I have been an advocate of holding fixed-term bond funds like the Invesco BulletShares 2026 High Yield Corporate Bond ETF (BSJQ), as the all-in yields of non-investment grade bonds have reached attractive equity-like levels that should provide decent margin-of-safety even for negative economic scenarios. In a recent article discussing credit, one reader suggested I take a look at the iBond products from iShares, as they are a series of fixed-term bond funds.

In this article, I have chosen to review the iShares iBonds 2025 Term High Yield and Income ETF (BATS:IBHE) and provide updated thoughts on holding the BSJQ ETF.

Fund Overview

The iShares iBonds 2025 Term High Yield and Income ETF is a fixed term bond fund from iShares that seek to track the investment results of an index composed of high yield and other income generating corporate bonds that mature in 2025.

The iBond products are designed to mature like a bond, but trade like a stock, combining the defined maturity and regular income characteristics of a bond with the transparency of a stock. iBonds allow investors to build a diversified bond ladder while managing interest rate risk.

iBond Mechanics

Mechanically, the IBHE ETF will mature on or about December 15, 2025, at which time it will distribute its remaining assets to unitholders according to a plan of liquidation. IBHE tracks an index that consists of high yield (those rated lower than BBB) and BBB-rated bonds that mature between January 1, 2025 and December 15, 2025 (“maturity window”).

The underlying index begins with the Bloomberg U.S. High Yield Index, stripping out bonds that mature outside the maturity window (“Underlying Index”). When the time to maturity is less than 1.5 years but greater than 6 months, the IBHE ETF will introduce bonds from the Bloomberg U.S. Corporate Index (“Replacement Index”) that are BBB-rated and meet the maturity window to replace high yield bonds that are called or are no longer eligible for inclusion because of credit rating changes or value declines.

If the market value of the securities in the Underlying Index falls below $30 billion in aggregate prior to 1.5 years from maturity, the Underlying Index will add BBB-rated bonds from the Replacement Index to maintain the $30 billion minimum market value for the Underlying Index.

For bonds that mature in the first 6 months of the last year of operation of the IBHE ETF, the fund will reinvest the proceeds in the securities in the Underlying Index on a pro-rata basis. For bonds that mature in the last 6 months of operation, no reinvestment will be made and the proceeds are presumed to be held in cash earning no interest.

The IBHE ETF has $240 million in assets and charges a 0.35% expense ratio.

Portfolio Holdings

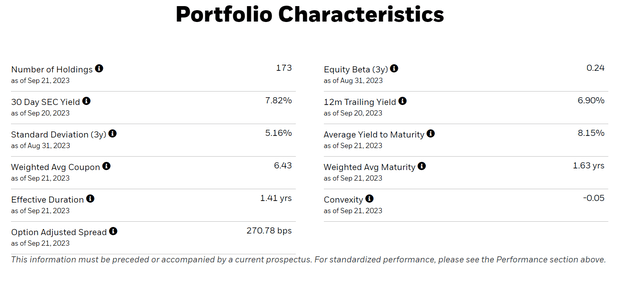

As designed, the IBHE ETF’s portfolio contains 173 bonds and has an effective duration of 1.4 years and an average time to maturity of 1.6 years (Figure 1). The portfolio has an average yield to maturity of 8.2% and a 30-Day SEC Yield of 7.8%.

Figure 1 – IBHE portfolio overview (ishares.com)

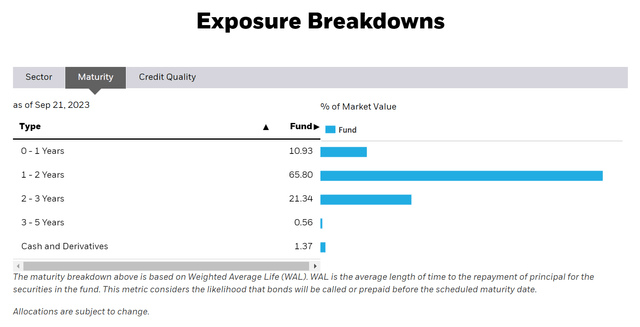

The IBHE ETF predominantly hold bonds that mature in 1 to 3 years, within the maturity window mentioned above (Figure 2).

Figure 2 – IBHE maturity allocation (ishares.com)

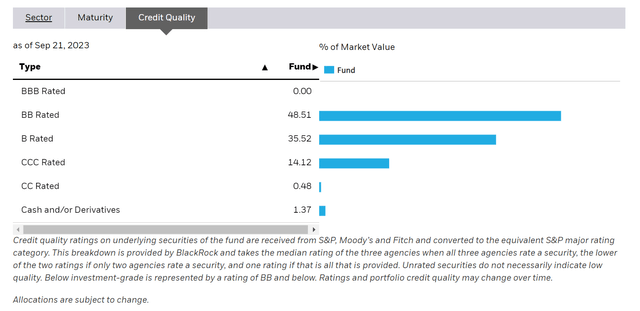

In terms of credit quality, the IBHE ETF holds 48.5% of its portfolio in BB-rated bonds, 35.5% in B-rated bonds, and 14.1% in CCC-rated bonds (Figure 3).

Figure 3 – IBHE credit quality allocation (ishares.com)

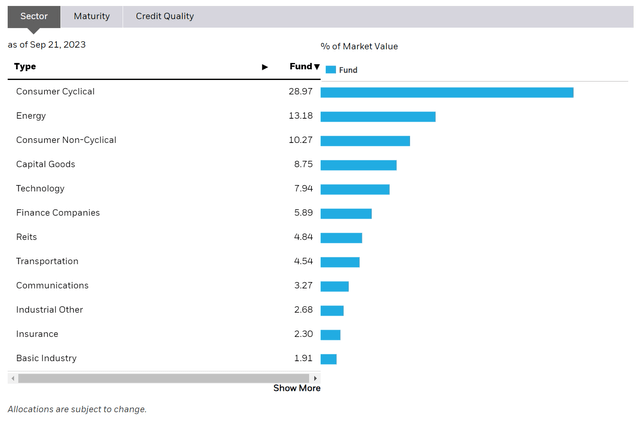

IBHE’s portfolio is broadly diversified, with Consumer Cyclicals being the largest sector weight at 29.0%, followed by Energy at 13.2%, Consumer Non-Cyclical at 10.3%, Capital Goods at 8.8%, and Technology at 7.9% (Figure 4).

Figure 4 – IBHE sector allocation (ishares.com)

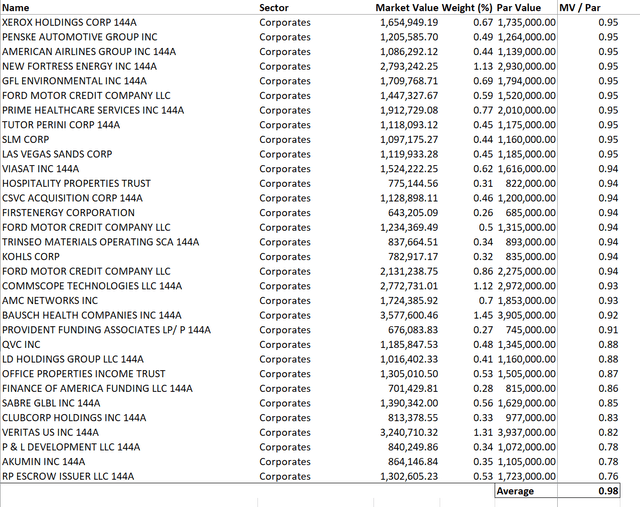

Digging into the fund’s portfolio, the average holding is currently trading at 98 cents to par. This is actually a fairly solid result, given how much interest rates have risen in the past 2 years as rising interest rates reduces the value of bonds (Figure 5).

Figure 5 – IBHE holdings details (Author created with data from ishares.com)

However, there are a few notable positions that are trading at distressed prices. For example, a $1.7 million face value holding of RP ESCROW ISSUER LLC is trading at 76 cents to par, a $1.1 million holding in AKUMIN INC is trading at 78 cents, and $1.1 million of P&L DEVELOPMENT LLC is trading at 78 cents.

RP ESCROW ISSUER (Radiology Partners) and AKUMIN are both radiology providers that are on default watch by the rating agencies. P&L Development LLC is a pharmaceutical company recently downgraded by Fitch.

Overall, IBHE’s portfolio appears pretty standard for a passive basket of high yield bonds; there will inevitably be winners and losers. As long as the vast majority of the portfolio does not default, investors will stand to reap a decent return.

Returns

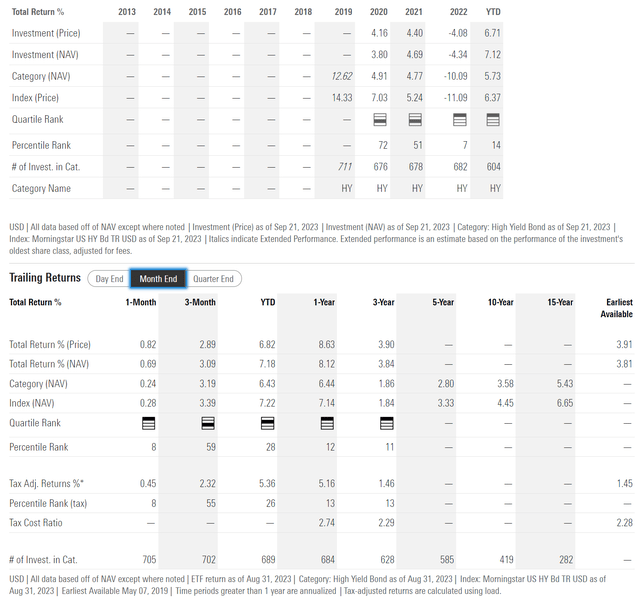

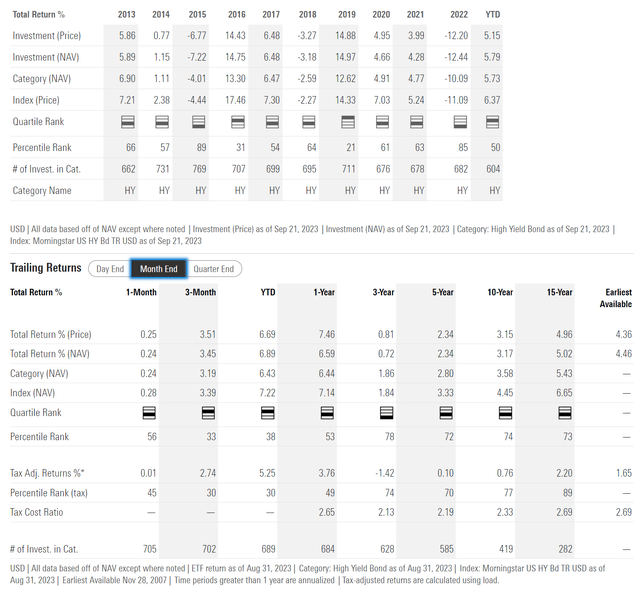

Speaking of returns, the IBHE ETF has delivered solid, if unspectacular historical returns, with 1 and 3 year average annual returns of 8.1% and 3.8% respectively to August 31, 2023 (Figure 6).

Figure 6 – IBHE historical returns (morningstar.com)

Notably, the IBHE ETF escaped 2022 relatively unscathed as its low duration minimized losses to only 4.3%, compared to the SPDR Bloomberg High Yield Bond ETF (JNK), which lost 12.4% in 2022 (Figure 7).

Figure 7 – JNK historical returns (morningstar.com)

Distribution & Yield

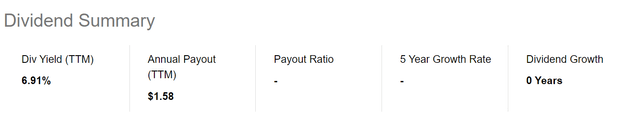

Currently, the IBHE ETF is paying an attractive trailing 12 month distribution yield of 6.9% (Figure 8). IBHE’s distribution is paid monthly.

Figure 8 – IBHE is paying a trailing 6.9% yield (Seeking Alpha)

IBHE’s yield is slightly higher than the weighted average coupon of its portfolio of 6.4%.

What Forward Returns Can Investors Expect?

Assuming IBHE’s portfolio does not experience any defaults until maturity, investors buying the IBHE ETF today can earn approximately 8% annualized forward return, as shown by the fund’s average yield to maturity of 8.1% in Figure 1 above. Alternatively, investors can think of earning a 6.9% distribution yield, plus ~1% per year as the fund’s holdings mature at par in ~2 years.

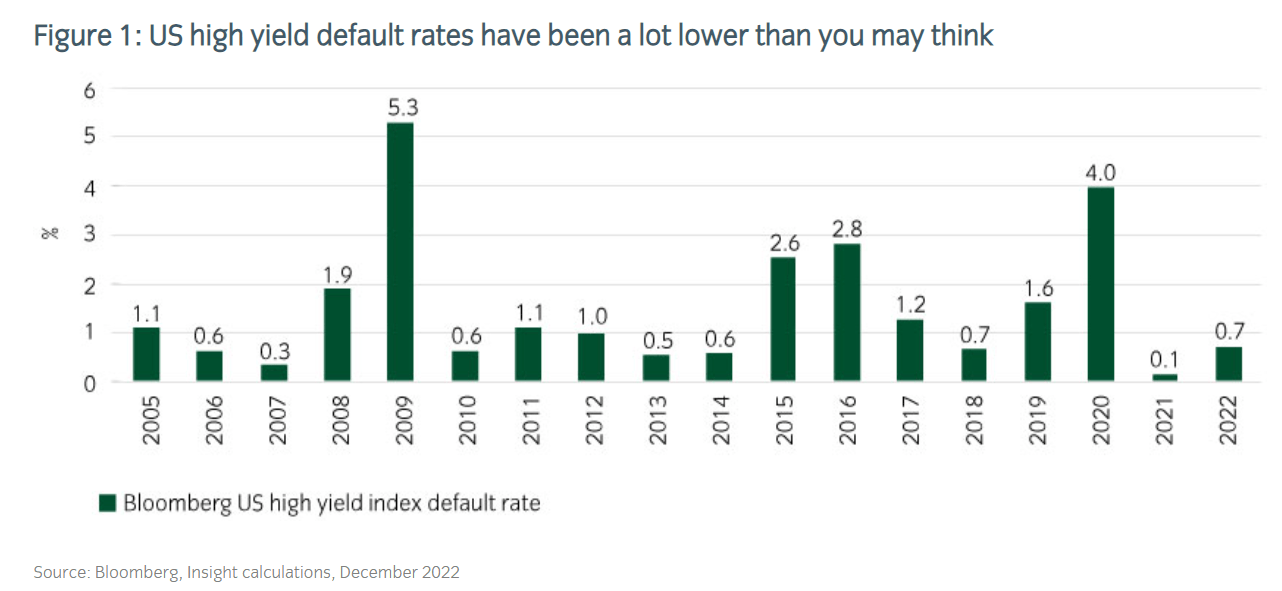

However, offsetting this theoretical return will be credit defaults. As mentioned above, IBHE’s portfolio contains several distressed issuers that are likely to default. According to data from Insight Investment, U.S. high yield default rates in the past 15 years have averaged ~1.5%, with peak defaults occurring in 2009 and 2020 due to the Great Financial Crisis (“GFC”) and the Covid-pandemic respectively (Figure 9).

Figure 9 – Historical U.S. high yield default rates (Insight Investment)

In fact, according to data from S&P Global, one of the three main credit rating agencies, global credit defaults totaled 107 in the year to August, with the number of defaults in August 2023 being the highest August tally since 2009 (Figure 10).

Figure 10 – Defaults in August the highest since 2009 (S&P Global)

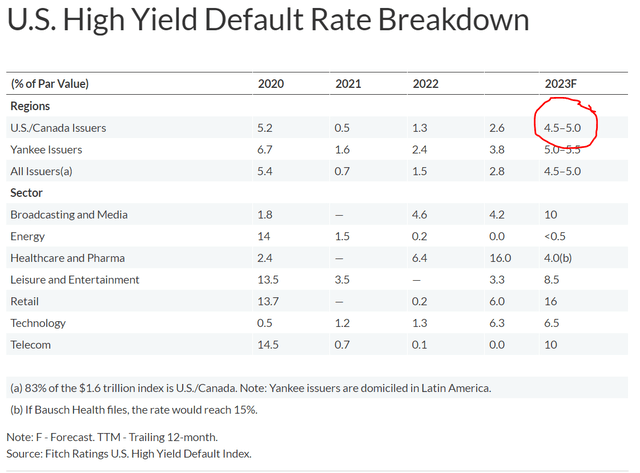

Overall, S&P Global expects U.S. high yield corporate defaults to continue rising, hitting 4.5% in 2023 from a trailing 12 month default rate of 3.7. Fitch, another credit rating agency, also expects similar levels of high yield credit defaults of 4.5-5.0% in 2023 (Figure 11).

Figure 11 – Fitch expects high yield credit defaults to hit 4.5% in 2023 (Fitch)

Assuming the credit rating agencies are correct and default rates rise to 4.5% for 2023 and 2024, then IBHE investors may be looking at an annual 2.25 – 3.15% drag from defaults (assuming 30-50% recoveries upon default). Therefore, instead of a theoretical 8% forward return, investors may actually experience ~ 5% returns over the next 2 years until IBHE matures.

Readers should note that this is the expected average annual forward return. If the economy experiences negative credit shocks, for example a recession in the next 2 years, then credit spreads may widen dramatically and IBHE’s NAV may decline. However, as long as the majority of issuers do not default, this mark-to-market NAV decline should be earned back as the underlying portfolio of corporate bonds march back to par at maturity.

IBHE Is Not Attractive At The Moment

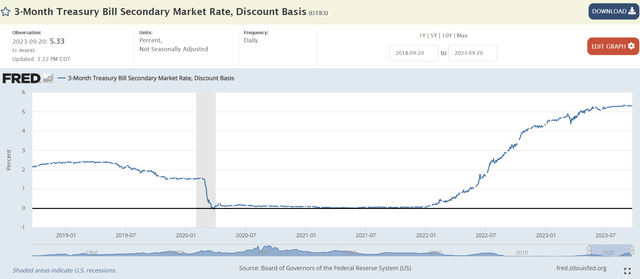

To be honest, a 5% forward return is not particularly attractive at the moment given risk-free 3-month treasury bills are earning 5.3% (Figure 12).

Figure 12 – Treasury bill yields north of 5% (St. Louis Fed)

In fact, with recent increases in default estimates by the credit rating agencies (Fitch has raised defaults from 3 to 4.5% since my BSJQ article), even the buy rated BSJQ ETF is not attractive as a fresh investment. Readers looking to buy fixed-term high yield funds should wait for better pricing.

Buy iBonds On Market Panics

Given the mean reverting nature of credit markets and the fixed-term nature of iBonds, there is a scenario where I would find IBHE and similar funds attractive.

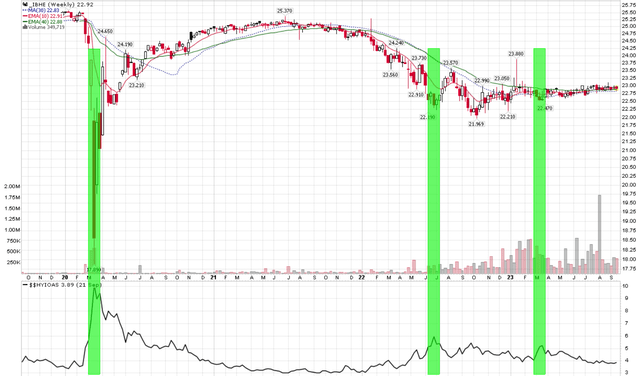

For example, if we look at the historical NAV performance of the IBHE ETF, we can see that during market panics when high yield credit spread spikes, IBHE’s NAV plunges (Figure 13). Although in 2022, as IBHE’s effective duration has decreased, the magnitude of the declines are also lessened.

Figure 13 – Credit funds plunge during market panics (Author created with price charts from stockcharts.com)

For investors with a strong stomach for volatility, buying a fixed term portfolio of high yield bonds like the IBHE ETF could be a very lucrative endeavor during market panics.

Recall, the highest historical annual default rates in the high yield bond markets were around ~4-5% due to GFC and Covid respectively. So if we can buy shares of a diversified portfolio of high yield bonds when the portfolio is pricing in panic (i.e., if the yield to maturity widens to > 10%), and the fund is held to maturity, then investors should be able to lock in a decent forward return for the remaining duration of the fund.

For example, IBHE’s NAV dropped to a low of $17.89 during the COVID panic when high yield credit spreads spiked to 10%. If investors had the mental fortitude to buy the IBHE ETF at attractive valuations, say at $20.00 NAV, then they would have earned over 14% in capital appreciation to the latest NAV of $22.87 (~4% p.a.), in addition to the ~6% annual distribution, or an annualized return ~10%.

Conclusion

I continue to believe fixed-term high yield bond funds can play an important role in investors’ portfolios. The iShares iBonds 2025 Term High Yield and Income ETF is one such fund, with a maturity date of December 2025.

However, looking at the math, an investor buying the fund today is only looking at a ~5.0% forward return to maturity, given elevated default expectations due to the high interest rate environment. Relative to risk-free treasury bills yielding over 5%, that is not an attractive proposition.

I would be more positive on the IBHE ETF and similar funds if credit spreads were to widen, giving investors more margin of safety, or if credit performance expectations were to improve, reducing the likelihood of defaults. I rate the IBHE ETF a hold.

Read the full article here

Leave a Reply