Introduction

The WSJ reported yesterday that Exxon Mobil (XOM) is in the late stages of finalizing a deal to purchase Pioneer Natural Resources (PXD) in a deal worth roughly $60 billion. A direct consequence of last year’s boom in oil prices which has left oil majors with cash to burn: Exxon reported a record profit of $56 billion in 2022 and held just shy of $30 billion in cash at fiscal year-end. The deal could be finalized and officially announced before the end of next week.

The potential Exxon-Pioneer deal is the latest in an emerging mergers and acquisitions boom in the oil and gas upstream sector. Enverus Intelligence released a report in July of this year stating M&A activity in the oil and gas upstream sector totaled $24 billion in the second quarter of 2023, tripling from $8 billion in the first quarter.

The natural question then, is which stock can investors look to next in the oil and gas M&A boom? In this article, we will take a look at a stock that has been gaining attention from investors, perhaps attributable to the fact that it is one of the worst-performing large-cap oil & gas stocks of the year: Devon Energy Corporation (NYSE:DVN).

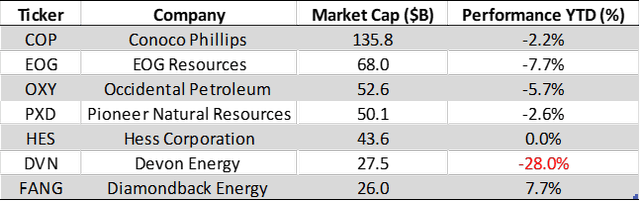

Relative Performance

With a market cap of $28 billion, Devon Energy is the sixth largest publicly listed oil & gas exploration company in the United States and the worst-performing of the large-cap stocks in its industry.

Data from Finviz.com

Priced at $43 per share, DVN stock is currently at 52-week lows, down a massive 45% from its 52-week high, down 28% YTD, and threatening to make new lows. In comparison, the iShares Oil & Gas Exploration ETF (IEO) is down just 1.95% YTD and down 14% from its 52-week high.

stockcharts.com

Does this massive underperformance from DVN present a major opportunity for investors given the backdrop of an M&A boom, or signal a major red flag?

The market perhaps leans towards the latter. Following the WSJ report of Exxon’s potential takeover of Pioneer, the reaction across the remainder of the industry remains muted. While, as of writing, Pioneer stock is up approximately 10% on the news of its pending acquisition, none of its peers have managed to gain more than 100 basis points. Devon Energy itself is up a mere 0.6% on the news. The market’s response may change in the coming days as it fully digests the news, but for now, this signal (or lack thereof) suggests that the market doesn’t have much faith in another industry mega-merger in the immediate future.

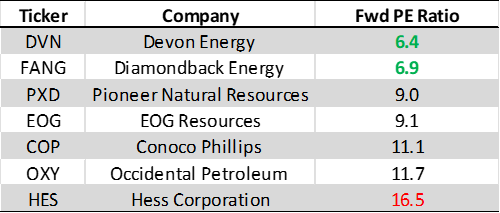

Valuation

In favor of a Devon Energy acquisition, it is perhaps the cheapest stock in the industry boasting a forward PE ratio of just 6.4 in comparison to Pioneer’s forward PE ratio of 9.0 (based on its price prior to the acquisition announcement).

Data from Finviz.com

Putting aside any potential acquisition for a moment, Devon Energy may be worth considering on a pure valuation basis. Whether or not Devon Energy is a good value investment hinges largely on whether oil prices will remain elevated. According to the Secretary General of OPEC as recently as October 3rd, higher oil prices are here to stay attributable to the recent and extended period of under-investment, supply cuts, and relentless demand growth.

Investors may also be attracted to Devon Energy’s well-defined dividend strategy to share a substantial portion of its free cash flow with its investors. A couple of years ago, the oil company introduced a unique dividend framework consisting of a fixed and variable dividend. It pays a flat quarterly dividend that it aims to maintain even during periods of lower oil prices. Additionally, it distributes up to fifty percent of its remaining free cash as variable dividends. In the calendar years 2021 and 2022, Devon Energy paid investors dividends totaling $1.97 and $5.17 respectively. Yields of 4.6% and 12% based on the current approximate share price of $43. In 2023 YTD, Devon has paid investors total dividends of $2.10, or a 6.51% annualized yield.

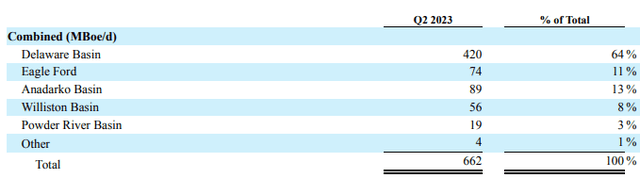

Devon Energy Assets

The idea that Devon Energy could be the target of an acquisition is also supported by the geographic location of the company’s assets. The Enverus Intelligence report cited earlier states that M&A activity is largely focused on operations and assets located in the Permian Basin. According to Devon Energy’s corporate website:

Devon’s operations are focused in five core areas: the Delaware Basin, Eagle Ford, Anadarko Basin, Powder River Basin and Williston Basin.

The Delaware Basin is the second largest component of the larger Permian Basin and, according to Devon Energy’s latest 10-Q, accounts for 64% of the company’s combined production volumes across Oil, Natural Gas, and Natural Gas Liquids.

Devon Energy Q2 2023 10-Q

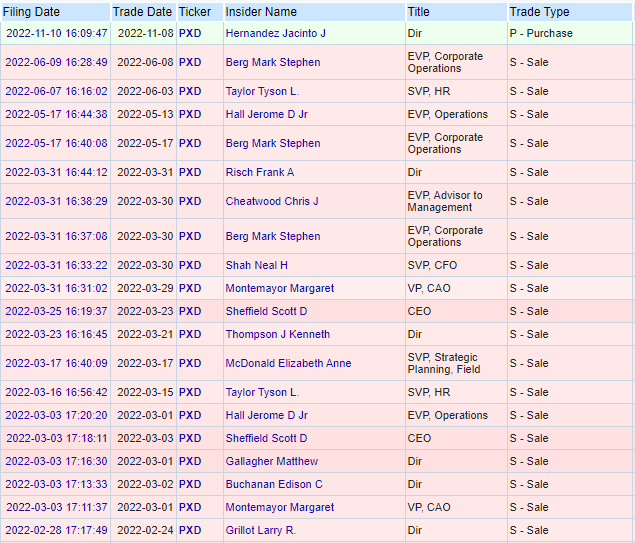

Insider Trading Activity

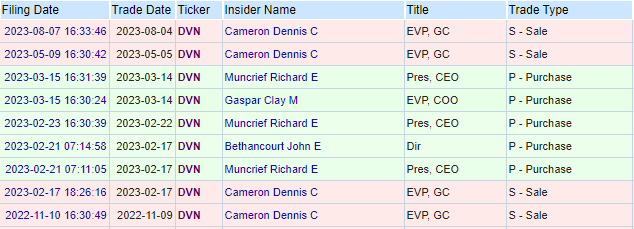

One factor working against the theory that Devon Energy could be a potential takeover target – at least in the immediate future – is the recent insider trading activity.

When company executives are privy to the fact that their company is currently the subject of an acquisition negotiation, their fiduciary duty to shareholders prevents them from initiating new transactions in the publicly traded financial products of their employer. Put simply, corporate executives are understandably prohibited from front-running acquisition news and illegally profiting off of private information at the expense of public investors. As a result, insider trades can provide a useful source of information to public investors regarding the potential and likelihood of acquisitions. Specifically, it is common to see corporate insiders “go quiet” – stop trading in their company stock – for an extended period prior to an acquisition announcement. For example, in the instance of Pioneer Natural Resources shown below, insiders consistently sold batches of stock throughout all of 2022 until June of that year when insider sales suddenly ceased. One purchase transaction can be seen in November of 2022 and then not a single transaction occurred for almost one whole year, bringing us to the present day when it is reported that the company is about to be acquired.

Pioneer Natural Resources Insider Trading History (OpenInsider.com)

In comparison, Devon Energy insiders have been transacting in company stock as recently as August.

Devon Energy Insider Trading History (OpenInsider.com)

This is not to say that Devon Energy could not be the subject of a surprise or hostile takeover bid, but it does almost certainly indicate that the company is not currently in talks to be acquired. One positive sign from insider trading activity is Devon Energy’s own CEO stepping up to buy over $1 million worth of company stock in open market transactions and at prices 25% above the current market price.

Final Opinion

Personally, I am a sucker for value investments. If I see a stock down nearly 50% from its highs my interest is immediately piqued. That’s not to say that I will immediately buy that which is out of favor with the market. In the case of Devon Energy, however, I am interested. Fossil fuels such as those supplied by Devon are an integral part of the modern economy and regardless of how much noise may surround the transition away from these fuels, I believe they will play a major role in the economy for decades to come. I like the cheap valuation of the business, which has come about due to recent weakness in the share price, and provides an attractive entry point regardless of any potential acquisition in the near future. I also like the concentration of the company’s assets in a geography that has proven itself desirable to the majors and other acquirers, especially considering the growth in M&A activity of the sector. As a final benefit, I like to see the CEO stepping up and putting his own hard-earned cash on the line, aligning his own incentives with those of the shareholders. Devon Energy gets my vote of approval and I believe shareholders entering at current levels will be rewarded in time.

Read the full article here

Leave a Reply