Our Bullish INMD Investment Thesis Failed To Materialize As Expected

We previously covered InMode (NASDAQ:INMD) in July 2023, discussing the stock’s discounted valuations and depressed stock prices, as the macroeconomic outlook remained uncertain over the next few years.

We had believed that the stock might eventually be re-rated closer to the higher historical means and sector medians, once Mr. Market recovered from the peak recessionary fears, since the company continued to record robust profit margins and high growth cadence.

INMD 6M Stock Price

Trading View

Unfortunately, our bullish INMD investment thesis has been invalidated since then, with the stock rapidly gaining after the excellent FQ2’23 double beat, but losing much of its previous gains at the time of writing.

For example, INMD reported revenues of $136.08M (+28.2% QoQ/ +19.8% YoY) and adj EPS of $0.72 (+38.4% QoQ/ +22% YoY) for the latest quarter, while similarly raising its FY2023 guidance to revenues of $535M (+17.7% YoY), adj gross margins of 84% (+0.2 points YoY), and adj EPS of $2.64 (+9% YoY).

This is compared to the management’s previous guidance of $527.5M (+16.1% YoY), 84% (+0.2 points YoY), and $2.59 (+7% YoY) in the FQ4’22 earnings call, respectively.

Demand for INMD’s products remain excellent in FQ2’23 as well, with US equipment revenues of $73.82M (+48.3% QoQ/ +17.2% YoY) and international equipment revenues of $40.63M (+11.7% QoQ/ +14.2% YoY), reaching over 1.6K units.

The latter is likely attributed to the management’s aggressive expansion globally in 92 countries, with demand continuing to be robust in the Europe, Asia, and Latin America regions, thanks to the intensified sales and marketing efforts worth $51.1M (+22.5% QoQ/ +28.7% YoY) in FQ2’23.

Most importantly, INMD’s consumables/ services revenue of $21.61M (+8.3% QoQ/ +43.8% YoY) reached “record quarterly” sales of over 270K in disposables, suggests that its “platforms are being used more frequently, signifying continued demand, and increased brand recognition.”

Combined with the management’s strategic focus on a robust gross margin target at approximately 85%, it is unsurprising that we are seeing drastic improvements in its balance sheet to $629.41M (+9.5% QoQ/ +41.8% YoY) by the latest quarter, further aided by the lack of debt whatsoever.

Based on the INMD management’s optimistic forward commentary, it appears that we may see its FY2023 guidance raised again in the upcoming earnings call:

But as of now, almost the end of the month of July, we don’t see a slowdown. We see it continue to grow. That means that the doctors are still promoting the minimally invasive and the ablative… So we might have a nice number in Q3, but I can assure you that Q4 will be much higher than what we see today. (Seeking Alpha)

Despite so, the INMD stock has retraced dramatically, way below the previous July 2023 levels to retest the March 2023 support levels. This development is unfortunate indeed, since it suggests a drastic lack of bullish support despite the exemplary earnings call.

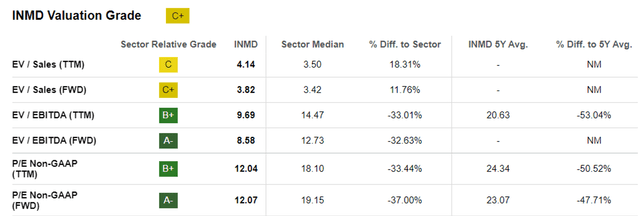

INMD Valuations

Seeking Alpha

Therefore, it is unsurprising that INMD trades at impacted valuations of FWD EV/ Sales of 3.82x, FWD EV/ EBITDA of 8.58x, and FWD P/E of 12.07x, somewhat in line to its 1Y mean of 4.14/ 9.69x/ 12.04x, though moderated compared to its 5Y mean of 7.79x/ 16.41x/ 22.06x, respectively.

The pessimism embedded in its valuations is surprising indeed, compared to its direct peers, Hologic (HOLX) at FWD EV/ EBITDA of 13.12x/ FWD P/E of 17.97x, and the Health Care Equipment sector median of 12.73x/ 19.15x, respectively.

Perhaps part of the pessimism embedded in INMD’s valuations is attributed to the consensus’ decelerating top and bottom line estimates at CAGRs of +16% and +12.5% through FY2025, respectively, compared to its normalized historical growth of +42.7% and +44.6%.

Then again, its forward execution is expected to outperform HOLX’s and Cutera’s (CUTR) stagnant top/ bottom line growth through FY2025 as well.

This implies that INMD’s sell off post FQ2’23 earnings call has been overdone, likely attributed to an aggressive profit taking cadence and short covering, based on the stock’s elevated short interest of 10.51% at the time of writing.

Depending on when bullish support materializes, long-term investors may want to remain patient for a little longer.

So, Is INMD Stock A Buy, Sell, or Hold?

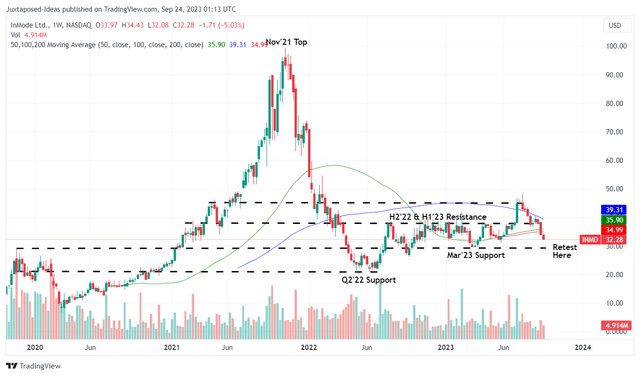

INMD 5Y Stock Price

Trading View

Perhaps this is why the INMD stock has failed to sustain its upward momentum then, despite the double beat FQ2’23 earnings call and raised FY2023 guidance.

With the stock already losing all of much of its gains since then, currently retesting the March 2023 support levels of $30, it remains to be seen how the situation may develop moving forward.

While we are optimistic about INMD’s upward re-rating closer to its historical mean and sector median, we are less certain now, due to the apparent pessimism observed thus far.

For now, based on the consensus FY2025 adj EPS estimates of $3.45 and its FWD P/E of 12.07x, there appears to be an excellent upside potential of +28.9% to our long-term price target of $41.64.

As a result of its mixed prospects, while we may continue to rate the INMD stock as a Buy, investors may want to temper their near term expectations, especially since its eventual reversal may take longer than a few quarters.

Read the full article here

Leave a Reply