Reason for the Update: Q2 Earnings and Sell Rating Re-iteration

Q2 2023 Earnings Overview

Idorsia (OTC:IDRSF) provided its half-year 2023 financial revelations, which, unfortunately, failed to inspire confidence. The company ended with a meager CHF43.8M in cash, cash equivalents, and short-term deposits. Their sales were below expectations, and the withdrawal of the ambitious 2025 revenue guidance of approximately $1B has further exacerbated concerns. This grim reality, combined with the company’s announcement that it would retract its forecast of achieving sustainable profitability by 2025, signals a turbulent financial position that made us keep our sell rating on the stock.

Importantly, we believe concerns are growing around the company’s business model, especially given the lack of clear evidence of QUVIVIQ’s rising revenues and J&J’s wavering commitment to aprocitentan. We expect investors will question the company’s viability, particularly considering Idorsia’s revised breakeven target date, which is now 2027, as opposed to the previously announced 2025.

Slow and Disappointing Sales Growth

Q2 2023 Sales Growth (Company Source)

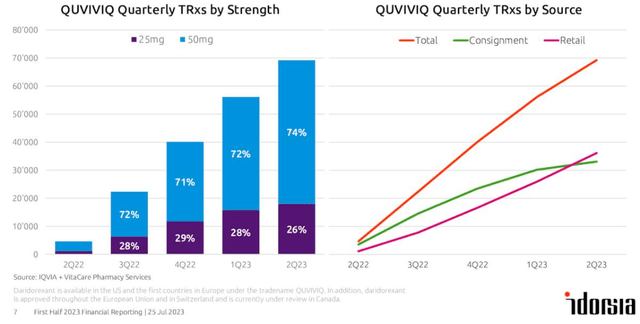

Idorsia’s daridorexant, an anti-insomnia drug, has witnessed underwhelming sales figures. While there is a discernible positive trajectory in product demand for QUVIVIQ™ (the U.S. brand name for daridorexant), its sales reached just CHF11.8M in 1H23. The drug’s performance, although promising in terms of new brand prescriptions, has been significantly slower than anticipated, significantly lower than what the street expected (>$1Bn 2026 projected by some analysts).

Cash Runway Concerns and Cost Reduction Measures

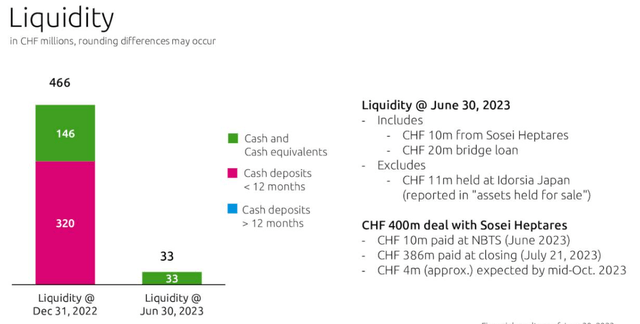

Idorsia reported having CHF43.8M in cash, cash equivalents, and short-term deposits as of their half-year 2023 financial results. During the earnings call, the management predicted a U.S. GAAP operating loss of approximately CHF735M for the year 2023, which is a tiny reduction from their prior guidance of a U.S. GAAP operating loss of ~CHF750M.

Q2 2023 earnings

Cost Reduction: Idorsia announced a cost reduction initiative aimed at cutting the cash burn at its headquarters by roughly 50%. This initiative involves scrutinizing the R&D pipeline and product portfolio and suspending or preparing for partnership/out-licensing of projects that are not in line with corporate priorities.

Sale of Assets: On July 20, 2023, Idorsia sold its operating businesses in the Asia Pacific (excluding China) to Sosei Heptares, securing CHF400M from the sale. This not only boosts the cash reserves but also diverts certain operating costs associated with these businesses.

By combining the proceeds from this asset sale with its existing cash resources, Idorsia anticipates that it has secured funding for operations into early 2024.

The company’s limited cash runway until 2024 has raised alarms, especially with an operating expense that remains high. Though Idorsia has initiated cost reduction plans, aiming to decrease the cash burn at headquarters by roughly 50%, it remains to be seen if these efforts will be fruitful. As part of this initiative, Idorsia plans to review its R&D pipeline, potentially rendering up to 500 positions redundant, primarily within R&D and associated support functions in Allschwil, Switzerland. Despite these changes, a looming one-off charge, the magnitude of which is yet to be finalized, is anticipated in the 2023 financial statements.

Q2 2023 Earnings (Company IR Deck)

Risks

Multiple risks cloud the prospect of investing in Idorsia. These include potential failures of late-stage candidates in pivotal trials, challenges in obtaining timely approval of vital assets, setbacks with early-stage candidates, and the looming risk of dilution in the near to medium term.

Conclusion

Given the aforementioned reasons, coupled with the evident slow traction of commercial sales that continuously disappoints, an uncertain cash runway, and the evident high risks associated with an investment, we are reiterating our Sell rating on Idorsia. The recent cost-saving initiatives, although commendable, are yet to prove their effectiveness, and the company’s overall position remains fraught with challenges. We do not see a positive catalyst on the horizon that can move the needle for the company, and we are planning to stay away until the company’s liquidity situation improves.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply