Innovative Industrial Properties (NYSE:IIPR) pioneered greenhouses for growing cannabis and is now in the transition period from high capex and growth to slower growth and sustainable profitability. As with any transition, investors have exhibited fear and now there is an opportunity to buy the stock at a depressed price.

First things first. This stock is not for everyone. It does not qualify under many socially conscious methods of investing. To invest in Innovative, you have to be willing to invest in a “sin stock.” Of course, not all sins are equal, so this is a matter for you to consider for yourself.

Innovative has gone through a peak-to-trough correction of about 80% in the past two years. It has rebounded recently and any retrace looks like an opportunity to buy an undervalued stock with a large dividend.

In addition, I believe that Innovative Industrial is a good replacement or complement to a cannabis ETF strategy when the next cannabis bull market starts running. I rate Innovative Industrial a buy under $80 per share.

How Margin Of Safety Investing Analyzes Innovative Industrial

At Margin of Safety Investing’s full service, we are also covering how to roughly double your income on Innovative Industrial through a simplified option selling strategy.

Our coverage of Innovative Industrial follows our standard approach of analyzing four key components for any investment:

- Secular trends impacting the business.

- Government and central bank policy affecting the company.

- Fundamental and financial factors within the framework of a standard SWOT analysis.

- Technical and quant analysis of price movements for a stock, which signals developing uptrends and downtrends.

Ultimately, for any company we invest in, we are looking for some additional margin of safety. In the past, finding stocks that were underpriced relative to their intrinsic value was how value investors found excess profits. With the advent of computer technology, including AI, that has gotten more difficult to do as most pricing inefficiencies are spotted quickly.

More often now, we find an added margin of safety in an element of the business the market does not understand or does not assign proper value to. This generally involves understanding how a business will develop over the next few years. In these cases, the market is either lazy, ignorant, and/or impatient (usually all three). We find a margin of safety by working hard to know what we are investing in and patiently waiting for the market to catch up.

Innovative Industrial Secular Trends

The secular trends of cannabis shifting from illegal to legal markets and of cannabis cannibalizing alcohol sales are very apparent at this point. A full primer of the cannabis industry is available at the Innovative Industrial website. Potential investors should start with the primer before allocating capital.

The short story is that cannabis use is on the rise while alcohol consumption is falling. This is not a sudden occurrence as illegal marijuana use has been growing for decades. Since 2009, over 20 million additional adults have reported using cannabis growing from about 30 million to about 50 million according to a SingleCare study.

As cannabis use has been decriminalized at the state and now federal levels, cannabis has become “normalized” even in states where it is not legal yet. As of 2022, about two-thirds of Americans live in a state with at least some legalization of cannabis.

Younger generations are largely turning to cannabis in place of alcohol. Whether it is rationalization or not, cannabis is seen as more healthy, or at least, less unhealthy than alcohol which is a top 10 cause of death in the United States.

Total alcohol sales are roughly a quarter billion dollar per year industry right now, but that number has been falling by a single-digit percentage since the 1990s. College students have seen a decreasing usage of alcohol and a switch to cannabis, this bodes well for future cannabis sales figures.

The total cannabis market estimation as of 2022 was about $85 billion including both legal and illegal markets. Legal distribution just crossed $30 billion (MJBiz Factbook). The total cannabis market is projected to grow to about $200 billion by 2030.

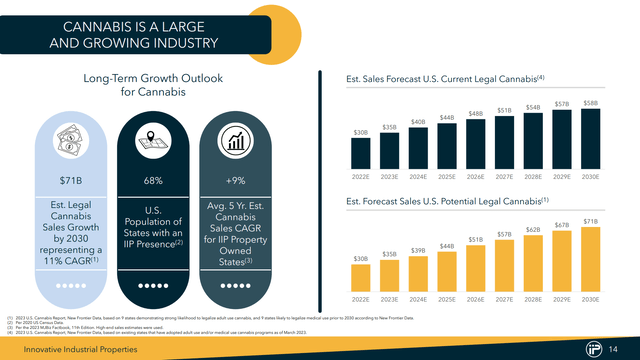

Cannabis Growth (IIPR)

Currently, estimates are only projecting about $70-80 billion in legal cannabis sales by 2030. I think that is significantly lower than likely since I believe legal sales will become a far greater percentage of total sales. But, even at $70-80 billion in legal cannabis sales by 2030, that would rival projections for spirits sales (about $100 billion) and wine sales (about $60 billion).

Policy Impact On Innovative Industrial

The decriminalization of cannabis has been a major driver of shifting about one-fifth of the marijuana market to legal corporate distribution. President Biden recently pardoned all prior federal convictions of simple marijuana possession. That shift will continue over time.

At the federal level, there are still restrictions on cannabis operations in the financial markets making banking difficult. This is not unsimilar to restrictions on certain forms of online gambling like poker.

The SAFE Banking Bill is on another go-around in Congress. The bill if enacted as the law would prohibit penalization of financial institutions that provide financial and banking services to cannabis-related businesses.

The bill has passed the House seven times and last week passed a Senate committee for the first time edging it closer to adoption.

If the bill is passed, it will generally open up capital for the industry at both the investment and working capital levels. Companies like Innovative could see a surge in growth initially, but more importantly, would be gaining renters with more solid financial prospects, ensuring rent payments that have ranged from 92% to 100% paid during uncertain times.

Higher interest rates are a headwind to most parts of the economy, however, as we have seen historically, sin stocks tend to be the exception.

If rates do indeed stay “higher for longer,” then Innovative might have a higher cost to refinancing their debt due in 2026, and their growth rate could further slow.

As readers know, I do not believe that “higher for longer” will be around for long. See my 2023 Q4 Outlook for more on that.

Strengths Of Innovative Industrial

Analysis of Innovative Industrial starts with reading their filed SEC documents, including the most recent 10Q. Innovative’s next 10Q is scheduled to be filed on Wednesday, November 1st, 2023.

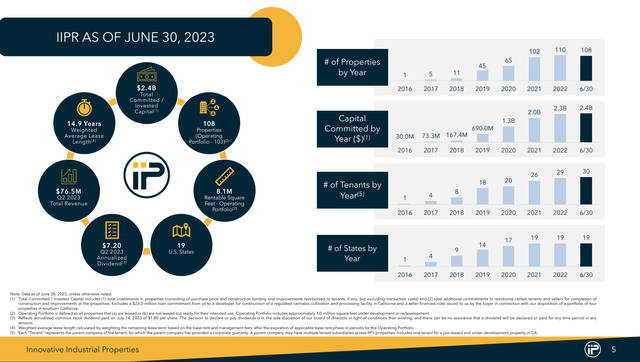

Innovative operates using desirable triple net leases with an average lease term of 14.7 years. Here is a quick look at the company as a primer.

IIPR At A Glance (IIPR)

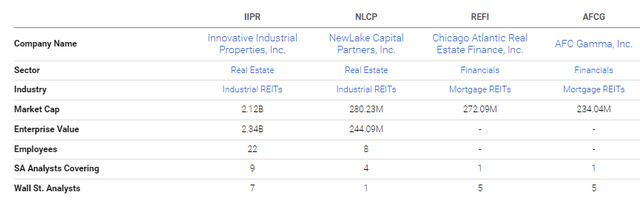

A core strength of Innovative is that they are far and away the largest of companies in this space with a market cap of over $2 billion and enterprise value approaching $2.4 billion.

Innovative is about eight to nine times larger than nearest rivals NewLake Capital Partners (OTCQX:NLCP), mREIT Chicago Atlantic Real Estate (REFI) mREIT AFC Gamma (AFCG) in a business that benefits from financial scale (think big bank capabilities versus regional bank capabilities).

Cannabis REITs (Seeking Alpha)

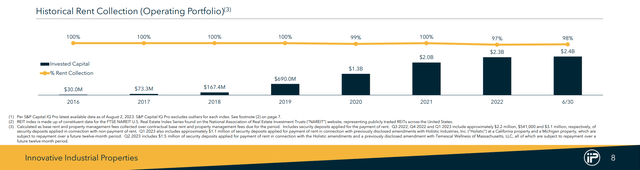

Rent collections are an obvious concern for any REIT, as we are seeing in the commercial space since Covid and now with higher interest rates.

IIPR Rent Collections (IIPR)

As with any fledgling industry, we should expect more volatility in rents, which I will cover more in depth below. However, it can also be recognized, as with gambling, that sin stocks do well in virtually any economic cycle relatively speaking. I wouldn’t expect any “it’s different this time” with Innovative.

Specifically to turnover of renters when they have problems, the industry is tight enough that Innovative has not been stuck with a larger problem. I have a hard time seeing them having problems similar to what banks face during recessions. There’s going to be a growing demand for cannabis facilities and a tight supply for a good many years. In this regard, higher interest rates might benefit Innovative to some extent.

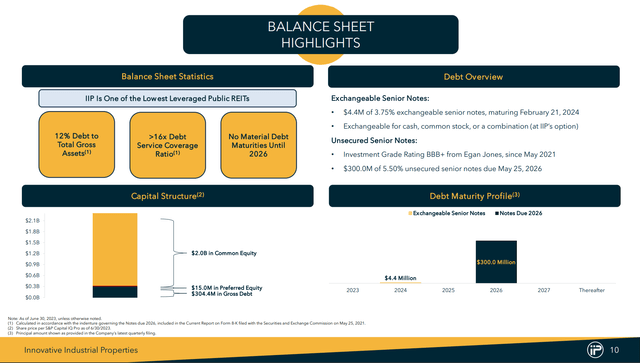

Importantly to dividend investors, Innovative is one of the lowest-leveraged REITs in the stock market. Their debt to total gross assets was last at 12% (which likely drifts into the teens), with 16x debt service coverage and no material debt maturities until 2026.

IIPR Balance Sheet (IIPR)

Innovative has experience in multiple jurisdictions, including lobbying at the Federal level. I believe this is a material advantage in a landscape that could see more capital available from banks and other financial institutions in the not-too-distant future (discussed in the policy section).

Weaknesses Of Innovative Industrial

The chief weakness is that Innovative really does not have a credit rating yet as it was only incorporated 7 years ago and does not carry significant debt (which is a strength). Egan Jones currently gives Innovative a BBB rating.

Egan-Jones expects ‘BBB’ ratings to have the moderate level of creditworthiness with moderate sensitivity to evolving credit conditions.

As with much of the industry, growth rates have come down materially. Investors should only expect single-digit growth rates going forward in my opinion. I believe the market has priced in worse.

Rent collections have strayed from 100% to as low as 92% on the Kings Garden and a few other client’s problems (back to 98% in Q2). Ultimately there has been no long-term material impact on Innovative as security deposits and the ability to turn the properties to other renters have mitigated a worse situation.

Important in the Kings Garden defaults was oversights by Innovative’s management about the viability of Kings Garden as a renter. Management’s chase of profits might have blinded them to the risks at Kings Garden (covered elsewhere) or they might have simply just missed out on that one.

It’s hard to say for sure what happened in detail at Kings Garden, but Innovative has done well in the courts on complaints from investors, having everything dismissed.

I am willing to give Innovative a pass for having to deal with an emerging industry, but, will have to reconsider if they face another serious event.

Opportunities For Innovative Industrial

This is the area that I do not believe most investors are good at analyzing, so I focus here as the information so far is easy enough to look up.

I think there are two major opportunities for Innovative going forward.

The first is the continued improvement in cannabis industry as companies with a “hope and a dream” fade out of existence, leaving stronger players. This is exceedingly good for a rent collector.

We have seen Innovative’s share price come down with the financial stress of an oversupplied and short-on cash industry. The oversupply has abated largely and surviving companies are on the verge of finally turning profits.

The bigger opportunity is what happens if:

- the SAFE Act passes freeing up capital and banking for the cannabis industry?

- nominal cannabis use continues its high-single digit growth rate?

- the shift from illegal to legal accelerates and shifts potentially 80% of a likely $200 billion per year market to legal distribution?

I think that is a recipe for Innovative to not only return to all-time highs but to set a significantly higher high. Seeing revenues and profits double by 2030 is already fairly easy to project, but, if the circumstances I suggest could play out, do play out, then revenues and profits, aka, FFO in the case of a REIT, could quadruple by 2030.

Diluted AFFO was $2.26 per common share in Q2 2023 with some headwinds. I do not think it is impossible to see that number 4x higher by decade end. For those who buy at these share prices that would turn into a massive dividend yield on cost.

Will things play out that way? Hard to say, but I do not think the current share price remotely considers that scenario.

There is one more possibility for Innovative Industrial that has not been discussed much and that is acquisition. If the SAFE Act passes, I think Innovative is a logical get for a larger REIT or finance company to get into the cannabis space with a lead and key people.

Threats For Innovative Industrial

The major threat for Innovative is that management takes on bad tenants in conjunction with an industry that cannot turn the corner on profitability for any reason. It is the nature of emerging growth industries to collapse and stay collapse for a long time before calmer waters prevail and a rising tide lifts all ships.

I am watching with keen attention to the SAFE Act because I feel that it will benefit Innovative. There is another scenario. Big competitors could emerge and somehow quickly duplicate Innovative’s strategy. I do not think that is likely due to the scarcity of people with expertise, but it could happen.

The problem with a takeover is that it probably comes at a much lower multiple than what I am thinking can happen by 2030. It does though offer a margin of safety that there could be bidding for the company if SAFE passes.

Technical & Quant Analysis For Innovative Industrial

My technical analysis is very simple using RSI and volume-weighted demand. I don’t need a lot of bells and whistles because I don’t trade much.

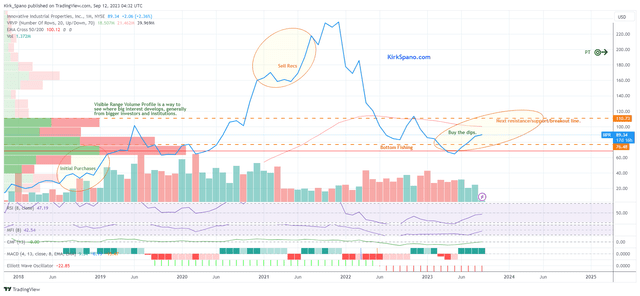

I look for value that has started to have upward price momentum. Value + momentum ETFs are among the leading funds out there. Here’s my chart for IIPR:

IIPR Volume Weighted Quant (Kirk Spano)

TradingView Chart

I am seeing a potential breakout to test the prior highs around or over $200 per share.

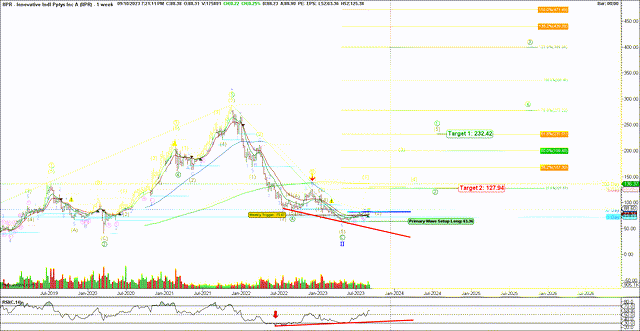

Our resident Elliott Wave analyst, Scott “Shooter” Henderson, has this to share:

IIPR Elliott Wave (Scott “Shooter” Henderson)

- IIPR is breaking out and has a very extended target into the $200+ range by late next year.

- In the short term, it could pull back, but so long as it holds the 8-day moving average it should resume its uptrend to around $200 or more.

- Around $200 we should start to look for a retrace, that is Wave 2 down, that would set up another buying opportunity for those looking to get in then.

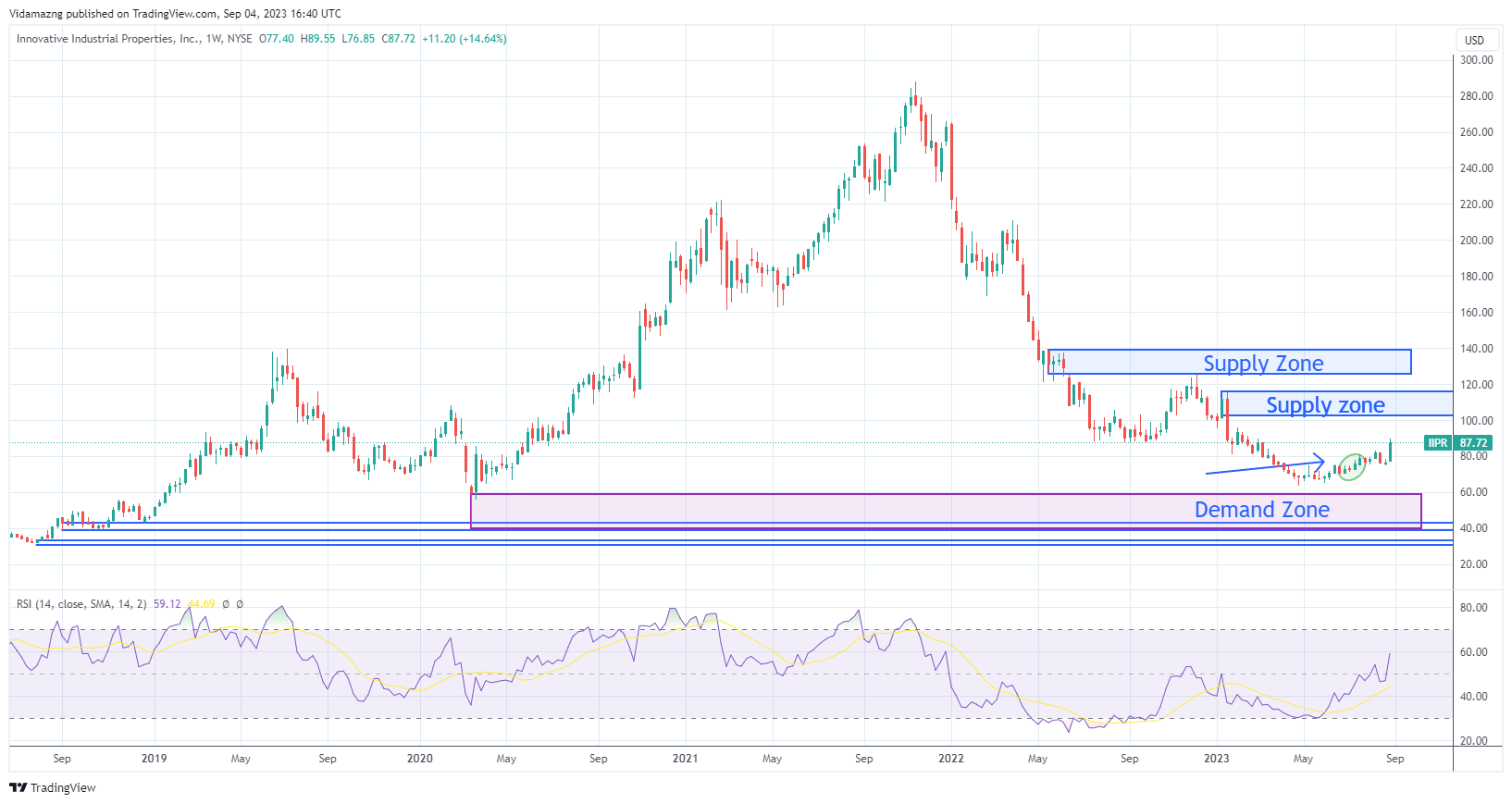

Theresa who uses a similar method as me has this to share:

IIPR Share Supply/Demand (Theresa May)

Her supply/demand-based model shows heavy buying interest around $60 which is almost where it bottomed. She sees it rallying to over $100 before hitting its first significant resistance. There is then a series of steps that, if it can break through about $140, open the ramp upwards to the Shooter’s target.

So, we have quite a bit of agreement between all three of us that Innovative can be choppy for a while, but that it is now working on breaking out into a significant uptrend. We all say, “buy the dips.”

Cannabis ETFs Versus Innovative Industrial

Innovative Industrial is a REIT, however, it compares favorably to the top cannabis ETFs.

The top two cannabis ETFs by market cap right now are the AdvisorShares Pure US Cannabis ETF (MSOS) with about a half billion in assets under management and the ETFMG Alternative Harvest ETF (MJ) with about a quarter billion under management. No other cannabis ETF has over $50 million under management. Innovative’s market cap is a little over $2 billion.

Where it gets interesting is comparing the top holdings for the ETFs with Innovative’s top renters. I view Innovative’s renters similarly to how I view the index holdings of the ETFs.

Here’s a comparison of the top holdings of the two mentioned ETFs with Innovative’s top renters.

Top 10 Holdings/Renters

| (MSOS) | (MJ)* | (IIPR) |

| Green Thumb (OTCQX:GTBIF) | Green Thumb (GTBIF) | PharmaCann (private) |

| Curaleaf (OTCPK:CURLF) | SNDL Inc | Ascend Wellness (private) |

| Verano Holdings (OTCQX:VRNOF) | Canopy Growth | Green Thumb (GTBIF) |

| Trulieve (OTCQX:TCNNF) | Cronos Group | Parallel (private) |

| Cresco (OTCQX:CRLBF) | Tilray Brands | Curaleaf (CURLF) |

| TerrAscend (OTCQX:TSNDF) | Trulieve (TCNNF) | Columbia Care / Cannabist (OTCQX:CBSTF) |

| Columbia Care / Cannabist (CBSTF) | Innovative Industrial | Trulieve (TCNNF) |

| Ayr Wellness (OTCQX:AYRWF) | Curaleaf (CURLF) | Holistic Industries (private) |

| Glass House Brands (OTC:GLASF) | TerrAscend Corp | Cresco Labs (CRLBF) |

| Jushi Holdings (OTCQX:JUSHF) | Chicago Atlantic (REFI) | 4Front Ventures (OTCQX:FFNTF) |

| about 95% of holdings | about 67% of holdings | about 72% of holdings |

* The ETFMG Alternative Harvest ETF’s holdings are derived by aggregating the holdings of the ETFMG U.S. Alternative Harvest ETF (MJUS) of which it has a roughly 50% position. For example, Green Thumb is the largest holding in MJUS at about 18% making its position in MJ about 9% (18% x 50%). I made those calculations throughout the top 10 holdings chart above.

What you can see from the holdings versus renters comparison is that there is considerable overlap between the two largest ETF holdings and the companies that Innovative rents to. Green Thumb, Curaleaf, and Trulieve are substantial holdings that are common to each.

The two ETFs have two themes in common:

- Cannabis

- High expenses.

- MJ .75% plus the cost of swaps held in MJUS plus MJUS management fees.

- MSOS .80% plus the cost of swaps.

What is not in common is that MSOS is U.S.-focused, while MJ is about 50% diversified outside of the U.S.

Given the regulatory component we discussed above, I think the value is in U.S. companies that might get favorable Congressional legislation in coming years. Therefore, I very much favor MSOS at this point, though, in the future, MJ might be an asset allocation component for a business cycle in the future.

I believe there are a couple questions to ask here.

- Is Innovative a complete replacement vehicle for the cannabis ETFs?

- Or, should Innovative be held with one of the ETFs?

For my money, I want to be U.S.-centric for the next cannabis bull market. Therefore, the choice in my mind is MSOS, IIPR, or both.

I think you CAN certainly use both MSOS and IIPR in a portfolio, however, I say that with caveats.

Because IIPR has private company renters, I like their diversification by corporation type, that is, some of the companies do not have to deal with publicly listed requirements. That, of course, can also be a detriment as Innovative learned with Kings Garden.

Essentially, Innovative gives us the type of private company exposure that say Berkshire Hathaway does (in a not as historically well-stewarded way). As I am an active private equity participant where I can find good deals, I like the private company exposure. And that of course is in addition to the fat and stable dividend.

Adding MSOS to your Innovative Industrial allocation can make sense once the next cannabis bull market seems set to begin if you are looking for further diversification. With MSOS, you are getting exposure to several good companies that Innovative is not doing business with. I would not own MSOS before a new uptrend develops.

If you buy MSOS, I only will be doing that in ETF-only accounts, I would overweight Innovative at 2 to 1 or 3 to 1, as I value the dividend and am not overly concerned with added diversification – which might just be with mediocre companies required to be added to the index.

An Added Margin Of Safety For Innovative Industrial

For the past two decades, I have believed that at some point in the climate-changed future that greenhouse growing of vegetables would become more important and prominent.

I have watched with interest as Will Allen pioneered urban farming in Milwaukee using greenhouses and aquaponics. I’ve met Will a few times. He was early to the game, and as it turned out, too early, as his nonprofit went under.

With stocks, you will often hear people say that being early is the same as being wrong. I guess for the impatient that is true. For Allen, being early meant having to go through bankruptcy. Does that mean greenhouse farming and aquaponics were a bad idea forever though? I don’t think so.

The planet is losing about 3% to 5% of its farmland each year to climate change and development. In the United States, we have lost about 30 million acres of farmland this century so far.

Most of the farmland lost is due to a combination of climate change-related factors and suburban development. I’ll leave it to skeptics to look it up and post to the comments.

The outright loss of farmland is on top of millions of acres being abandoned in outlying areas that do not have people to farm the land, generally owing to younger generations moving off the farm.

With population increasing globally and climate change migration already impacting the United States, as anticipated by the Pentagon’s Quadrennial Defense Review on risks (since replaced by the National Defense Strategy), greenhouse farming has a likely bright future.

If cannabis does not produce the profits we expect, then perhaps farming does. Innovative Industrial’s properties are already mechanized for growing and it would only take small changes to switch crops to the broccoli your mom’s told you to eat.

Investing Thoughts On Innovative Industrial

Innovative Industrial Properties (IIPR) substantial dividend and undervalued assets appear to be a good buy are recent prices. Here are the quick thoughts on IIPR:

- Cannabis is a growing industry versus compared to alcohol which is shrinking. Popular culture is significantly favoring cannabis over alcohol not only for recreation but for medicinal purposes (real or imagined).

- Innovative pioneered greenhouses for growing cannabis which grew fast and is now in the drive to higher profitability with lower capex.

- Currently in 19 states, with nearly 9 million square feet across 108 properties, generally with 15-20 year triple net leases. Rent collections have ranged from 98% to 100% per year – better than all other REITs except gambling (so far).

- Most cannabis businesses are shut out from traditional financing. Innovative has capitalized on that by providing financing to companies to use Innovative’s facilities, essentially getting paid twice.

- Very low leverage balance sheet with only 12% debt to assets, 16x debt service coverage, and no large debt maturities until 2026 which is easily paid with a combination of refinancing, equity, and/or asset sales.

- A big fat $7.20 annual dividend against a share price under $80, which is down about 80% from highs a couple years ago.

- Their greenhouses are ideal for growing produce with minimal remodeling if that becomes a more profitable industry with climate change impacting farmers.

The stock is crushed and I am currently accumulating with the intention of having a full position by year-end. Buy the dips on IIPR.

Read the full article here

Leave a Reply