Investment Thesis

IFF (NYSE:IFF) is one of the world’s largest specialty ingredients producers. Their products are utilized in consumer and industrial products across the globe and have become an essential element of many different supply networks.

The firm’s difficult FY23 results have been characterized by weakness in their largest revenue stream of Functional Ingredient products leading to falling profitability and revenues.

Recent acquisitions have led to internal operational inefficiencies which have become compounded by the weakening macro environment.

However, the firm’s core business case is still sound with management being laser focused on divesting inefficient businesses from the firm. When combined with a potential 40% undervaluation, I believe a Strong Buy opportunity could exist for value-oriented investors.

Company Background

IFF FY23 Q2 Press Release

International Flavors & Fragrances is an American producer of specialty scents, fragrances, flavorings, food stuffs and pharma solutions which are used as components in a variety of consumer products.

The firm’s products may be niche and often invisible to the end-consumer but that hasn’t stopped IFF from carving out a meaningful position within the food and cosmetics industries as an indispensable supplier of products critical to the consumer value chains of other companies’ consumer products.

Many of the firm’s additives are essential elements of different packaged food, cosmetics and cleaning products. This has helped make the firm itself a critical supplier to many different companies who rely on IFF’s unique portfolio of products to manufacture their own product offerings.

IFF has grown through multiple acquisitions and mergers to become the dominant player within their unique commodities industry. The most recent acquisitions of Frutarom in 2018 along with DuPont’s (DD) bioscience and nutrition businesses in 2021 has made the company a powerhouse within the specialty ingredients environment.

This rapid growth combined with IFF holding key supplier contracts with huge consumer products producers such as Mondelez (MDLZ) and Estee Lauder (EL) have allowed the firm to build robust revenue streams and create a truly unique portfolio of products.

CEO Frank Clyburn is at the helm of IFF since early 2022 and has been responsible for steering the company through difficult macroeconomic conditions marred by global uncertainty. I believe his history with Merck & Co along with the extensive experience held by Clyburn within the industry as a whole makes him well suited to run IFF moving forwards.

Economic Moat -In Depth Analysis

IFF harbors a wide and robust economic moat that stems from their unique product portfolio and their position as the dominant producer of indispensable scents, cultures, tastes, enzymes, proteins and probiotics.

The massive breadth present within IFF’s product portfolio allows the firm to serve a massive number of different markets and producers which helps to significant increase the robustness of their revenue streams.

The firm currently operates across four key segments: Nourish, Health & Biosciences, Scent and Pharma Solutions.

IFF Businesses | Nourish

Their Nourish business segment focuses on creating tastes, probiotics, enzymes and cultures that enable food stuffs producers to create products with certain taste or texture designs.

The firm achieves this through producing a range of natural and plant-based specialty food ingredients such as soy and pea proteins, emulsifiers and sweeteners. The firm also produces a wide range of flavors designed to mimic, replicate or enhance the flavors present in savory and sweet products.

These specialty ingredients are essential elements of many manufactured and pre-packaged food stuffs which simply could not exist without the presence of IFF products within their recipes.

IFF’s acquisition of DuPont’s nutrition and bioscience divisions was designed to significantly enhance the exposure IFF enjoys to the rapidly growing “functional ingredients” division of the Nourish segment thus allowing for large amounts of future growth to be harnessed.

IFF’s Health and Biosciences business segment consists of the development and production of advanced biotechnology-derived enzymes, food cultures, probiotics and specialty ingredients used both in food and non-food applications.

IFF Probiotics

The firm’s probiotics business segment supplies essentially 1/3 of all probiotics to yoghurt and fermented milk manufacturers worldwide. For every three pots of yoghurt opened by a consumer, probability dictates that one will have IFF produce enzymes or probiotics within its recipe.

These enzymes are also used by manufacturers such as P&G in laundry or dishwashing detergents, fabric and textiles cleaners as well as industrial uses including animal nutrition products.

The Scent segment creates fragrance compounds that are used in some of the world’s finest perfumes, cosmetics, household and personal care products. The firm’s huge portfolio of natural and synthetic scents places IFF firmly as the market leader within this business with their scents being essentially omnipresent within our modern western world.

IFF Pharma Solutions

Finally, IFF operates their Pharma Solutions business segment to serve pharmaceutical customers looking for cellulosics and seaweed-based specialty pharma excipients. These unique products allow biopharma companies to improve the delivery, functionality and release formulations of their drugs.

It is clear from IFF’s dominant positions within each of their unique business segments that the firm is the unquestionable market leader when it comes to the specialty ingredients industry. Furthermore, IFF has significant R&D capabilities with multiple R&D activities located across the U.S. and Europe.

These facilities focus on improving and innovating within the respective businesses in which IFF operates to ensure the firm is able to continue meeting the novel demands presented by it’s customer companies.

IFF Science Creation

This continuous innovation and dominance within the industry is highlighted by the 940 granted and 546 pending patent applications that protect the products produced by IFF. The firm has developed multiple molecules and delivery systems for customers that are used as the foundations of world-famous consumer products across the world.

While the spread out nature of IFF’s R&D facilities initially seems like an inefficient setup, the reality couldn’t be further from the truth. A significant element of IFF’s ingredients business revolves around catering to the unique demands each different market has for their products.

Some geographic regions prefer different flavors, scents, textures and ingredients to each other which creates demand for a wide range of locally specific products. IFF is able to meet these demands excellently thanks to the firm having R&D facilities across the U.S. and Europe that can design products with geographically relevant input and testing that meet these often varied local tastes.

The geographically varied consumer insights and R&D processes allow IFF to rapidly and accurately create products that match the requirements demanded by suppliers across the globe thus providing the firm with a tangible competitive edge.

This advantage ultimately results in IFF products and ingredients being more capable with regards to the unique qualities customers demand from their foods. As consumers want less saturated fats, sugars and salt in their food while retaining flavor and texture, companies such as Kraft Heinz, Kelloggs and Mondelez require more of the specialty ingredients and value-add products IFF creates.

IFF Science Creation

By creating such advanced ingredients and specialty products IFF is able to operate in a ‘higher end’ segment of the specialty ingredients market whereby their products compete not on a price advantage but on the merits of their capability to meet consumer demands accurately.

This provides IFF with increased pricing power thus allowing the firm to extract outsized returns on their invested capital compared to competitors competing on price alone.

Furthermore, the nature of how many of IFF’s specialty ingredients are used by companies in the design of a food, cleaning or industrial use product means that switching costs are figuratively and literally significant for IFF’s customers.

Many manufactured food or cleaning products are designed holistically with the unique qualities of many ingredients acting together constituting the final product utilized by end-consumers. This means that for a firm like Mondelez to change the supplier of a texturizing agent of emulsifier would mean redesigning their entire product.

For IFF this means that once a supply deal is struck with a manufacturer for a certain specialty product, the agreement lasts essentially until the end-of-life for that specific product within the retail space. This supply-deal longevity provides IFF with significant stability with regards to their revenue streams and once again increases the bargaining power IFF has with their prospective corporate customers.

Overall, IFF has a hugely broad and varied portfolio of unique and patent protected products that create a wide economic moat for the firm. The difficulty for competing companies to create products that not only equal those made by IFF, but also on the scale demanded by many of IFF’s largest clients is essentially impossible without huge capital investment and a long timeframe.

Therefore, I believe IFF will benefit from a tangible competitive advantage stemming from their massive economic moat for at least the next 25 years.

Financial Situation

From a fiscal operating performance perspective, IFF has been a mostly profitable organization. Their consistent 5Y average gross, operating and net margins of 37.45, 10.31 and 1.71 are impressive and actually represent a decrease to their historic performance pre-2021.

The acquisition of DuPont’s bioscience and nutrition businesses added significant moatiness and scale to IFF’s operations at the cost of short-term profitability due to the costs associated with acquiring and integrating these operations into the IFF structure.

This has resulted in 2021 and 2022 ROIC dropping to 2.25% and -5.12% respectively while net margins have fallen from a pre-2021 5Y average of around 8% to just 2.30% in 2021 and -15.02% in 2022.

Historically the firm has managed ROA and ROEs in the low and high single digits respectively with the last two fiscal years seeing drops to negative mid-single digit returns. These dropping fiscal performance metrics may initially seem worrying, but in fact are not all too surprising when the underlying factors are better understood.

The DuPont acquisition was designed to enhance the firm’s Functional Ingredients business by exposing the business to larger growth markets with significant future potential. Unfortunately, it is exactly their Functional Ingredients business that now presents a real challenge to the firm with regards to efficiency and profitability.

When analyzing the firm’s FY23 so far, a clear trend emergers regarding the functionality of their key business segments.

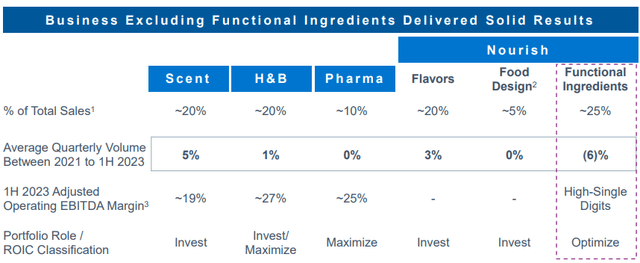

IFF FY23 Q2 Report

Without considering the firm’s Functional Ingredients business, IFF is fundamentally profitable and earning substantial operating EBITDA margins. Their Scent, H&B, Pharma and Nourish (flavors and food design) businesses continue to earn the firm outsized returns and exhibit consistent if limited amounts of QoQ growth despite the tricky macroeconomic conditions.

I believe the strength IFF exhibits in these businesses stems from how well integrated and optimized these units are compared to the recently expanded functional ingredients segment.

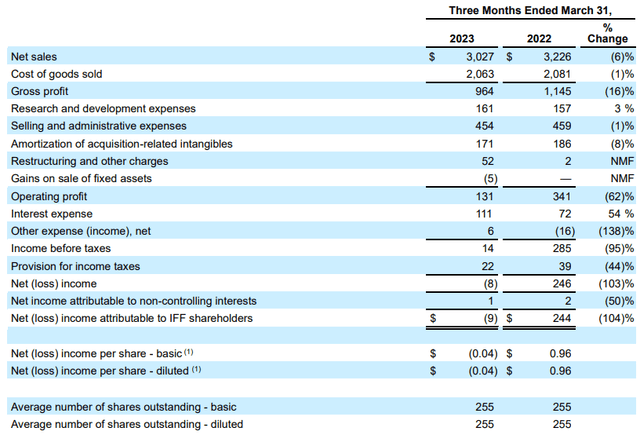

IFF FY23 Q1 10Q

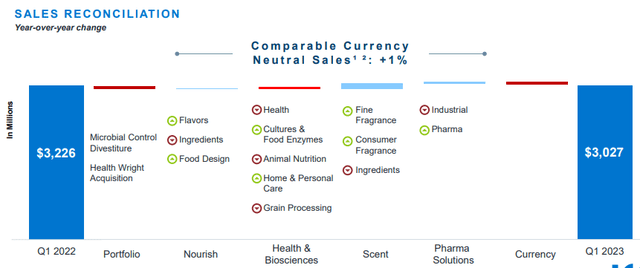

Nonetheless, a soft Q1 saw net sales drop 6% to $3.03B with an essentially consistent set of COGS resulting in gross profits falling a substantial 16%. Largely unchanged R&D expenses, administrative costs and restructuring charges left IFF’s operating profits 62% down YoY which, when accompanied by rising interest expenses resulted in a net loss of $8M.

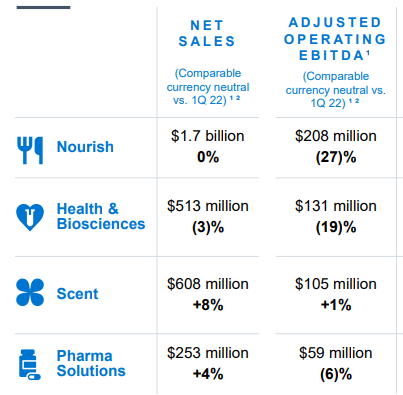

IFF Q1 Presentation

This difficult quarter was characterized by weak overall volumes caused by the inflationary macroeconomic environment increasing pricing levels across the firm’s key business segments.

IFF FY23 Q1 Presentation

While net sales in many of the firm’s segments saw reasonable low single-digit net sales growth, an overall stagnation in growth combined with operational inefficiencies the firm defines as “unfavorable manufacturing absorption” placed pressure on margins and overall profitability.

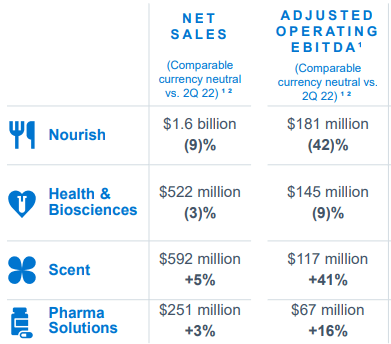

IFF Q2 Presentation

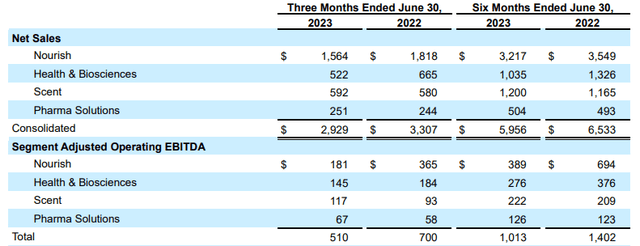

Q2 saw IFF’s Scent and Pharma segments flourish with strong growth and operating EBITDA increasing 41% and 16% respectively thanks to productivity improvements and pricing strengths. This bright spot in the firm’s 10-Q was unfortunately overshadowed by 42% and 9% decreases within their Nourish and H&B segments respectively.

While the firm’s Health and Biosciences segment reportedly experienced price increases, and productivity improvements generated by IFF’s efforts to streamline their operations, the weakness within the Functional Ingredient’s segment still appears to be caused by operational inefficiencies stemming from the DuPont acquisition.

IFF has struggled to integrate the DuPont operations into their own operational structure in such a manner as to extract significant profitability and returns from the segment. This is perfectly illustrated by the lackluster EBITDA being extracted from the firm’s historical powerhouse Nourish business segment.

IFF Q2 10Q

The abysmal $181M earned in EBITDA by IFF from their Nourish business compared to the huge $1.6B in net sales illustrates just how inefficient this segment has become. While the firm’s other business segments operate with an adjusted operating EBITDA margin of around 20%-25%, Nourish is only able to earn 11.6% margins even compared to 2022 margins of 20.1%.

This fundamental weakness stems from two key factors, the businesses’ exposure to cyclical changes in demand for products as well as fundamental inefficiencies present within the operations structure.

Many of the firm’s nourish business customers have seen falling levels of sales and profitability themselves with Kraft Heinz, Kelloggs and Nestlé acting as just a few examples of this phenomenon.

In turn, these firms have reduced their own levels of production and innovation which fundamentally impacts the overall demand for IFF’s specialty functional ingredients.

When combined with some lingering integration problems post-acquisition of DuPont’s businesses, IFF has been faced with a double whammy when it comes to the profitability of one of their most important businesses.

IFF Q2 Presentation

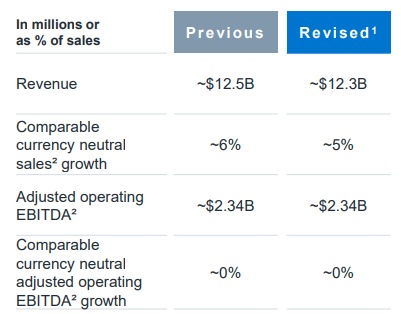

This has led to the firm cutting FY23 estimates with total revenue estimates decreased around 8% from $12.3B to just $11.3B. Adjusted operating EBITDA guidance has been decreased almost 20% to just $1.85B-$2.00B for FY23.

These guidance cuts suggests IFF does not expect the headwinds currently facing their businesses to relent this fiscal year and illustrates just how tricky an environment IFF currently operates in.

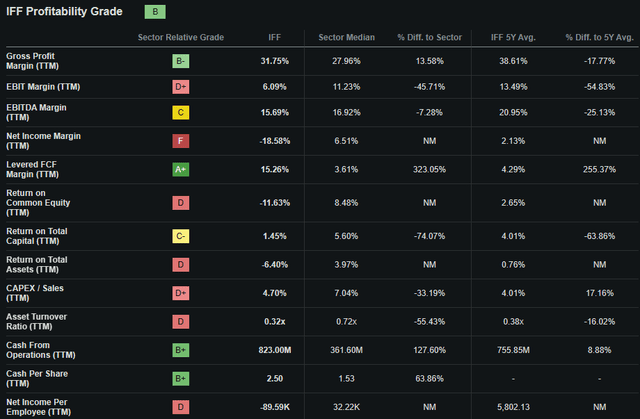

Seeking Alpha | IFF | Profitability

Seeking Alpha’s Quant calculates a “B” profitability rating for IFF. I believe this to be an accurate overview of the firm’s overall profitability and income statement strength as it represents the mixed-bag of results currently being generated by the firm.

From a balance sheet perspective, IFF appears to be mostly sound despite their relatively elevated levels of debt.

While the DuPont acquisition generated significant levels of long-term debt for the firm, I believe the firm fundamentally is not facing any real liquidity threat.

The firm currently has $6.44B in total current assets while total current liabilities amount to $3.93B. This reasonable short-term liquidity leaves the firm with an excellent current ratio of 1.64 and a quick ratio of 0.74.

Total assets for the firm amount to $34.5B with total liabilities just $16.8B. This leaves the firm with an excellent debt/equity ratio of 0.64.

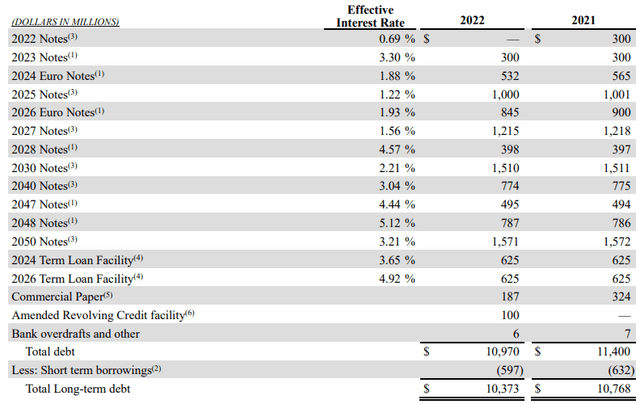

IFF FY22 Annual Report

IFF now holds $10.4B in long-term debentures. This is significant and leaves the firm with a leverage ratio of 2.00x. While the total lump of debt is significant, the staggered maturity profile allows IFF to payoff their debentures gradually and creates ample opportunity for refinancing.

IFF has also been trimming their portfolio of business having already divested multiple business units over the past year. Crucially, IFF is planning to sell the Lucas Meyer cosmetics business with the intent of using proceeds to cover debt obligations maturing in 2024.

IFF has received an affirmed Baa3 credit rating from Moody’s for their senior unsecured notes and an affirmed Prime-3 commercial paper rating. The outlook remains stable. Baa3 is classified as credit obligations which are of medium grade and are subject to medium credit risk.

Considering IFF as a whole I still believe that the firm is fundamentally profitable and should be able to begin producing solid results for investors in 2024. While the headwinds currently facing the firm combined with internal inefficiencies have resulted in poor 2023 fiscal results, I do not believe that their position within the market has been tangibly affected.

Therefore, and given the huge economic moat underpinning their business, I believe IFF will still be able to return to profitability once the DuPont and Frutarom businesses are integrated efficiently into their operational profile.

Furthermore, the new management team’s more cost-focused attitude should allow for COGS to be reduced be it through productivity improvements or inefficient business divesture.

Valuation

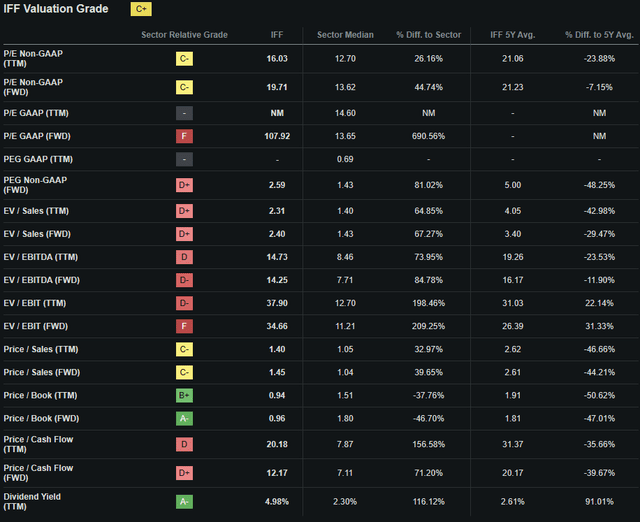

Seeking Alpha | IFF | Valuation

Seeking Alpha’s Quant assigns IFF with a “C+” Valuation grade. I believe this is an excessively pessimistic representation of the intrinsic and future value present within IFF’s shares.

The firm currently trades at a P/E GAAP FWD ratio of 107.92x. This metric is not particularly useful given the lack of profitability currently present at the firm and fails to encompass the firm’s previous years of performance.

IFF’s P/CF FWD of just 12.17x is a little elevated for my liking. Their FWD EV/EBITDA of just 14.25x is equally unimpressive. IFF’s EV/Sales TTM and FWD are 2.31 and 3.40 respectively which is a little elevated but not overly concerning.

The more impressive figures form a valuation perspective are IFF’s P/B TTM and FWD of 0.94 and 0.96 along with the firms solid 4.98% dividend yield.

Considering only these basic valuation metrics alone I believe IFF is impossible to price accurately. This has potentially created a situation where the stock has become underfollowed due to the lack of easy-to-read metrics upon which to value the firm.

Seeking Alpha | IFF | Summary Chart

From an absolute perspective, IFF shares are trading at a significant discount relative to previous valuations. The stock has produced negative returns for investors for five years to the tune of 53% which is very poor.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison do little to paint any meaningful picture of the value present within IFF, a more objective solution should help create a clearer understanding of the situation.

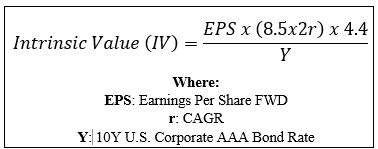

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using IFF’s current share price of $64.82, an estimated 2024 EPS of $4.45, a realistic “r” value of 0.10 (10%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.13x, I derive a base-case IV of $108.80. This represents a massive 40% undervaluation in the firm.

Even when using a more pessimistic CAGR value for r of 0.07 (7%) to reflect a scenario where IFF sees little improvement to their Nourish segment and sluggish growth in other key businesses, shares are still valued at around $85.90 representing a 25% undervaluation.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe IFF is clearly trading in what can only be considered value territory.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. The significant negative sentiment surrounding the firm combined with uncertainty regarding the time in which IFF can turnaround their struggling Functional Ingredients business means downward pressure may continue to exist on shares.

Tax harvesting may also lead to an even greater selloff in shares as many investors seek to maximize the tax efficiency of their portfolios.

I also believe the firm’s short-term performance is partly tied to the sentiment surrounding the U.S. market as a whole. While I do believe that IFF has a robust economic moat and is set to expand margins significantly, the timescale of these improvements may not fall within the next 12 months.

In the long-term (2-10 years), I see IFF strengthening their position as a clear market leader in the specialty ingredients industry. While this scenario does require IFF to recalibrate their Functional Ingredients business in particular, I believe that management’s focus on reducing inefficiencies and driving sustained pipeline growth could help see IFF succeed as a business.

Risks Facing IFF

IFF faces multiple tangible risks that stem from a competitive industry environment and from the firm’s own internal operational struggles.

While IFF is an undoubted market leader within the specialty ingredients segment, the firm relies on their aforementioned R&D prowess to produce new and innovative products which are more capable than those of its competitors.

Should IFF fail to execute on any of these new developments, the firm may find themselves struggling to capture supply deals and become forced to bargain on price. This would lead to a destruction of margins and profitability.

While I view the probability of such consistent failed execution in R&D as improbable due to the proven abilities of IFF to innovate successfully over the last 20 years, the threat still remains.

From an internal perspective IFF faces the short-term threat of an underperforming functional ingredients business undermining the profitability and success being created at the firm’s other business segments.

While no immediate illiquidity threat is facing the firm, IFF must return to pre-2021 levels of profitability to ensure the long-term viability and success of their businesses.

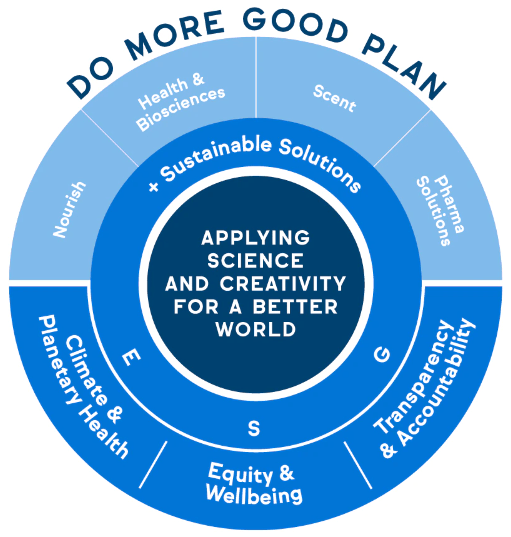

From an ESG perspective, IFF is relatively well protected against any material risks. The firm’s 2030 “Do More Good” strategic plan aims to increase the sustainability of their operations by achieving net zero GHG emissions by 2040 and to be climate positive by 2050.

IFF ESG Responsibility

Socially the firm is aiming to increase worker wellbeing by focusing on inclusivity and 40% people of color representation in management roles within the U.S. by 2030. IFF also has the goal of having 50% women at all organizational levels including the board of directors.

For governance factors IFF aims to expand oversight for ESG governance across the company and to increase the transparency of their annual disclosures to stakeholders.

Considering these factors, I would happily recommend IFF to a more ESG conscious investor as the material lack of ESG risks facing the brand would make the firm a great pick. Of course, opinions may vary and I implore you to conduct your own ESG suitability research should this be of concern to you.

Summary

IFF is a market leading company that is facing a difficult set of internal and external headwinds. While the firm’s huge moat provides for a tangible competitive advantage, poor execution of the ambitious DuPont nutrition and bioscience and Frutarom acquisitions have led to their key revenue stream stalling in both profitability and growth.

This internal weakness has become amplified by a cyclical macroeconomic environment compounding the lack of growth and overall demand for specialty ingredients products.

However, from a valuation perspective and regarding IFF’s core business model, I believe the firm is still well placed to earn investors outsized returns. The new management team’s laser focused objective to divest any unprofitable businesses is a sound and welcomed strategy and suggests a new cost-efficient future lies ahead for the firm.

While the timeframe for this turnaround to occur in is unclear, IFF is still substantially undervalued with a potential 40% undervaluation being present in shares.

Therefore, I rate IFF a Strong Buy due to the deep value nature of shares at present time. However, I do believe that IFF is surrounded by more uncertainty than some other potential deep value plays due to the internal nature of some of their headwinds.

Read the full article here

Leave a Reply