Investment Thesis

Insteel Industries Inc.’s (NYSE:IIIN) stock price has remained relatively flat since my previous article in January, where I recommended waiting on the sidelines until a bottom is in place. The company’s revenue and margins have continued to decline since then. The company recently reported its Q4FY23 results, and while the quarter wasn’t particularly strong, I believe we are now much closer to the bottom, with the potential for the company to return to year-over-year growth in both revenues and margins as FY24 progresses.

After several quarters of inventory destocking by distributors, the channel inventory has returned to normalized levels which should be one less headwind. Also, while high interest rates continue to impact the construction market, the federal government stimulus from the IIJA, CHIPS, Science Act, and IRA is expected to offset this impact. Furthermore, price-to-cost dynamics are likely to turn positive in the coming quarter, and the valuation appears attractive on the company’s normalized earnings potential. Therefore, I am upgrading my rating on the stock to a “buy.”

Revenue Analysis and Outlook

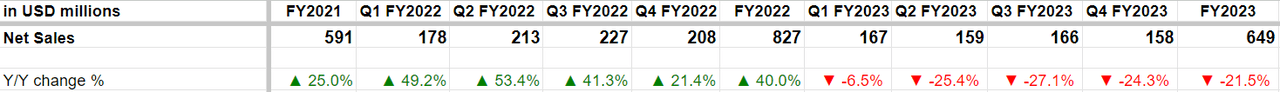

After benefiting from strong end-market demand and price increases in FY21 and FY22, Insteel’s revenues declined meaningfully in FY23 as rising interest rates started impacting end-market demand, prices started declining, and there was a good deal of inventory destocking in the channels. In the fourth quarter of 2023, the company’s net sales declined 24.3% Y/Y due to a 27.8% decrease in average selling prices.

IIIN’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the end market conditions remain mixed. The company is exposed to the construction end-market with non-residential construction-related sales accounting for 85% of its total sales while the rest come from residential end-markets.

Both these end markets are seeing negative impacts from rising interest rates as well as tightening lending standards from banks.

Architectural Billings Index (ABI) which is a leading indicator of the nonresidential construction index dropped to 44.8% in September 2023. A reading below 50% indicates contraction. The Dodge Momentum Index, which tracks non-residential building projects going to planning, also declined 5% Y/Y in September but was up sequentially. Similarly, if we look at multi-family housing starts (where the company has most of the residential exposure), they have also started seeing a meaningful slowdown.

Not everything is bad though. The company’s non-residential business also has good exposure to infrastructure projects, especially related to transportation, and the federal government’s stimulus in the form of the Infrastructure Investments and Jobs Act (IIJA) is expected to help fuel good growth in these projects in the coming years. The bidding/ award activity for these projects increased meaningfully of late, and since most of these projects are long-term in nature, the demand for the company’s products should benefit as these projects ramp up over the next few years.

Another area of strength is industrial construction projects which are benefiting from the recent reshoring trend driven by government stimulus in the form of CHIPS and Science Act and the Inflation Reduction Act (IRA).

So, the overall end market is mixed with high interest rates hurting construction projects while the federal government’s stimulus helps.

One favorable thing for the company is inventory destocking among its distribution channel partners is almost over after four quarters of reduction in inventory levels. So, this is going to be one less of a headwind in FY24 and, even without end markets improving meaningfully, the company’s revenues can improve as sales trends more in line with end market demand. Further, according to management, the downward slide in steel scrap and hot-rolled pricing has run its course and prices are likely to see recovery in the coming quarters. This should help revenues.

One added benefit of price bottoming is that distributors who were hesitant to order new inventory given the declining prices trend (which may have resulted in losses), would be more comfortable ordering inventory as the pricing stabilizes or starts recovering. So, there is a potential for some inventory restocking as well.

The comparisons are also getting easier for the company moving forward. As discussed before, after Y/Y growth in FY21 & FY22, the company’s sales turned negative in Q1 FY23 and the decline worsened in Q2 FY23. So the Y/Y comparisons should get easier in the coming quarters. Overall, while Q1 2023 may still see some headwinds, I believe the company’s revenue should return to Y/Y growth from Q2 2023 onwards as construction projects benefiting from government stimulus programs ramp up, inventory destocking ends, pricing stabilizes and comparisons get easier.

Margin Analysis and Outlook

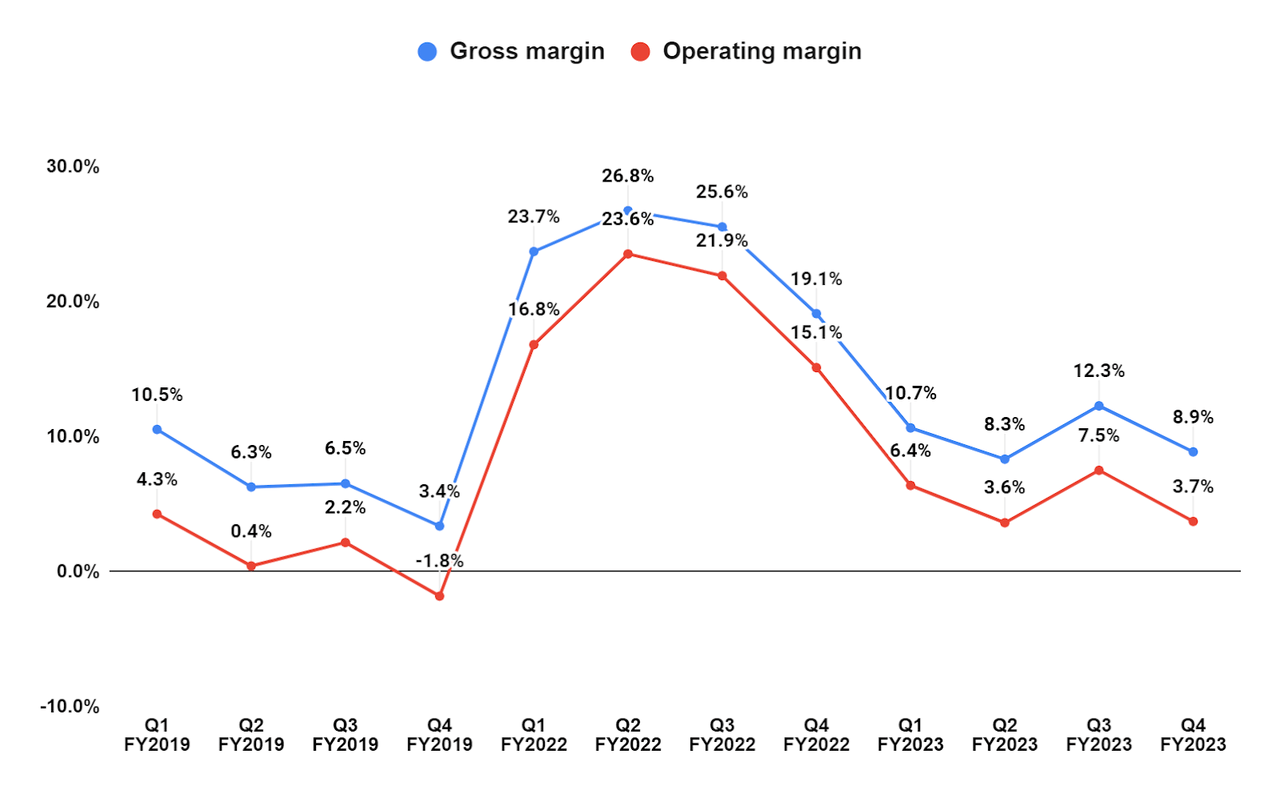

The sharp decline in selling prices impacted the company’s margins in the recent quarter. While raw material prices also corrected, the company uses FIFO accounting and has to sell the higher-priced inventory it bought earlier first. So, the decline in raw material costs trailed the decline in average selling prices.

In addition, the unit cost absorption was also negative as the company curtailed its production and reduced inventory levels at plants in response to slowing end-market demand.

IIIN’s Gross margin and Operating margin (Company Data, GS Analytics Research)

Management expects internal inventory reduction to be completed by the end of Q124 which should result in much better unit cost absorption and lead to margin improvement post the quarter. Further, as discussed in the revenue section, pricing is also stabilizing and management mentioned that its inventories at the end of Q4 were valued at average unit cost that was lower than Q4 cost of sales. So the price/cost should improve meaningfully in the coming quarters and help margin recovery as FY24 progresses.

Valuation and Conclusion

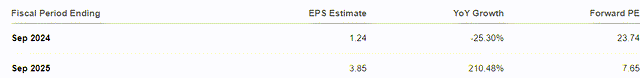

I believe Q1 FY24 will likely mark the bottom of the cycle for IIIN and the company should see recovery as FY24 progresses. If we look at the current sell-side estimate, the company is expected to post $1.24 in FY24 EPS and then post a sharp recovery with EPS increasing to $3.85 in FY25. So, the company’s P/E valuation based on the FY24 EPS estimate is 23.74x and FY25 EPS estimate is 7.65x. Over the last 5-year, IIIN stock has traded at an average forward P/E of 18.76x.

IIIN Consensus EPS estimate (Seeking Alpha)

As FY24 progresses and investors realize that the worst is behind us with revenues bottoming and margins improving, they should start becoming more optimistic about the stock and start looking at the company’s normalized earnings power rather than the current year’s EPS. Further, there is a good potential for growth once the interest rate cycle reverses.

The company has a strong balance sheet with no debt and $125.7 million of cash as of the last quarter’s end. Management has also done a good job in terms of returning cash to shareholders and has paid multiple special dividends over the last couple of years including a $2 per share special dividend in FY23.

As some early green shoots emerge with both internal and distributor destocking approaching its end, government stimulus resulting in increased infrastructure as well as industrial construction projects, price/cost situation improving, and comparisons easing in the coming quarters, I believe investor sentiment around the stock should improve. The valuation is also reasonable if we look at the company’s earnings potential for FY25 and beyond. So, I am moving to a buy rating on the stock.

Read the full article here

Leave a Reply