Summary

Readers may find my previous coverage via this link. My previous rating was a hold for Hugo Boss (OTCPK:BOSSY), as I wanted to continue monitoring the situation before becoming optimistic about the turnaround. I am revising my hold rating to a buy rating as I believe the business turnaround situation is on track and trends into 3Q23 continue to be positive.

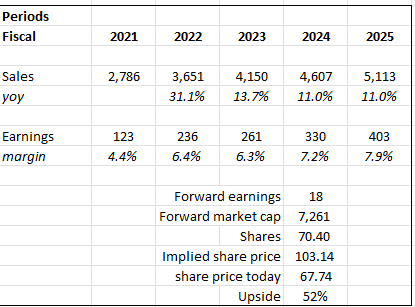

Financials / Valuation

With organic sales growth of 20% and an EBIT of €121 million in 2Q23, the company showed impressive performance. Both domestic and international demand contributed to a 20% increase in the Americas and a 15% increase in Europe, the Middle East, and Africa. The Middle East, Germany, and France were singled out as three of EMEA’s top performers. Finally, APAC grew by 41%.

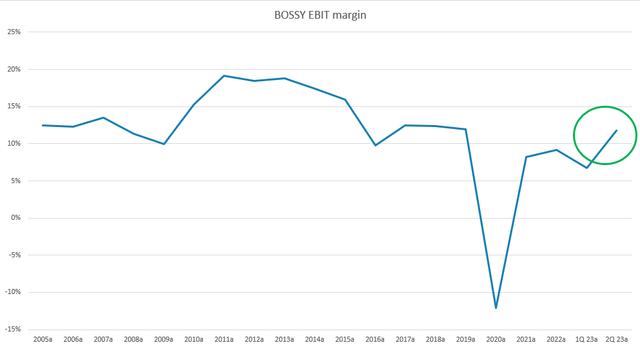

Based on my view of the business, BOSSY should be able to grow at its CAGR target through FY25 (at 11%). FY23 should be a good year for BOSSY as management continues to see strong traction, even in July (pointing to a good 3Q23). I am staying more cautious here by not extrapolating this strong FY23 to FY24 and FY25. I expect margins to continue increasing as operating leverage continues to kick in (the trend is going up). If BOSSY can sustain this momentum and meet its FY23 guidance, the market should give credit for BOSSY’s turnaround situation, thereby driving valuation up to its historical average of 18x.

Based on author’s own math

Comments

Having seen BOSSY’s 2Q23 sales across all regions and channels, which confirmed the brand momentum acceleration seen in 1Q23 and FY22, my previously cautious optimism is beginning to give way to more outright optimism. The key takeaway is that sales increased in the 2Q23 across all channels and regions. As a result of this impressive showing, management has increased their growth forecast for FY23 to a range of 12-15%. This is a significant increase from the previous forecast of 10%, and it becomes even more so when considering the expectation for EBIT to increase by 20-25%, from €370-€400 million to €400-€420 million. I am confident that BOSSY will meet or exceed guidance if the current trend continues. According to comments made by management during the call, the current trend appears to be continuing into 3Q23. Particularly, they have expressed extreme satisfaction with current trading in the month of July, citing unaltered consumer demand across regions and channels in addition to continuing strong 2H23 order books.

Actually, we are very happy with the performance ended July. In July we have seen no somehow a change in consumer demand for our both brands or for channels or geography. So, everything as we are operating on all firing on all cylinders. Source: 2Q23 earnings

Although the company’s gross margin performance was lackluster in 2Q23, management has reaffirmed their previous projections that gross margins will be stable or higher in FY23. Since 1H23 gross margin came in at 61.87%, it implies that 2H23 gross margin will see a step up from 2H22 by at least 70+bps (from 61.1% in 2H22). As freight costs decrease, price increases in comparison to a weaker competitor from last year, and other cost savings result from lower raw material prices, I am confident that gross margin will improve from here.

and regarding the financial expenses, we have had some positive effects, actually from the ForEx side in the second half of the year.

The latter reflects both quality investments as part of ’25 and general cost inflation, which were only partly offset by our latest round of mid-single-digit price increases successfully implemented for our fall 2023 collections. Source: 2Q23 earnings

Moving to the operating profit level, BOSSY has demonstrated positive operating leverage this quarter, resulting in an increase in EBIT margin compared to both the previous year and the previous quarter. This indicates that the revenue growth has translated effectively into improved profitability. The key driver behind this operating leverage has been the ongoing enhancement of the company’s B&M retail business, which has witnessed a notable 13% increase in store productivity. Retail productivity rose thanks to rising customer traffic and average selling prices, while conversion and sales volume remained relatively unchanged. I believe that the new store concepts and redesigns implemented by the company are largely responsible for the uptick in foot traffic. Therefore, I believe this increase in productivity per square foot of retail space will continue to drive EBIT margin upwards.

Based on author’s own math

Risk & conclusion

This is a turnaround situation, and that itself is a risk, as no turnaround situation is 100% successful. In particular, for the fashion industry, where consumer preferences are always changing, the risk with BOSSY’s current situation is not entirely out of the woods yet. Failure to continue maintaining the current execution momentum would be detrimental to the stock price.

With the above, I am upgrading my rating for BOSSY from hold to buy as the company’s turnaround efforts appear to be on a positive trajectory. Recent financial results show impressive performance, with 2Q23 organic sales growth of 20% and EBIT of €121 million. The trend continues into 3Q23, with robust consumer demand and strong order books. While gross margin performance was modest in 2Q23, expectations are for stability or improvement in FY23. Positive operating leverage has boosted EBIT margins, driven by increased store productivity. However, it’s worth noting that turnaround situations carry inherent risks, particularly in the fashion industry, where consumer preferences evolve. Continued execution momentum is crucial for sustaining stock price growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply