If you worry about taking risks, don’t do it. – Cyd Charisse.

This has been an extraordinarily one-sided market, favoring large-cap growth all year. That’s about to change, which is why as much as the iShares Russell Top 200 Growth ETF (NYSEARCA:IWY) has done well, it’s vulnerable to a significant correction.

Fund Overview

IYW seeks to track the investment results of the Russell Top 200 Growth Index. This index is composed of large-capitalization U.S. equities that exhibit growth characteristics. IWY was launched on September 22, 2009, and has since amassed over $7 billion in net assets. The fund charges an expense ratio of 0.20%, which is relatively competitive in the exchange-traded fund (“ETF”) space.

No doubt, the fund has delivered strong performance since its inception, outperforming the broader market represented by the S&P 500 Index (Sp500). In 2023, IWY has performed exceptionally well. But if we zoom out and look at the price ratio of IWY against the S&P 500 (SPY), we see that this has had some huge swings relative to the broader stock market, and if anything the trend this year looks like it is vulnerable to reversal.

stockcharts.com

Holdings and Sector Exposure

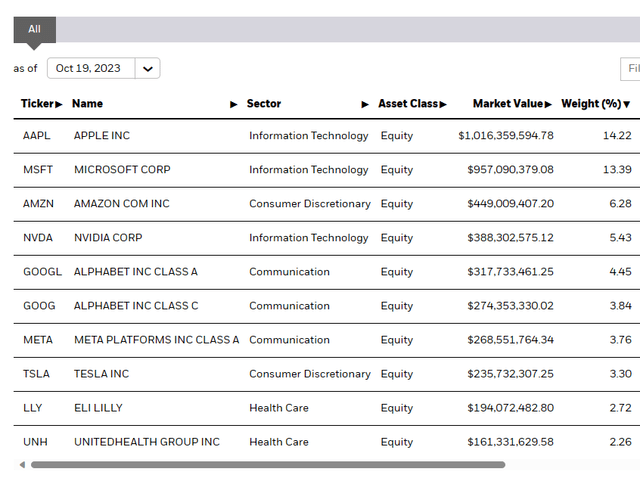

IWY’s portfolio consists of large-cap U.S. companies that are expected to experience above-average earnings growth compared to the broader market. The fund’s top holdings include prominent technology companies such as Apple Inc. (AAPL), Microsoft Corp (MSFT), and Amazon (AMZN). These holdings represent a significant portion of IWY’s portfolio. They have been the place to be, but also now I believe are a source of liquidity.

ishares.com

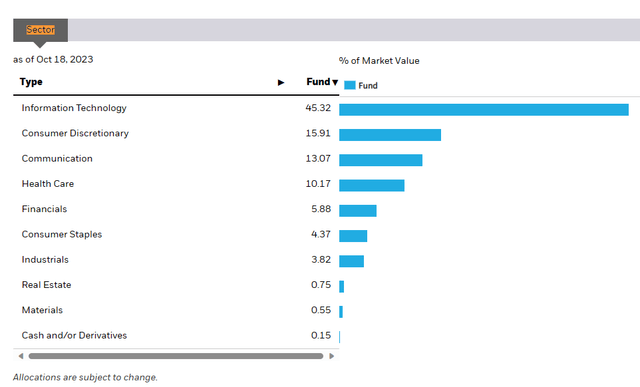

Sector-wise, IWY has the majority of its holdings in the Information Technology sector, which accounts for approximately 45% of the total portfolio. Other notable sectors include Consumer Discretionary, Communication, and Health Care. This sector concentration reflects the growth-oriented investment strategy of IWY. It also reflects what could be a real pain point entering a corporate credit event.

ishares.com

Peer Comparison

To gain a better understanding of IWY’s performance and positioning in the market, it’s important to compare it with similar ETFs. Two notable competitors are the Vanguard Growth ETF (VUG) and the iShares Core S&P U.S. Growth ETF (IUSG). When comparing the performance of these ETFs, IWY stands out as it has outperformed both VUG and IUSG over the long term substantially. This is mainly due to the more concentrated nature of IYW, and again – this, I believe, is what makes the fund vulnerable on a relative basis.

Valuation Analysis

While IWY has delivered strong returns, its valuation is elevated. The forward P/E ratios of the major sectors in IWY’s portfolio, such as Information Technology and Consumer Discretionary, are higher than their historical averages. This suggests that these sectors may be trading at relatively expensive levels. The current P/E ratio is 33.46 – hard to justify with interest rates where they are. I believe valuations matters in higher rate environments, and it’s only a matter of time for this to come back to earth.

Conclusion

The iShares Russell Top 200 Growth ETF offers investors exposure to large-cap U.S. companies with strong growth potential. The fund has a track record of delivering solid performance, outperforming the broader market in the long run. However, given current valuation levels and potential vulnerability to market dislocations, this is a strong pass for me now.

Read the full article here

Leave a Reply