Today, I invest about 50% of my net worth into a portfolio of 25 real estate investment trusts, or REITs, that I have cherry-picked to maximize returns in a future recovery.

But I often get asked:

What REITs would you buy if you could only own 3 of them?

It is a tough question to answer because there are a lot of REITs in my portfolio that I wouldn’t buy if I had to be so concentrated. To give you an example, I think that Medical Properties Trust (MPW) is opportunistic, and a small investment could make sense as part of a well-diversified portfolio. But it is also very speculative and, therefore, I wouldn’t buy it if I could own only 3 REITs.

If I had to be so concentrated, then I would need to focus on more conservative REITs that:

- Have proven themselves,

- Enjoy strong balance sheets,

- Have attractive long-term growth prospects,

- Aren’t facing any major secular threats that could detail the thesis,

- And ideally, I would buy them at low valuations to enjoy margin of safety.

In what follows, I will highlight three such REITs that I would build my base around if I could only own a few names.

Crown Castle Inc. (CCI)

Crown Castle is a REIT that specializes in cell towers, and I think that it is one of the best investment opportunities in today’s market.

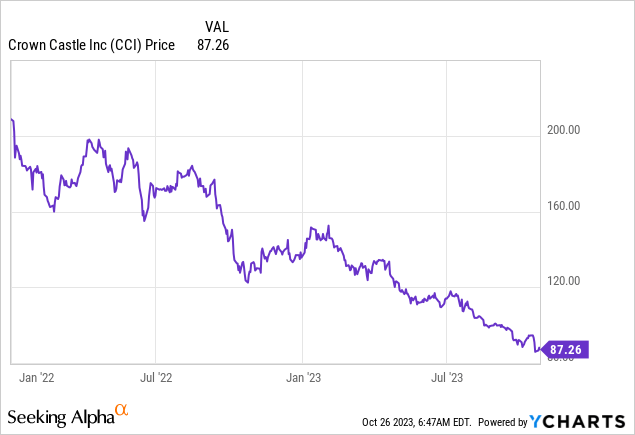

That’s because the company has all the characteristics of a blue-chip REIT, but it is going through a temporary slowdown in its growth rate, and as a result, the market has overreacted and repriced it as if it would never grow again:

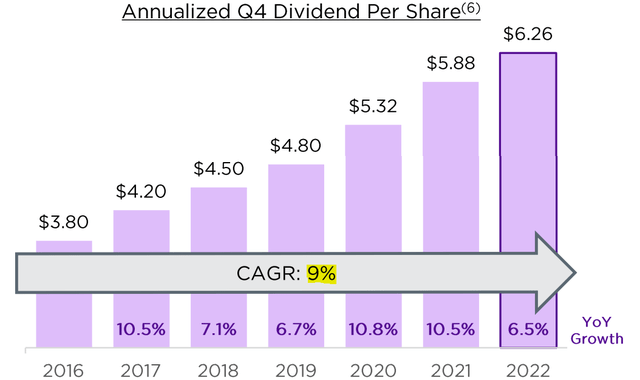

Historically, CCI has targeted a 7-8% annual growth rate in funds from operations (“FFO”) and dividend per share, and it has managed to do even better than that:

Crown Castle

But today, it is facing a temporary headwind that should cause it to miss its growth target in 2024 and 2025.

It is facing some lease cancellations as a result of T-Mobile US’s (TMUS) recent acquisition of Sprint. Both are tenants of CCI, and going forward, they won’t both need to lease space on the same tower.

The CCI management has noted the lease cancellations will weigh on their results through 2025 and cause them to miss their growth target.

But beyond that, they are confident that they can return to their historic 7-8% annual growth target. Here is what the management said on their most recent conference call (emphasis added):

“Beyond 2025, I would look at the business and say based on the characteristics that we see for organic revenue growth and our long-term forecast for where we think the carriers are going to invest to continue to build out 5G, which is going to take the better part of the decade we expect, we see organic growth in AFFO returning to that targeted level of 7% to 8%. And so, feel good about the underlying demand drivers of how we’re going to get there. And then, as we get closer to that date, we can talk more specifically about what we think the growth rate will be in 2026.”

We are confident that they will pull this off because they have already contracted most of their growth for the coming years, and the recent dip in growth is clearly an anomaly that’s caused by a one-time factor.

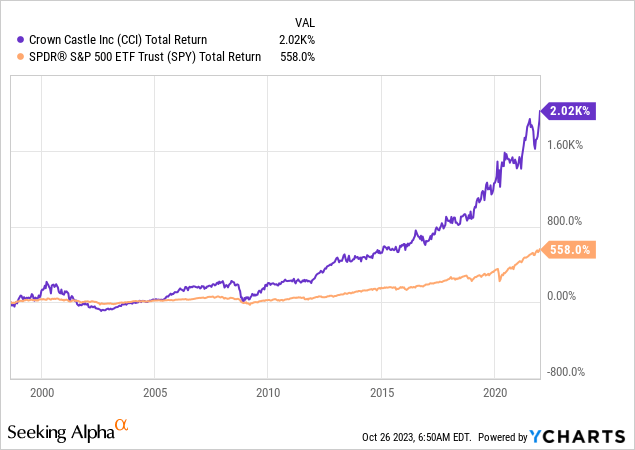

Moreover, if you doubt the management, just consider that they have historically under-promised and overdelivered. They have consistently beaten their 7-8% growth target and massively outperformed the rest of the market:

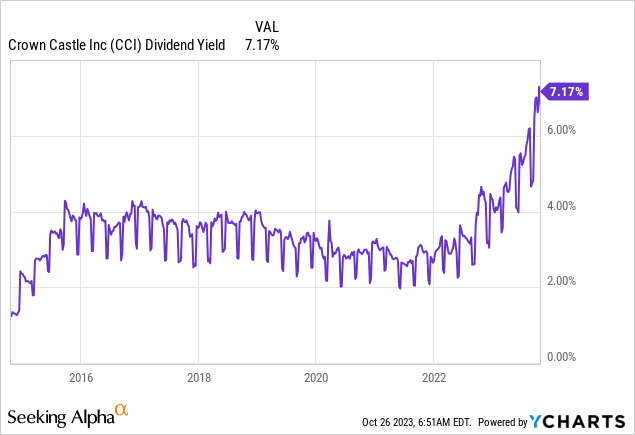

Yet, following its recent crash, the stock is now priced at its lowest valuation in years at just 12x FFO and its highest dividend yield ever at 7.2%:

If like me, you believe that CCI will be able to return to a 7-8% annual growth rate, then this is a historic opportunity because it will likely reprice at a materially higher multiple and lower yield once its growth reaccelerates in a few years from now.

Prior to the recent crash, CCI traded at 26x FFO. That’s probably a bit much for today’s higher interest rate environment, but even returning to just 18x FFO, a historically low multiple for CCI, would result in 50% upside from here.

And beyond that, you will also be earning ~15% average annual total returns post-2025 from a blue-chip REIT with defensive fundamentals.

7.2% yield + 7-8% growth rate = ~15% average annual returns

It’s hard to beat that coming from a fairly conservative mega-cap REIT with an investment grade rating and attractive long-term growth prospects.

One last thing: before you comment that satellites are a threat to towers, please do a bit of reading on the topic. Satellites are meant for more remote areas that are poorly covered by towers. It is a much slower and more expensive solution. Even Elon Musk has made it clear that satellites are not a competitor to towers.

Big Yellow Group Plc (BYG / OTCPK:BYLOF)

If I had to own only 3 REITs, I would want to also have some international diversification in the mix.

And it happens that my Top Pick in the self-storage sector is based in the UK.

Big Yellow Group

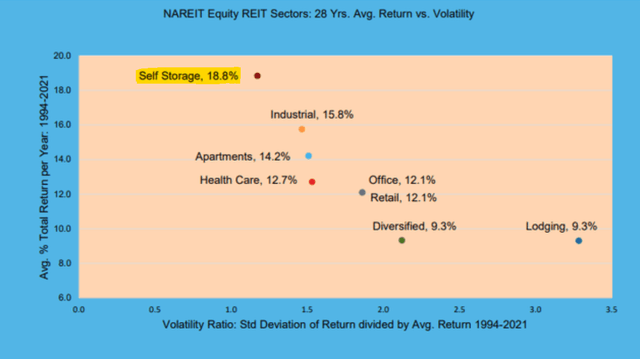

Self-storage has historically been the most rewarding of all property sectors. It has earned 19% average annual total returns over the past ~30 years, and that’s despite also being the least volatile of all property sectors:

National Storage Affiliates

Self-storage REITs achieved these exceptional results because of three main things:

- Superior organic growth: this is a sector in which scale and professional management really made a big difference. REITs could acquire properties from unsophisticated operators, rebrand them, implement revenue-optimization systems, and add them to national advertising campaigns to rapidly growth their cash flow and value. The potential for “value-add” was significant and this allowed REITs to grow at a rapid pace without having to invest much capital in their properties.

- Superior investment spreads: Beyond that, as the demand for self-storage grew, REITs were also able to develop new properties, often earning initial yields near 10%, resulting in very large spreads over their cost of capital. A REIT like Realty Income (O) may have earned a 150 basis point spread, but REITs like Public Storage (PSA) may have earned 2x or 3x as much.

- Recession-resistant: Best of all, self-storage REITs didn’t lose much, if anything, during recessions, and so that also helped their average performance. Self-storage may in some cases even grow in demand during recessions as people downsize to smaller homes and businesses cut down their office footprint to save money and need some space to store the extra stuff. The demand is not very cyclical.

But past performance is not indicative of future results and the next decades will likely look a lot different.

That’s because the secret is now out and a lot of new players have entered the market in the US and built new storage facilities at every busy intersection of the country.

But the European market is very different.

I think that it is essentially 30 years behind and so there is an opportunity to replicate these superior returns over the next decades.

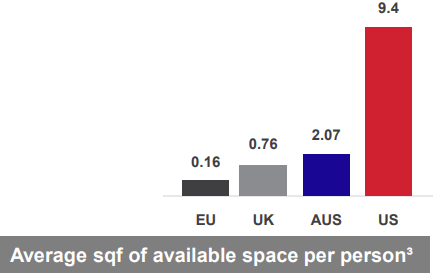

Today, there is just 1 square foot of space in the UK compared to 10 in the U.S.:

Big Yellow Group

But the same demand drivers exist in Europe and the concept is now rapidly growing in popularity as European consumers learn about it.

Big Yellow Group is capitalizing on this opportunity.

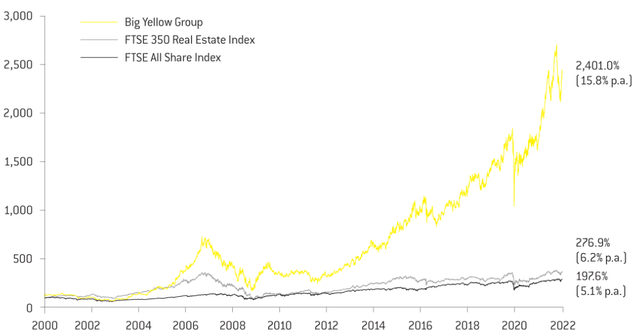

It was the first mover in the UK, and it has been buying and developing self-storage facilities since the late ’90s. Here are its results since then:

Big Yellow Group

It has managed to do just as well as its U.S. peers, but the difference is that the opportunity remains big in Europe and I think that it can keep this going for another few decades.

Today, it has a strong balance sheet with a low 20% LTV, plenty of liquidity, and a large pipeline of development projects underway with expected initial yields of nearly 10%.

That should significantly grow its cash flow and dividend in the coming years, but despite that, Big Yellow is currently priced at a historically low valuation of just 16x FFO and a high 5% dividend yield.

Just a year ago, it traded at a roughly 2x higher valuation.

Perhaps that was a bit too much, but today’s valuation is too low when you consider how big the opportunity is in Europe for self-storage. Big Yellow has managed to grow its FFO per share by 12% per year on average since going public and it can keep growing at a rapid pace for a long time to come.

How many REITs do you know that are able to grow this rapidly with so little leverage?

There simply aren’t many, especially trading at just 16x FFO.

We expect 50% upside potential as it returns closer to 22x FFO and it is today one of my largest international REIT holdings.

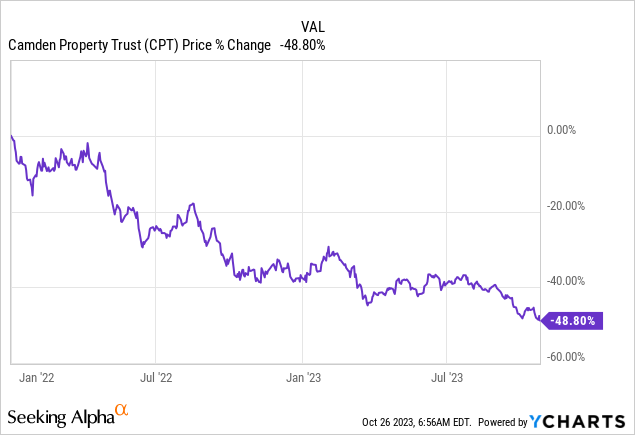

Camden Property Trust (CPT)

Finally, I would want to complete my portfolio with some residential exposure.

I think that there are today some smaller residential REITs that are a bit more opportunistic than Camden Property Trust, but it is hard to beat CPT in terms of its risk-to-reward.

That’s because it has all the characteristics of a blue chip:

- Long track record of massive outperformance

- A-rated balance sheet

- Resilient cash flow

- Strong growth prospects

- Etc.

Camden Property Trust

But despite that, it has crashed recently and it now trades at a huge discount relative to the fair value of its assets.

At the current share price, the implied cap rate is about 7%, but if you actually tried to buy similar apartment communities in its sunbelt markets, you would get 5% at best. Some of its assets would sell at closer to a 4.5% cap, even in today’s market.

As a result, we estimate that CPT trades at a 40% discount to its net asset value, or put differently, it is priced at just 60 cents on the dollar.

That’s truly exceptional for a REIT of this quality.

The market appears to be very concerned about the surge in interest rates and the risk of overbuilding in its markets.

But as we noted earlier, CPT has an A-rated balance sheet. This is literally one of the safest balance sheets in the REIT sector. And beyond that, CPT owns mainly class B properties with rents that are materially lower than those of new development projects, providing margin of safety.

That does not mean that CPT will be immune to the new supply, but the impact won’t be significant, and times of overbuilding are followed by times of undersupply and that’s precisely what we expect because the high-interest rates and elevated construction costs have made it almost impossible to build new properties.

So if you have the patience to wait a few years, I believe that CPT will likely eventually trade at much closer to its net asset value, unlocking about 50% upside from here, and while you wait, you earn a 4.2% dividend yield. The yield may not seem high, but that is because the REIT retains about 40% of its cash flow to reinvest in growth.

If CPT fails to reprice higher, I also wouldn’t be surprised if it got bought out by Blackstone (BX), Brookfield (BAM), or any other major private equity player.

Bottom Line

These three REITs are great portfolio anchors in my opinion.

They of course present some risks, but generally speaking, they are amongst the safer REITs, and yet they are just as heavily discounted as the rest of the sector.

Note, however, that I would never want to own just 3 REITs because the lack of diversification would hurt the risk-to-reward. I would much rather include more property sectors and geographies in the portfolio in order to optimize my returns and minimize my risk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply