Dear readers/followers,

Iberdrola (OTCPK:IBDSF) has been an investment of mine for over a year. It’s a business that’s an attractive EU-based utility, though not as attractive currently as some other businesses, including the European utility Enel (OTCPK:ENLAY). The two utilities, together with Fortum (OTCPK:FOJCF), have been my “bets” on this market for some time, and all of them have showcased truly excellent overall returns.

Iberdrola has not seen as solid returns as Enel – and I went “HOLD” on the company in this, the latest of my articles on the business, which proved to be the right choice – because the company is down more than 10% since my article in July, whereas the overall market is only down 3%.

So, I made the right choice, not buying more. The reasoning was simple. A 4%-yielding utility isn’t as attractive when you can get 7-9% from pref stocks or debt investments that are investment-rated.

In this article, I’ll be updating you on Iberdrola and showing you what I expect for the business.

Iberdrola – Good fundamentals with a problematic forecast

What do I mean by problematic forecast?

Essentially, if you invest in a utility, you’re not investing in a whole lot of growth. The same is true here. While the company is expected to see some growth, a 4-5% growth rate is standard here. This coupled with the company’s 3.88% yield here is far from the greatest potential in the sector – or even in Spain as an investment geography, given you could be buying the native listing of IBE, on the Madrid market.

So let’s see what the company has delivered here.

Company net sales are up, and Iberdrola saw strong operating performance with significant volume growth despite lower energy purchases, due to increased operating efficiencies. Company investments are progressing well – Iberdrola has invested over €10B in the last 12 months, improving RAB and installing over 3,100 MW of renewables, bringing Iberdrola’s total volume of renewable generation to 41,300MW, with the associated supply chains secured.

Despite these significant investment amounts, the company has seen significant FFO improvement and a reduction in net debt, coming in now at FFO to net debt on an adjusted basis of 23.2%.

On a housekeeping note, we now have 85% of debt at a fixed rate – excluding Brazil, which is lower, and a continued liquidity of over €20B, more than twice the capital invested over the past 12 months.

The company also increased the dividend, to €0.2/share for the interim, an 11% improvement.

These are 3Q23 results, and these positives come despite of the challenges faced by the company, coming in the form of rising inflation, rising interest rates which puts pressure on interest costs, volatility in commodity pricing (even with Iberdrolas increasing freedom due to renewables) and pressure on the overall GDP growth.

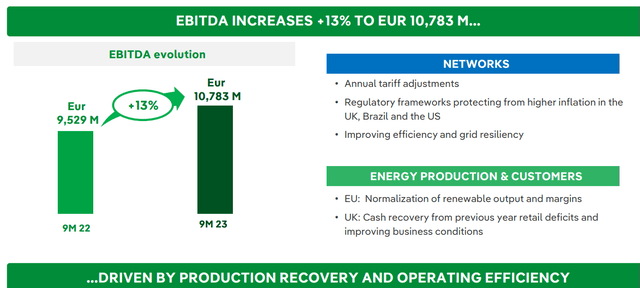

It’s therefore impressive that we’re seeing an EBITDA growth of 13%, to over €10B on a 9M basis…

Iberdrola IR (Iberdrola IR)

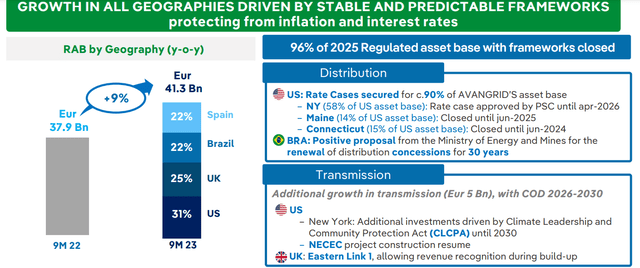

I also want to take this opportunity to point out just how good the company’s mix and diversification actually is – with no one geography having over 32% in terms of RAB.

Iberdrola IR (Iberdrola IR)

Furthermore, Iberdrola is tilting its growth towards high-rating rather than volatile countries, as you can see above. The company has already secured much of its relevant rate case and is investing additional capital in both USA and the UK.

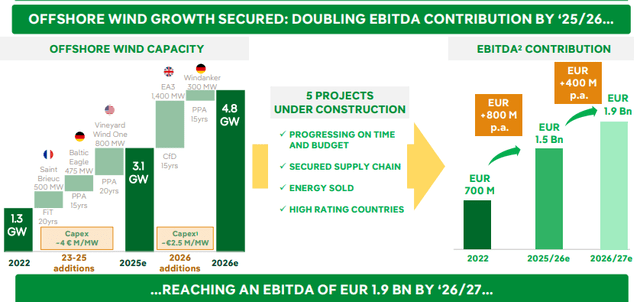

The company now focusing on onshore renewables, with 2.7 GW currently installed, and another 4.4 GW in construction, coming to a total of 7.1 GW, which means that 60% of the 2023-2025E Onshore plan has been, or is currently being executed. Here are the specifics of the current offshore wind plans.

Iberdrola IR (Iberdrola IR)

I would personally estimate the potential EBITDA contribution of this segment as lower due to the trouble in renewables in terms of interest rates and profitability, but I do believe the company will deliver far better profitability than what we’ve seen from some years-old plans from other renewable producers and utilities here. Also, and more fortunately, the company is focusing on far more than just on/offshore renewables and also focusing on pumped hydro to modulate the company’s supply and demand. The company already has more than 100m kWh of pump storage capacity and is quickly adding to this capacity with a target of over 270 M kWh, more than 2.5x the capacity, in future projects, with additional battery operations in Spain, UK, and Australia.

Iberdrola is an attractive operator. Proof?

Around 90% of the planned production for 2023-2025E is already sold, and the company has already secured 100% of the relevant supply chain for its 2025E offshore and onshore wind projects. In the networks segment, over 80% of the supply chain has already been secured as well.

A word on asset rotations and disposals and/or partnerships to remain attractive here, including JV’s with Norges Bank, MIP, Mapfre, BP, and others – all of these transactions are proceeding as planned, and the company is active in Mexico, Brazil, Spain, Portugal, Germany and the UK (Source: Iberdrola 3Q23).

The company is seeing improvements in operating cash flow, a flat net debt, and improvements in other fundamentals. Unlike Enel and other utilities, the company is unfortunately less than 100% clear. The interim dividend is increased, but the supplementary dividends are always determined by the GSM. The current expectations and implications are somewhere at the €0.3-€0.4 level, which would put the total yield between around 4.7% and somewhat above 5%. This would still not be significantly above the risk-free rate available on the market today. On the positive side, the company has reached its 2025E dividend floor targets 3 years early.

I said in my earlier article that Iberdrola is less risky than Enel. This is technically still true, but I did say in my last article that Iberdrola had a lot more valuation risk than we’re seeing with Enel – and this has been proven to be the case as of this article, with Enel having dropped less than Iberdrola and still being. In my last article, Iberdrola wasn’t cheap by any metric – as things stand now, it’s getting cheaper.

I didn’t sell my investment at the time, and I’m certainly not selling now that the company is down since I last wrote about it.

This company had good results. I don’t see a near-term downturn in earnings for the next few years, but I also don’t see as much growth in the near term as I did only 1-2 years ago. As a result of this, I’m cautious about investing in Iberdrola at this valuation.

Let me clarify the upside further here – or rather, the lack of long-term downside.

Valuation for Iberdrola – the upside still isn’t that compelling.

The company sometimes trades at a premium of 16-17x P/E – but I won’t forecast it at this level if it rises that high – great. if it doesn’t, and I’ve bought at 15x P/E, that’s where my upside lies. With that in mind, the last time the company was attractive was in the fall of 2022. Since then, mostly a share price that I would consider to be too high.

While the company is now below a 15x P/E normalized, around 14.28x. The upside isn’t 15% per year here – but it’s over 13% to a forward P/E of 15x, which is conservative.

However, my previous PT for the company was €10/share. I do not see any reason at this time, even with the company’s upside, to allow for the company to trade at a higher level here. Maybe at €10.10, I could call it a rounding error – but at close to €10.50, that’s not the case.

I’m not changing my price target here – which means that Iberdrola at this valuation is still a “HOLD”. You could see 13% annualized RoR here to a valuation of 15x – but why would you do that, when you could get a conservative 33% annualized RoR with a 6.5% yield for Enel to 15x P/e? Or, if you want to go lower, a 20% annualized RoR to a P/E of only 11.5x.

Utilities are a great income investment – but I would very clearly state here that Enel is a far superior investment in terms of valuation to Iberdrola, even if Enel is somewhat riskier in terms of its mix and fundamentals, and Iberdrola has come far longer in its ESG/renewable push.

That makes the company a relatively easy Thesis as I am updating this – and I confess to being surprised at still being a “HOLD” here because I expected the company to drop a bit farther. I say “HOLD” because I believe the annual conservative upside to be capped at around 10-13%, and this isn’t enough for me to invest in this instead of other alternatives.

While Iberdrola is a long-term excellent investment, I don’t view it as all that attractive at this valuation, and consider other companies more interesting here.

Thesis

- Iberdrola is a superb utility stock with plenty of upside at the right valuation. However, the keyword here is “right valuation”. At too high a valuation, the upside for these investments can go down to 4-7% conservatively even with a 3-4%+ yield, and this is where Iberdrola currently trades.

- I forecast the company a 15x P/E, and at that level, the company has no more than 7-8% normalized, which is not good enough for my investment targets, even with this company.

- I say that you should “BUY” Iberdrola at a price no higher than €10/share. That’s a normalized P/E 15x at the current 2023-2025E level.

- For that reason, it’s “HOLD” here as of my update in November of 2023.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

For these reasons, I consider the company to only be a “HOLD” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply