In this new article about International Seaways (NYSE:INSW), I will explain why I believe that the company is still worth a STRONG BUY recommendation. Particularly, I will provide an overview of the 2023-Q2 results and I will explain why the current oil tanker dynamics could provide International Seaways with room for further growth and upside.

If you are interested in other tanker companies, I also recently covered Teekay Tankers and Scorpio Tankers.

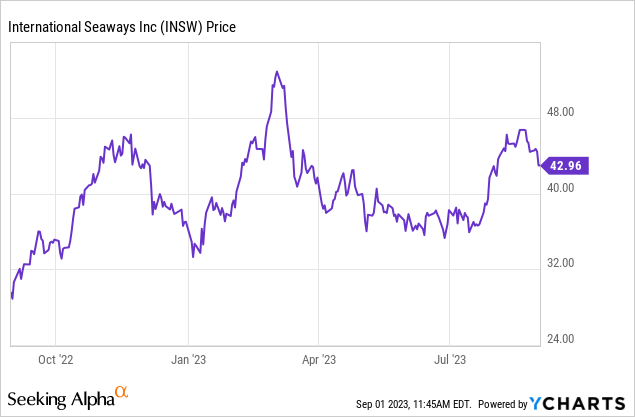

Stock Performance

International Seaways is currently trading at $42.97/share, equivalent to a market cap of $2.1 B. During the last year, the stock increased by 46% reaching a peak of $52.9/share (52-week maximum, March 3rd, 2023) and a minimum of $28.9/share on September 1st, 2022. Since the beginning of the year, International Seaways has increased its value by 16%, and I believe that the bullish rally is still not over. When I wrote my last article about the company, the share was at $41.8 and has ever since gained a 3%.

2023-Q2 Financial Results

During the second quarter of 2023, Time Charter Equivalent (TCE) revenues increased 55% year-on-year, from $186 M in Q2-2022 to $286 M in Q2-2023. The increase in revenues was uneven across the tanker types: crude tankers’ revenues increased by 148% or $89 M while product tankers’ revenues increased by 10% or $13 M. This skewed growth led to an increase in the weight of crude tankers’ revenues from 32% in Q2-2022 to 51% in Q2-2023.

If we compare Q2-2023 revenues with the previous quarter (Q1-2023), one can see that TCE revenues only increased by 2% with crude tankers’ revenues increasing by 16% and product tankers decreasing by 10%.

It is also worth mentioning that International Seaways, differently from other companies, generates more than 90% of its revenues in the spot market.

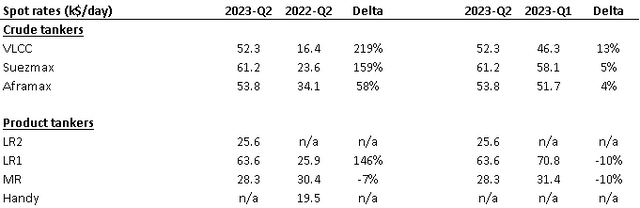

The increase in revenues is mostly explained by the increase in day rates rather than revenue days. Indeed, as can be seen from the table below, day rates increased y-o-y across all vessel types with the only exception of MR vessels. The story is a bit different if we compare Q2-2023 with Q1-2023: in this case, crude tanker rates increased across all vessel classes, while product tankers decreased.

International Seaways

Moving to the cost side, total operating expenses increased less than proportionally if compared to revenues, going from $100 M in Q2-2022 to $123 M in Q2-2023 (+23%). The largest cost items are vessel expenses ($65 M, +10%), D&A ($32 M, +19%) and G&A ($12 M, +6%).

Net income was positive at $153 M, up 122% from $69 M recorded in 2022-Q2.

Cash Flows, Liquidity and Capital Structure

Cash flow from operations generated during the first half of 2023 was positive at $414 M, mostly driven by the high net income. Cash flow from investing was negative at -$208 M due to CapEx being spent on vessels (3 new dual-fuel VLCCs) and vessel improvements. Cash flow from financing was negative at -$333 M due to dividends paid ($177 M) and debt restructuring. As of June 30th, International Seaways has total liquidity of $493 M composed of cash for $236 M and an undrawn revolver for $257 M. Total debt amounts to $947 M while net debt is $711 M. Noteworthy, the first debt maturities will not be before November 2026.

Market Dynamics

From the analysis of Q2 results, it is clear that International Seaways has a strong financial position and is generating a significant operating cash flow thanks to the high tanker day rates. Indeed, the success of a company such as International Seaways is strictly related to the market dynamics: if the market is tight, then day rates are high and oil/product tanker companies will be able to generate healthy cash flows.

In the last year and a half, due to the Russian-Ukrainian conflict, day rates have reached levels never seen before. While rates are now slightly lower than a few months ago, they are still around levels that ensure profitability for International Seaways (day rate cash breakeven is about $16k/day).

In the next months, I believe that these dynamics will still support such levels due to a mismatch between tankers’ demand and supply. Oil tanker demand is expected to increase driven by rising oil demand (+2 Mbbl/d in 2023 and +1.5 Mbbl/d in 2024, IEA) and decreasing inventory levels. On the other hand, the supply of tankers is still limited with newbuild slots not available before 2026. Oil and product tanker companies are also thinking twice before placing new orders due to potential environmental regulations that could mandate new vessel features and, in addition, prices for newbuilt vessels are currently above historical averages.

Overall, these dynamics will sustain high day rates, benefiting International Seaways.

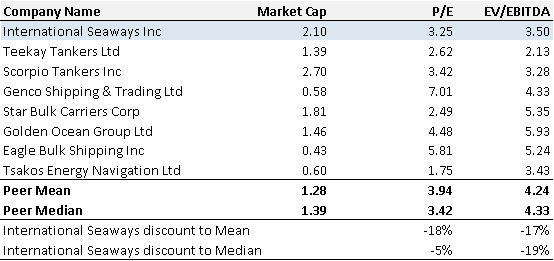

Peer Comparison

To have a better understanding of how International Seaways is trading, I performed a peer multiple review. I chose a panel of oil/product tanker companies with a comparable market capitalization, and I analyzed the P/E and EV/EBITDA. The results show that International Seaways is trading at a discount to other similar companies: P/E is trading at an 18% discount to the mean and at a 5% discount to the median, while EV/EBITDA is trading at a 17% and 19% discount respectively. In other words, International Seaways is currently cheaper than other oil/product tanker companies.

Thomson Reuters

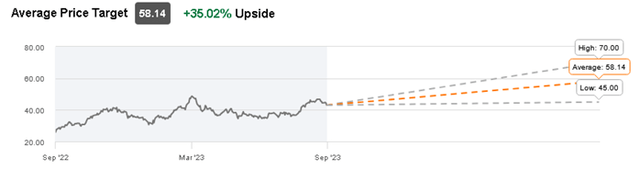

Target Price

International Seaways is covered by 7 equity research analysts who have issued a rating in the last 90 days. Six of them suggested a strong buy recommendation, while one provided a buy rating. The average target price is $58.1/share, which would represent a 35% upside versus the current trading price.

Seeking Alpha

Risks

Coming to the risks, I believe that the largest one to which International Seaways is exposed is represented by events that could disrupt the tankers’ demand/supply dynamics. In terms of demand-side events, the most realistic risk is a drop in oil demand and consequently in oil tankers’ demand, with an unavoidable reduction in day rates. From the supply side, a potential disruption could happen if, all of a sudden, new vessels enter the market. In this case, more vessels supply, if not followed by an increasing demand, will lead to lower day rates, even though, I believe this is a very remote option.

In addition, we should always remember that companies operating in maritime transport are always exposed to risks such as piracy, incidents, and environmental issues. International Seaways is insured against this type of risk but, as the company discloses in the 10-K, insurance may not be adequate to cover potential losses.

Conclusion

Overall, I believe that International Seaways is a good stock to own. The company is strong from a financial point of view and the market in which it operates is experiencing favorable dynamics that will continue in the next months.

Read the full article here

Leave a Reply