Thesis

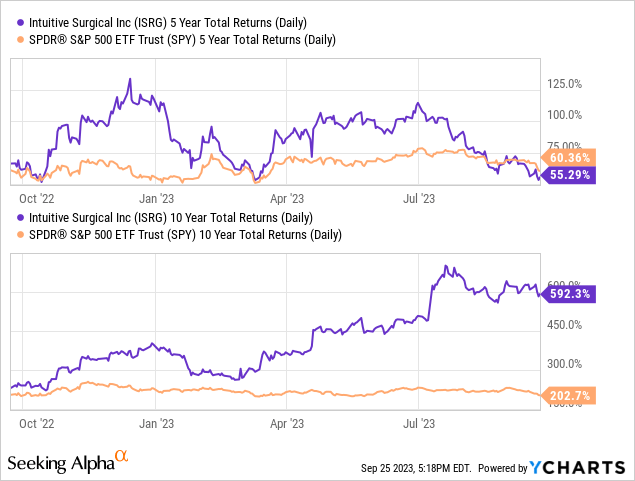

Intuitive Surgical (NASDAQ:ISRG) is an interesting, high-quality company that has generated strong returns for early investors. However, due to the hype and increased multiple, new shareholders are unlikely to see the same returns going forward. Therefore, if you are planning to invest in this company, I would wait for a better entry point as the market will most likely offer opportunities due to temporary issues that the market overreacts to somewhere in the future. Because what is currently missing is an attractive entry point for new investors.

ISRG’s Competitive Position

ISRG has a whopping 83% recurring revenue because of their business model where customers buy their surgical systems, but they also have to have a service contract and the ability to buy additional parts. So their differentiation is that they have built an ecosystem. Because doctors need to be trained on new surgical systems, switching costs are quite high, and barriers to entry are also high because it is difficult to acquire the knowledge to build surgical systems that are as good as ISRG. Even established companies like Johnson & Johnson (JNJ) will struggle to build the same ecosystem.

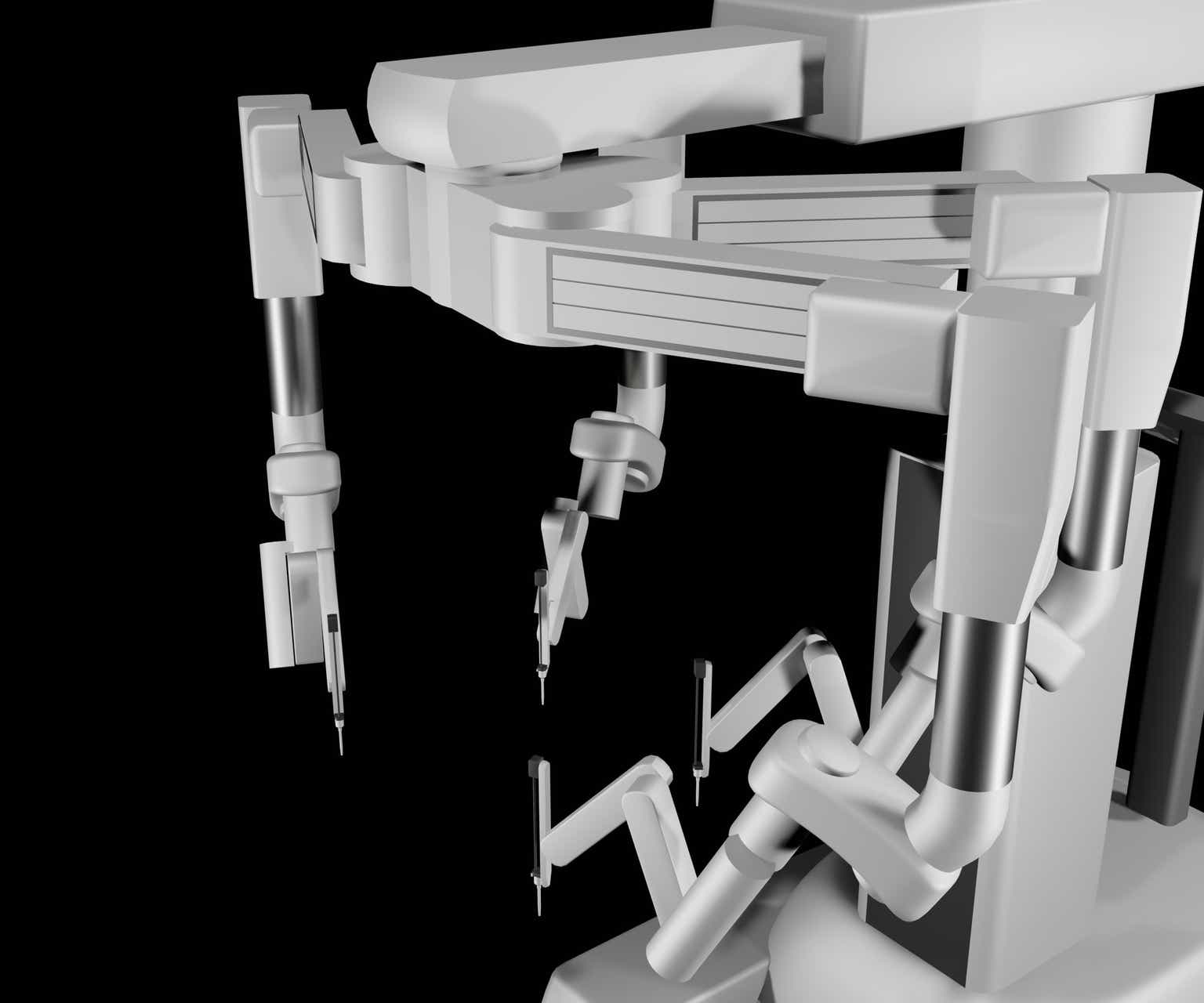

With the Da Vinci SP, Da Vinci Xi and Ion, ISRG is well positioned for the future. Combined with their large investments in research and development and their relationships with many hospitals in the U.S., they have a sticky business model that is not easy to disrupt.

ISRG’s balance sheet is also healthy, as they have $5.7 billion in cash and equivalents and zero total debt. So they get full points for their liquidity when we also factor in their ability to generate FCF.

In summary, IRSG has a competitive advantage, high switching costs, high barriers to entry, while also having a fortress-like balance sheet, while also having very high recurring revenues. So it is almost everything an investor wants to see in a company.

Intuitive Surgical’s Capital Allocation

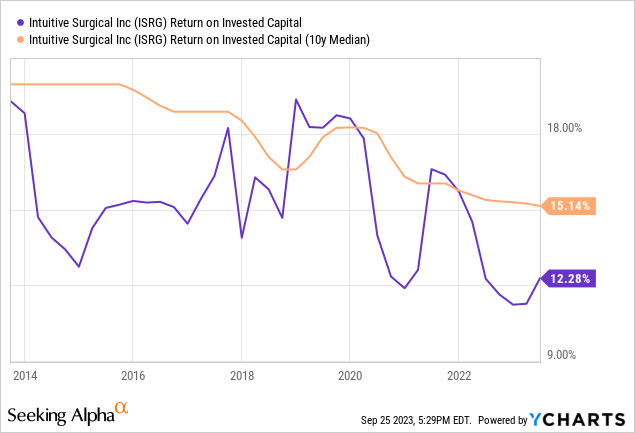

Companies that continually improve their ROIC tend to be the best investments. In contrast, companies with declining ROIC tend to be underperformers. Unfortunately, ISRG is in the second category, as its ROIC has been declining since 2014. This can be seen particularly well if you look at the median of the ROIC 10y in the above chart. If ROIC were to settle at around 15%, it would be strong, but not extraordinary, as there are many companies with much higher returns on capital. But ISRG’s advantage is that they have no debt and therefore have a low cost of capital, resulting in a favorable ROIC-WACC spread. So they are still creating enormous value with their use of capital.

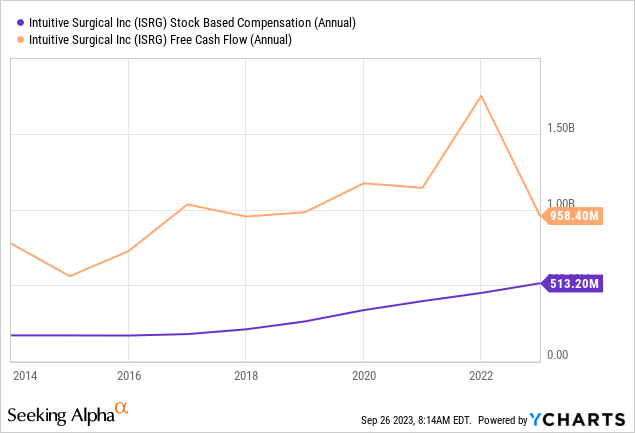

The FCF compound annual growth rate over the last 10 years is 6.23%, and even if we exclude the SBC charges, the FCF is still positive. And there are a lot of companies where that is not the case today. However, SBC costs are rising faster than FCF, so this is definitely something to keep an eye on. But they still have between $400 million and $1 billion+ of FCF each year to spend.

ISRG’S Valuation

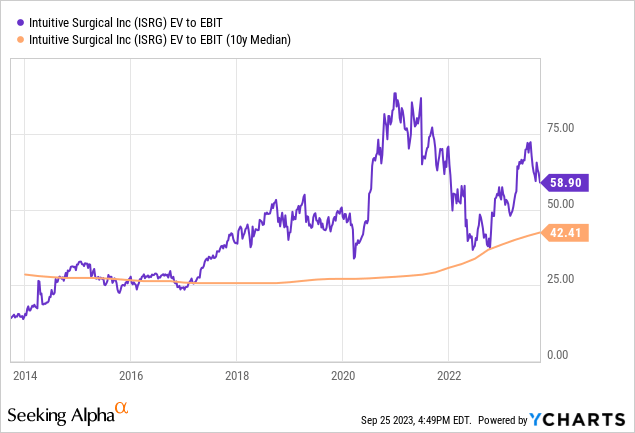

At around 58x, ISRG trades well above its 10-year median EV/EBIT multiple of 42x. And the 10-year EBIT CAGR of 5.91% is not enough to justify such a high valuation. For investors seeking a return above the long-term TR S&P average of about 10%, the multiple should be more in the 20x to 25x range to have a good chance of achieving it.

If you had bought this company 5 years ago at 40 to 45 times EBIT, you would have had almost the same return as the S&P 500 over that period, as you can see in the first chart above. However, if you had bought at 20x EBIT, as in the second chart, your returns would have easily beaten the S&P. So the entry point is very important, and with a 58x multiple, the probability that future returns will be unsatisfactory is high.

So I would say an entry point of about 20x to 25x EBIT would be preferable for long-term investors. Maybe even 30x, depending on the market environment. At the Wells Fargo Healthcare Conference, ISRG said that their customers have a constrained budget right now and hospitals are working through their backlog, so the 58x multiple could be a little lower on a normalized basis. Nevertheless, the company is highly overvalued at this price.

Reverse DCF To See If ISRG’s Share Price Is Justified

Author

- Diluted EPS TTM: $3.99

- Discount Rate: 10%

- Terminal Multiple: 30x in 10 Years

To justify the current share price and generate a 10% annual return, ISRG must grow diluted EPS by 23% annually over the next 10 years. Over the past 10 years, its compound annual growth rate was 7.64%. This is very different from what is required for the next 10 years and again shows that the stock is currently overvalued. Sure, they could surprise us, but 23% over 10 years is a hell of a task. It would put them in a league with very few other companies.

Risks

The biggest risk to future returns is clearly the high valuation, but another risk is that China, which currently accounts for 5% to 6% of all procedures, is at risk of cutting budgets due to economic problems. China is also a growth opportunity, but regulatory timelines are very long and a decision on the pending application is not expected until 2024. Korea is the same.

Growth Opportunities

China is a growth opportunity for almost every company today, and India is likely to follow in the next few years. First Ion systems were also installed in Europe during the quarter, and new procedures for colon, HBP and hernia are in the pipeline. In general, the plan is to expand into more areas with their robotic surgery systems and there is definitely a demand for this as this company is helping to improve people’s lives. I see a great deal of opportunity in this industry over the next few decades. But the question is, will the growth opportunities be enough to grow earnings to match the valuation?

Conclusion

A very powerful company that will move humanity forward, but at this price it is probably not an investment if you want to achieve a 15% CAGR. I do not see room for multiple expansions and therefore the returns in the future will only consist of earnings improvement. Over the past 10 years, EPS has grown 7.64% annually and net income has grown 7.27%. So if they stay about the same, future shareholder returns will be about that, plus a dividend if they pay one in the future. So I would say at this share price you could expect a high single-digit return, probably between 7% and 9% over the next 10 years. In any case, a steadily rising dividend would positively influence shareholder returns, as they have the FCF to pay one. All in all, as a potential new investor in ISRG, I would wait for a better entry point.

Read the full article here

Leave a Reply