Editor’s note: Seeking Alpha is proud to welcome Rasmus Tolppanen as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

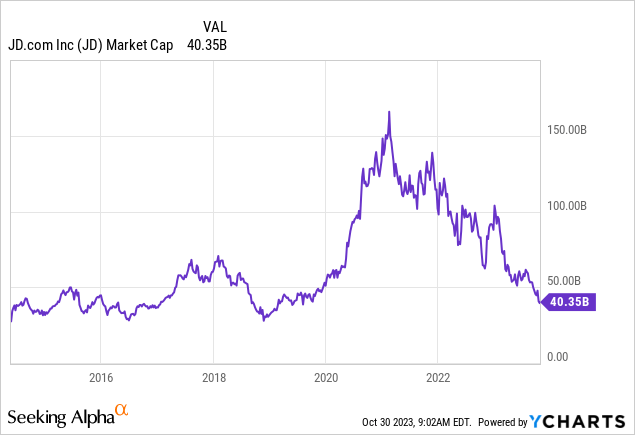

JD.com (NASDAQ:JD) is vastly undervalued in my view, creating a terrific buying opportunity for long-term investors and traders to make a decent buck. In USD, JD trades at about $40B market capitalization while having a cash balance of $32.4B. Subtract the total debt of $10.05B, and you get a cash balance covering 56% of the company’s capitalization.

Even if the revenue growth stagnates at the current 6.8% YoY, the stock has a tremendous financial margin of safety according to my analysis. That’s one of the worst and somewhat probable scenarios that can happen, and even that doesn’t sound so bad considering the prevailing situation.

For long-term investors, JD can at least double in the next few years as the Chinese economy gets back on its feet, resuming better growth, and the extreme pessimism surrounding the equities dissipates. The company also issued its first annual dividend of $0.62 (2.42%) for the troubles of holding the stock.

For traders, there are some opportunities to make some quick cash from the monetary and fiscal policy changes, rebounding in the Chinese consumer sentiment, or a bullish earnings season. In this article, I pinpoint the multiple reasons for my optimism. First, we need to go back in time, as this sets the stage for my rationale behind the thesis.

Reflections

The picture above feels like a lifetime ago. JD.com was listed on NASDAQ on July 29, 2015, when the Chinese growth story was in its infancy. What became next was a period of exuberance. I used to hate Chinese equities when the frenzy was at its peak, as JD and Alibaba (BABA) had weekly recurring screen-time on Bloomberg and CNBC. Valuations were running crazy, and growth was unstoppable. After every peak, the investors hailed these companies to triple in a year or two. Back then, I knew how it would ultimately end when the realities could no longer meet the extraordinary expectations.

I’m embarking on a journey into the mind of George Soros and his ageless “Alchemy of Finance” masterpiece. In it, he ponders extensively the theory of reflexivity, human bias, and its tendency to self-reinforce booms and busts. This theory is somewhat applicable in our following brief study of the past eight years in Chinese equities. In 2021, after a hot bull market, the bubble finally burst.

JD and Alibaba had tripled in market cap in no less than three years, and it took almost the same amount of time for them to lose those gains. The self-reinforcement that allowed those stocks to reach such flashy returns turned on itself. The “unreliability” of the Chinese government and equities started reinforcing itself, and the Western media took every opportunity to get those clicks and comments about the hot topic. Suddenly, those stocks didn’t get the weekly screen time. I haven’t seen more than a few clips from CNBC and Bloomberg in the past year.

Countless investors saw their portfolios in flames, vowing never to invest in China again. It’s in human psychology to avoid things that one has traumatic memories about, so the reactions are understandable. I didn’t lose a dime, but the plunge did reinforce my sentiment about the Chinese ex-darlings. About a year ago, a surprising opportunity made me question every feeling about Chinese equities. Alibaba reached a price not seen since the early innings of its trading history at the NYSE. $60-70 became too cheap to ignore, and I bought in hesitantly. Long story short, I made a successful bet and still hold some, currently in the green.

This commentary isn’t to flex about one bet that went right; it’s about the JD.com thesis that sits close to its all-time low.

Overview

For those unacquainted, JD.com is a Chinese e-commerce company headquartered in Beijing. It is the largest online retailer in China and one of the largest in the world. The company sells a wide variety of products, including electronics, home appliances, apparel, groceries, and more. It also offers a variety of services, such as logistics, online travel booking, and financial services. It has a strong presence in China, with over 900 fulfillment centers and 140,000 delivery stations across the country. JD has previously been in the low-margin 1P business model but has realized its potential in the 3P model and actively engages in it.

Here is a summary of JD.com’s key business segments:

- E-commerce: JD.com’s core business is e-commerce. The company sells a wide variety of products through its online platform, JD.com.

- Logistics: JD.com operates its own logistics network, which allows it to offer fast and reliable delivery to its customers.

- Financial services: JD.com offers a variety of financial services, including online payment, consumer credit, and investment products.

- International business: JD.com has expanded its international presence, with operations in the United States, Southeast Asia, and Europe.

The company is known for its focus on quality, authenticity, and fast and reliable delivery. JD.com is also investing in new technologies, such as artificial intelligence and big data, to improve its customer experience and operational efficiency. The company mainly competes with Alibaba and Pinduoduo Holdings Inc. (PDD), but more on that later.

Fundamentals

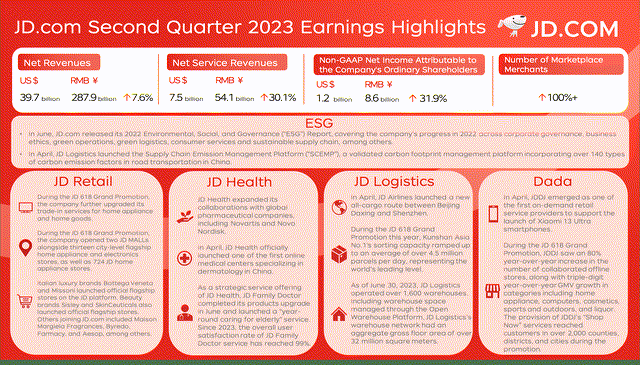

Overall, the revenues continue to experience headwinds and can be sluggish for the next few quarters. JD Retail experienced a 5% increase in revenues compared to a quarter a year earlier, and Logistics revenues were up 31%, a bright spot in the segment.

JD Q2 Highlights (JD.com)

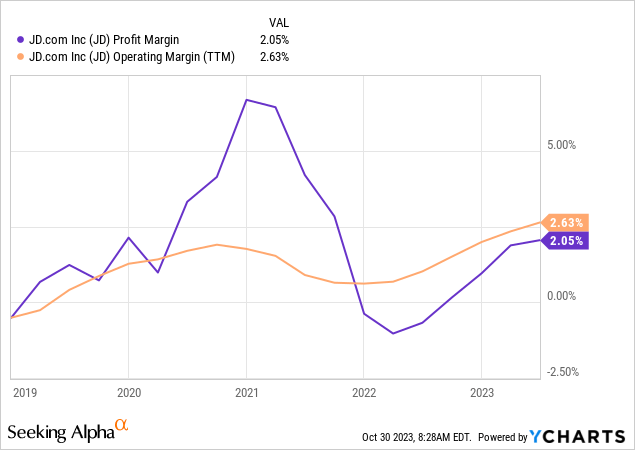

The overall revenue growth is expected to rebound next year as macro shows strength. As sales increase, the logistics segment performs better. The company is experiencing margin expansion as its new strategies with marketplace (3P) business model scaling continue to kick in. Growth in the logistics business also helps to drive up the profitability.

CFO Ian Shan shared the following quote in the Q2 earnings call:

I would like to highlight that revenues generated by third-party merchants grew faster than 1P in the quarter, driven by 3P advertising revenues. As we roll out more supportive measures for merchants, we saw notable acceleration in merchant base expansion in the quarter. It’s also encouraging to see that our traffic conversion rate had a meaningful improvement that indicates our traffic allocation algorithm is driving co-development of our 1P and 3P business effectively.

Average revenue per user continues to climb, as JD Plus gathered 36 million members into its ecosystem. This is a positive sign, as it’s clear that JD still gains more customers that are likely to stay loyal customers. The subscription model also provides more reliability on cash flows and helps to track growth.

This is what the CEO Sandy Xu said in the Q2 earnings call:

During the quarter, we observed strong user engagement trends, including higher purchase frequency and ARPU on our app. In particular, the number of repeat customers continued to grow by double digits, while the average GMV per user increased by high-single digits. The number of JD Plus members continued to grow over 20% year-over-year and reached 36 million in Q2.

JD’s return to superior customer service doubled 3P merchants due to reducing rates, creating long-term benefits. In terms of free cash flow, JD had a great year with $4.6B, up 21% YoY. This is a great win for the company in a truly challenging economic environment.

Its business model change means becoming similar to Amazon (AMZN). As a result, margins have started to rebound. If JD follows Amazon’s suit as it could, OM can reach realistically 6%, three times the current margins. JD is still optimizing its operations into what the management wants it to be, which is a dominant force providing a vast supply of products in the most cost-friendly and convenient manner as the company increases its revenues and margins to new heights.

Chinese middle-class will experience an additional 80 million citizens by the decade’s end per BCG. These consumers will be more technologically savvy, driving the e-commerce space and the tech giants higher with increasing consumption in the areas these companies have conquered, including JD.

Valuation

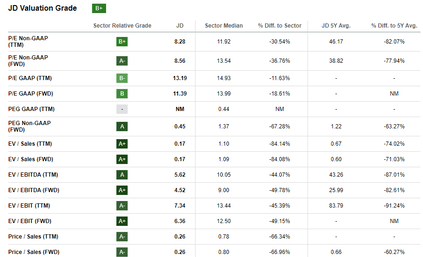

No matter the metric, JD screams of undervaluation and oversold. P/S at 0.26, P/E Non-GAAP (‘FWD’) at 8.56, PEG Non-GAAP (‘FWD’) at 0.45. More often than not, people argue about what metrics to use in e-commerce valuation. The prevailing valuations need no such behavior, as most would arrive at the same conclusion.

JD SA Valuation (Seeking Alpha)

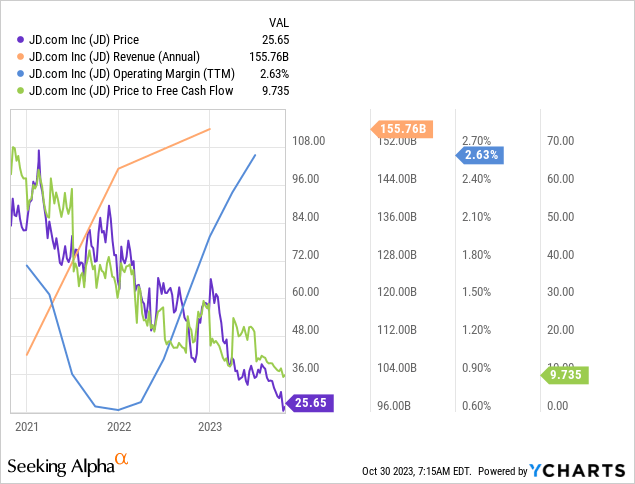

We can use historical figures to showcase how JD is highly undervalued. As I detailed previously, JD is entering into a higher-margin business model, increasing its profitability on multiple fronts. The following chart will compare its price action, revenue growth, operating margin growth, and P/FCF.

As you can see, JD’s fundamentals have improved throughout the 3Y period while its price has gone down, and its P/FCF ratio has dropped from 100+ to a mere 9.7. This is a clear sign of misalignment.

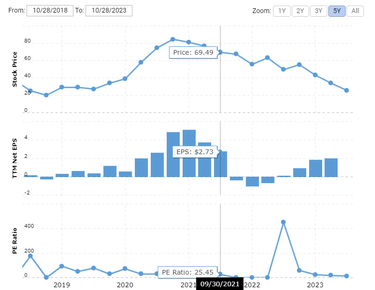

Next, we analyze JD’s price action with EPS and P/E ratio. After its all-time high, JD’s stock price started a downward trend, accompanied by a decrease in earnings per share. At the start of 2022, it went underwater, and its share price continued plummeting. We are closing in the $2.73 EPS mark before going under, where the price was at $70 and P/E at 25.45.

The financial metrics have recovered and exceeded previous marks, yet the price continues to go down, mainly because of macroeconomic worries and uninspiring momentum. As stated, JD’s P/E is now at 8.56 (‘FWD’). JD continues to expand, achieving great numbers in a horrific environment. Thus, it isn’t a reach to assume that the multiple of 8.28 could double to 16.56, as its historical multiple in a financially weaker situation was at 25.45. Two years ago, the company was experiencing COVID-19 turmoil and held that multiple and share prices despite the troubles.

Assuming positive news regarding the Chinese economy or JD comes sooner or later, The multiple is poised easily to expand to double digits. That translates into a share price appreciation, at the target price of $50, double its current $26 share price. Worth mentioning is that JD traded at that $50 per share level less than eight months ago, while it has taken significant steps to improve its profitability, and the Chinese economy has most likely experienced a bottom. In summary, I think JD’s financial and competitive position is largely ignored in its share price, creating an opportune buying moment.

JD Price, EPS, P/E History (Macrotrends)

Competition

JD has long been synonymous with Alibaba in the e-commerce industry, but now the differences have become clear. JD has decided to opt out of aggressive international expansion and focus on perfecting its operations in China. In contrast, Alibaba is expanding into different areas, achieving a 41% increase in growth YoY in International Commerce. JD has superior supply chain and logistics operations, while Alibaba intensely increases its international footprint. JD’s products are also considered more premium than Alibaba’s.

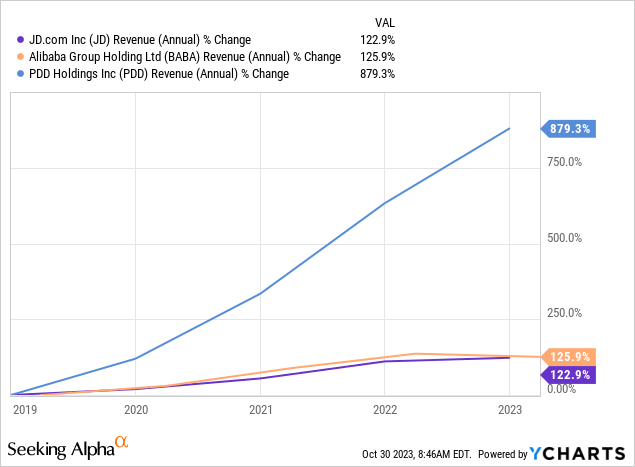

However, Pinduoduo has emerged as the new kid in the block, eating some of JD’s market share and achieving remarkable growth against JD’s and Alibaba’s numbers. PDD is also aggressively expanding Temu in the US, which could grow a worthy contender against Walmart (WMT), Amazon, and the like. PDD doesn’t have the infrastructure to dethrone Alibaba or JD in China, but its low-cost structure forced JD to launch its similar low-cost initiative, hurting its short-term margins. Nonetheless, the e-commerce industry overall in China is expected to grow 11.3% CAGR into 2028, so there will be growth for every player in the land.

Risks

Investing in China, or any country, never comes without risks. The real estate sector is facing a significant battle, and this is a dent in the overall Chinese GDP growth. Kick-starting the economy from the COVID shutdowns with the real estate crisis causes the current deflationary pressures. In my view, this crisis doesn’t drastically affect the consumption of the average citizen. They still want to purchase the majority of what JD offers, and sooner or later, the real estate crisis will solve itself.

Luckily, the current problems also offer a silver lining. Further escalations in geopolitics seem improbable since it would be a dire strategic mistake, especially for China to engage in such behavior, given its current state. Taiwan isn’t a problem today, and US-China tensions should remain in the realm of the sane because both need each other one way or the other to prosper. Minor poking is warranted, but that doesn’t change the thesis for this particular company. Should the geopolitics escalate significantly, it will send every stock market into gushing red along with “Magnificent Seven” -stocks, and that’s the ultimate bear scenario.

Furthermore, I think the worst regulatory issues are also behind us for the foreseeable future since the CCP can’t afford to crack down on the country’s biggest employers and the ones driving the GDP. An article came out that the CCP is encouraging companies to buy back their shares, which has previously been almost the death sin in the Chinese corporate world. Additionally, JD isn’t as targeted compared to Alibaba, as JD doesn’t possess characteristics that are a matter of national security. The atmosphere feels different, and the CCP knows what further harassment could mean for the economy. The only other viable option is to ease with scrutiny, and that’s also the most logical and probable solution.

The competition against Alibaba and Pinduoduo will be brutal, and nobody can forecast the situation in 2028. The most important thing to watch will be JD’s operational efficiency in its core businesses in Retail and Logistics.

Despite the challenges, the recent GDP growth number of 4.9% beat expectations, signaling that recovery is slowly happening. Patience is a virtue at this point.

Price action discrepancies

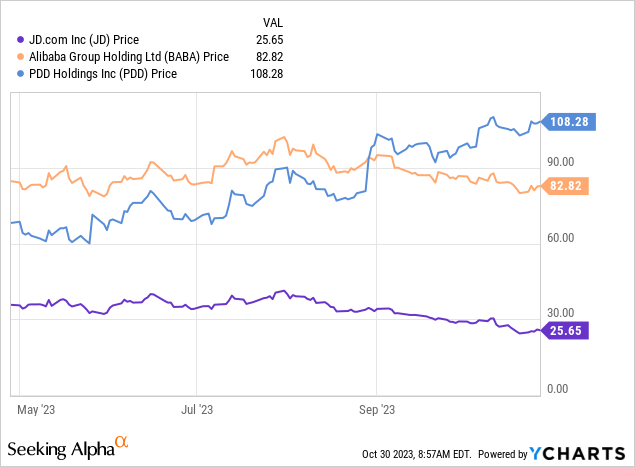

The negative sentiment surrounding Chinese equities this past year has been interesting. The majority has gone way down, and rightfully so. Alibaba even had a good quarter, and yet it’s selling off. However, PDD has defied the gravity, up 30% YTD. Why is that? PDD saw its revenue jump 66% from the year earlier, a monstrous jump in a challenging environment. A big reason for the revenue jump is the low-cost solutions that attracted customers, which explains JD’s operational actions. But isn’t the sell-off of Chinese equities because of the state of the Chinese economy, government, and geopolitics?

JD’s plunge is somewhat rational because of sluggish performance and other risks. Alibaba has plenty of good things going on, and the risks that apply to Alibaba also apply to PDD. Yet one has been selling off and trading sideways, while the other has skyrocketed. It’s hard to find the rationale behind this phenomenon. I think this situation is also applicable to Soros’ self-reinforcing theory. Alibaba stock has a constant negative sentiment around it because it’s synonymous with China and the history of the stock prices driving off the cliff. For Westerners in particular, Alibaba is this distant speculative company that doesn’t really affect their daily lives and is easy to dismiss. PDD doesn’t have the same negative sentiment around it because it made a touchdown at the latest Super Bowl, becoming very real for many Americans and Westerners. Both companies are subject to this bias based on investors’ memories, realities and sentiments.

While these self-reinforcing actions are the complete opposites of these companies, it’s a fact that both are made from the same elements when it comes to risks that the investors worry about the most. It’s as if the momentum is allowing investors to look past the supposed real risks that occupy Chinese companies. Can the same momentum appreciation happen to Alibaba and JD? Absolutely, but the timing of it is really tough since the self-reinforcement process holds true as long as it doesn’t. I think it’s important to ponder these questions and seek rational reasoning behind the emotional stock market.

Conclusion

For those investors who have been burned before or are otherwise bearish about China: I hear you, and I’ve been you. It’s comforting to stay in the “safe zone”; investing shouldn’t keep you up at night. You can probably recite multiple reasons not to invest in these stocks, starting from an example of Russia to several stated risks associated with investing in China. I have also weighed seriously on these issues, and I’m much less biased as a European.

But I decided to sum up all the facts and create realistic scenarios of what can happen. The probabilities are currently in buyers’ favor based on all the available information with logical and strategic reasoning, disregarding sentimental issues. You don’t even have to believe in the classic growth story of China but recognize an obvious dislocation in the market. I believe that once the macro headwinds improve, the institutional money will return, resulting in multiple expansion. JD is a Strong Buy at these levels due to extreme pessimism that almost entirely ignores the financial realities and future of the company.

Read the full article here

Leave a Reply