In Europe, we are seeing mainline carriers such as Lufthansa (OTCQX:DLAKF) struggle in the first quarter after it faced strikes earlier this year and also Air France-KLM (OTCPK:AFRAF) did not have a higher quarter as costs are mounting. International Consolidated Airlines Group or IAG reported first quarter earnings on the 10th of May. In this report, I will be discussing the results and assess whether the stock is still after surging 17.6% since my coverage of the IAG Capital Markets Day.

IAG Benefits From Capacity Growth And Unit Revenue Strength

IAG

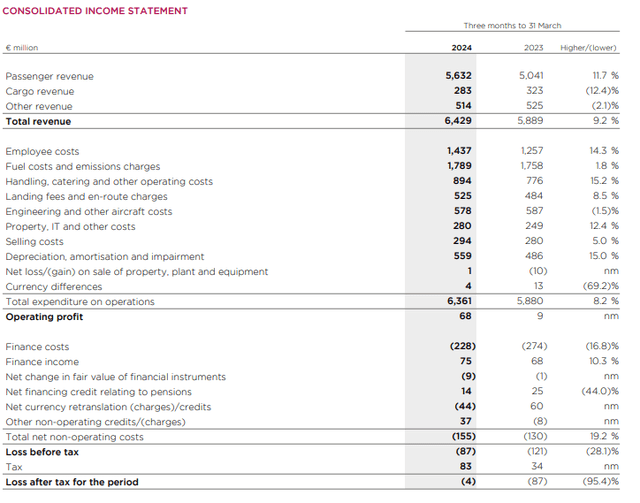

A look at the results shows us that overall revenue growth outpaced cost growth resulting in margin expansion. Q1 2024 operating margins were slim at 1.1% but it is up from 0.2% in the same quarter last year and it should be noted that the first quarter tends to be the weakest quarter of the year. On the top line we see that passenger revenues grew by 11.7% but that was partially offset by a 12.4% decline in cargo revenues. A good sign is that passenger revenue growth outpaced the 7% growth in capacity. The Asia Pacific region saw the highest growth of around 40% in capacity and revenue passenger kilometers, but we primarily see the strength in the core markets. In Europe, capacity increased by 9% while still seeing nearly 6% higher unit revenues and in the Domestic market there was 6.5% higher capacity and 6.9% higher unit revenues. In the North American market we saw roughly flat capacity and a 6.5% increase in unit revenues. Putting it all together, revenue growth was driven by 7% higher capacity and 4% unit revenues partially offset by lower cargo revenues.

On the cost end, the cost growth was not as favorable. On 7% capacity growth, we saw cost grow 8.2% and even 10% growth when excluding fuel costs. On a unit cost basis, the non-fuel costs were up 3.7%. So, just like with many other airlines we are seeing higher costs on labor, investment and inflation components increasing the cost basis where capacity additions that should normally drive fixed cost absorption are not offsetting inflationary costs.

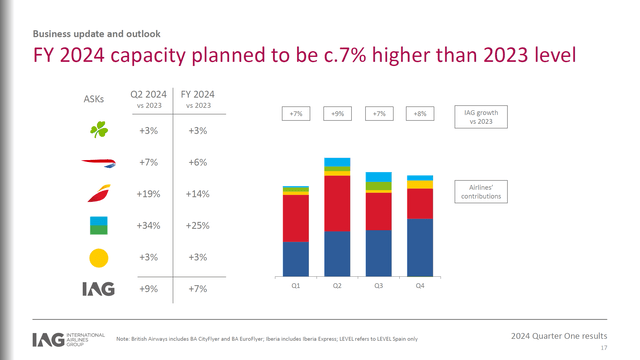

IAG Continues To Grow Capacity

IAG

For the second quarter, IAG aims to expand capacity by 9% with the most notable growth for Level and Iberia and to a lesser extent British Airways. For the full year, the company expects 7% capacity growth and non-fuel unit costs to continue to rise driven by continued investments in the business. For the second quarter the company is hedged on 75% of its fuel use and roughly 70% for the remainder of the year.

IAG Stock Remains A Buy

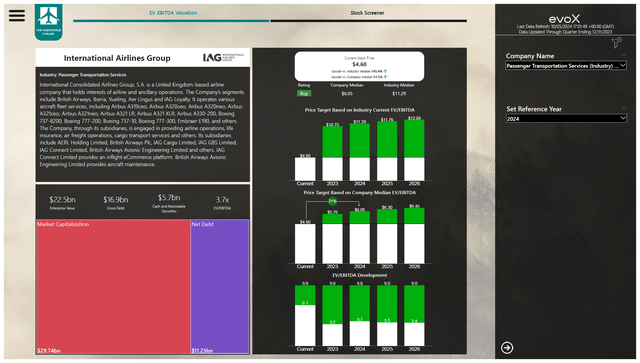

The Aerospace Forum

International Airlines Group has not yet provided a detailed financial report, but I used the most recent available balance sheet data as well as projections for the EBITDA and cash flows in the coming years and put those in my stock screener which also factors in the score for historical performance against the benchmark and based on those inputs. Based on those inputs I believe that the buy rating for IAG remains valid with a $6.05 price target representing 31% upside.

Conclusion: IAG Is Performing Well

The first quarter results were promising with strength shown in the core markets and while costs grew, I consider them manageable. IAG also has reduced its debt profile quite significantly which feathers in positively in the stock price assessment. As a result, I maintain my buy rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

Read the full article here

Leave a Reply