Dear readers/followers,

Advertising has not been in a good spot for large parts of 2023. This has especially impacted your traditional advertising businesses. I’m talking about companies I’ve covered for a long time, like Omnicom (OMC) as well as Interpublic Group (NYSE:IPG). I cover more than just these, including some European ones, but in this case, I’m going to be looking at Interpublic Group to see what’s happened and what we can expect going forward.

Interpublic Group has mostly played second fiddle to my investments in companies I view as superior, such as Omnicom. The company is smaller, has less appealing fundamentals as well as a lower yield.

In this article, I’ll update you on IPG for the first time in over a year – let’s see what we got.

Updating on The Interpublic Group of Companies

My thesis on this company has actually performed fairly well. Since selling my very modest position back in early January when I felt that the upside, given the rates and what else was available out there, I was actually up over 25% in a short time inclusive of dividends.

However, I did not provide many readers with adequate guidance to alert them to my own way of handling the situation, so this is what we currently have. Not a negative return, but market underperformance if you held onto your shares.

Seeking Alpha IPG RoR (Seeking Alpha)

Something about IGP then. IPG is a company with operations across the globe. It’s one of the world’s largest advertising and market service companies, employing 56,800 people and with a BBB credit rating. It has a well-covered yield and a long history of stable performance.

That’s the positive fundamentals and upsides you have here. I would argue that anyone who says that you need to worry fundamentally about the business really isn’t being that truthful.

This is really, on a fundamental basis, one of the best advertisers out there. I’m talking about an above-average operating margin at a near-9% net margin with a class-leading (or really up there) RoE of 26.5%, which is in the upper 85th+ percentile in its sector. The company is consistently profitable with very good ROIC relative to its cost of debt and capital. The last time it was even close to negative here was back in 2013, and that was only for a short time.

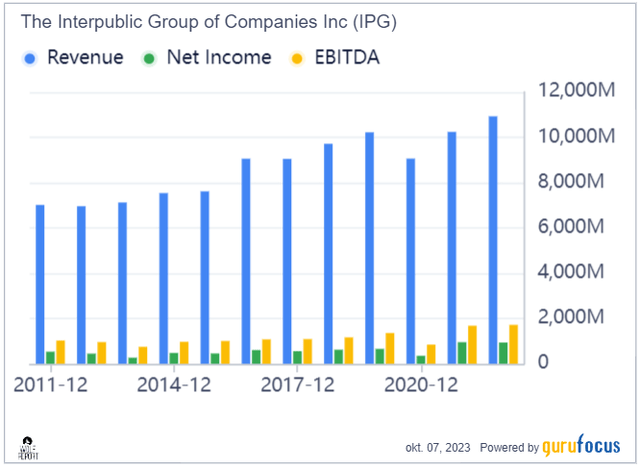

There have been speedbumps in terms of revenue and EBITDA, but the overall major trends are very good.

IPG Revenue/net (GuruFocus)

In terms of the business model, looking at basic things like COGS, like SG&A, while COGS-heavy, it’s a working business model that generates around an $8-$9 net profit on $100 revenue.

However, the company also operates in one of the quickest-shifting and rapidly evolving spaces. Media channels continue to shift, fragment, and evolve and the consumer environment can’t be characterized as anything except “complex” in a world where the internet has been given the sort of role that it has in our daily lives today.

So the question you need to begin asking yourself is – is this even something you want to be in? Because there are safer places to deploy capital.

The ancillary Telco business is a good example. It has a significantly better yield, it has more stability (though not necessarily share price stability as of late). There are others as well. I’m not saying any one specific sector is “safe” here, we’ve seen incredible declines in the past few months, but the fundamental safety is higher than in other businesses in advertising. This has to do with the typical contract structures and customer trends, which are changing much quicker than in other sectors.

However, one of the most common misconceptions that were levied at the business during the onset of COVID-19 was that legacy marketing and advertising companies would crumble like stale cookies in the face of “new technology” – and this has been proven demonstrably false.

IPG and peers such as Omnicom and Publicis Groupe (OTCQX:PUBGY) in fact performed superbly, and what we saw in terms of reversion following post-pandemic trends saw significant growth in both revenue and profit – In fact, higher than ever before. There were records following this period. And the current downtrend isn’t really based on earnings worries. This is what provides a really mixed view of the entire sector here.

The latest results confirm this overall positive picture. We’re looking at the decline in revenue – down around 2%. The company took advantage of the low valuation to repurchase shares, which is…fine (though I’d have preferred focusing on debt here, even at a low 1.29x to equity and 2.84x to EBITDA).

Every single metric that matters saw a decline – except expenses, showcasing some of the structural challenges the industry is facing. The income industry was down $30M which for a company with quarterly results of around $350M is significant. Thanks to lower provisions for income taxes, the company’s net income was up YoY though.

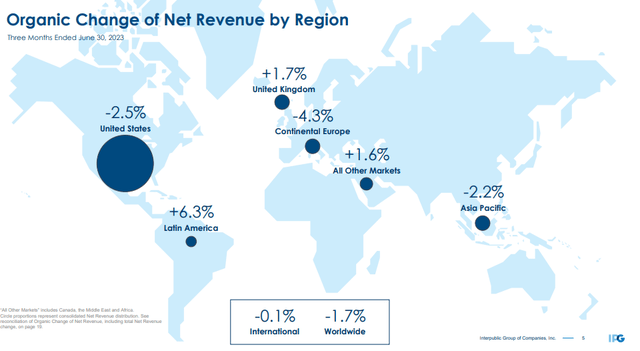

A quick geographic look shows us the weakness and strength of the company’s sectors, with the US-heavy mix being a bit of a problem as the only markets going up are where IPG has only a limited presence.

IPG IR (IPG IR)

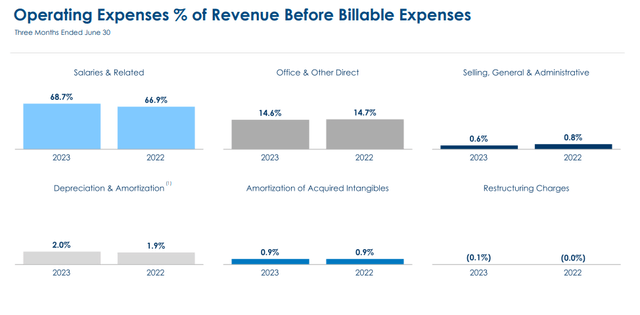

As I said, the company does not have expenses under control yet either. The company’s expenses for salaries are actually up around 200 bps on a YoY basis, and this is what is driving these changes, given the amount of salary/employee costs for a business like this.

IPG IR (IPG IR)

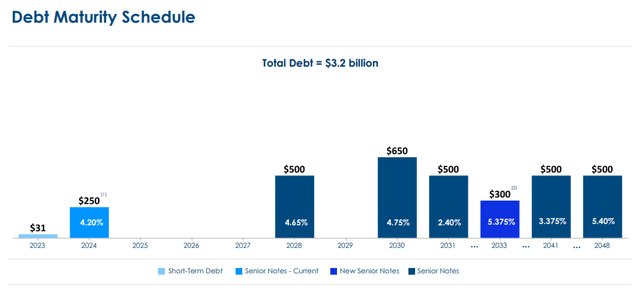

On the whole of it though, the company is solid. What I mean is that debt is very much under control, with a solid maturity schedule with expirations between 2028 and beyond 2030.

IPG IR (IPG IR)

The challenge for this entire industry is the unclear trends in advertising going forward. Current IPG organic growth is impacted by a lack of tech advertising/tech softness. The specialty agencies within IPG are seeing significant headwinds, and I view it as more than just slight softness. It seems like a pullback in spending. To give you an illustration of this drop, we’re talking from a 15% of net revenue down to close to below 12% in 2Q23 (Source: IPG 2Q23), and a 3% mix drop in around a year is obviously significant.

The question is also, how will AI impact this sector and the various companies in it?

The current uncertainty on a macro level makes it unclear to me how we should forecast not only IPG but other companies on a forward basis. Growth is currently expected, and I want to reiterate that I don’t see any of these trends turning these legacy advertisers into “dinosaurs” – but I do believe we’ll see an increasing cost pressure as well as pricing pressure. This is not made easier by the current macro.

Positives do exist. The company’s forecast for this year is not actually dependent on any massive recovery. The trends in tech and telco advertising are significant – that’s where pressure currently is, among other areas.

Whenever an industry is going through a significant change like this, I become somewhat careful. Why? Because we don’t know how low things may end up going. This goes beyond IPG and to the entire sector, including Publicis.

When we get more clarity here, I will be the first one to invest and take advantage of what I hope will be a low valuation at that point – but for now, let’s look at valuation and impact here.

IPG – The valuation is positive, and there is an upside despite the risk

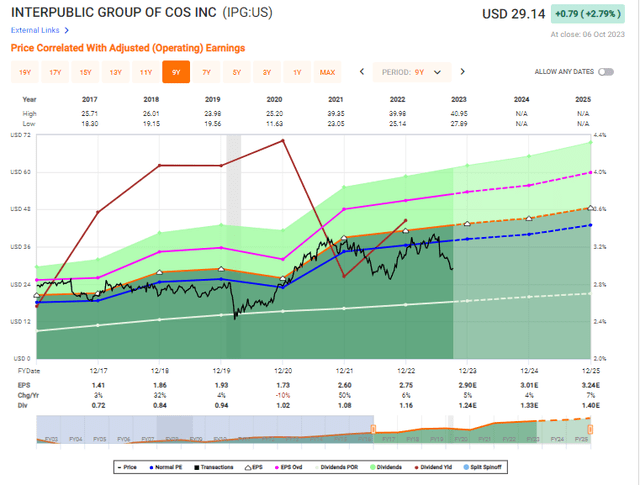

At the current 10.17x normalized P/E, I do view IPG as a “BUY” here. The sector is under definite pressure, and we should be careful in what we expect. I would also point out some of the company’s peers that are larger and might have a larger upside, such as OMC, but there is absolutely no denying that the company is at an attractive level here.

F.A.S.T Graphs IPG Upside (F.A.S.T Graphs)

As you can see, we’ve seen the company drop to around these levels before reversing. The reason why I want to be careful here is that I don’t necessarily consider the forward trends in terms of growth to be all that likely given the cost pressures and sector/macro trends we’re seeing here.

Yes, even on a discounted 12.5x we’re having almost a 21% upside to the 2025E results – but this is based on EPS growth above 6.5% per year, which I don’t necessarily consider that likely. And if that isn’t likely, how would a flat or 2-3% EPS growth rate impact valuation?

I would prefer to err on the side of safety and forecast at 10-11x P/E, which means our upside is between 10-15% per year, at best.

You may start seeing here why I’m not as positive as others – but why I do say “Yeah, you can buy the company here”.

The thing is, IPG’s closest peers more or less have almost the same upside. OMC is almost exactly the same in terms of upside, despite a 1% lower yield, but better fundamentals. So the advertising industry we’re seeing today gives you a potential 10-16% at a P/E of 10-11.2x on a forward 3-year basis assuming an earnings growth of 5-7%.

If you think that you’ve seen better alternatives in the last few weeks, that’s probably because you’re right – there are alternatives with better yields, better upsides, and better fundamentals in the communications and telco sectors, many of which I actually cover.

So while I do view IPG as a “BUY” here – I would encourage you to take a look at other alternatives for your investing here, because finding a 5-8% yield with a better upside isn’t hard.

S&P Global analysts definitely consider the company to be undervalued here. With a low target in the range of $33/share to $43 on the high side, every single analyst is considering the company undervalued here – 11 of them. That’s why it’s very surprising to me that 8 analysts are at “HOLD”. I believe it echoes my own concerns about the sector.

But my target isn’t the $38/share average that is being covered by those analysts – I would say the target is closer to $35/share, so I’m lowering my price target here to account for the uncertainty and rate increases we’ve seen of the past year.

Here is my thesis for the company as it currently stands.

Thesis

I have the following thesis for IPG:

- This company is a “BUY” with a PT of $35 based on decent earnings and positive trends. There are advertising companies with better fundamentals, which is what led me to favor OMC above IPG, but IPG is still a good business. However, given what other alternatives are available on the market today, I would be careful about going “too deep” into this company here.

- I view the downside as unlikely given the market dynamics for companies such as this are continually positive.

- I continue to hold a very small position of shares and may add more here if we see more drops.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

The company also fulfills several of my investment criteria.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company has a significant upside/is cheap based on conservative forecasts and historical valuation trends.

Thank you for reading.

Read the full article here

Leave a Reply