of 1.78 which is very cheap no matter how you look at it. Then again airlines almost always traded for cheap multiples. This is just how the entire industry has been because almost all major airline companies have a history of bankruptcies and insolvencies. This is one of those industries that’s almost always traded at a deep discount and this might not change anytime soon.

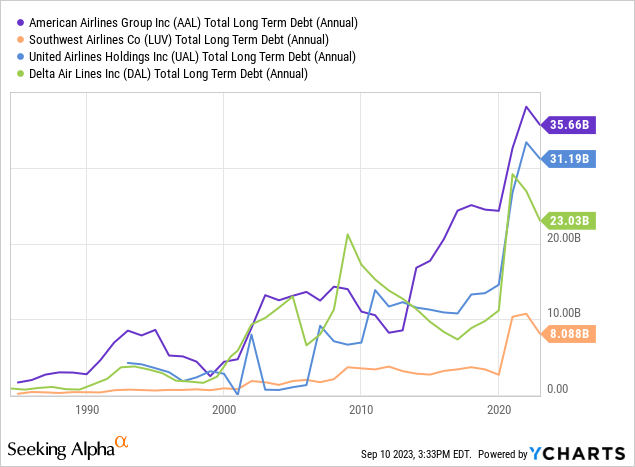

In 2020 most airlines had to take on large amounts of debt to survive because their businesses had mostly dried up due to pandemic-related shutdowns and lockdowns. Their very survival and existence was in jeopardy. All major airlines were able to obtain liquidity in a timely manner and survived the pandemic and they have been paying down their debt since then, driven by strong cash flows they’ve been generating. They still have large amounts of debt as compared to their historical averages. As long as we don’t get another black swan event like what we saw in 2020, most of them should be able to comfortably cover their debt payments from their cash flows but I wouldn’t expect them to be able to post much growth either.

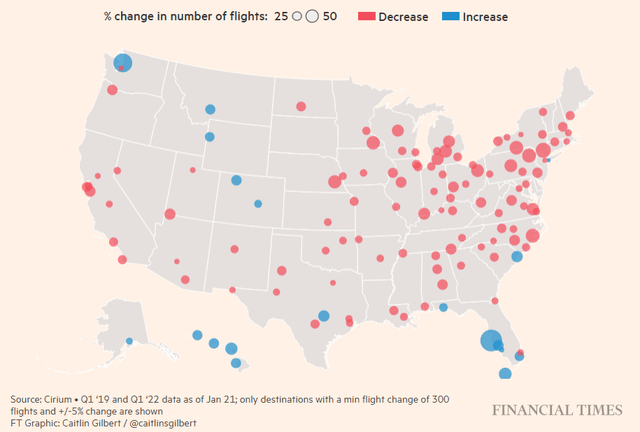

One thing airlines did in 2020 which helped them not only survive but thrive is that they took a long hard look at all their flights to see profitability of each flight. In the old days airlines took pride in how many flights they offered to how many different spots of the world but this had to now take the back seat as profitability came into focus. Many airlines decided to reduce redundant flights or eliminate some routes entirely, consolidate their airport spots and even collaborate with some of their competitors with better coverage without expanding their resources. This also helped them charge higher prices because fewer available seats meant less supply for consumers and they had to pay higher prices for those flights.

Changes in domestic routes (Financial Times)

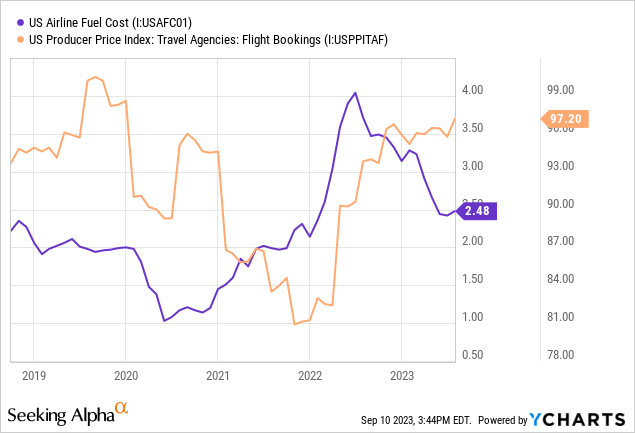

Last year when oil prices rose sharply for a variety of reasons including the war in Ukraine, airlines were able to hike their prices quickly to pass those higher costs to consumers. Now fuel costs are coming down but ticket prices aren’t coming down which means airlines might be able to enjoy higher margins for a while. There are some signs that this might not last for long though because latest CPI reports are pointing to consumers spending less on travel including flights.

Airlines are also facing labor challenges though. Many airline workers are unionized and they are demanding better pay because of higher costs of living due to inflation. This will be a challenge for many airline companies and put pressure on their margins and cash flows in the future as we’ve already seen with Southwest Airlines (LUV) earlier this year.

There are reasons to be bullish on airlines such as low valuations, strong margins, solid cash flows, effective cost cutting and the overall strength of the economy but there are also reasons to be bearish on them such as slowing demand, high debt levels, history of airline failures and tightening money supplies because of higher interest rates. As they say it, sometimes stocks (and sectors) are cheap for a reason and cheap stocks (and sectors) tend to remain cheap for a long time.

JETS has a relatively high expense ratio of 0.60%. For a passively-managed fund with most of its assets in a few airline stocks, this seems especially steep. It’s not like this fund’s portfolio is difficult to replicate or anything like that. If investors are particularly interested in investing into airlines, they could simply buy the big four airliners (American Airlines, Southwest, Delta and United) plus add Boeing to the mix as a manufacturer and this would cover most of the industry. I am just not convinced that this fund is offering much to investors above and beyond what they can already get by holding a handful of stocks.

Read the full article here

Leave a Reply