Elevator Pitch

I assign a Buy investment rating to Jamf Holding Corp. (NASDAQ:JAMF) shares. JAMF’s recent third quarter results were better than what the analysts predicted, and the company is in a favorable position to gain market share at the expense of its rivals.

Company Description

Jamf calls its “cloud software platform” the “only vertically-focused Apple (AAPL) infrastructure and security platform of scale in the world” on its investor relations website.

An Overview Of JAMF’s Product Offerings

Jamf’s November 2023 Investor Presentation Slides

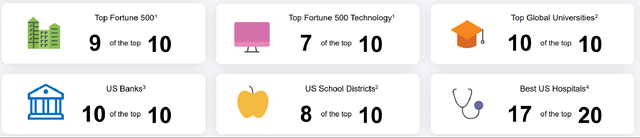

Jamf’s Wide Customer Network

Jamf’s November 2023 Investor Presentation Slides

As indicated in its investor presentation, JAMF derived 79% and 21% of the company’s Annual Recurring Revenue or ARR as of September 30 this year from the Management Solutions and Security Solutions businesses, respectively. In terms of client mix, commercial and education customers contributed 73% and 27% of Jamf’s ARR as of end-Q3, respectively.

JAMF’s Q3 Results Were A Positive Surprise

Jamf revealed the company’s Q3 2023 financial performance on November 8 after trading hours, and both the actual top line and bottom line for Jamf exceeded the Wall Street analysts’ expectations.

JAMF’s revenue expanded by +15% YoY from $124.6 million in the third quarter of the prior year to $142.6 million for the most recent quarter. The actual Q3 top line for Jamf was +2% ahead of the sell side’s consensus sales forecast of $140.1 million as per S&P Capital IQ data.

The company’s diluted normalized earnings per share or EPS doubled from $0.04 for Q3 2022 to $0.08 in Q3 2023. In contrast, the sell-side analysts had forecasted a lower third quarter non-GAAP adjusted EPS of $0.07, before JAMF announced its recent quarterly results.

The above-expectations Q3 top line for the company was driven by the strength of “the strategic core of Jamf’s business, SaaS recurring revenue” and “significant traction replacing the legacy vendor in the commercial space” as per management commentary at the third quarter earnings call. JAMF’s ARR grew +15% YoY in Q3 2023 as disclosed in its November 2023 investor presentation. Specifically, JAMF revealed in its Q3 2023 results release that the proportion of ARR generated from commercial clients increased from 71% as of end-Q3 2022 and 72% at the end of last year to 73% as of September 30, 2023.

Separately, greater economies of scale should have been responsible for JAMF’s Q3 2023 earnings beat. At its third quarter earnings briefing, Jamf stressed that it is “committed to improving efficiency within our business by having our scalability initiatives.” Notably, JAMF’s normalized operating profit margin improved by a significant +3 percentage points from 6% for Q3 2022 to 9% in Q3 2023.

Investors were satisfied with Jamf’s most recent quarterly financial performance as evidenced by JAMF’s share price action. JAMF’s shares declined by -2.5% at the end of the November 8 trading day prior to the company’s Q3 earnings announcement. But Jamf’s stock price went up by +3.5% (source: Seeking Alpha price data) during post-market trading hours following its above-expectations third quarter results release.

Jamf Is In A Good Position To Gain Market Share

In its November 2023 investor presentation, JAMF refers to itself having the “No.1 market position” in the Apple enterprise solutions space. There are various indicators suggesting that Jamf is well-positioned to extend its market leadership over its rivals going forward.

Jamf highlighted at the company’s Q3 2023 results briefing that “one of our larger competitors” is in the midst of “a change in liquidity event” which “creates some uncertainty.” In my opinion, JAMF is likely to be talking about VMware, Inc. (VMW). VMW is in the process of being taken over by Broadcom (AVGO); and fellow SA contributor MontrealValue had noted in its March 27, 2023 article that “VMware has historically been JAMF’s largest competitor.” With VMware in transition, it is reasonable to assume that JAMF can seize the opportunity to expand its market share.

At its most recent quarterly results call, JAMF also shared that “the macro is affecting them (rivals that aren’t of the same scale as Jamf) and probably more drastically than it’s affecting us given our scale.” In general, the pace of industry consolidation tends to accelerate in difficult economic conditions favoring the market leader. As such, it is pretty realistic to expect that sub-scale competitors will most probably cede share to JAMF.

Also, meaningful competition from Apple is also unlikely. Jamf participated in the Canaccord 43rd Annual Growth Conference in August this year and expressed its views on the potential competition posed by AAPL. JAMF emphasized that Apple will “rank so low on the competitive threats because of other competitors” and AAPL’s “non-experience in the enterprise.” From my perspective, Apple is still much more focused on growth opportunities in the consumer space, and this means that the probability of AAPL competing with its partner and supplier Jamf in the near term appears to be low.

Concluding Thoughts

Jamf is currently valued by the market at a consensus forward next twelve months’ Enterprise Value-to-Revenue multiple of 3.8 times, which is way lower than its all-time historical mean Enterprise Value-to-Revenue metric of 8.5 times as per S&P Capital IQ data. JAMF’s third quarter earnings beat and the company’s potential for share gains don’t seem to have been fully factored into its valuations, which makes the stock a Buy.

Read the full article here

Leave a Reply